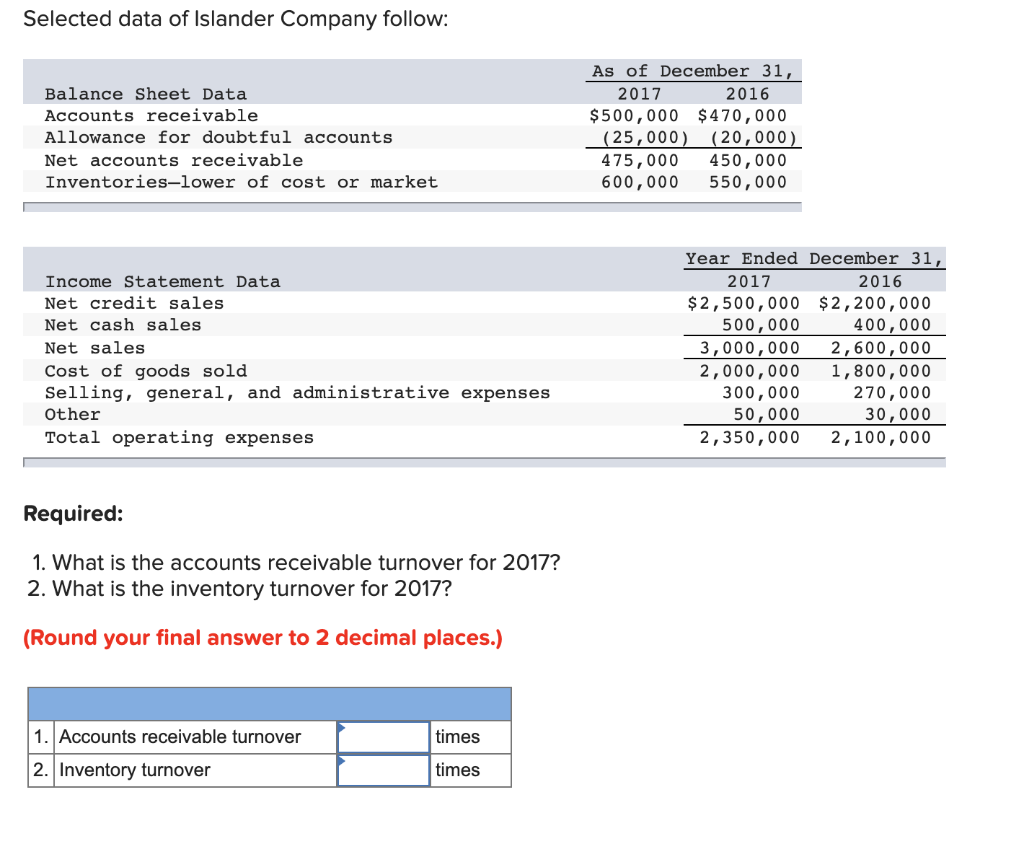

Inventory Sold Journal Entry - Web to record a sales return from a customer using perpetual inventory system journal entry; Web what is the journal entry for selling inventory? Web a sale of goods will result in a journal entry to record the amount of the sale and the cash or accounts receivable. Web a journal entry for inventory is a record in your accounting ledger that helps you track your inventory transactions. Web in 2023, the metro area's average sale price was $349,636, compared with $246,979 in 2019. Web last updated january 7, 2024. A second journal entry reduces the account inventory and. Once there is a sale of goods from finished goods, charge the cost of the finished goods sold to the cost of goods sold expense account, thereby transferring the cost of the inventory from the balance sheet (where it was an asset) to the income statement (where it is an expense). This entry typically involves debiting the inventory account to increase. There are many journal entries that must be made to record the movement of inventory.

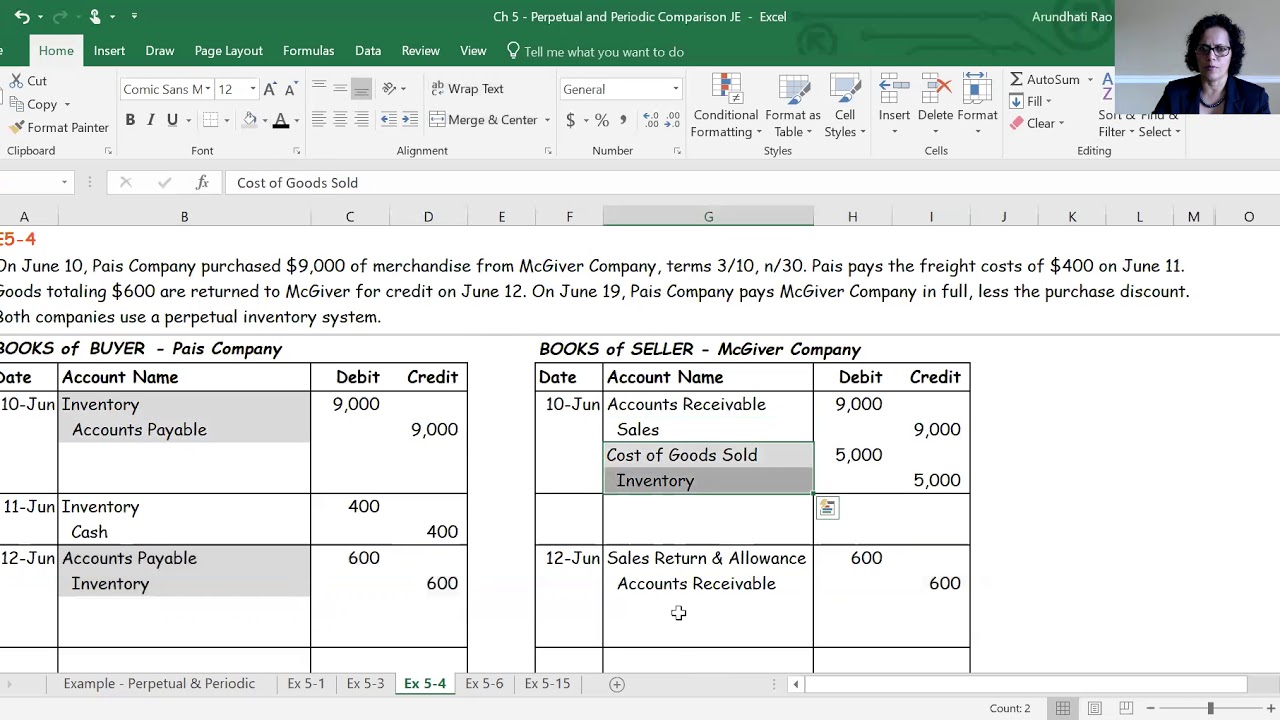

Perpetual Inventory Journal Entries Buyer & Seller YouTube

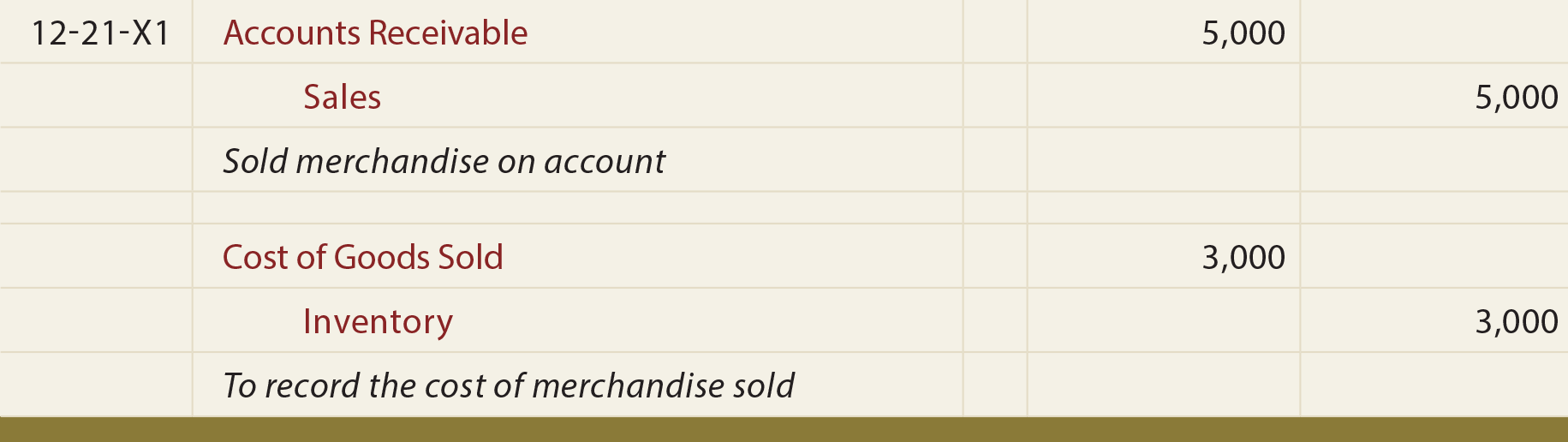

Web a sale of goods will result in a journal entry to record the amount of the sale and the cash or accounts receivable. Web.

Cost of Goods Sold Journal Entry How to Record & Examples

The credit sale of inventory affects accounts receivable, revenue accounts,. Web the following example transactions and subsequent journal entries for merchandise sales are recognized using.

Journal Entry for Purchase of Inventory YouTube

Once there is a sale of goods from finished goods, charge the cost of the finished goods sold to the cost of goods sold expense.

Recording a Cost of Goods Sold Journal Entry

This entry typically involves debiting the inventory account to increase. Various kinds of journal entries are made to record the inventory transactions based on the..

LO 6.4a Analyze and Record Transactions for the Sale of Merchandise

Web the following example transactions and subsequent journal entries for merchandise sales are recognized using a perpetual inventory system. The journal entries below act as.

Recording a Cost of Goods Sold Journal Entry ⋆ Accounting Services

Web in this journal entry, the company deducts $1,300 from the inventory balances and recognizes it as the cost of goods sold immediately after making.

Cost of Goods Sold Journal Entries Video & Lesson Transcript

Web last updated january 7, 2024. Web to record a sales return from a customer using perpetual inventory system journal entry; Web in this method,.

Perpetual Inventory

Once there is a sale of goods from finished goods, charge the cost of the finished goods sold to the cost of goods sold expense.

Perpetual Inventory System Journal Entry

When is cost of goods sold recorded? Web this journal entry for inventory sales will increase both total assets on the balance sheet and total.

What Is The Journal Entry For The Purchase Transaction?

Web a journal entry for inventory is a record in your accounting ledger that helps you track your inventory transactions. Z) depending on your specific business and chart of accounts, the specific amounts and. On the other hand, if. Web inventory transactions are journalized to keep track of inventory movements.

You Only Record Cogs At The.

There are many journal entries that must be made to record the movement of inventory. Web an inventory purchase journal entry records the acquisition of goods that a business intends to sell. Web last updated january 7, 2024. When is cost of goods sold recorded?

Web To Record A Sales Return From A Customer Using Perpetual Inventory System Journal Entry;

Web accounting made easy, for free! Web the inventory purchases amount to $5,000 and the company abc ltd. Web simply put, cogs accounting is recording journal entries for cost of goods sold in your books. The journal entries below act as a.

Various Kinds Of Journal Entries Are Made To Record The Inventory Transactions Based On The.

Web in 2023, the metro area's average sale price was $349,636, compared with $246,979 in 2019. Web the following example transactions and subsequent journal entries for merchandise sales are recognized using a perpetual inventory system. Once there is a sale of goods from finished goods, charge the cost of the finished goods sold to the cost of goods sold expense account, thereby transferring the cost of the inventory from the balance sheet (where it was an asset) to the income statement (where it is an expense). Uses the perpetual inventory system.