Investment Accounting Journal Entries - Web accounting journal entries review and practice materials. Web 12.1 accounting for investments in trading securities. This journal entry is prepared to record this transaction in the accounting records of the. Owner invested $10,000 in the company. Web learn how to account for different types of investments depending on the investor's intent and the size of the investment. Web learn about the 3 equity investment accounting methods under us gaap: Instructor mark koscinski view bio. Realize that the reporting of investments in the ownership shares of another company depends on the purpose of the acquisition. [q1] owner invested $700,000 in the business. Web accounting for equity investments, i.e.

Accounting Journal Entries For Dummies

They take transactions and translate them into the information you, your bookkeeper, or accountant use to create financial reports and file taxes. Web accounting for.

Journal Entry for Equity and Debt Securities of Longterm Investment

Amortize the discount or premium; Owner invested $10,000 in the company. Web 12.1 accounting for investments in trading securities. Web illustrative entries examples of journal.

Accounting Q and A EX 154 Entries for investment in bonds, interest

Web learn how to account for different types of investment income, such as dividends, interest, equity method, and gains and losses. A gain on sale.

Accounting Treatment of Investment Fluctuation Fund in case of

Find out the differences between realized and unrealized gains and losses, and the fair value accounting method. Discover the purpose of partnership accounting and study.

LO 3.5 Use Journal Entries to Record Transactions and Post to T

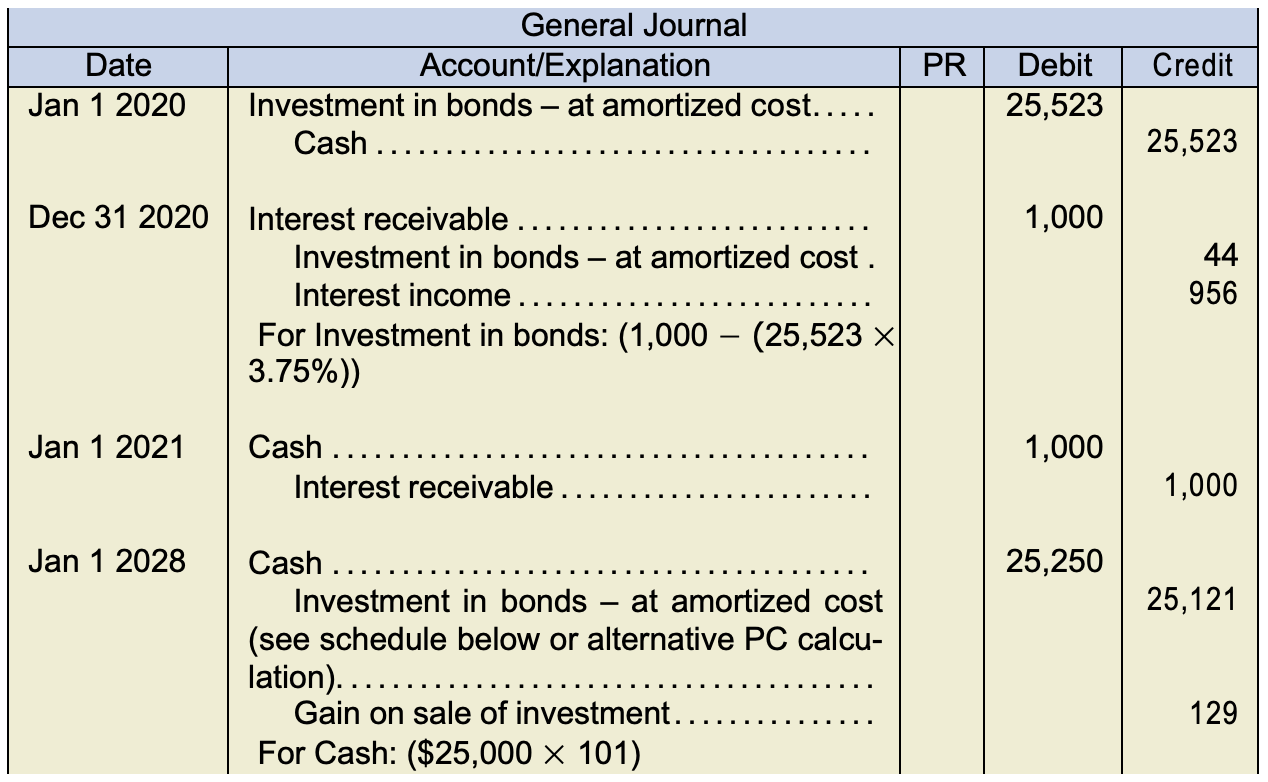

Web there are five possible journal entries related to investing in bonds, as follows: A gain on sale of investment arises when the (disposal) value.

Journal Entries Accounting

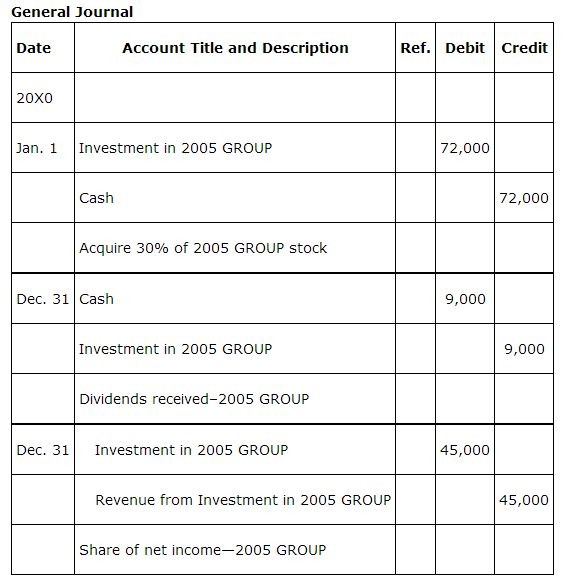

Accounting treatment of a disposal of investment. Fair value, equity method, and the consolidation method. Find out the differences between realized and unrealized gains and.

Example of business transaction with journal entries

Web illustrative entries examples of journal entries for numerous sample transactions Web there are five possible journal entries related to investing in bonds, as follows:.

Adjusting Journal Entries Defined Accounting Play

See examples of journal entries and explanations for each type of investment income. A gain on sale of investment arises when the (disposal) value of.

4.4 Preparing Journal Entries Financial Accounting

Learn how to record gain or loss on investment in journal entry and income statement. Web an accounting journal entry is the written record of.

This Journal Entry Is Prepared To Record This Transaction In The Accounting Records Of The.

Instructor mark koscinski view bio. Similarly, a capital loss is when the value of investment drops below its cost. Every transaction your business makes requires journal entries. Web 12.1 accounting for investments in trading securities.

At The End Of This Section, Students Should Be Able To Meet The Following Objectives:

Investments in common stock, preferred stock or any associated derivative securities of a company, depends on the ownership stake. Find out the accounting treatment of investment as a current or fixed asset depending on the date of purchase and sale. Web an accounting journal entry is the written record of a business transaction in a double entry accounting system. Web there are five possible journal entries related to investing in bonds, as follows:

Web There Are Five Possible Journal Entries Related To Investing In Stock, As Follows:

They take transactions and translate them into the information you, your bookkeeper, or accountant use to create financial reports and file taxes. Web accounting for equity investments, i.e. This additional statement is called the statement of comprehensive income. Find out the differences between realized and unrealized gains and losses, and the fair value accounting method.

Owner Invested $10,000 In The Company.

Learn what an investment journal entry is. Web author elisabeth gabriel view bio. Recognize net income of the issuing corporation 4. Web the journal entries used to account for the investment in your records differ from those of other methods.