Journal Entry For Amortization Of Bond Premium - Web the premium will disappear over time as it is amortized, but it will decrease the interest expense, which we will see in subsequent journal entries. The baseline amount is the amount of all remaining payments other than qualified stated interest (qsi). Web the entry to record the issue of the bond on january 1 would be: Issuing of bonds at a premium. Web what is the journal entry for the amortization of bond premium for the three years using: Debit premium on bonds payable for $3,000. On 1 january 2001, codestreet, inc. Journal entry for amortization of goodwill. Web accounting questions and answers. Taken together, the bond payable liability of $100,000 and the premium on bond payable contra liability of $4,460 show the bond’s carrying value or book value —the value that assets or.

Bonds Issued at a Premium Explanation, Examples & Journal Entries

Web by obaidullah jan, aca, cfa and last modified on oct 31, 2020. Web the entry to record the issue of the bond on january.

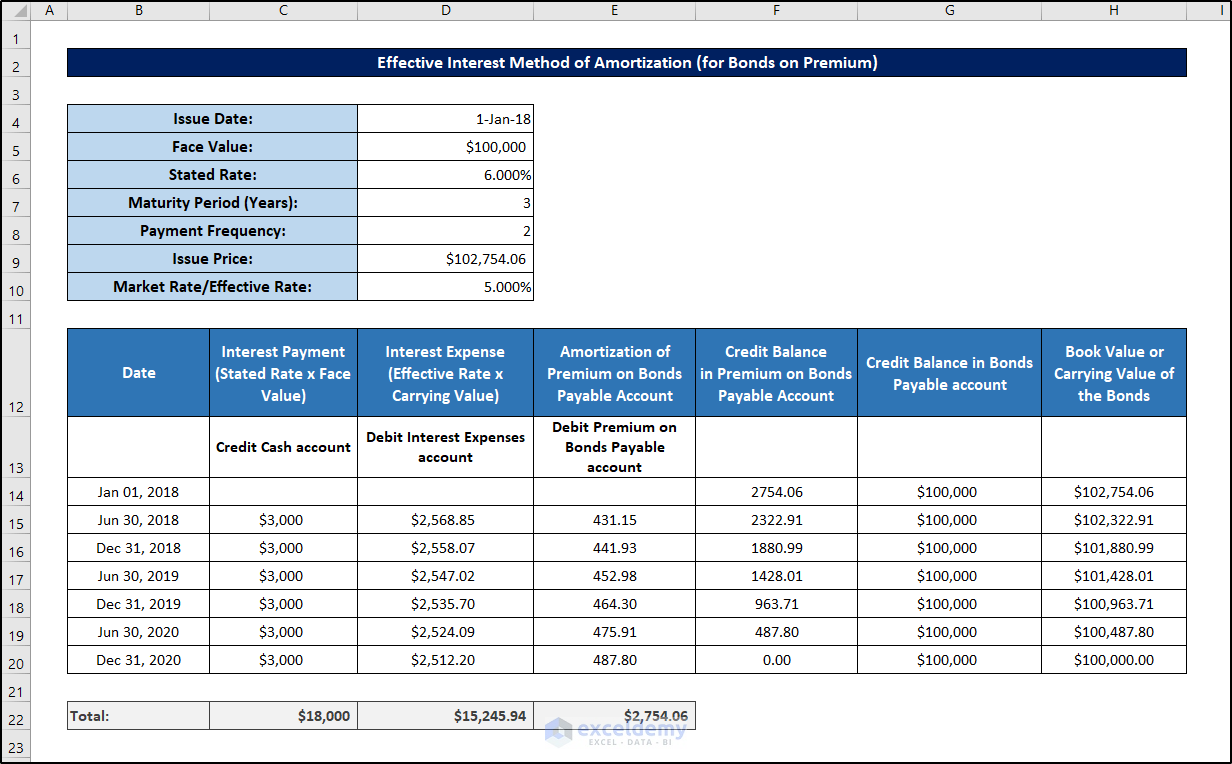

How to Create Effective Interest Method of Amortization in Excel

B) prepare the bond premium amortization schedule for the first 4 interest periods. Market interest rates and bond prices. *p11.5 (lo 2, 5) on january.

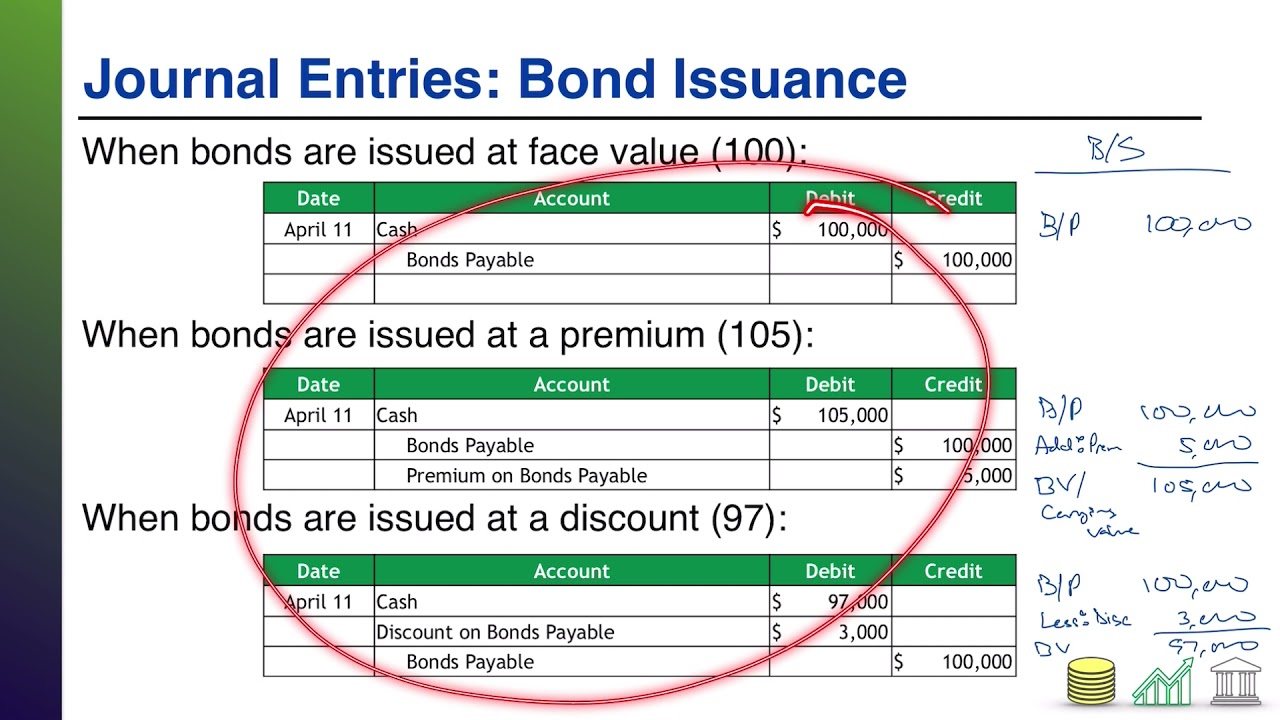

Bond Issuance Journal Entries and Financial Statement Presentation

Bonds issued at par with accrued interest. This entry ensures that the reduction in cash is matched by a corresponding decrease in the loan liability.

Solved Bond premium, entries for bonds payable transactions,

Journal entry for amortization of goodwill. In this example the premium amortization will be $5,250 discount amount / 6 interest payment (3 years x 2.

Bonds Payable Lecture 2 Journal Entries YouTube

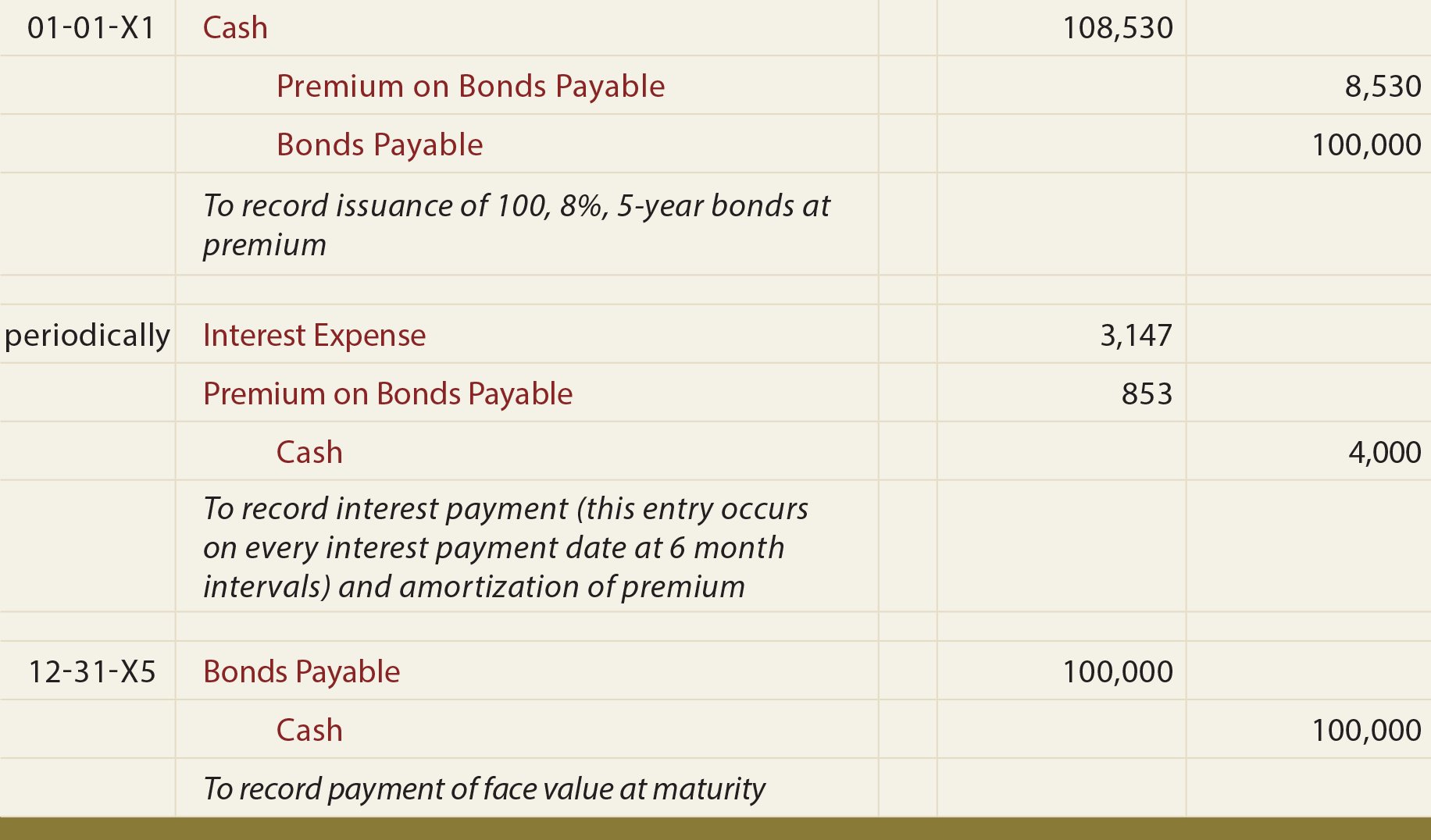

On 1 january 2001, codestreet, inc. A bond has a stated coupon rate of interest and pays interest to the bond investors based on such.

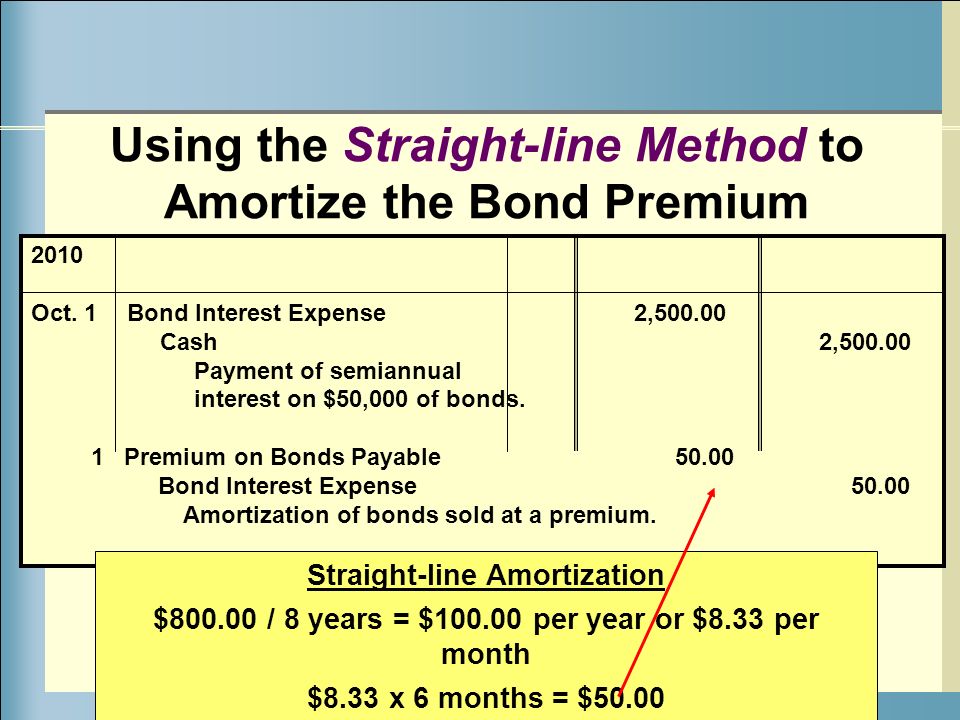

Bond Premium with StraightLine Amortization AccountingCoach

Calculating the present value of a 9% bond in an 8% market. Web the journal entry would involve debiting the interest expense account for $200,.

Premium On Bonds Payable Journal Entry / Bonds Issued At A Premium

Web the premium will disappear over time as it is amortized, but it will decrease the interest expense, which we will see in subsequent journal.

Bonds Payable at a Premium

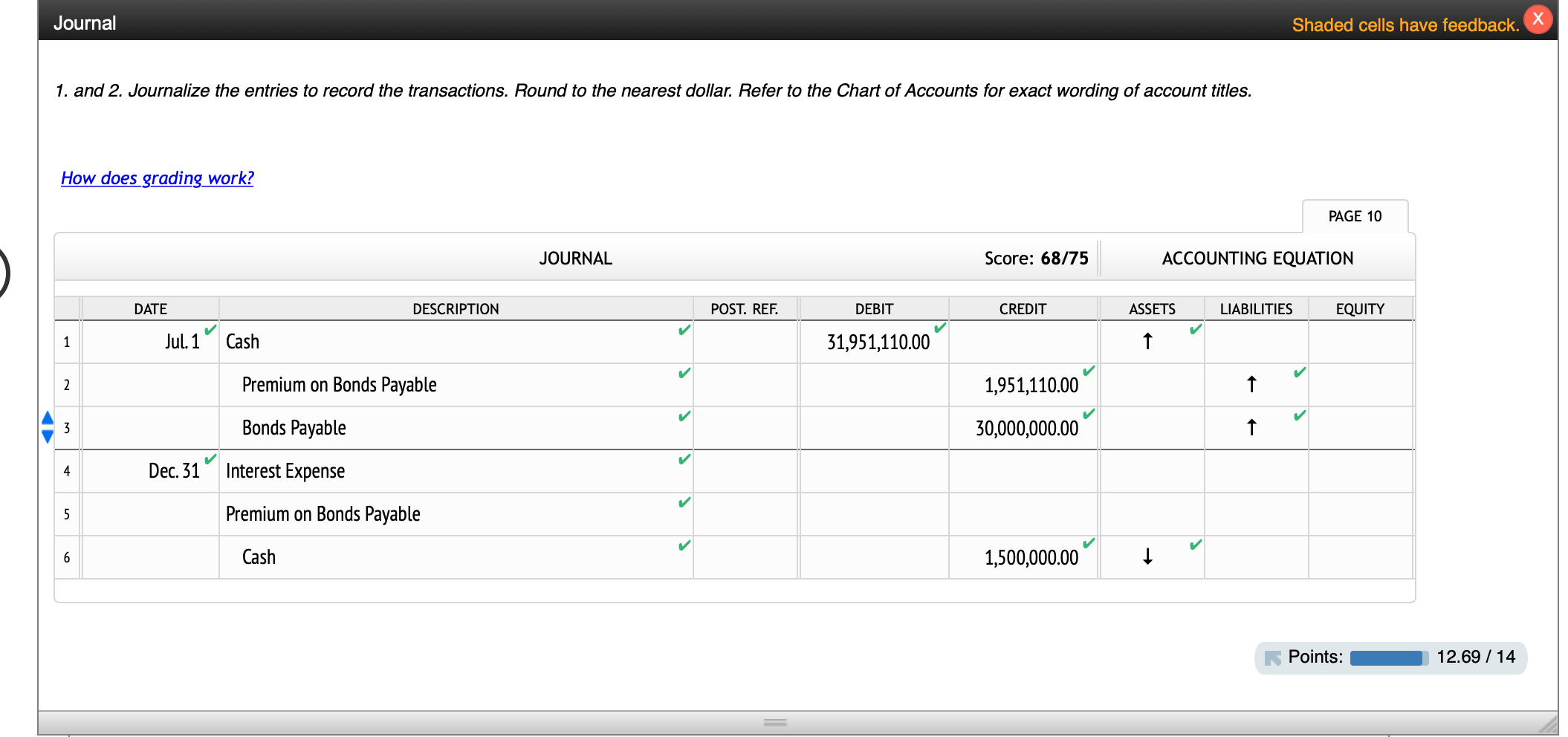

Calculating the present value of a 9% bond in an 8% market. Web a) prepare the journal entry to record the issuance o the bonds.

Bond Discount or Premium Amortization Business Accounting

Thus, the amortization of bond premium for each period is $1,623 ($16,225.40/10). Web the entries for 2023, including the entry to record the bond issuance,.

Web Accounting Questions And Answers.

Taken together, the bond payable liability of $100,000 and the premium on bond payable contra liability of $4,460 show the bond’s carrying value or book value —the value that assets or. The baseline amount is the amount of all remaining payments other than qualified stated interest (qsi). On 1 january 2001, codestreet, inc. Bonds issued at par with accrued interest.

Web What Is The Amortization Of Bond Premium?

Amortization of bond premium refers to the amortization of excess premium paid over and above the face value of the bond. A bond has a stated coupon rate of interest and pays interest to the bond investors based on such a coupon rate of interest. Market interest rates and bond prices. Web the entry to record the issue of the bond on january 1 would be:

Entry Using Accumulated Amortization A/C.

Amortize the discount or premium; Journal entry for amortization of patent. Web there are five possible journal entries related to investing in bonds, as follows: Thus, the amortization of bond premium for each period is $1,623 ($16,225.40/10).

Web The Entry For The Annual Amortization Will Be The Following:

Introduction to bonds payable, bond interest and principal payments. Bond discount amortization is the process through which bond discount is written off over the life of the bond. We can make the journal entry for issuing of bonds at a premium by debiting the $512,000 to. The bond premium rules address situations in which a bond holder has purchased a debt instrument at a price that exceeds a baseline amount.