Journal Entries For Operating Lease - Determine the lease term under asc 840. The present value of all known future lease payments. Web operating lease accounting example and journal entries. Web so what does this mean? Web to help accounting teams at businesses and nonprofits, here are some of the basic journal entries you’ll need to use to account for operating leases under the new lease standard. Utilizing the amortization table, the journal entry for the end of the first period is as follows: Lessors but not lessees are required to classify their leases into finance and operating. What is a lease under asc 842? This article cuts through the confusion and provides a clear roadmap for mastering asc 842 lease accounting. By obaidullah jan, aca, cfa and last modified on may 8, 2020.

Finance Lease Journal Entries businesser

Determine the lease term under asc 840. On the asc 842 effective date, determine. Web what is asc 842? The lessor keeps the ownership rights.

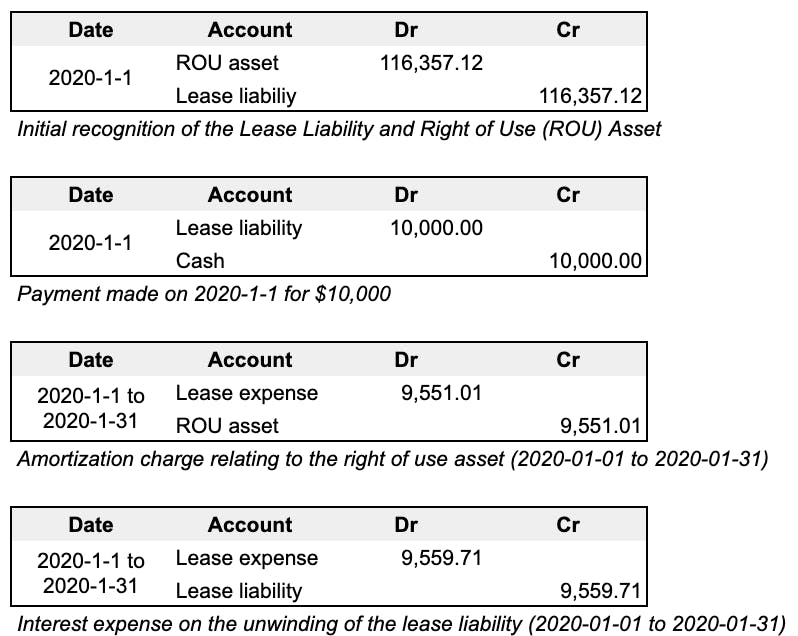

Journal entries for lease accounting

The lessee does not recognize the leased. Web to help accounting teams at businesses and nonprofits, here are some of the basic journal entries you’ll.

How to Calculate the Journal Entries for an Operating Lease under ASC 842

Web to help accounting teams at businesses and nonprofits, here are some of the basic journal entries you’ll need to use to account for operating.

In an Operating Lease the Lessee Records JaelynhasCox

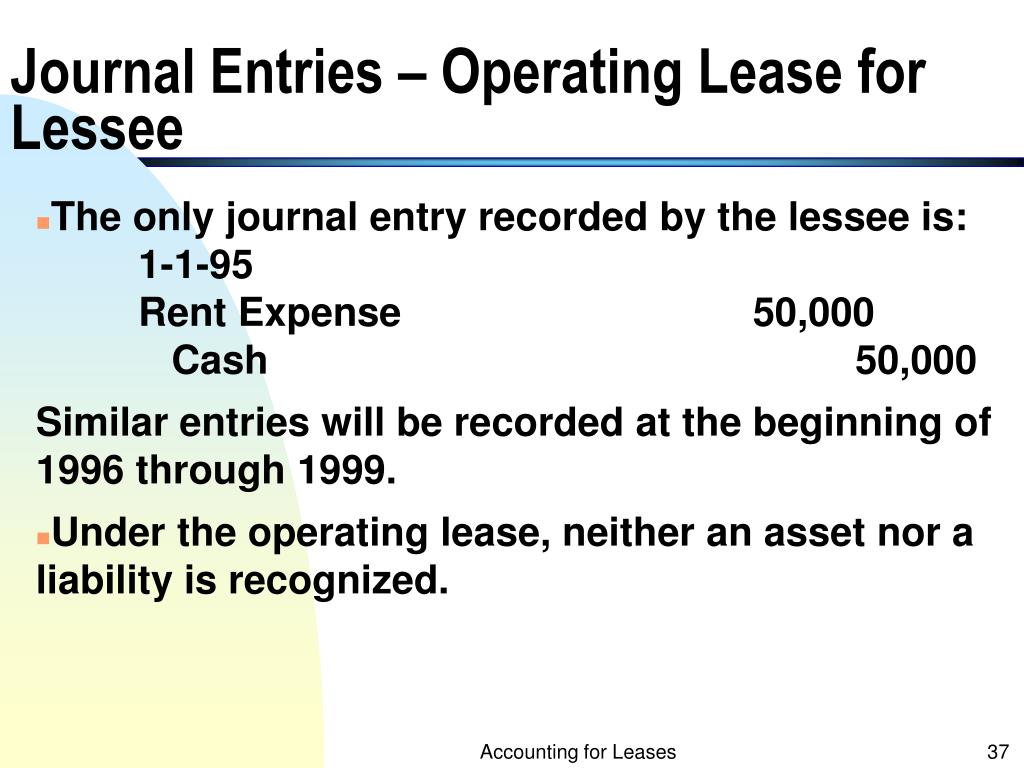

Operating lease is a lease which does not involve transfer of risks and rewards of ownership of the leased asset to the lessee. Web what.

Examples of New Operating Lease Treatment CSH

We’ll tackle accounting for operating leases under asc 842 much like the standard (or “topic”) released by the fasb does. Web what is asc 842?.

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

What’s covered and what’s not covered? The monthly rental expense will be calculated as follows, rental expense per month = total lease rental / no..

Finance Lease Journal Entries businesser

Web the journal entry at the end of year 2 would be as follows: On the asc 842 effective date, determine. Operating lease is a.

Accounting Treatment Of Operating Lease And Finance Lease businesser

Utilizing the amortization table, the journal entry for the end of the first period is as follows: Recognize the lease liability and right of use.

PPT Accounting for Leases PowerPoint Presentation, free download ID

It's essentially like accounting for all your leases as if they were capital leases under asc 840. Web show the journal entry for the operating.

Web An Operating Lease Refers To A Lease Contract Where The Ownership Of The Asset Does Not Transfer To The Lessee.

Determine the lease term under asc 840. Web how to calculate the journal entries for an operating lease under asc 842. Web show the journal entry for the operating lease transaction. Below we present the entry recorded as of 1/1/2021 for our example:

Determine The Total Lease Payments Under Gaap.

This includes the following steps (how to record journal entries): Web to show what asc 842 journal entries would look like for operating leases, we are going to give an example. For many businesses, navigating the complexities of asc 842 journal entries can be a daunting task. Web what is asc 842?

Details On The Example Lease Agreement.

Web operating lease accounting example and journal entries. Web the journal entry at the end of year 2 would be as follows: Web you'll learn the key differences between operating and finance leases, see illustrative examples and journal entries, and understand the financial reporting implications around operating lease accounting. The lessee does not recognize the leased.

We’ll Tackle Accounting For Operating Leases Under Asc 842 Much Like The Standard (Or “Topic”) Released By The Fasb Does.

Web journal entries for different types of leases. Effective date for private companies. Web to help accounting teams at businesses and nonprofits, here are some of the basic journal entries you’ll need to use to account for operating leases under the new lease standard. This article cuts through the confusion and provides a clear roadmap for mastering asc 842 lease accounting.