Journal Entry Advance Payment - If there exist a sales order, you can directly create a payment entry for the advance amount. Web create a special journal entry. Yet the supplier hasn’t delivered any services or products to you, and you haven’t. We can create chart of account “customer deposit” which is easy to control. Web create a special journal entry for advance payments of any kind. Web in accounting, any advance payments received from customers are treated as a liability until the underlying goods are supplied, or services are offered to the respective clients. Company abc is purchasing the machinery from the supplier cost $ 120,000. Web the purpose of this paper is to give you a brief introduction to when company receives advance payment from customers and how it should be treated in accounting. Web whenever an advance payment is made, the accounting entry is expressed as a debit to the asset cash for the amount received. In other words, customer advances are.

How To Record Advance Payment Best Practices & Accounting Entries

A comes back, he needs to clear cash advances with the company. Web journal entries for advance to suppliers accounting treatment for advance to suppliers.

3.5 Use Journal Entries to Record Transactions and Post to TAccounts

First, make sure you have the supplier listed in quickbooks online. A comes back, he needs to clear cash advances with the company. Web the.

Cash Advance Received From Customer Double Entry Bookkeeping

Web customer advances can be defined as the amount that is taken from the customers in advance of the order actually being processed. The journal.

Advances to Employees Journal Entry Kevin Mathis

Web the journal entry is debiting staff advance $ 500 and crediting cash $ 500. Web create a special journal entry. Web advance billing means.

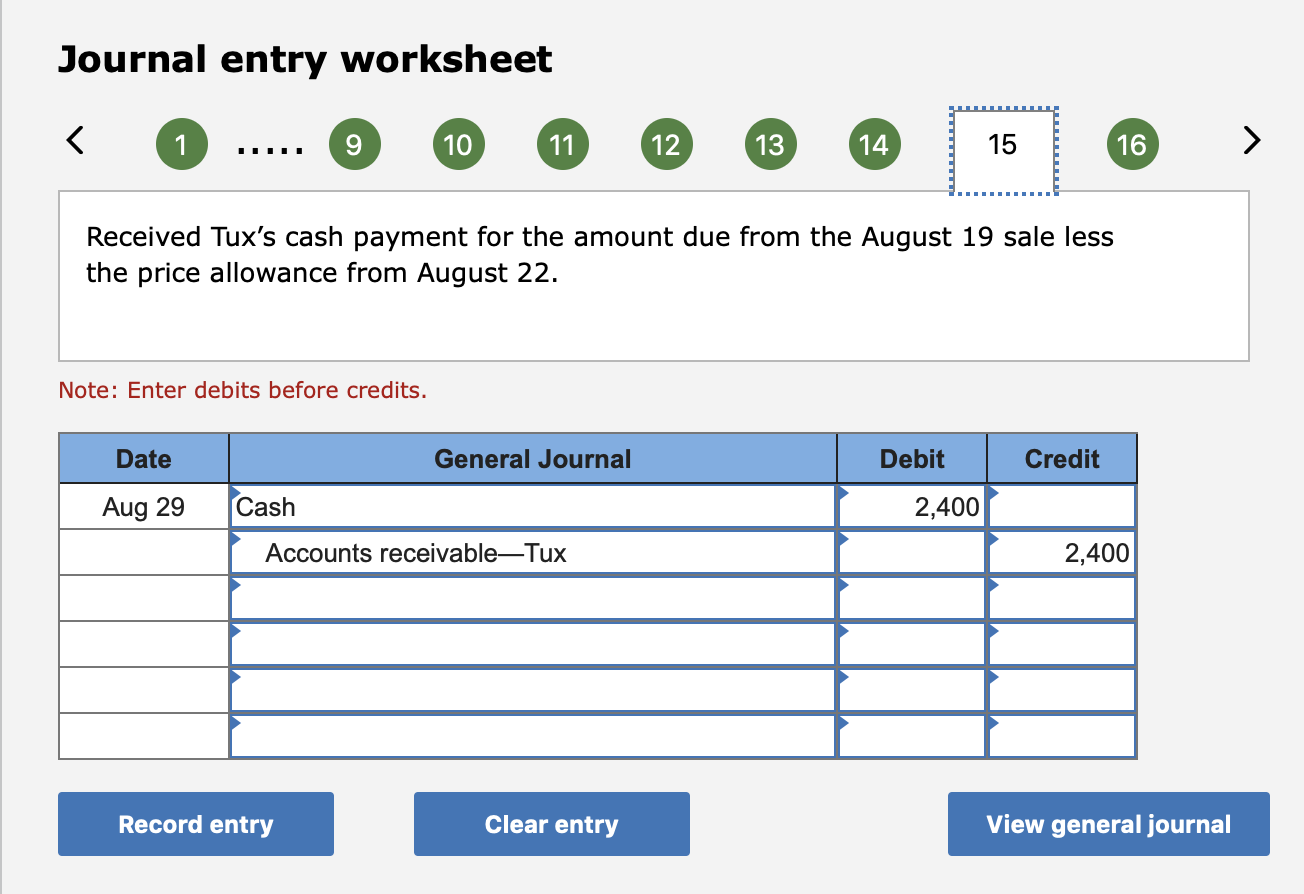

Solved Prepare journal entries to record the following

A credit also needs to be made to the liability. We can create chart of account “customer deposit” which is easy to control. If you.

3.5 Use Journal Entries to Record Transactions and Post to TAccounts

We can create chart of account “customer deposit” which is easy to control. Web customer advances can be defined as the amount that is taken.

What Is The Journal Entry For Payment Of Salaries Info Loans

It protects the seller from the risk of. Web the journal entry is debiting cash and credit unearned revenue. Web create a special journal entry.

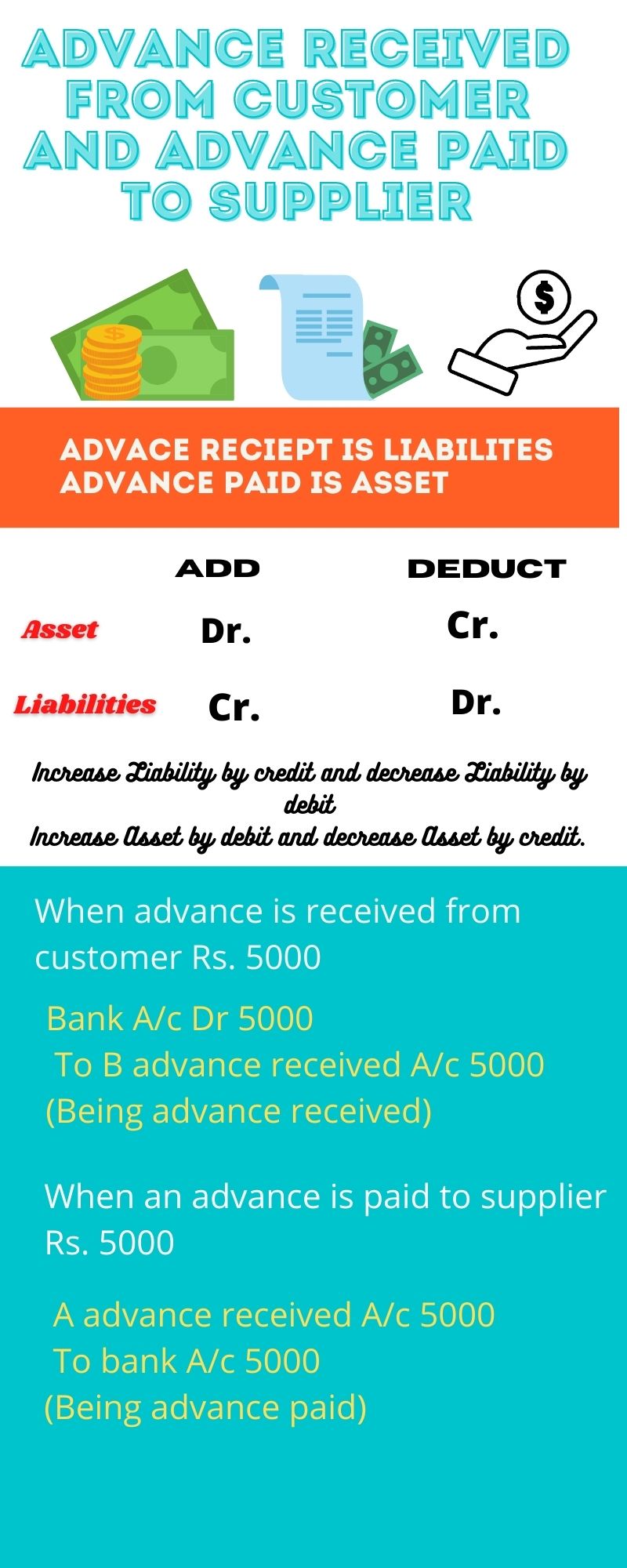

Journal entry of Advance received from Customer and advance paid to

Web two journal entries are involved. Web we can make the journal entry for advance paid to supplier by debiting the advance to supplier account.

journal entry format accounting accounting journal entry template

Web we can make the journal entry for advance paid to supplier by debiting the advance to supplier account and crediting the cash account for.

Web In Erpnext, Advance Payment Entry Is Created Using Payment Entry.

Web create a special journal entry for advance payments of any kind. When the time comes for your monthly payment, you can also create a journal entry for it. Web two journal entries are involved. Company abc is purchasing the machinery from the supplier cost $ 120,000.

It Protects The Seller From The Risk Of.

The journal entry will increase. Debit the cash account and credit the customer advances (liability) account. The payment in advance is an expense for your company. Web create a special journal entry.

Basically, It Means Getting Your Money Upfront.

Yet the supplier hasn’t delivered any services or products to you, and you haven’t. A comes back, he needs to clear cash advances with the company. First, make sure you have the supplier listed in quickbooks online. Web the journal entry is debiting staff advance $ 500 and crediting cash $ 500.

Web The Double Entry Bookkeeping Journal Entry To Show The Revenue Received In Advance Is As Follows:

Web a customer advance payment journal entry is a financial transaction recorded in a company’s accounting records when a customer makes an advance payment or deposit. We can create chart of account “customer deposit” which is easy to control. Advance payments should relate to a particular customer account. Web follow these steps to record the advance payment: