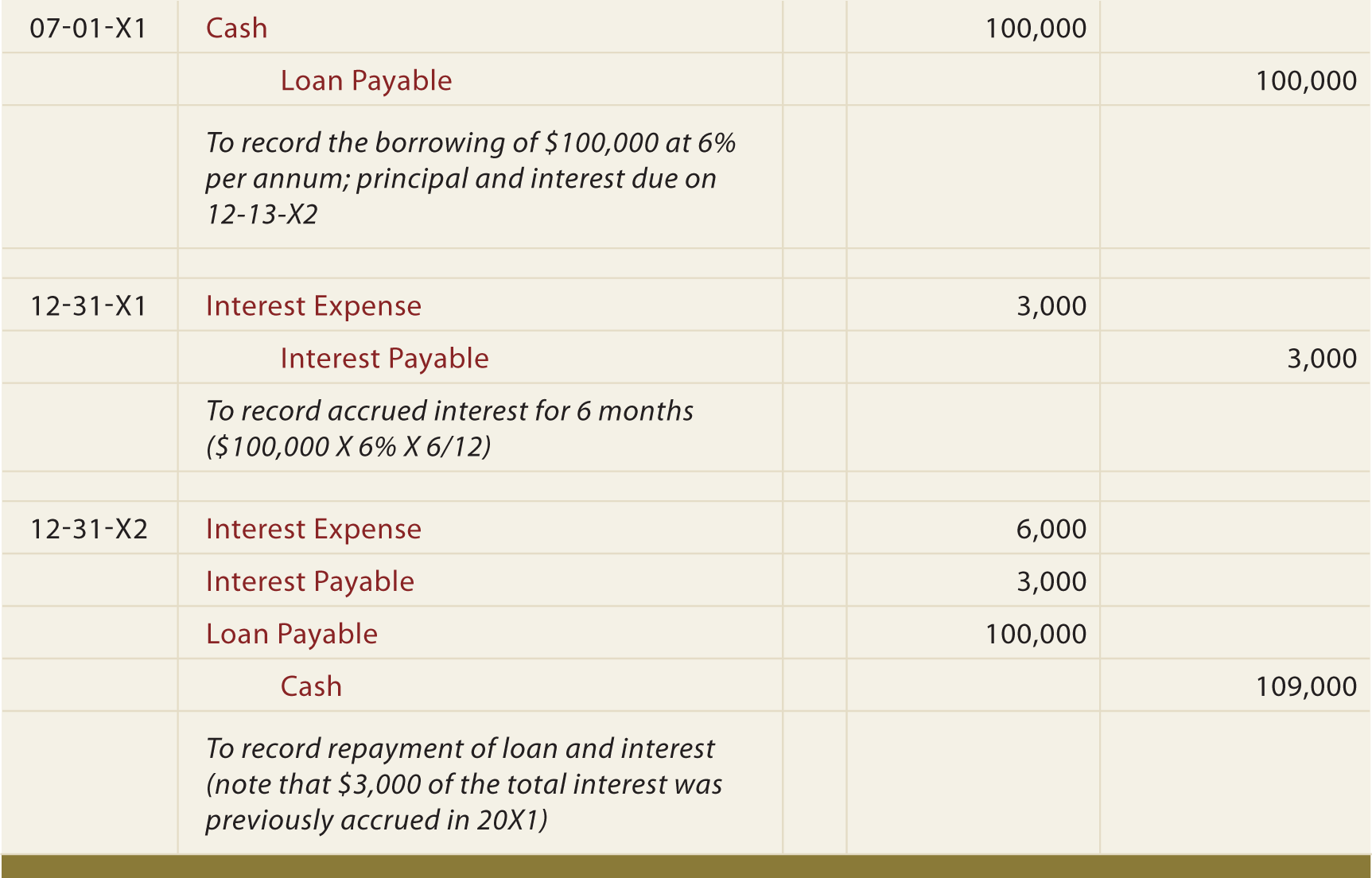

Journal Entry For Accrued Interest Expense - This journal entry of the accrued interest expense is made to recognize and record the expense that has already occurred for. Web the journal entry is debiting accrued interest receivable $ 2,000 and interest income $ 2,000. Web how to record an interest expense journal entry. Accrued interest = interest rate x (time period/365) x loan amount. Web the journal entry for accrued interest expense is as follow: Web example of accrued expense journal entry. Web total interest revenue $675. Interest expense is recorded based on the accrual basic which is not related to the cash payment. The appropriate journal entries for the following dates are shown in the table below: A company, xyz ltd, has paid interest on the outstanding term loan of $1,000,000 for march 2018 on 5th april 2018.

What is Accrued Interest? Formula + Loan Calculator

The accrued expenses may include interest expense,. Web the adjusting entry for accrued interest consists of an interest income and a receivable account from the.

Great Paying Interest Expense And Receiving Revenue Are Examples Of The

Web the accounting records will show the following bookkeeping transaction entries to record the accrued interest income. Accrued expense is the expense that has already.

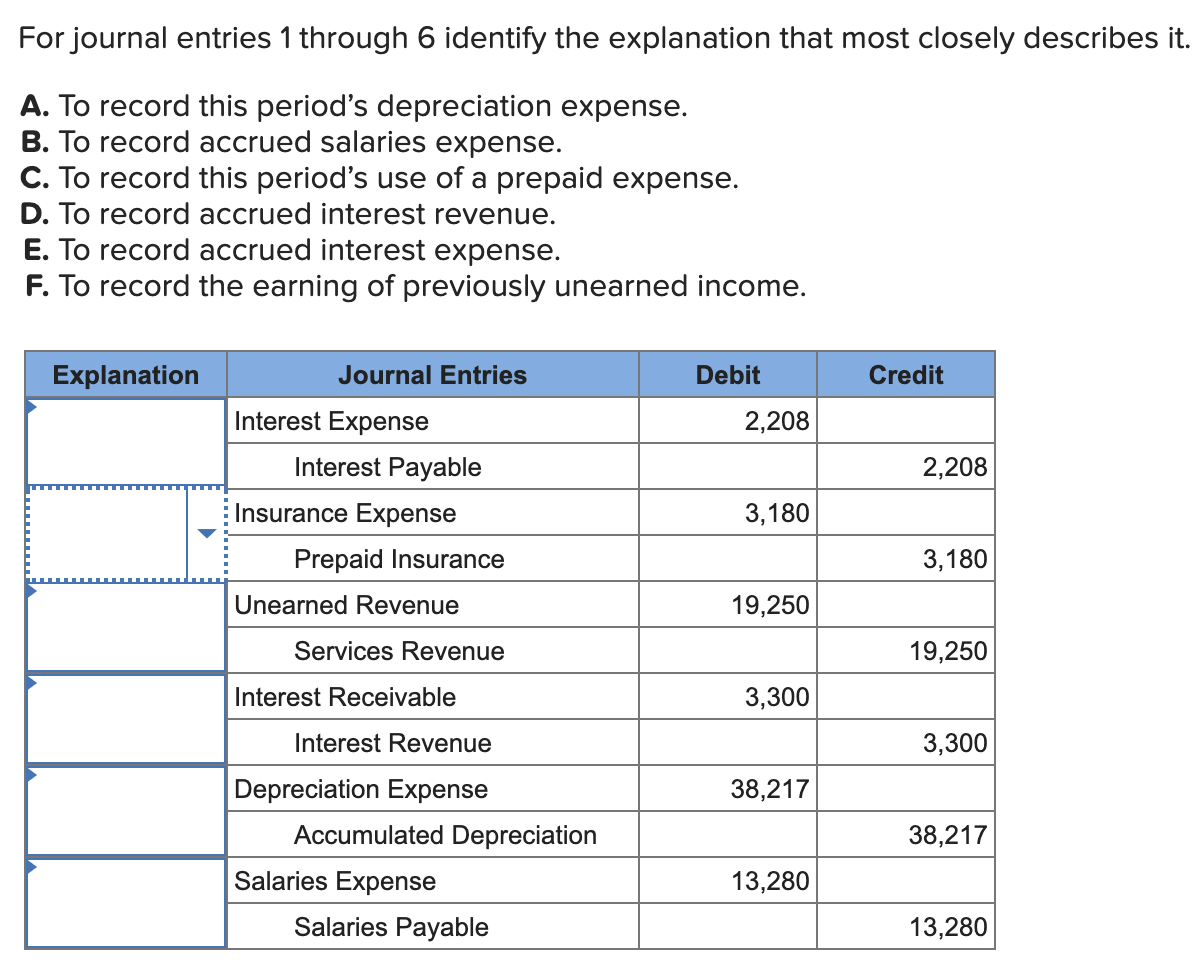

Solved For journal entries 1 through 6 identify the

Web the accounting records will show the following bookkeeping transaction entries to record the accrued interest income. This journal entry of the accrued interest expense.

Accrued Expense Explained With Journal Entry and Adjusting Entry

Web the journal entry is debiting accrued interest receivable $ 2,000 and interest income $ 2,000. 1 june 2019, the date of the loan; Web.

Accrued revenue how to record it in 2023 QuickBooks

1 june 2019, the date of the loan; Interest expense is a type of expense that accumulates with the passage of time. This transaction will.

Self Study Notes The Adjusting Process And Related Entries

Web the adjusting entry for accrued interest consists of an interest income and a receivable account from the lender’s side, or an interest expense and.

What is Accrued Interest? Formula + Loan Calculator

It depends on the loan principle, interest rate, and time. The accrued expenses may include interest expense,. The appropriate journal entries for the following dates.

Accrued Expense Meaning, Accounting Treatment And More

Web accrued interest is booked at the end of an accounting period as an adjusting journal entry, which reverses the first day of the following.

Accrued Expenses Journal Entry How to Record Accrued Expenses With

This journal entry of the accrued interest expense is made to recognize and record the expense that has already occurred for. A company, xyz ltd,.

A Company, Xyz Ltd, Has Paid Interest On The Outstanding Term Loan Of $1,000,000 For March 2018 On 5Th April 2018.

Web understand the essentials of accrued interest, from calculations and journal entries to its impact on financial statements and tax implications. Web how to record an interest expense journal entry. Interest expense is a type of expense that accumulates with the passage of time. Web the adjusting entry for accrued interest consists of an interest income and a receivable account from the lender’s side, or an interest expense and a payable account from the.

Web The Journal Entry Is Debiting Interest Expense, Interest Payable And Credit Cash Paid.

Then, for the subsequent payment made on 3 april 20x9, the journal entry for such interest payment is as follow:. Web total interest revenue $675. Interest expense is recorded based on the accrual basic which is not related to the cash payment. 1 june 2019, the date of the loan;

Web The Interest Expense, In This Case, Is An Accrued Expense And Accrued Interest.

Accrued expense is the expense that has already incurred during the period but has not been paid for yet. Likewise, the company needs to account for interest expense by making journal. When a company borrows money, they must pay interest and record the interest payable or expense accurately to reflect. Web the accounting records will show the following bookkeeping transaction entries to record the accrued interest income.

When It’s Paid, Company Abc Will Credit Its Cash Account For $500 And Credit.

The accrued expenses may include interest expense,. It depends on the loan principle, interest rate, and time. This transaction will reverse the interest payable to zero and record interest expense from the. Web the journal entry for accrued interest expense is as follow: