Investment Write Off Journal Entry - How to determine if the equity method is applicable. Web create a journal entry to write off the appropriate amount of the asset. Web the journal entry for a $1,000 temporary decline in market value would be: £50,000 investment (shares) in a subsidiary which is now dormant and has no assets. Most publicly traded companies now have a fifth statement in addition to the balance sheet, income statement, statement of cash flows, and statement of owners’ equity. You will need to enter the following. Accounting for an investment using the equity method. Please see the following example. Web for proper recording of accounts that get written off, one has to make the following standard journal entries in their accounts book: It is primarily used in its most literal sense by businesses seeking to.

Uncollectible Accounts Written Off Accounting Methods

£50,000 investment (shares) in a subsidiary which is now dormant and has no assets. It is primarily used in its most literal sense by businesses.

Journal Entry for Equity and Debt Securities of Longterm Investment

Web for proper recording of accounts that get written off, one has to make the following standard journal entries in their accounts book: Accounting for.

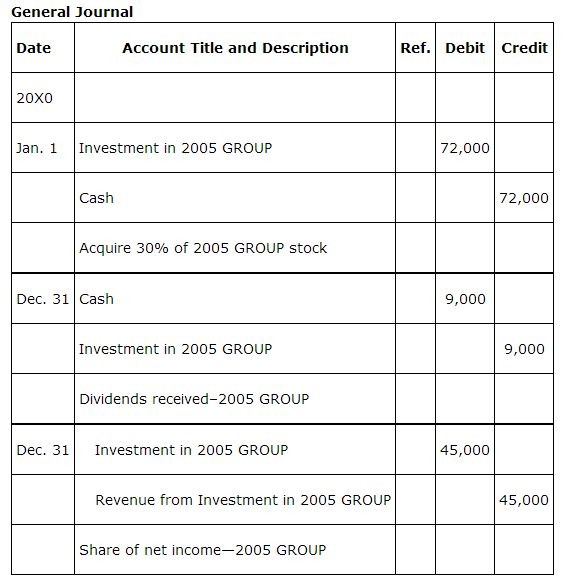

Guide to Subsidiary Accounting Methods and Examples

There are two choices for the debit part of the entry. Web accounting for equity investments, i.e. A client company has shares in 100% owned.

Journal Entry Problems and Solutions Format Examples

What is the equity method of accounting? It is primarily used in its most literal sense by businesses seeking to. Web create a journal entry.

journal entry format accounting accounting journal entry template

How to determine if the equity method is applicable. Most publicly traded companies now have a fifth statement in addition to the balance sheet, income.

Outstanding 30 Journal Entries With Ledger Trial Balance And Final

Web the journal entry for a $1,000 temporary decline in market value would be: First, you must enter a debit from your. For example, assume.

Journal Entries Format Examples Problems And Solutions

On january 1, as we acquired 80% of share ownership in the company xzy, it became our subsidiary company afterward. For example, assume you must.

[Solved] Show how to prepare journal entries for these shortterm

Most publicly traded companies now have a fifth statement in addition to the balance sheet, income statement, statement of cash flows, and statement of owners’.

Accounting Journal Entries For Dummies

In this case, we can make the journal entry for the $800,000 investment in subsidiary by debiting this amount to the investment in subsidiary account.

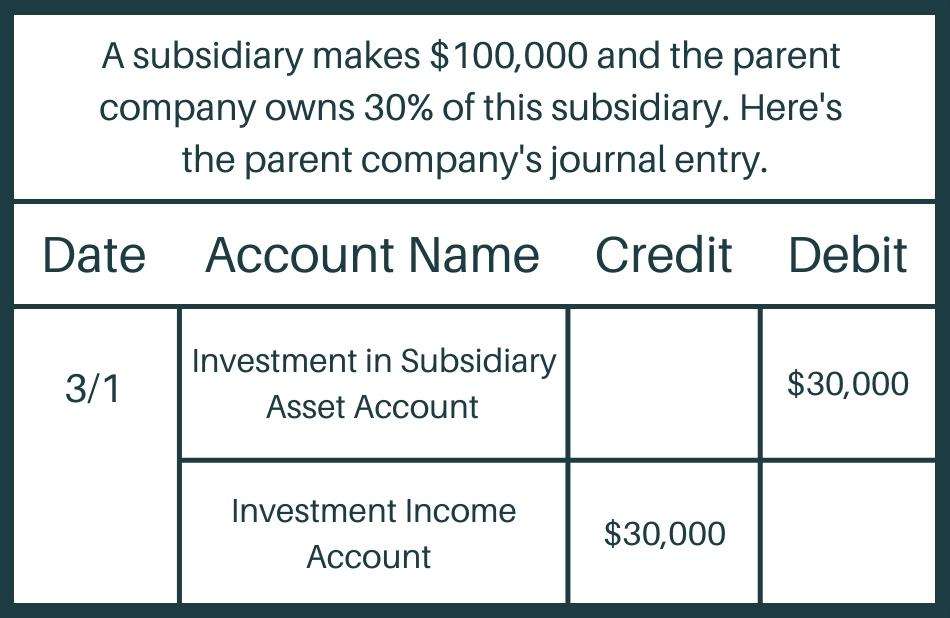

Investments In Common Stock, Preferred Stock Or Any Associated Derivative Securities Of A Company, Depends On The Ownership Stake.

Most publicly traded companies now have a fifth statement in addition to the balance sheet, income statement, statement of cash flows, and statement of owners’ equity. Accounting for an investment using the equity method. Web create a journal entry to write off the appropriate amount of the asset. It is primarily used in its most literal sense by businesses seeking to.

What Is The Equity Method Of Accounting?

If a subsidiary's value declines, it needs to be reflected on the parent company's. Web please first navigate to the transaction list, select new transaction and select journal. Accounting for an equity method investment. There are two choices for the debit part of the entry.

Web The Accounting For Investments Occurs When Funds Are Paid For An Investment Instrument.

This additional statement is called the statement of comprehensive income. Investor a would record the following journal entry. Web for proper recording of accounts that get written off, one has to make the following standard journal entries in their accounts book: Web investment agreements may include allocations among investors for the investee’s earnings, taxable profit and loss, distributions of cash from operations,.

£50,000 Investment (Shares) In A Subsidiary Which Is Now Dormant And Has No Assets.

Please see the following example. The exact type of accounting depends on the intent of the investor and the proportional size of the investment. For example, assume you must write off $2 million of your investment in a subsidiary. How to determine if the equity method is applicable.