Journal Entries For Lease - The period of the lease lasts at least 75% of the useful economic life of the asset. Asc 842 journal entries for finance leases. The new lease accounting standard is effective for. Record the opening journal entry under gasb 87. Reviewed by dheeraj vaidya, cfa, frm. Following the example above, if we determine that the lease is a finance lease, the lessor shall pass the following. Web what is the journal entry for an operating lease? The lease is noncancellable during this time. The year’s closing balance is. Under asc 842, an operating lease you now recognize:.

Journal entries for lease accounting

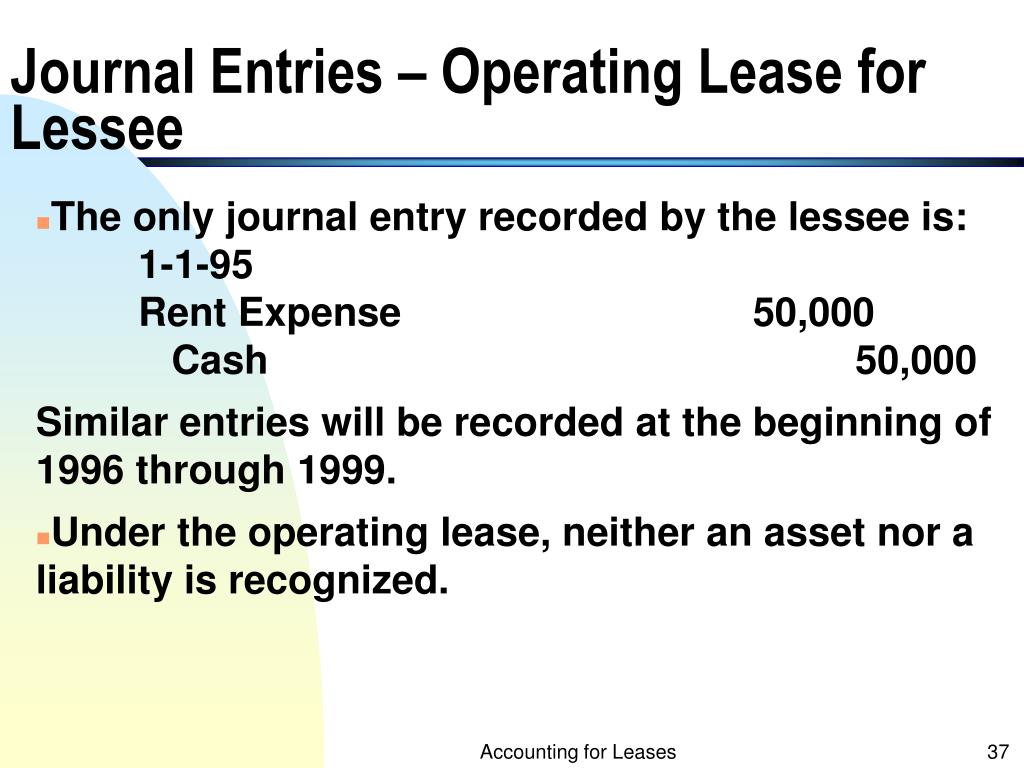

Web journal entries for operating lease: 30 sep 2021 (updated 31 aug 2022) us leases guide. Under asc 842, journal entries for operating leases are.

Finance Lease Journal Entries businesser

Web journal entries for operating lease: Determine the lease term under asc 840. Reviewed by dheeraj vaidya, cfa, frm. The period of the lease lasts.

Check this out about Capital Lease Accounting Journal Entries

Web so what does this mean? Under asc 842, journal entries for operating leases are concise calculations on the debits of your rou assets. Determine.

PPT Accounting for Leases PowerPoint Presentation, free download ID

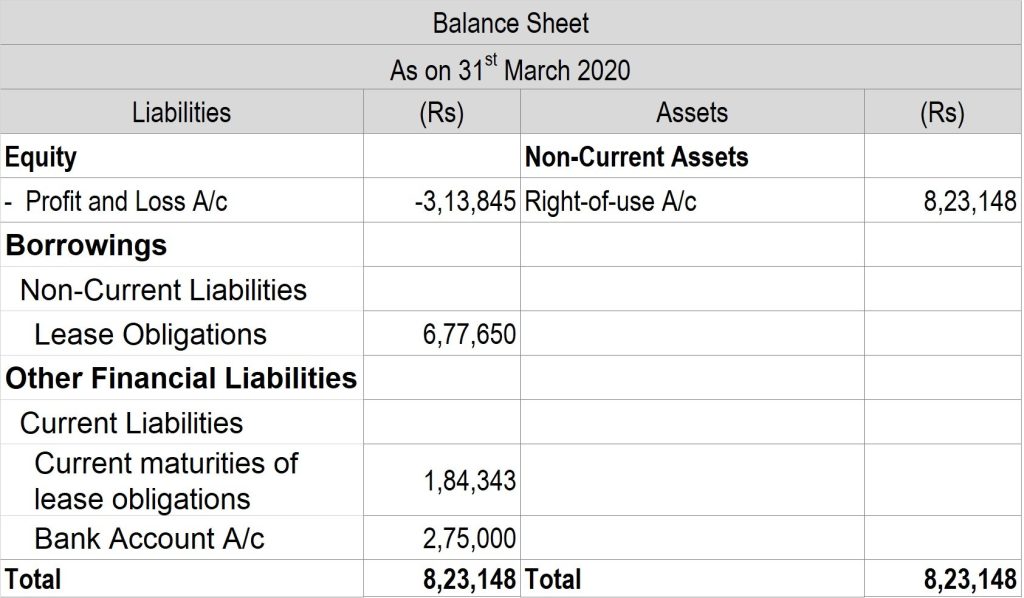

This lease accounting standard replaced the previous standard ias 17 and. Web operating lease accounting example and journal entries. The lease is noncancellable during this.

Journal entries for lease accounting

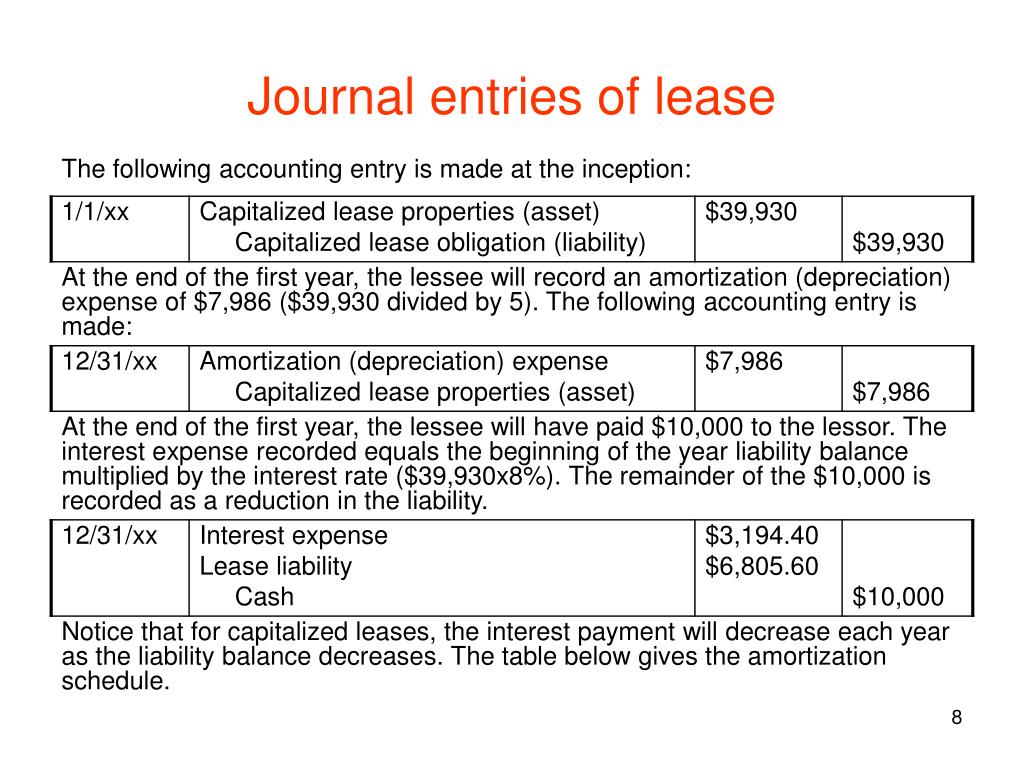

Below we present the entry recorded as of 1/1/2021 for our example: When a lease is terminated in its entirety, there should be no remaining.

Finance Lease Journal Entries Lessor businesser

Web the journal entry would involve debiting the interest expense account for $200, debiting the loan liability account for $800, and crediting the cash account.

How to Calculate the Journal Entries for an Operating Lease under ASC 842

Fogelman’s interest rate, known by tacoking, was 4%.required:1. It's essentially like accounting for all your leases as if they were capital leases under asc 840..

PPT Chapter 4 Asset Analysis PowerPoint Presentation, free download

What is a lease under asc 842? Under asc 842, an operating lease you now recognize:. The new lease accounting standard is effective for. Fogelman’s.

Finance Lease Journal Entries businesser

What is a lease under asc 842? 30 sep 2021 (updated 31 aug 2022) us leases guide. Utilizing the amortization table, the. Web what is.

What Is Capital Lease Accounting?

Web what is the journal entry for an operating lease? This lease accounting standard replaced the previous standard ias 17 and. When a lease is terminated in its entirety, there should be no remaining lease liability or. Asc 842 can be overwhelming;

Web So What Does This Mean?

Reviewed by dheeraj vaidya, cfa, frm. Details on the example lease agreement. Fogelman’s interest rate, known by tacoking, was 4%.required:1. Calculate the initial lease liability.

Record The Opening Journal Entry Under Gasb 87.

Web journal entries in an employer's accounts are a payment of a 'recipients contribution', 'recipient's payment' or 'recipients rent' only if all of the following conditions are met: Following the example above, if we determine that the lease is a finance lease, the lessor shall pass the following. 30 sep 2021 (updated 31 aug 2022) us leases guide. Web according to asc 842, journal entries for operating leases are as follows:

It's Essentially Like Accounting For All Your Leases As If They Were Capital Leases Under Asc 840.

Below we present the entry recorded as of 1/1/2021 for our example: Web journal entries in case of a finance lease. Web journal entries for operating lease: Web the journal entry would involve debiting the interest expense account for $200, debiting the loan liability account for $800, and crediting the cash account for the.