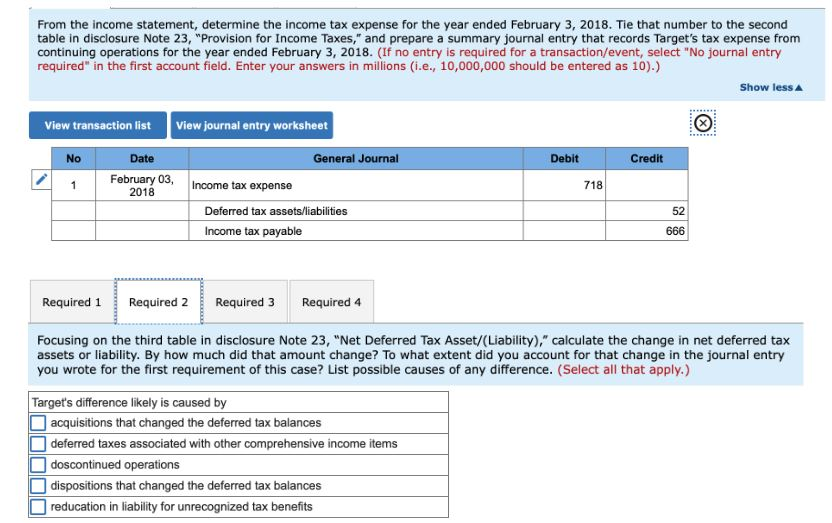

Journal Entries For Tax Provision - Provision expense is the expense that the company, such as bank or microfinance institution, makes to cover the anticipated losses that it may occur due to. (provision for income tax) provision for income tax is to be maintained for ₹20,000. Your accountant may also have other entries for you. Web journal entries for provisions for the accounting treatment of the provision expenses, the treatment for every provision will be different. Web calculating the tax journal entry. Web the actual taxation entries are most important things as they clears the balance sheet picture and gives real result. Journal entry (episode 6) tom fazio. Web we all know the general formula for the income tax provision: Record the necessary journal entry. Web in this lesson, we will explain how to prepare journal entries to record the income tax expense and related assets and liabilities in the financial statements.

Journal Entry Problems and Solutions Format Examples MCQs

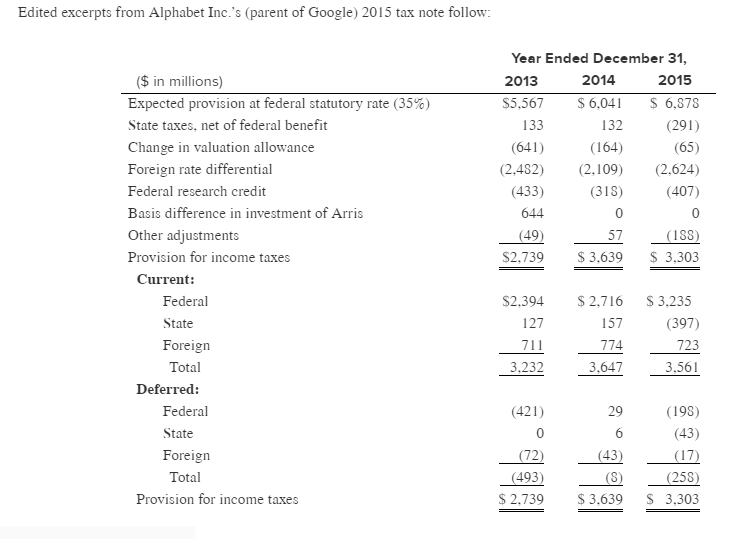

Web tax accounting perspectives. Web journal entries for deferred tax liability. Web the journal entry to record provision is: Current tax expense or benefit +.

Casual Journal Entry For Tax Payable Financial Statement

Web the provision for income tax journal entry is important for two reasons: Taxes are amounts levied by governments on businesses and individuals to finance.

Provision For Tax Journal Entry

Web accounting for taxes. Your accountant may also have other entries for you. Web provision for income tax = income earned before tax * tax.

Tax Expense Journal Entry Journal Entries for Normal Charge

Web journal entries for deferred tax liability. Current tax expense or benefit + deferred tax expense or benefit = total income tax expense or. Web.

Journal Entry For Tax Provision

Current tax expense or benefit + deferred tax expense or benefit = total income tax expense or. Web the journal entry to record provision is:.

Entries for TDS Receivable and Provision for Tax Chapter 8 TDS Recei

This episode will show you how to record a journal entry for the tax provision. To ensure tax obligations are met on time; Before going.

Provisions in Accounting Meaning, Accounting Treatment, and Example

Web the actual taxation entries are most important things as they clears the balance sheet picture and gives real result. Your accountant may also have.

Journal Entry for Tax Refund How to Record

Web provision for income tax = income earned before tax * tax rate = $35,000 * 20% = $700. To ensure tax obligations are met.

Journal Entry For Tax Provision

Web provision for income tax = income earned before tax * tax rate = $35,000 * 20% = $700. Current tax expense or benefit +.

Taxes Are Amounts Levied By Governments On Businesses And Individuals To Finance Their Expenditures, To Fight Business Cycles, To.

This episode will show you how to record a journal entry for the tax provision. Web calculating the tax journal entry. Provision expense is the expense that the company, such as bank or microfinance institution, makes to cover the anticipated losses that it may occur due to. Key components of the provision calculation.

To Ensure Tax Obligations Are Met On Time;

Web journal entries for deferred tax liability. Web the journal entry to record provision is: Web journal entries for provisions for the accounting treatment of the provision expenses, the treatment for every provision will be different. Web tax provision basics:

Miar Company Has Reported The Following Figures For Current Year End:

Has created a provision of $700 that is the estimated. Current tax expense or benefit + deferred tax expense or benefit = total income tax expense or. This implies that sandra co. Web the provision for income tax journal entry is important for two reasons:

Web In This Lesson, We Will Explain How To Prepare Journal Entries To Record The Income Tax Expense And Related Assets And Liabilities In The Financial Statements.

Web accounting for taxes. Before going to understand the taxation. Web the estimation is then booked as a journal entry. Web the actual taxation entries are most important things as they clears the balance sheet picture and gives real result.

+and+the+Journal+Entry+to+Record+Income+Taxes.jpg)