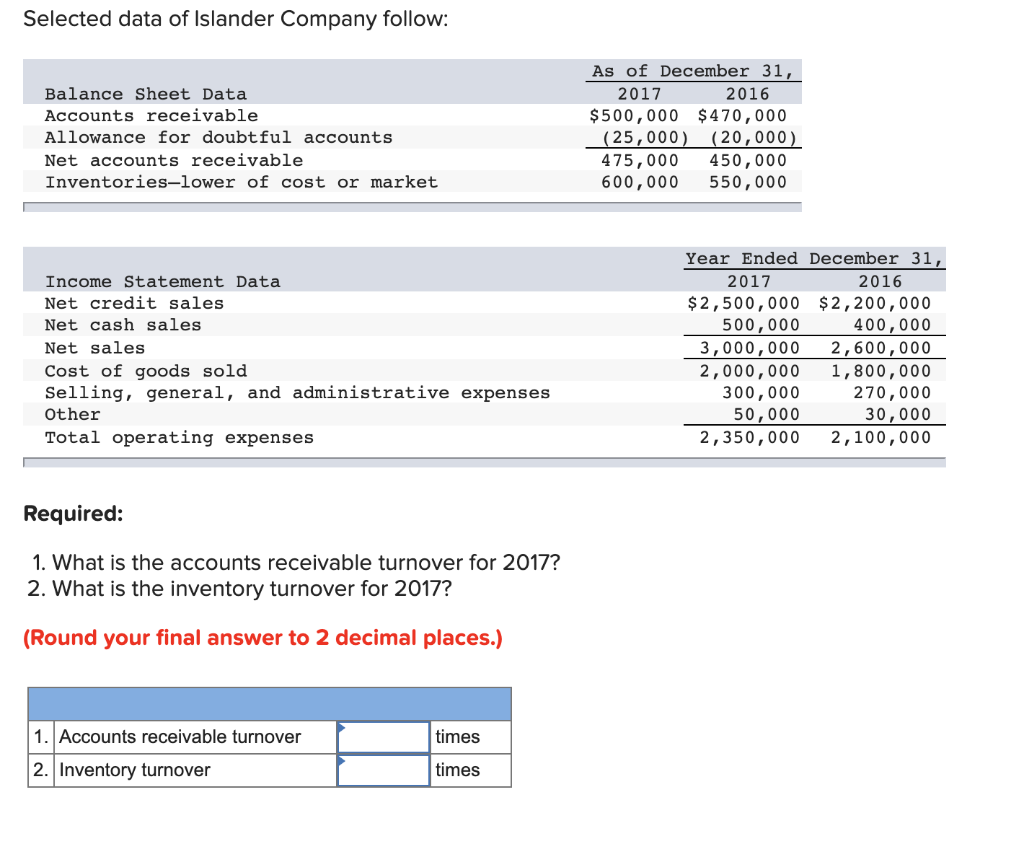

Journal Entries For Inventory And Cost Of Goods Sold - Web the cost of goods sold (cogs) is the cost of goods that have been sold by a business during a particular period of time. To correct the cost of goods sold in the income statement we need to increase the purchases by the beginning inventory and as before reduce the purchases by the ending inventory. Web the journal entry for cost of goods sold is a calculation of beginning inventory, plus purchases, minus ending inventory. This entry matches the ending balance in the inventory account to the costed actual ending inventory, while eliminating the $450,000 balance in the purchases account. Web these methods include the periodic inventory system and perpetual inventory system, costs included in cost of goods sold. Web accounting for a sales return involves reversing (a) the revenue recorded at the time of original sale, and (b) the related cost of goods sold. With the information in the example, we can calculate the cost of goods sold as below: The periodic inventory system is better for those businesses that maintain less inventory. Describe cost of goods sold in relation to the matching principle. A journal entry transfers costs from the balance sheet to the income statement.

[Solved] Develop journal entries and find out the cost of goods sold

Web inventory cost is an asset until it is sold; Collect information ahead of time, such as your beginning inventory balance, purchased inventory costs, overhead.

Perpetual Inventory Systems

The final number will be the yearly cost of goods sold for your business. Once any of the above methods complete the inventory valuation, it.

How to Record a Cost of Goods Sold Journal Entry insurance1health

With the information in the example, we can calculate the cost of goods sold as below: This entry matches the ending balance in the inventory.

Cost of Goods Sold Journal Entries Video & Lesson Transcript

If you purchase for resale one item at 100 and the carriage costs to deliver the item to your warehouse are 20 then the double.

Recording a Cost of Goods Sold Journal Entry

Once this inventory is sold, it becomes the cost of goods sold, and the cost of goods sold is an expense. Web when it comes.

Inventories and the Cost of Goods Sold online presentation

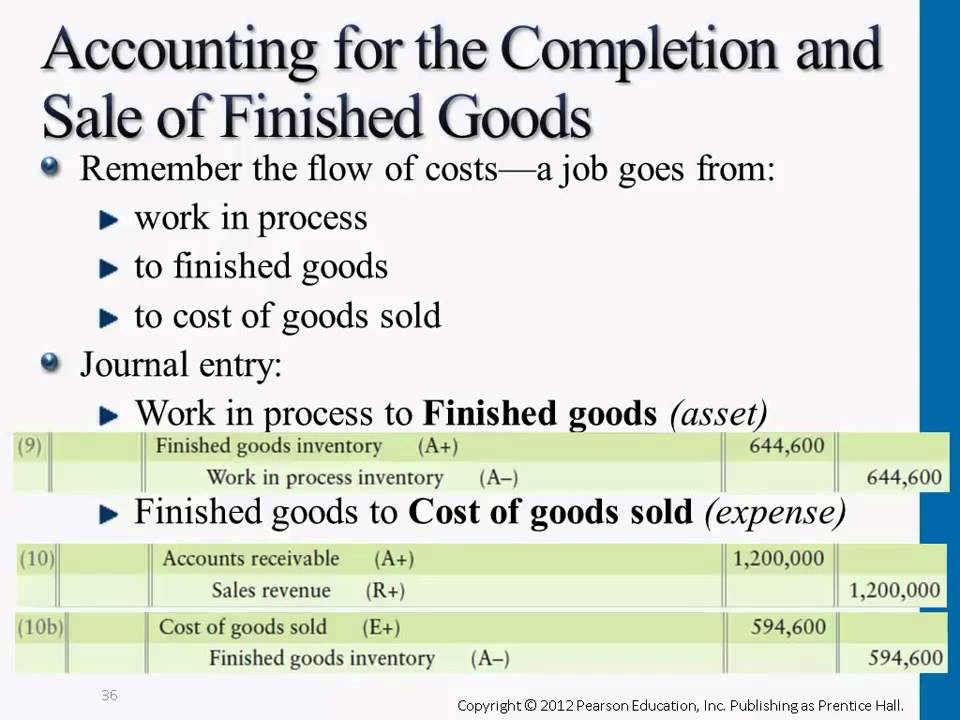

Web in job order costing, when a job is completed and products are ready for sale, the company can make the journal entry for finished.

How to Account for Cost of Goods Sold (with Pictures) wikiHow

Once any of the above methods complete the inventory valuation, it should be recorded by a proper journal entry. Collect information ahead of time, such.

Completion of Sale & Finished Goods Journal Entries YouTube

This entry matches the ending balance in the inventory account to the costed actual ending inventory, while eliminating the $450,000 balance in the purchases account..

LO 6.4a Analyze and Record Transactions for the Sale of Merchandise

If you purchase for resale one item at 100 and the carriage costs to deliver the item to your warehouse are 20 then the double.

Z) Depending On Your Specific Business And Chart Of Accounts, The Specific Amounts And Account Names May Differ.

Then, subtract the cost of inventory remaining at the end of the year. Inventory is the cost of goods we have purchased for resale; Once the inventory is issued to the production department, the cost of goods sold is debited while the inventory account is. Using a very simple (but unrealistic) example.

Based On Your Company’s Accounting System, Enter The.

Web what is the journal entry to record the cost of goods sold at the end of the accounting period? The cost of goods sold entry records the total of all. Web the following cost of goods sold journal entries outline the most common cogs. Gather information from your books before recording your cogs journal entries.

If You Purchase For Resale One Item At 100 And The Carriage Costs To Deliver The Item To Your Warehouse Are 20 Then The Double Entry Would Be As Follows:

Once this inventory is sold, it becomes the cost of goods sold, and the cost of goods sold is an expense. An inventory purchase entry is an initial entry made in your inventory accounting journal. Collect information ahead of time, such as your beginning inventory balance, purchased inventory costs, overhead costs (e.g., delivery fees), and ending inventory count. This lesson focuses on inventories of.

There Is A Simple Formula Associated With Calculating The Inventory Cost:

Knowing the cost of goods sold can help you calculate your business’s profits. A journal entry transfers costs from the balance sheet to the income statement. Web accounting for a sales return involves reversing (a) the revenue recorded at the time of original sale, and (b) the related cost of goods sold. Web journal entry for cost of goods sold: