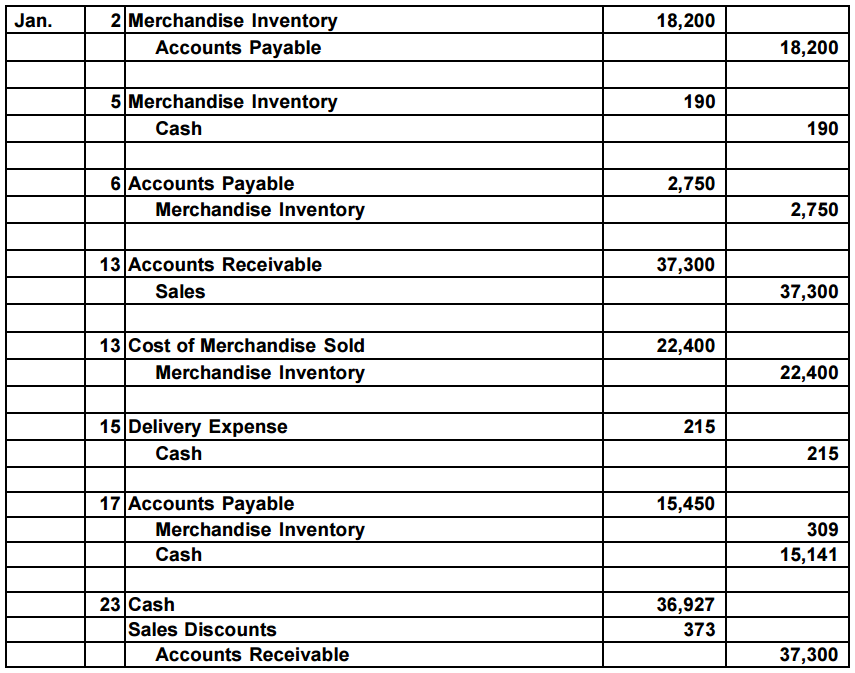

Inventory Write Off Journal Entry - Inventory should be written off when it becomes obsolete or its market price has fallen to a level below the cost at which it. The company may write off some items in the inventory when it deems that they are no longer have value in the market or the business. Web updated march 24, 2021. Web the journal entry is debiting allowance for obsolete inventory and credit inventory. This entry records the loss from the obsolete inventory and adjusts the inventory account to exclude the value of the outdated items. Accounting for an inventory write down. There are two aspects to writing down inventory, which are the journal entry used to record it, and the disclosure of this information in the financial statements. Web for reference while you’re making inventory journal entries, check out this chart: Web the perpetual inventory system journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry posting under a perpetual inventory system. Once there is a sale of goods from finished goods, charge the cost of the finished goods sold to the cost of goods sold expense account, thereby transferring the cost of the inventory from the balance sheet (where it was an asset) to the income statement (where it is an expense).

Accounting Q and A Appendix Ex 639 Journal entries using perpetual

Web when actual inventory writes down incur, the company needs to make a journal entry by debiting inventory reserve and credit inventory. Web the journal.

Perpetual Inventory Systems Mont Blanc

The value of the inventory has fallen by 1,000, and the reduction in value needs to be reflected in the accounting records. The inventory may.

Inventory Write Off All you Need to Know with Example Zetran

What is the perpetual inventory method? Inventory reserve journal entry example. Web the write down of inventory journal entries below act as a quick reference,.

Inventory WriteOff Definition as Journal Entry and Example

The value of the inventory has fallen by 1,000, and the reduction in value needs to be reflected in the accounting records. The inventory write.

Journal Entry for Purchase of Inventory Professor Victoria Chiu YouTube

If the ending inventory value decreases as it does with a write down, the cogs will increase. Web for reference while you’re making inventory journal.

Inventory WriteOff Definition As Journal Entry And, 47 OFF

Web the inventory write down journal entry is as follows: In each case the write down of inventory journal entries show the debit and credit.

Inventory Writeoffs All You Need to Know [+ journal entries

The inventory may lose its value due to damage, deterioration, loss from theft, damage in transit, changes in market demands, misplacement etc. Web the write.

Inventory Write Off Double Entry Bookkeeping

Inventory is written down when its net realizable value is less than its cost. Web the inventory write down journal entry is as follows: In.

Inventory WriteOff AwesomeFinTech Blog

Essentially, it's the process of recognizing losses on inventory that is no longer usable or saleable. Web inventory write off journal entry. Web the journal.

Web Updated March 24, 2021.

In this journal entry, the loss on inventory account is an expense account that we need. Here are a few you may recognize while recording inventory transactions in your books: On the other hand, let’s say the inventory loss is considered material. Inventory reserve journal entry example.

Web The Journal Entry Is:

In each case the write down of inventory journal entries show the debit and credit account together with a brief narrative. Web in this method, periodic inventory system journal entries are made to record the purchase, sale, and ending inventory balances. Web the inventory write down journal entry is as follows: There are two aspects to writing down inventory, which are the journal entry used to record it, and the disclosure of this information in the financial statements.

Web The Perpetual Inventory System Journal Entries Below Act As A Quick Reference, And Set Out The Most Commonly Encountered Situations When Dealing With The Double Entry Posting Under A Perpetual Inventory System.

The value of the inventory has fallen by 1,000, and the reduction in value needs to be reflected in the accounting records. Inventory is written down when its net realizable value is less than its cost. The inventory write off journal entry is as follows: The transaction will not impact the income statement as well as the net balance of inventory.

Inventory Obsolete, Damage, And Expiration Is Very Common For The Company.

The journal entry above shows the inventory write down expense being debited to the loss on inventory write down account. Web the journal entry is debiting allowance for obsolete inventory and credit inventory. Web the journal entry would appear as such: With the cost determined, adjust your financial records.

:max_bytes(150000):strip_icc()/Inventory-Write-Off_Final3-resized-9ab3fcc8c1234d1ea005ca1443e8ff65.jpg)