Journal Entry For Accounts Receivable Write Off - As the name suggests, this method will directly remove accounts receivable to bad debt expenses. For example, nate made sales of $9,000 to serena on credit in 2017. D’s account with the receivable balance of usd 2,000. Decide to write off mr. Web what is the journal entry for accounts receivable? One method of recording the bad debts is referred to as the direct write off method which involves removing the. Web the accounting records will show the following bookkeeping entries for the bad debt written off. Debit the bad debts expense. Bad debt write off bookkeeping entries explained. From the company menu, select make.

What is Accounts Receivables Examples, Process & Importance Tally

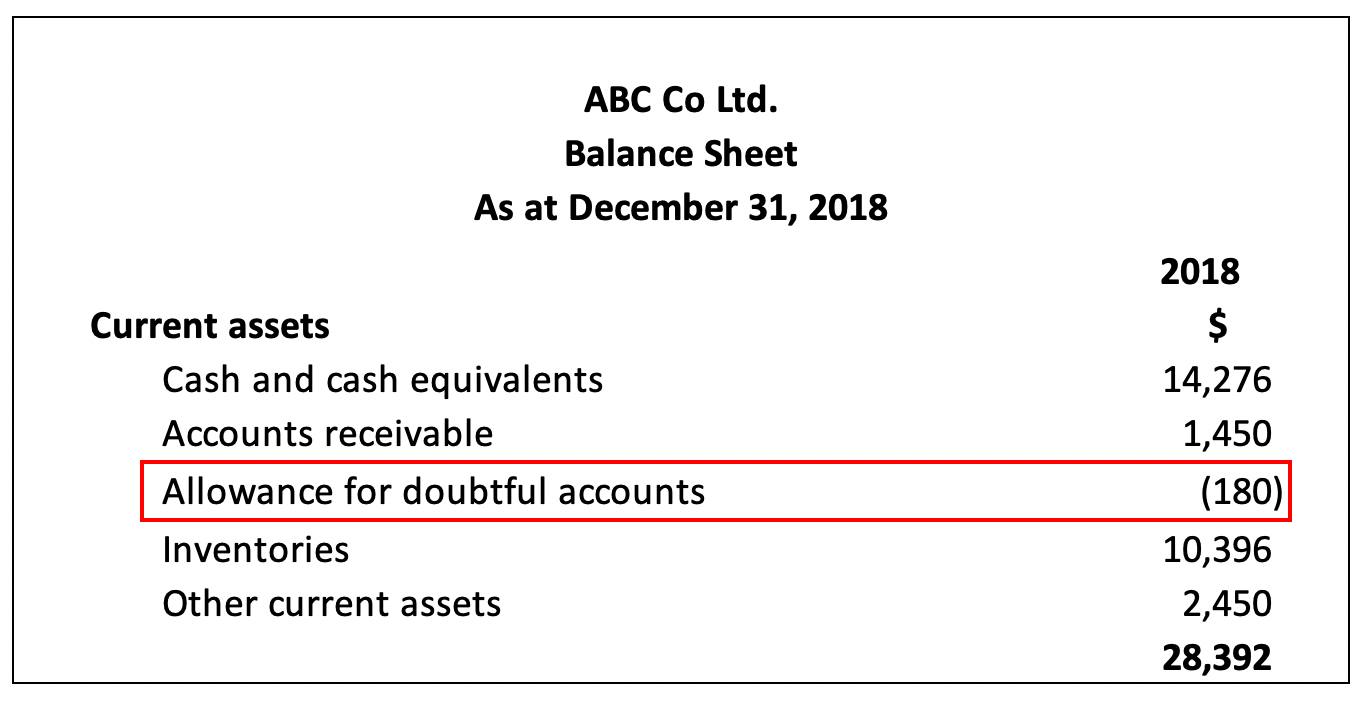

The visual below also includes the journal entry necessary. What happens if accounts receivable is not. Bad debt expense d r. When you decide to.

Recovering Writtenoff Accounts Wize University Introduction to

For example, on september 05, 2020, the company abc ltd. Web the journal entry is a debit to the bad debt expense account and a.

Journal Entries of Loan Accounting Education

Web the accounting records will show the following bookkeeping entries for the bad debt written off. As the name suggests, this method will directly remove.

Accounts Receivable Journal Entry Example Accountinguide

Web the accounting records will show the following bookkeeping entries for the bad debt written off. Web what is the journal entry for accounts receivable?.

Accounting Q and A EX 914 Entries for bad debt expense under the

For example, on september 05, 2020, the company abc ltd. Debit the bad debts expense. There are two choices for the debit part of the..

journal entry format accounting accounting journal entry template

They simply write off the amount as an expense (or a loss) from the financial. One method of recording the bad debts is referred to.

300 utility bill with cash. On in 2021 Journal entries, Accounting

It’s important to note that the creation. Web create a journal entry to write off the appropriate amount of the asset. Create a general journal.

Accounts Receivable Journal Entry Complete Guide AR Journal Entries

Web create a journal entry to write off the appropriate amount of the asset. There are two choices for the debit part of the. An.

Accounting Journal Entries For Dummies

Web here are the 34 business records trump was found guilty of falsifying, as described in judge juan merchan 's jury instructions: From the company.

For Example, Nate Made Sales Of $9,000 To Serena On Credit In 2017.

This will be a credit to the asset account. How does accounts receivable work? 1) entry to record the amount of an asset written off. Web journal entries for accounting receivable.

Bad Debt Write Off Bookkeeping Entries Explained.

Web journal entry for writing off uncollectible account. You can also use the. They simply write off the amount as an expense (or a loss) from the financial. Create an appropriate journal entry.

D’s Account With The Receivable Balance Of Usd 2,000.

The visual below also includes the journal entry necessary. From the company menu, select make. What happens if accounts receivable is not. Web the following journal entry is passed:

It’s Important To Note That The Creation.

It may also be necessary to reverse any related. Notice that the preceding entry reduces the receivables balance for the item that is uncollectible. An accounts receivable balance represents an amount due to cornell university. Bad debt expense d r.