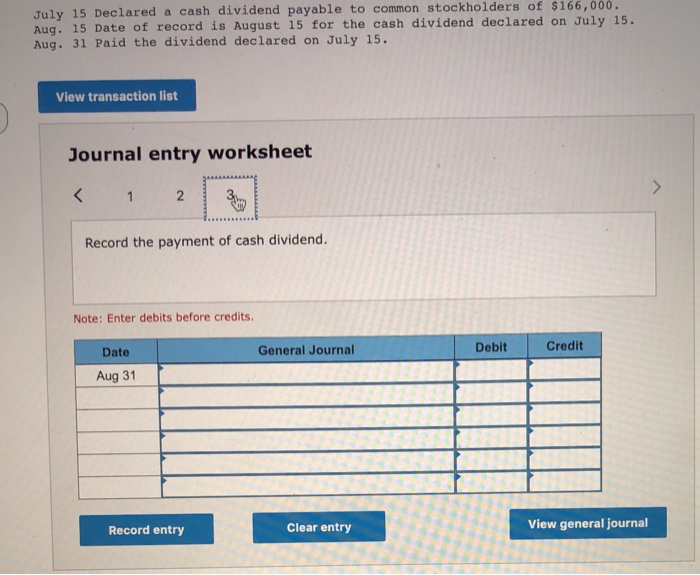

Journal Entries To Record Cash Dividends Are Made On The - Record date is 14 may 2015. Web the journal entry on the date of declaration is the following: Cash dividend is a distribution of earnings by cash to the shareholders of the company. The debit is a charge against the retained earnings of the business and represents a distribution of the retained earnings to the shareholders. Record date and payment date d. Web the journal entry to record the declaration of the cash dividends involves a decrease (debit) to retained earnings (a stockholders’ equity account) and an increase (credit) to cash dividends payable (a liability account). No journal entry is required to be made. Dividends declared journal entry bookkeeping explained. Web on the payment date of dividends, the company needs to make the journal entry by debiting dividends payable account and crediting cash account. Create an account to view solutions.

Cash Dividends How to record a cash dividend Journal entry for cash

Record date and payment date d. Web this section explains the three types of dividends—cash dividends, property dividends, and stock dividends—along with stock splits, showing.

Journal Entry for Dividends YouTube

The company purchased $12,000 equipment and paid in cash. To record the payment of cash dividend. Because financial transactions occur on both the date of.

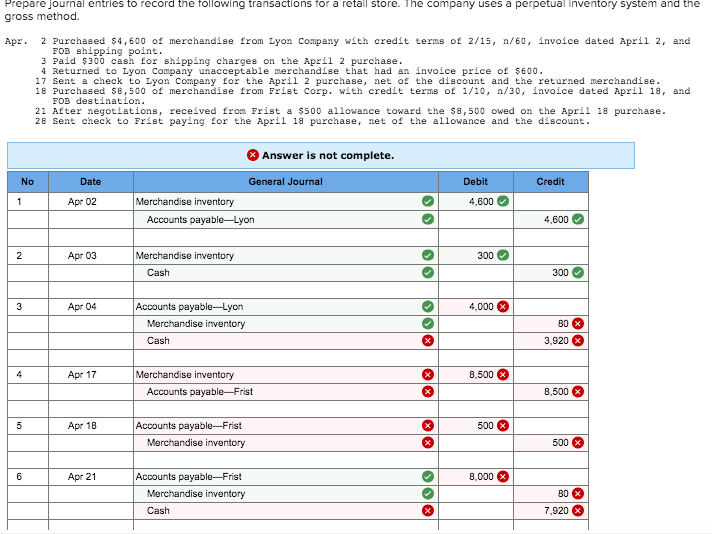

Solved Prepare journal entries to record the transactions

Web the journal entry to record the declaration of the cash dividends involves a decrease (debit) to retained earnings (a stockholders’ equity account) and an.

Dividends Payable Accounting Journal Entry

Cash dividend decreases retained earnings. Once the previously declared cash dividends are distributed, the following entries are made on the date of payment. Web this.

Solved Prepare journal entries to record the following

Web the declaration of dividends is journalized as follows: Delaration date and record date 13·the statement of stockholders' equity shows a. Because financial transactions occur.

Calculating Dividends, Recording Journal Entries YouTube

Web the journal entry on the date of declaration is the following: Because financial transactions occur on both the date of declaration (a liability is.

How to Record Dividends in a Journal Entry Accounting Education

Declaration date and payment date. Web the journal entry on the date of declaration is the following: Web the cash dividend declared is $1.25 per.

3.5 Use Journal Entries to Record Transactions and Post to TAccounts

Record date is 14 may 2015. Journal entries to record cash dividends are made on the? Web journal entries are required on both the date.

Cash Dividends (Journal Entries) YouTube

Dividend payments reduce the company's retained earnings, so debit the retained earnings balance. To record the declaration of a dividend, you will need to make.

Declaration Date And Record Date.

Web the cash dividend declared is $1.25 per share to stockholders of record on july 1, (date of record), payable on july 10, (date of payment). Record date and payment date d. Only the ending balance in cach stockholders' equity account b. Web record the journal entry to recognize the declaration of dividends when the announcement is made.

Century 21 Accounting General Journal.

As shown in the general ledger above, the retained earnings account is debited by $50,000 while the payables account is credited $50,000. Cash balance increases by $20,000. Web the journal entry to record the declaration of the cash dividends involves a decrease (debit) to retained earnings (a stockholders’ equity account) and an increase (credit) to cash dividends payable (a liability account). Journal entries to record cash dividends are made on the?

Web Prepare Journal Entries To Record These Transactions.

Declaration date, record date, and payment date. Web journal entries to record cash dividends are made on the: Cash dividend is a distribution of earnings by cash to the shareholders of the company. Web journal entries to record cash dividends are made on the:

Web Journal Entries Are Required On Both The Date Of Declaration And The Date Of Payment.

Web the dividends declared journal entry is shown in the accounting records using the following bookkeeping entries: The debit is a charge against the retained earnings of the business and represents a distribution of the retained earnings to the shareholders. No journal entry is required to be made. The company purchased $12,000 equipment and paid in cash.