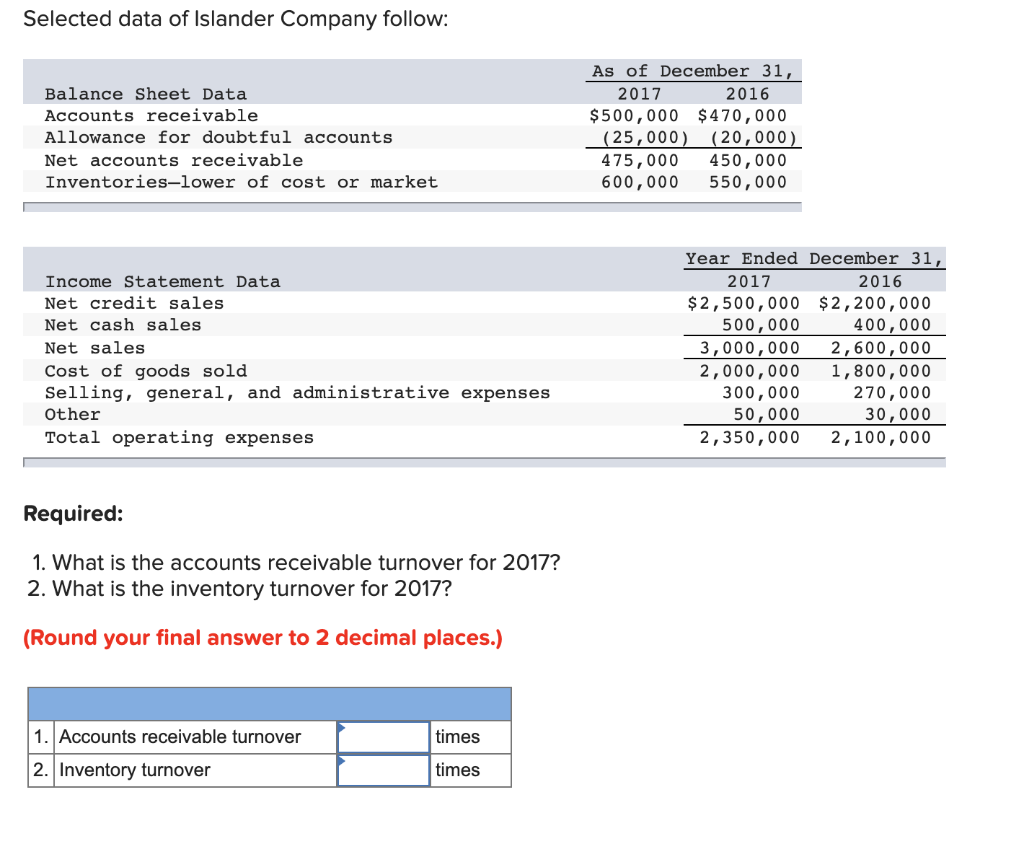

Journal Entry Cost Of Goods Sold - What we have now learned is that using the periodic inventory system the cost of goods sold. Web cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. The sign for job mac001 had a. With the information in the example, we can calculate the. Sales revenue minus cost of goods sold is a business’s gross. Web what is the cost of goods sold? The credit entry to balance the adjustment is $13,005, which is the total amount that was. Identify the cost of goods sold. Sales of goods are not just about cash and revenue accounts. Knowing the cost of goods sold.

Recording a Cost of Goods Sold Journal Entry ⋆ Accounting Services

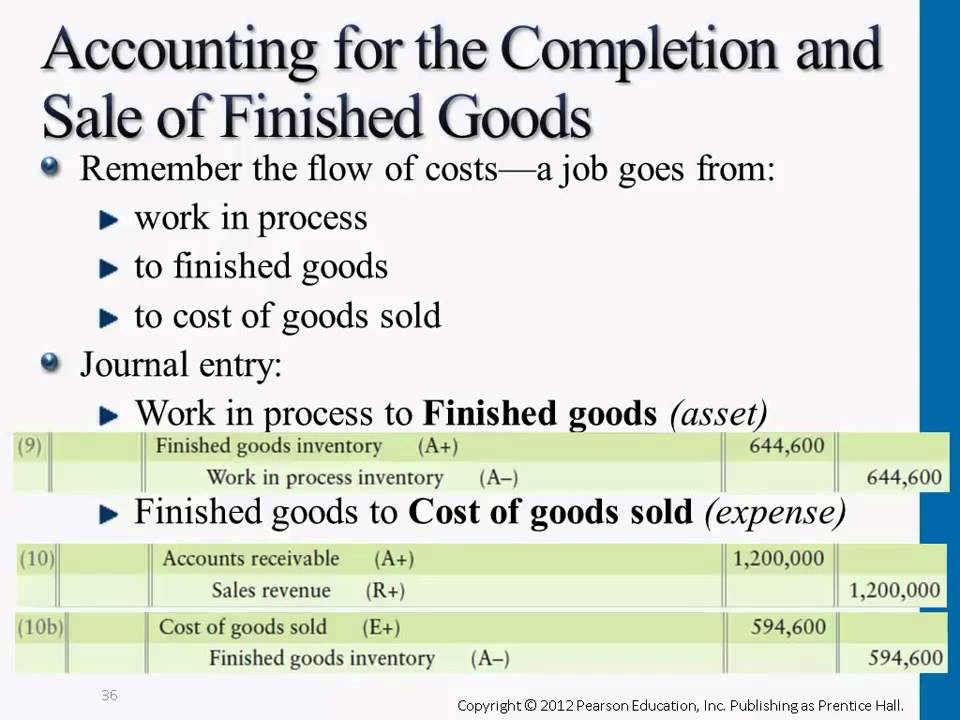

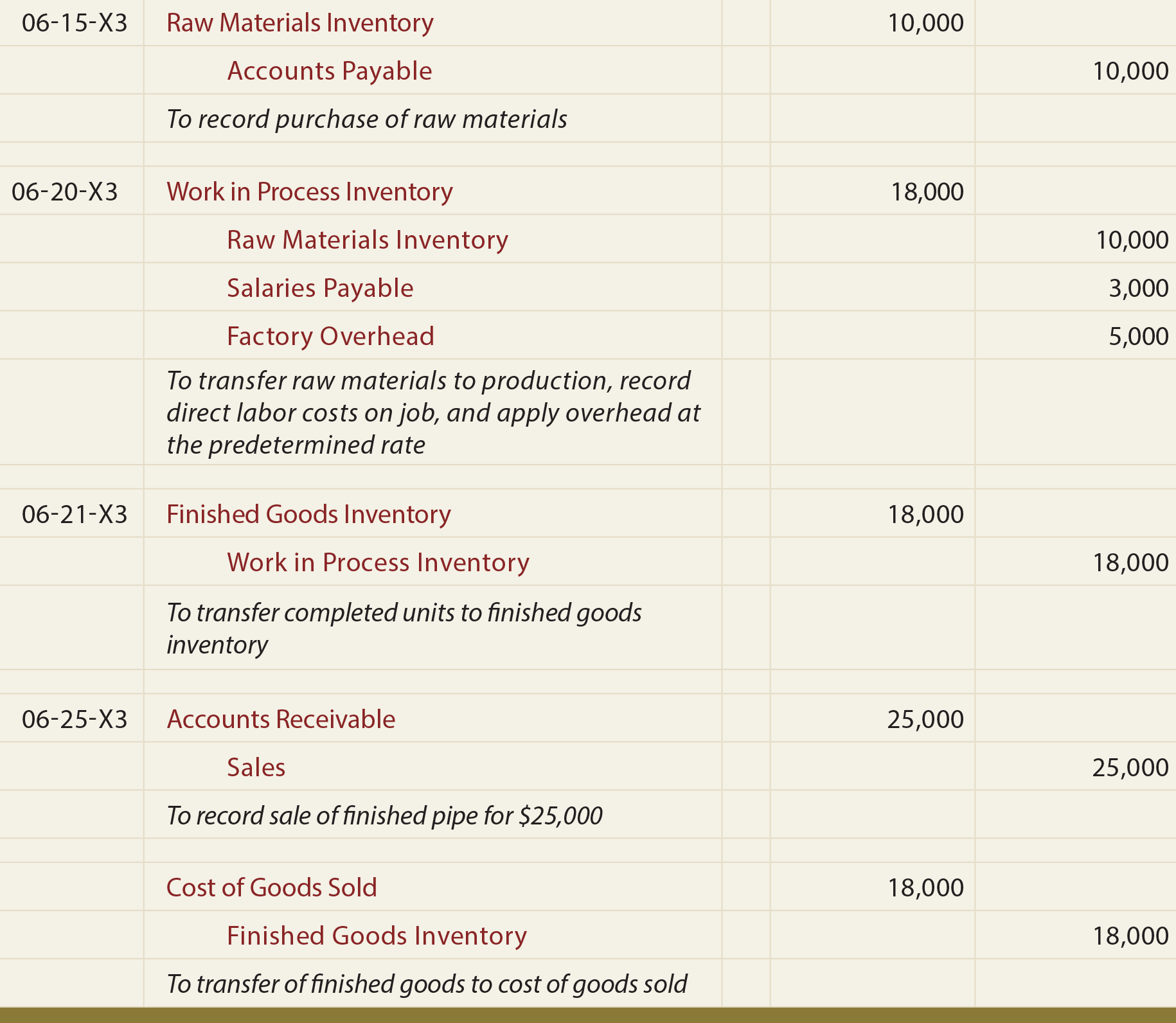

Web the product is transferred from the finished goods inventory to cost of goods sold. Once any of the above methods complete the inventory valuation,.

Journal Entry for Goods Sold on Credit YouTube

Web what is the journal entry to record the cost of goods sold at the end of the accounting period? Web the cost of goods.

Recording a Cost of Goods Sold Journal Entry

As the first part of this step, ensure you have all raw. Web cost of goods sold was calculated to be $7,260, which should be.

[Solved] Develop journal entries and find out the cost of goods sold

Sales of goods are not just about cash and revenue accounts. Web we won’t write the journal entry for this transaction. What we have now.

Completion of Sale & Finished Goods Journal Entries YouTube

Your business earns income, and you’re making a customer happy. Knowing the cost of goods sold. (being fittings sold for 10,000 to mr. Web journal.

LO 6.4a Analyze and Record Transactions for the Sale of Merchandise

Opening inventory plus purchases and production costs minus closing inventory. Web a cost of goods sold journal entry is used to reduce the cost of.

Cash Sales Journal Entry Example

Opening inventory plus purchases and production costs minus closing inventory. The journal entry for cost of goods sold is a calculation of beginning inventory, plus.

Recording a Cost of Goods Sold Journal Entry

Sales revenue minus cost of goods sold is a business’s gross. What we have now learned is that using the periodic inventory system the cost.

The Journal Entry to Record Labor Costs Credits

Web the cost of goods sold sometimes abbreviated to cogs or referred to as cost of sales, is the costs associated with producing the goods.

Sales Revenue Minus Cost Of Goods Sold Is A Business’s Gross.

Web we won’t write the journal entry for this transaction. Knowing the cost of goods sold. This formula can be used to calculate how much it costs to. Sales of goods are not just about cash and revenue accounts.

Identify The Cost Of Goods Sold.

Web what is the cost of goods sold? Z) depending on your specific business and chart of accounts, the specific amounts and. The sign for job mac001 had a. Web cost of goods sold is likely the largest expense reported on the income statement.

When The Cost Of Goods Sold Is Subtracted From Sales, The Remainder Is The Company’s Gross.

Your business earns income, and you’re making a customer happy. Web what is a journal entry for cost of goods sold? The cost of goods sold (cogs) refers to the cost of producing an item or service sold by a company. Next, let’s record the sale of.

Web The Journal Entry For The Above Transaction Will Be:

Web the cost of goods sold sometimes abbreviated to cogs or referred to as cost of sales, is the costs associated with producing the goods which have been sold. Opening inventory plus purchases and production costs minus closing inventory. Web cost of goods sold was calculated to be $7,260, which should be recorded as an expense. Instead, as the sporting good store’s accountants, we’ll just use t accounts to describe the entry: