Journal Entries For Prepayments - Such expenses are shown on the asset side of balance sheet under current assets heading. These are both asset accounts and do not increase or decrease a company’s balance sheet. A guide to prepaid expense accounting. Web create a prepaid expenses journal entry in your books at the time of purchase, before using the good or service. 25% of the policy lapses during the fourth quarter and should be expensed. Brett johnson, avp, global enablement. A prepayment transaction is recorded initially by debiting an asset account (such as prepaid insurance, prepaid rent etc.) and crediting cash or bank. Recall that prepaid expenses are considered an asset because they provide future economic benefits to the company. Though salaries of $70,000 were paid on 4 july 2014, they related to services provided by employees in june 2014. When a payment is made for a future expense, the following journal entry is made:

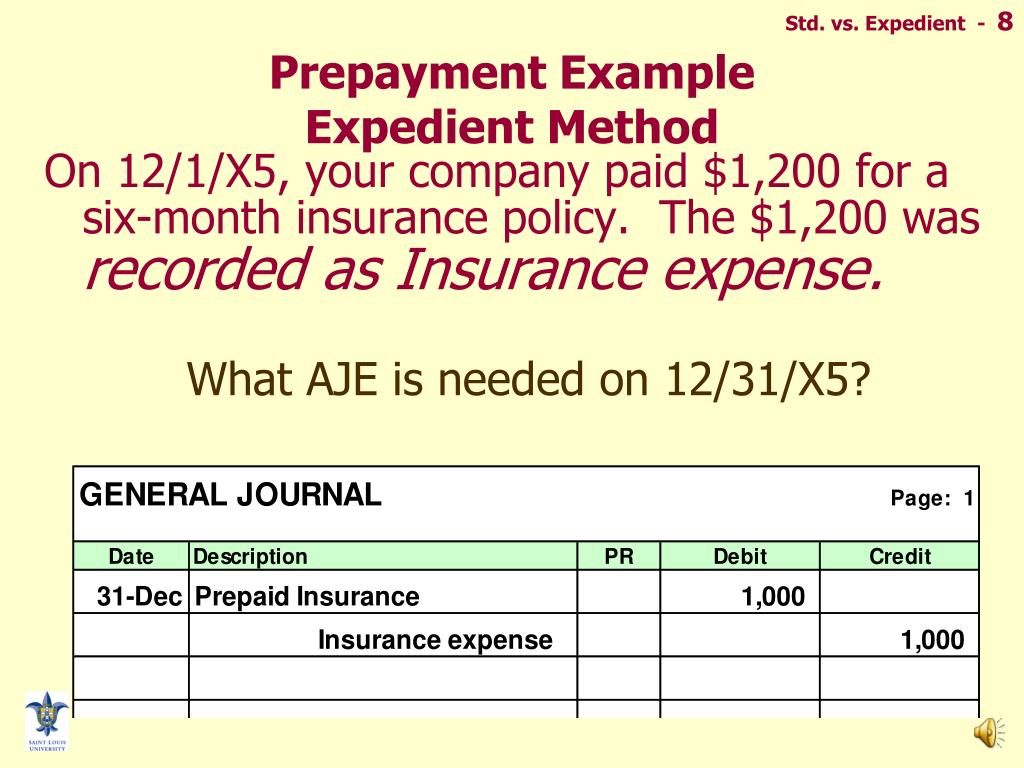

PPT ADJUSTING JOURNAL ENTRIES Prepayments/Deferrals PowerPoint

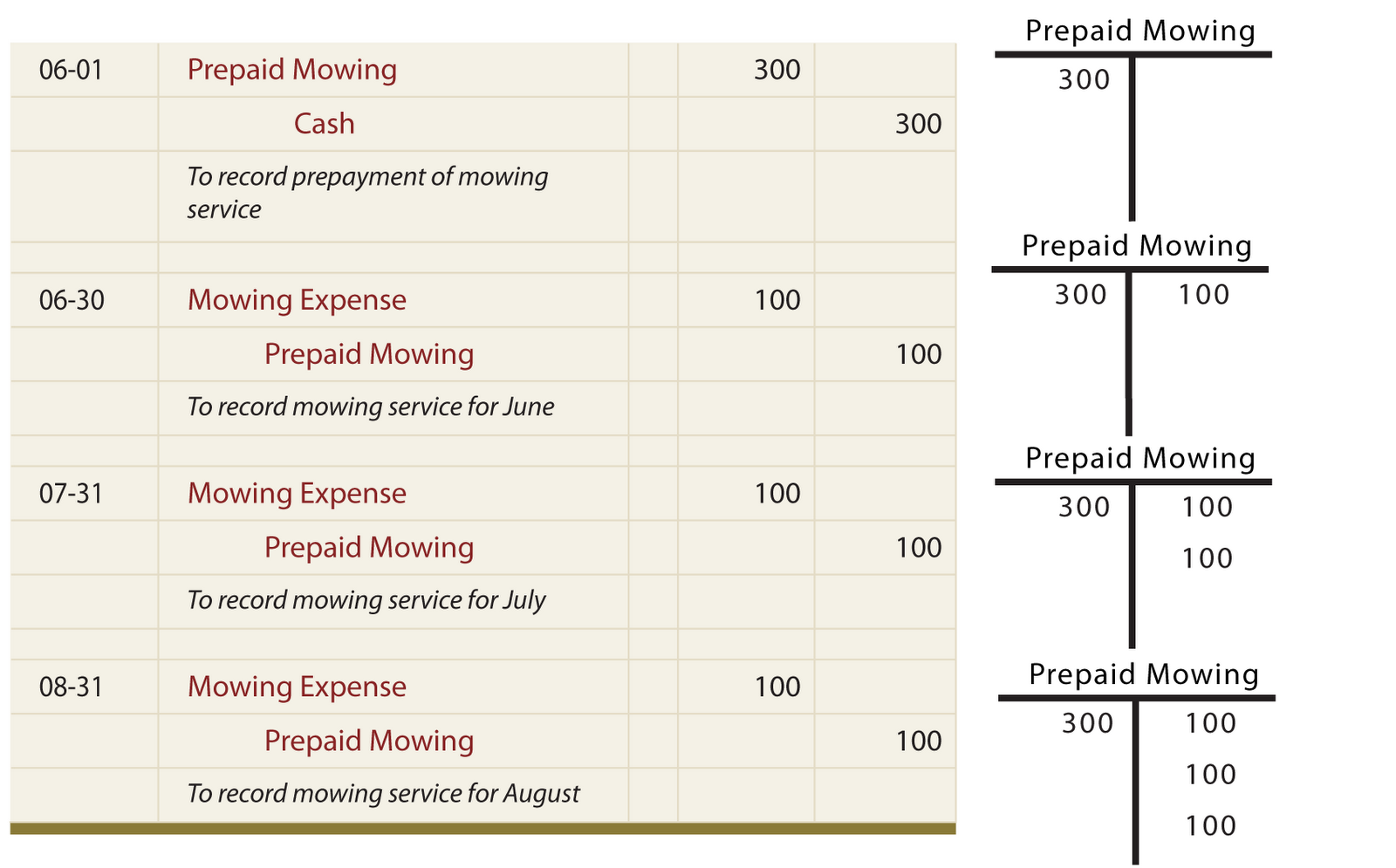

Web journal entries for prepaid expenses. Prepaid expense a/c and expense a/c. Web below are examples of journal entries under two different methods of recording.

Journal Entry For Prepaid Expenses

Web for example, let’s say a journal entry is recorded as amount x paid for abc prepaid expense; Web a full guide on accounting for.

Journal Entry for Prepaid Insurance Better This World

Web prepaid expenses may need to be adjusted at the end of the accounting period. Web prepaid expenses journal entry: Recall that prepaid expenses are.

Prepaid Salary Journal Entry

Web below are examples of journal entries under two different methods of recording prepaid expenses using the following information: Web prepaid expenses journal entry: Web.

Accounting Journal Entries For Dummies

1 accruals basis of accounting. Web for example, let’s say a journal entry is recorded as amount x paid for abc prepaid expense; Web explain.

Accruals and Prepayments Journal Entries HeathldDunn

It is double entry accounting. As a financial consultant or business owner, it is critical to understand prepaid expenses and how to account for them..

What is Prepaid expense Example Journal Entry Tutor's Tips

A guide to prepaid expense accounting. A prepaid expense is a payment made in advance for goods or services that will be received in the.

Accounting Journal Entries For Dummies

(1) the asset method, and (2) the expense method. Prepaid expense a/c (a newly opened account) cr. Web prepaid expense journal entry. Within a financial.

Prepaid Salary Journal Entry

The following journal entry accommodates a prepaid expense: Web a prepaid expense is any expense you pay that has not yet been incurred. Web the.

Web The Initial Journal Entry For Prepaid Rent Is A Debit To Prepaid Rent And A Credit To Cash.

Definition, journal entry and examples. Web journal entries for prepaid expenses. Prepaid expense a/c (a newly opened account) cr. Illustrate the process of adjusting for accruals and prepayments in preparing financial statements.

The Following Journal Entry Accommodates A Prepaid Expense:

The steps in the accounting process. Web explain the need for adjustments for accruals and prepayments in preparing financial statements. In our examples, the original business transaction is posted to an expense in the profit and loss. At the time of payment:

The Adjusting Entry For Prepaid Expense Depends Upon The Journal Entry Made When It Was Initially Recorded.

These are both asset accounts and do not increase or decrease a company’s balance sheet. Web create a prepaid expenses journal entry in your books at the time of purchase, before using the good or service. Trump revocable trust, dated march 17, 2017, bearing voucher number 846907, and kept or maintained by the trump. Web prepaid expenses may need to be adjusted at the end of the accounting period.

Web A Prepaid Expense Is Any Expense You Pay That Has Not Yet Been Incurred.

Web when a company prepays for an expense, it is recognized as a prepaid asset on the balance sheet, with a simultaneous entry being recorded that reduces the company's cash (or payment account) by. Web a full guide on accounting for prepaid expenses including journal entries and amortization schedules for leases, subscriptions, and insurance. Within a financial year, each time a portion of the expense is paid off, the prepaid account is. 75% of the annual policy remains prepaid as of december 31.