Journal Entry Debit Credit Examples - Credit the cash account for rs. What’s the difference between debits and credits? Web accounts payable would now have a credit balance of $1,000 ($1,500 initial credit in transaction #5 less $500 debit in the above transaction). Read our explanation (4 parts) free. A journal entry is made. A business pays a wage of 500.00 to a staff member. Web whenever cash is received, debit cash. Web in an accounting journal entry, we find a company's debit and credit balances. Subtract the total deductions from the gross pay to find the net pay—the amount that will actually be disbursed to the employee. Web credits (cr) record money that flows out of an account.

Debits and Credits Accounting Play

Web for example, you debit the purchase of a new computer by entering it on the left side of your asset account. Read our explanation.

LO 3.5 Use Journal Entries to Record Transactions and Post to T

The journal entry consists of several recordings, which either have to be a. Credit the cash account for rs. With the knowledge of what happens.

Debit credit journal entries mainvector

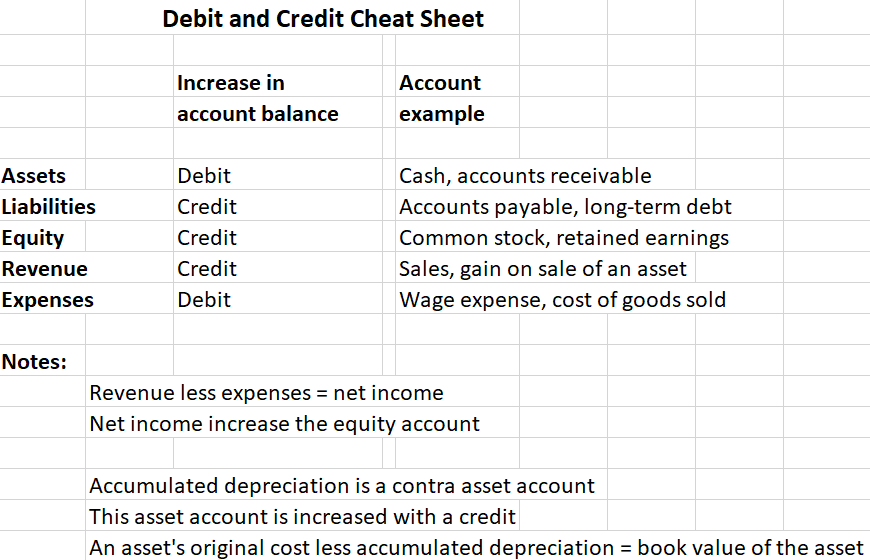

Web credits (cr) record money that flows out of an account. A debit, sometimes abbreviated as dr., is an entry that is recorded on the.

Accounting Basics Part 1 Accrual DoubleEntry Accounting Debits

Sold inventory for $3,000 with a cost of goods sold of $1,500. Whenever cash is paid out, credit cash. Here are a few examples of.

What is Double Entry Bookkeeping? Debit vs. Credit System

Web here is the journal entry example of xyz ltd: Web credits (cr) record money that flows out of an account. The wage is an.

Debits and Credits Cheat Sheet • 365 Financial Analyst

Web accounts payable would now have a credit balance of $1,000 ($1,500 initial credit in transaction #5 less $500 debit in the above transaction). With.

Sample Journal Entry Debit Card Banking

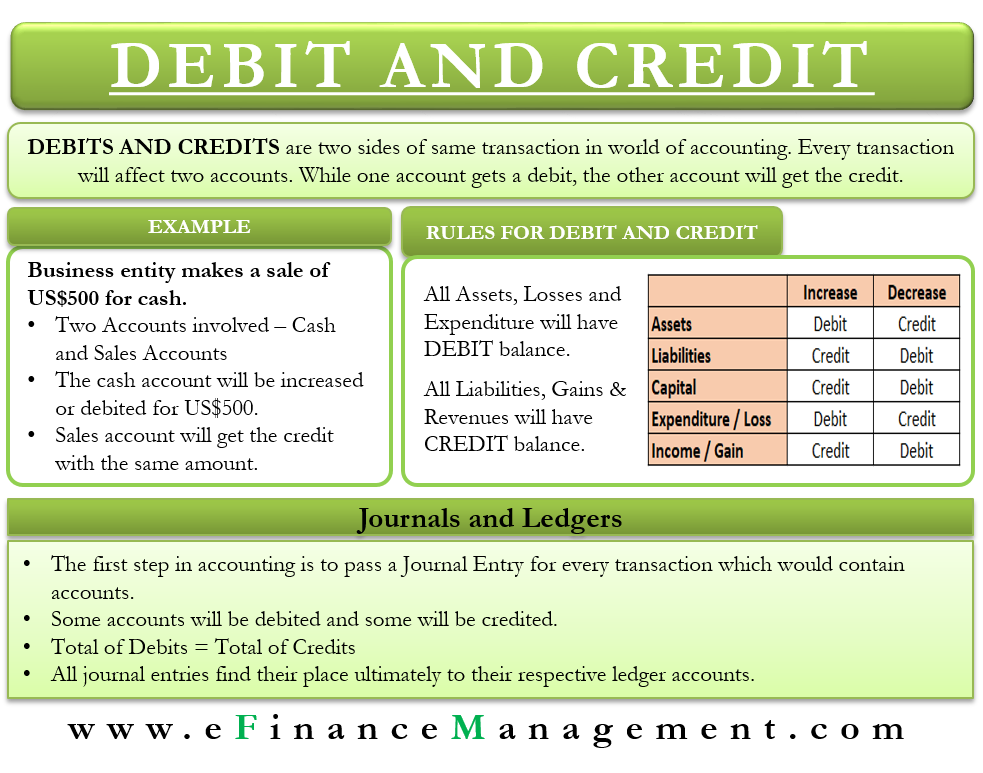

Web journal entries are used to record business transactions and events. Debit and credit movements are used in accounting to show increases or decreases in.

Debits and Credits Accounting and finance, Bookkeeping business

With the knowledge of what happens to the cash account, the journal entry to record the debits. Debit the machinery account for rs. Owner invested.

Debits and Credits Introduction, Journal and ledger, Usage

A debit, sometimes abbreviated as dr., is an entry that is recorded on the left side of the. Journal entries are recorded in the journal,.

To Use That Same Example From Above, If You Received That $5,000 Loan, You Would Record A Credit Of $5,000 In Your.

Read our explanation (4 parts) free. Web these are two different things. Web for example, you debit the purchase of a new computer by entering it on the left side of your asset account. Debit and credit movements are used in accounting to show increases or decreases in our accounts.

What’s The Difference Between Debits And Credits?

Web accounts payable would now have a credit balance of $1,000 ($1,500 initial credit in transaction #5 less $500 debit in the above transaction). Credit the cash account for rs. Web for example, received $500 cash from a customer who purchased goods on credit. Our explanation of debits and credits describes the reasons why various accounts are debited and/or credited.

Web Journal Entries Are Used To Record Business Transactions And Events.

Web to write a journal entry you need to figure out which accounts are affected, which items decrease or increase, and then translate the changes into debit and credit. Sold inventory for $3,000 with a cost of goods sold of $1,500. On the other hand, a credit. Every transaction your business makes requires journal.

Whenever Cash Is Paid Out, Credit Cash.

Web to illustrate this further, here are some journal entry examples: Web credits (cr) record money that flows out of an account. Subtract the total deductions from the gross pay to find the net pay—the amount that will actually be disbursed to the employee. Here is an example of debits and credits: