Journal Entries For Lease Accounting - Web ifrs 16 has revolutionised lease accounting journal entries, emphasising transparency and accurate reporting. 30 sep 2021 (updated 31 aug 2022) us leases guide. The initial journal entry under ifrs 16 records the asset and liability on the balance sheet as of the lease commencement date. Lessees need to carefully consider the terms of. Utilizing the amortization table, the journal. Web to help accounting teams at businesses and nonprofits, here are some of the basic journal entries you’ll need to use to account for operating leases under the new lease standard. Effective date for public companies. Web asc 842 journal entries for operating leases. Web journal entries in case of a finance lease. In this journal entry, the amount of lease asset.

Finance Lease Journal Entries Lessor businesser

For a fuller explanation of journal entries, view. The initial journal entry under ifrs 16 records the asset and liability on the balance sheet as.

Finance Lease Journal Entries businesser

Web as a result, on the commencement of the lease, you will recognize the following journal entries: Whether you're an accountant or a business. It.

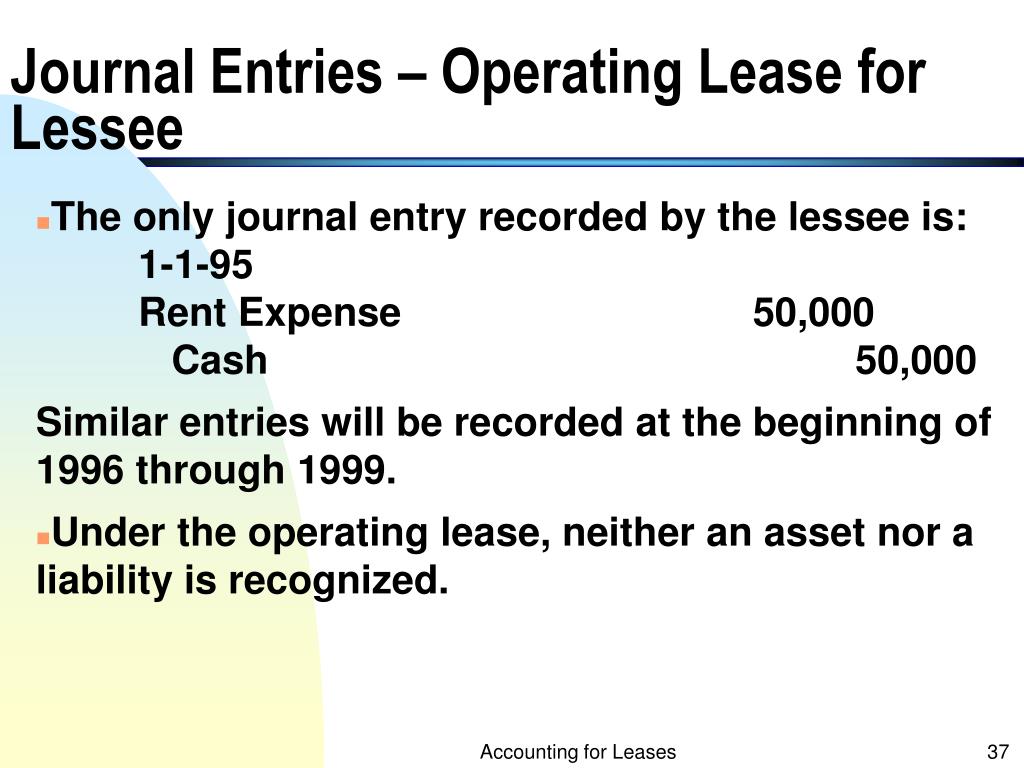

PPT Accounting for Leases PowerPoint Presentation, free download ID

Asc 842 journal entries for finance leases. Web 4.3.2.1 direct financing lease — initial measurement. 30 sep 2021 (updated 31 aug 2022) us leases guide..

Finance Lease Journal Entries businesser

Web as a result, on the commencement of the lease, you will recognize the following journal entries: Web the principal payment is the difference between.

Journal entries for lease accounting

The initial journal entry under ifrs 16 records the asset and liability on the balance sheet as of the lease commencement date. For a fuller.

Journal entries for lease accounting

Web the principal payment is the difference between the actual lease payment and the interest expense. Web the new lease accounting standard, released by fasb.

How to Calculate the Journal Entries for an Operating Lease under ASC 842

The initial journal entry under ifrs 16 records the asset and liability on the balance sheet as of the lease commencement date. Asc 842 journal.

Check this out about Capital Lease Accounting Journal Entries

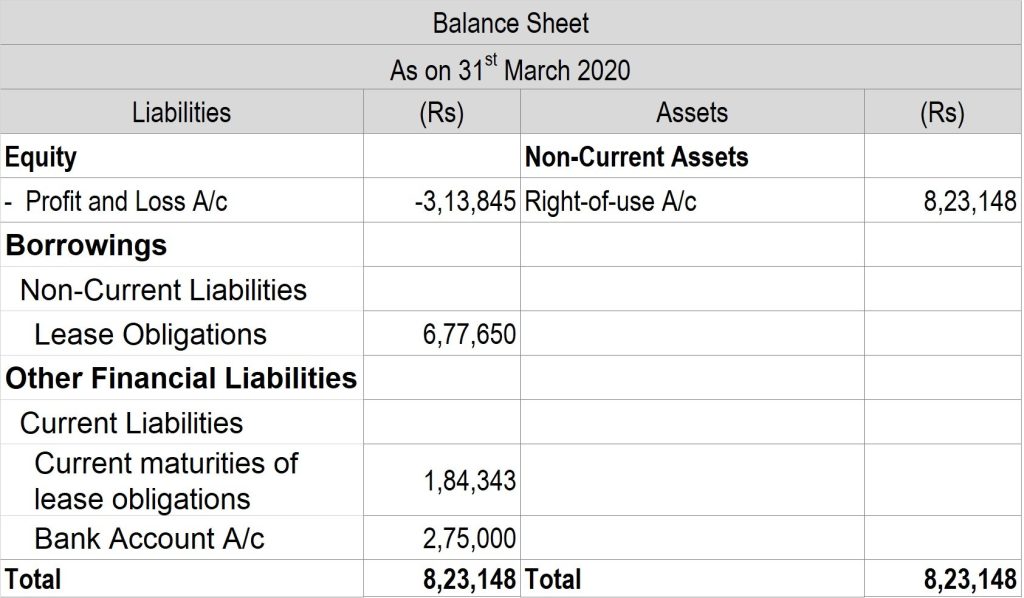

Consistent with the journal description, the lease liability and right of use asset. For a fuller explanation of journal entries, view. Properly recording lease transactions.

Journal entries for lease accounting

Web recording journal entries appropriate for the lease accounting standard being tracked is critical for accurate financial reporting. Utilizing the amortization table, the journal. Lessors.

Web Journal Entries In Case Of A Finance Lease.

Lessees need to carefully consider the terms of. Web ifrs 16 has revolutionised lease accounting journal entries, emphasising transparency and accurate reporting. Web the new lease accounting standard, released by fasb in early 2016, represents one of the largest and most impactful reporting changes to accounting principles in decades. Web recording journal entries appropriate for the lease accounting standard being tracked is critical for accurate financial reporting.

Following The Example Above, If We Determine That The Lease Is A Finance Lease, The Lessor Shall Pass The Following Journal Entry At The.

Web to help accounting teams at businesses and nonprofits, here are some of the basic journal entries you’ll need to use to account for operating leases under the new lease standard. It is considered as if the asset was purchased according to. 30 sep 2021 (updated 31 aug 2022) us leases guide. Utilizing the amortization table, the journal.

Below We Present The Entry Recorded As Of 1/1/2021 For Our Example:

This classification is fundamental in lessor accounting, given that the accounting requirements. In this journal entry, the amount of lease asset. Web asc 842 journal entries for operating leases. Web a capital lease accounting entry is passed when a renter or lessee is entitled to the temporary use of the asset.

The Initial Journal Entry Under Ifrs 16 Records The Asset And Liability On The Balance Sheet As Of The Lease Commencement Date.

Web 4.3.2.1 direct financing lease — initial measurement. Whether you're an accountant or a business. Effective date for public companies. Web the company can make the finance lease journal entry by debiting the lease asset account and crediting the lease liability account.