Journal Entry Equipment Purchase - Web the double entry bookkeeping journal entry to record the purchase of the networking equipment is as follows: The journal entry shows that the company received computer equipment worth $1,200. March 06, 2022 06:25 am. At the beginning of the hire purchase, buyer pays for the initial deposit which depends on the agreement between both parties. Web the journal entry to record the purchase of the equipment paying $50,000 cash and by signing a note for the balance would be: Web the company purchased $12,000 equipment and paid in cash. Which account will be credited when. Journal entry to record the purchase of equipment. This type of entry tracks the monetary value. Web journal entry for hire purchase.

Journal Entry Examples

Cash is decreased by $800, the amount paid. The journal entry would be: They have to record the fixed assets on the balance sheet. Journal.

Journal Entry Buying Equipment YouTube

Web equipment purchase journal entry is an accounting record that documents the purchase of equipment, such as machinery and tools. Web the journal entry to.

Journal Entry For Equipment Purchase Jenkins Exchilliked

Yes create a fixed asset named for the equipment, and a fixed asset account for accumulated depreciation. Web journal entry for hire purchase. Web the.

Perpetual Inventory System Journal Entry

Web a journal entry for equipment purchase is a structured business transaction used to record the acquisition of goods or services. They have to record.

Journal Entry for Purchase of Inventory Professor Victoria Chiu YouTube

This type of entry reflects the receipt of new. A purchase of equipment journal entry is a type of ledger entry accounting for the purchase.

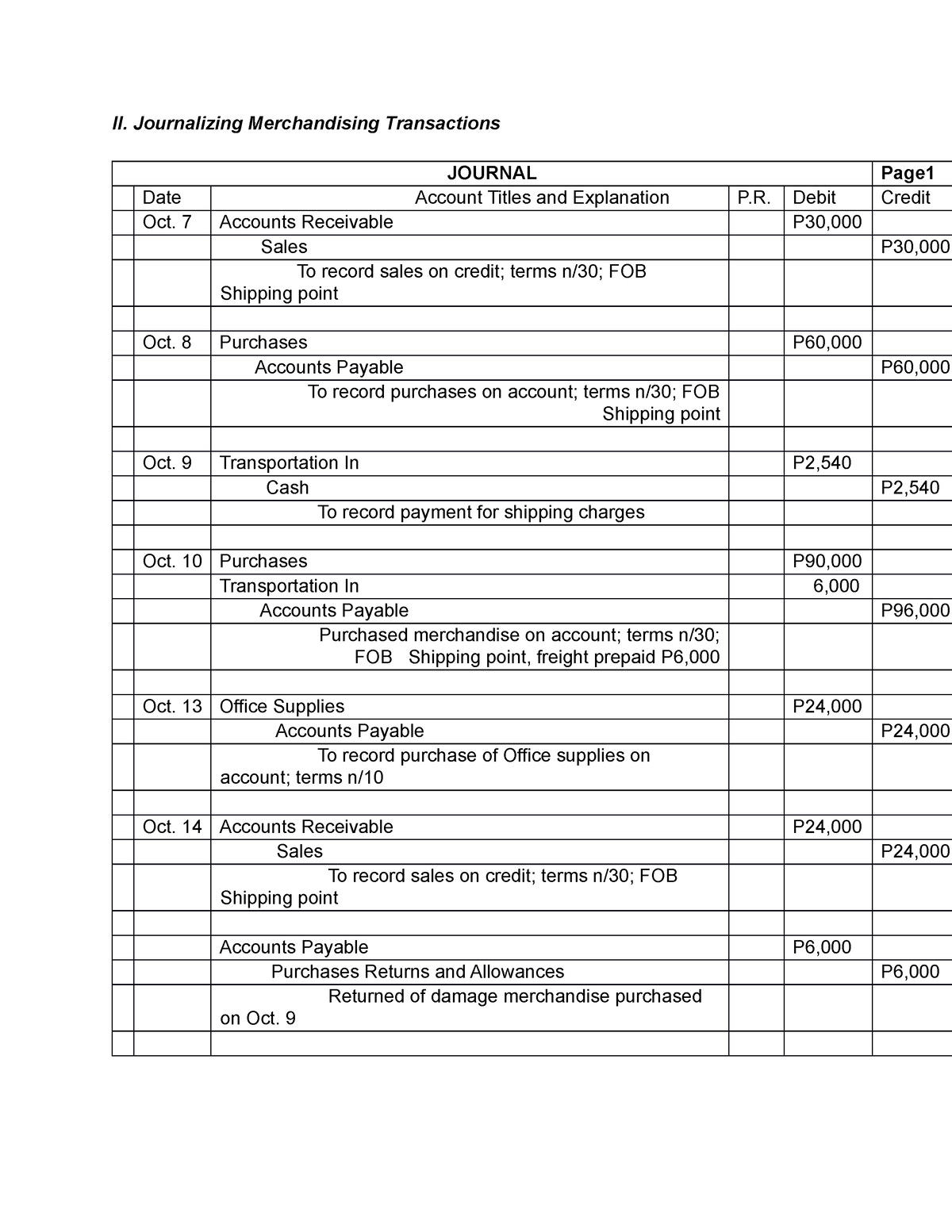

Merchandising business Example of a journal entry II. Journalizing

Web for manual tracking of equipment purchase, you can create an asset account for the equipment. March 06, 2022 06:25 am. To learn more, launch.

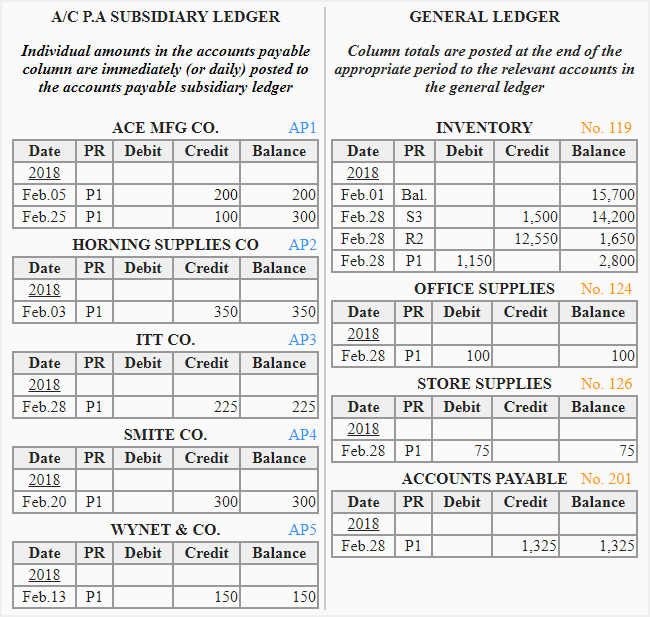

Purchases Journal (Purchase Day Book) Double Entry Bookkeeping

Web the double entry bookkeeping journal entry to record the purchase of the networking equipment is as follows: Cash is decreased by $800, the amount.

Accounting Journal Entries For Dummies

Web the journal entry to record the purchase of the equipment paying $50,000 cash and by signing a note for the balance would be: As.

General Journal entry form June 1 . Purchased equipment in the amount

Web for manual tracking of equipment purchase, you can create an asset account for the equipment. Machinery purchased journal entry example. At the beginning of.

Web The Double Entry Bookkeeping Journal Entry To Record The Purchase Of The Networking Equipment Is As Follows:

As it is a credit purchase, it will record. Web journal entry for hire purchase. Buy equipment with down payment in cash journal entry. Go to lists and choose chart of accounts.

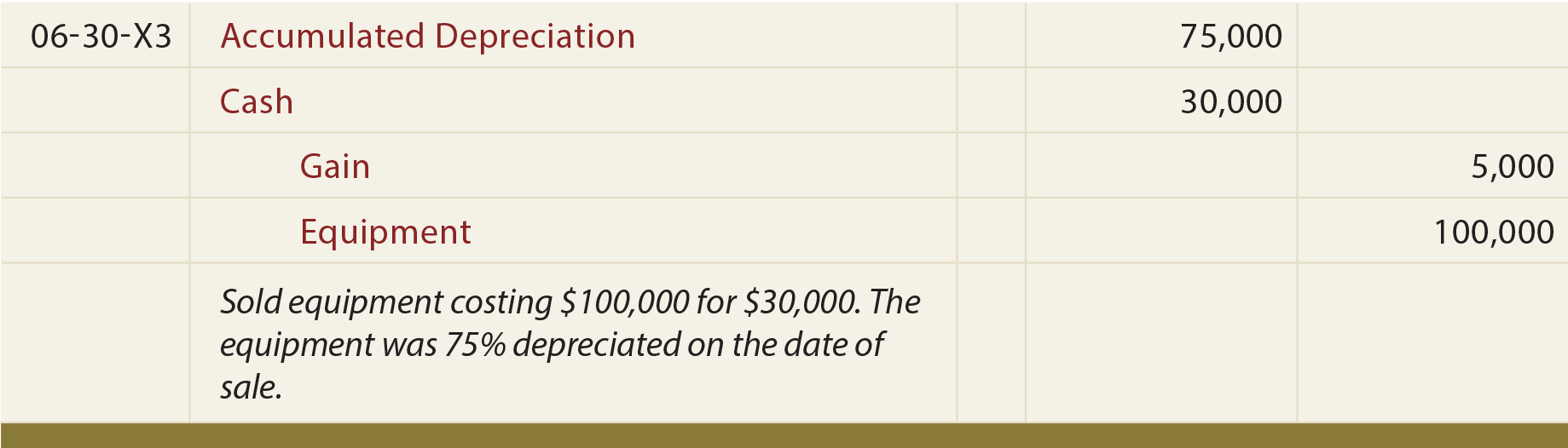

Web The Company Has Purchased The Equipment, And It Has Already Been Received.

Web what’s the journal entry? The company paid a 50% down payment and the balance will be paid after 60 days. On january 9, 2019, receives $4,000 cash in advance from a customer for. Web a journal entry for equipment purchase is a structured business transaction used to record the acquisition of goods or services.

Web To Write A Journal Entry You Need To Figure Out Which Accounts Are Affected, Which Items Decrease Or Increase, And Then Translate The Changes Into Debit And Credit.

At the beginning of the hire purchase, buyer pays for the initial deposit which depends on the agreement between both parties. A purchase of equipment journal entry is a type of ledger entry accounting for the purchase of any tangible asset that will benefit the company in the. The journal entry shows that the company received computer equipment worth $1,200. Machinery purchased journal entry faqs.

Which Account Will Be Credited When.

Web on january 5, 2019, purchases equipment on account for $3,500, payment due within the month. They have to record the fixed assets on the balance sheet. Journal entry to record the purchase of equipment. Web purchased equipment on account journal entry is an accounting term that refers to the recording of a business’s purchase of necessary equipment for use in their operations.