Journal Entry For Accrued Interest - It will increase the interest receivable amount $ 2,000 and interest income for. Web the journal entry is debiting interest expense, interest payable and credit cash paid. Web an accrued interest journal entry is a method of recording the amount of interest on a loan that has already occurred but is yet to be paid by the borrower and yet. Since the payment of accrued. I = p x r x t. Web the journal entry is debiting accrued interest receivable $ 2,000 and interest income $ 2,000. Web the entry consists of interest income or interest expense on the income statement, and a receivable or payable account on the balance sheet. Updated on february 23, 2023. Web accounting concepts and practices. Reviewed by subject matter experts.

What is Accrued Interest? Formula + Loan Calculator

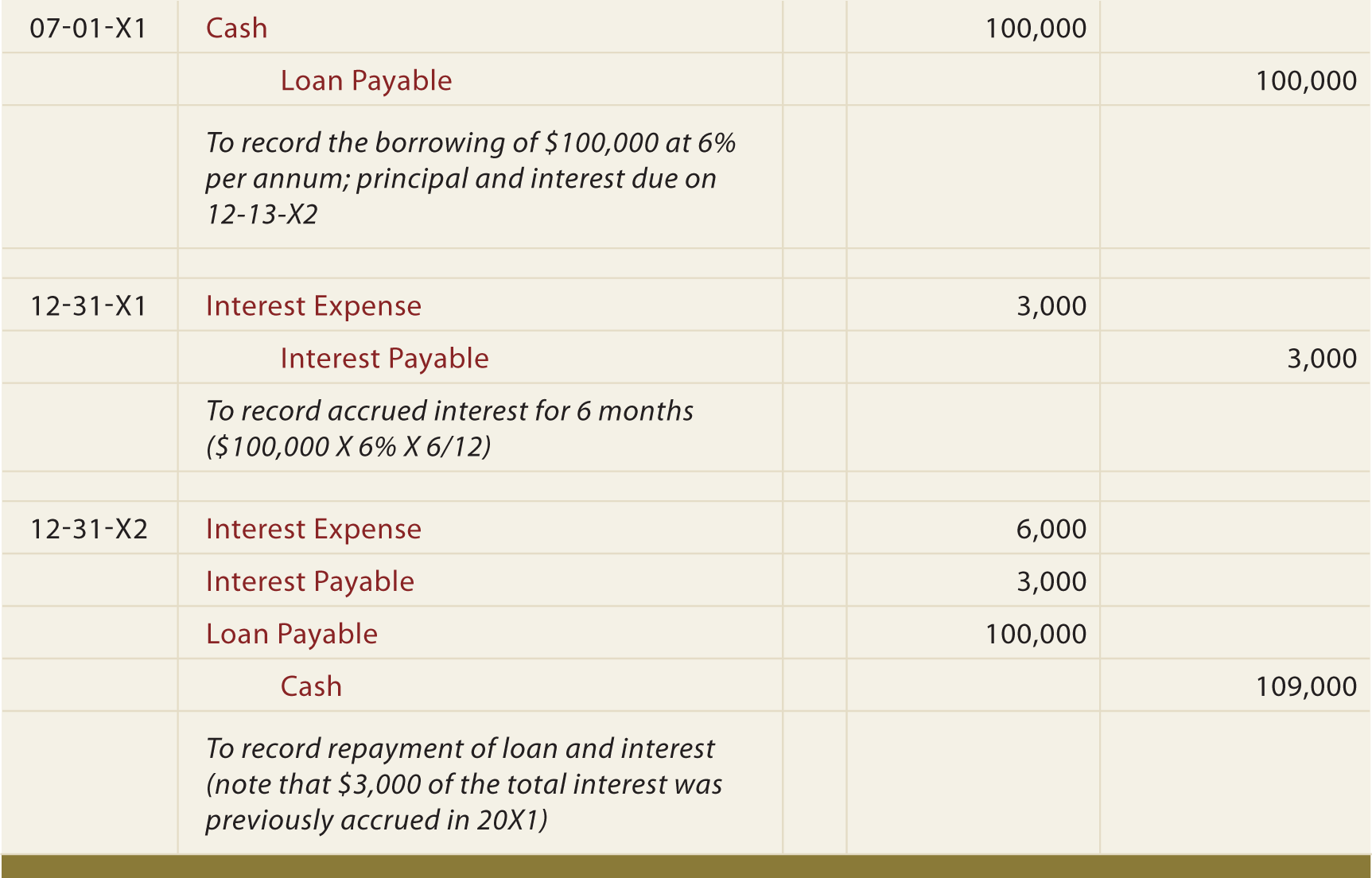

Web the journal entry is debiting interest expense, interest payable and credit cash paid. When the company abc borrows $100,000 money from the bank on.

Self Study Notes The Adjusting Process And Related Entries

Reviewed by subject matter experts. Web this journal entry of the $2,500 accrued interest is necessary at the end of our accounting period of 2021..

Accrued Interest Revenue Journal Entry Ppt Powerpoint Presentation Icon

Web the journal entry is debiting interest expense, interest payable and credit cash paid. Since the payment of accrued. Web an accrued interest journal entry.

Basic Accounting for Business Your Questions, Answered

Reviewed by subject matter experts. Since the payment of accrued. Web the term accrued revenue, also known as accrued income, refers to revenue or income.

Mortgage Payable Journal Entry

Web the term accrued revenue, also known as accrued income, refers to revenue or income for which no cash payment has been received before the.

Accruals and Prepayments Journal Entries HeathldDunn

Reviewed by subject matter experts. Web the journal entry is debiting accrued interest receivable $ 2,000 and interest income $ 2,000. Web this journal entry.

What is Accrued Interest? Formula + Loan Calculator

Web the journal entry is debiting interest expense, interest payable and credit cash paid. Web the term accrued revenue, also known as accrued income, refers.

Accrued revenue how to record it in 2023 QuickBooks

Web the term accrued revenue, also known as accrued income, refers to revenue or income for which no cash payment has been received before the.

Accruals Definition India Dictionary

Reviewed by dheeraj vaidya, cfa, frm. Web updated on january 3, 2024. Written by true tamplin, bsc, cepf®. Web the journal entry is debiting interest.

Web In General, The Correct Amount Of Accrued Interest Can Be Calculated Using The Following Formula:

Web an accrued interest journal entry is a method of recording the amount of interest on a loan that has already occurred but is yet to be paid by the borrower and yet. Calculate and record accrued interest. I = p x r x t. Edited by ashish kumar srivastav.

This Transaction Will Reverse The Interest Payable To Zero And Record Interest Expense From.

Web the journal entry is debiting interest expense, interest payable and credit cash paid. Web on january 1, 2020. When the company abc borrows $100,000 money from the bank on january 1, 2020, it can make the journal entry as below: Web accounting concepts and practices.

Web The Entry Consists Of Interest Income Or Interest Expense On The Income Statement, And A Receivable Or Payable Account On The Balance Sheet.

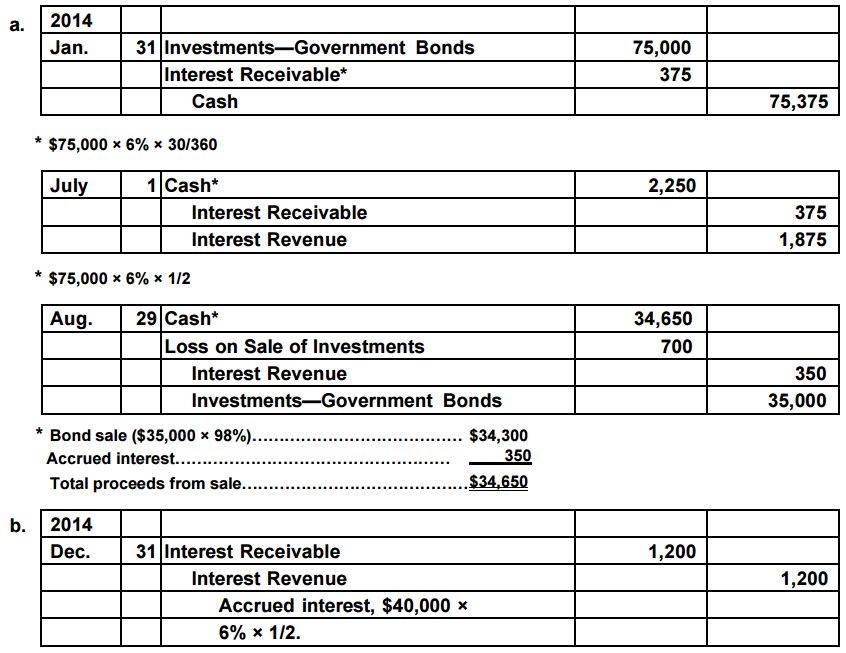

It will increase the interest receivable amount $ 2,000 and interest income for. See examples of adjusting entries and delayed bond issues for accrued interest. Web the term accrued revenue, also known as accrued income, refers to revenue or income for which no cash payment has been received before the end of the. Interest is the fee charged for use of money over a specific time period.

Since The Payment Of Accrued.

Web the journal entry is debiting accrued interest receivable $ 2,000 and interest income $ 2,000. Calculations, entries, and financial impacts. Web this journal entry of the $2,500 accrued interest is necessary at the end of our accounting period of 2021. P = principal of the loan.