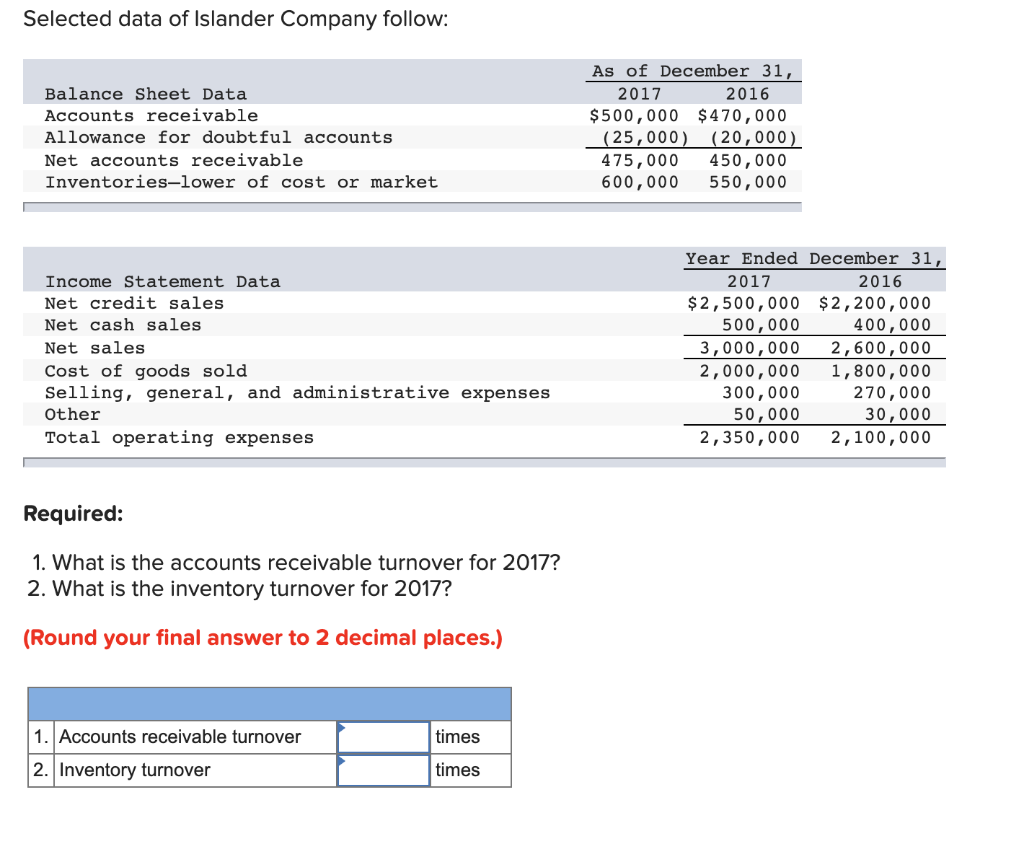

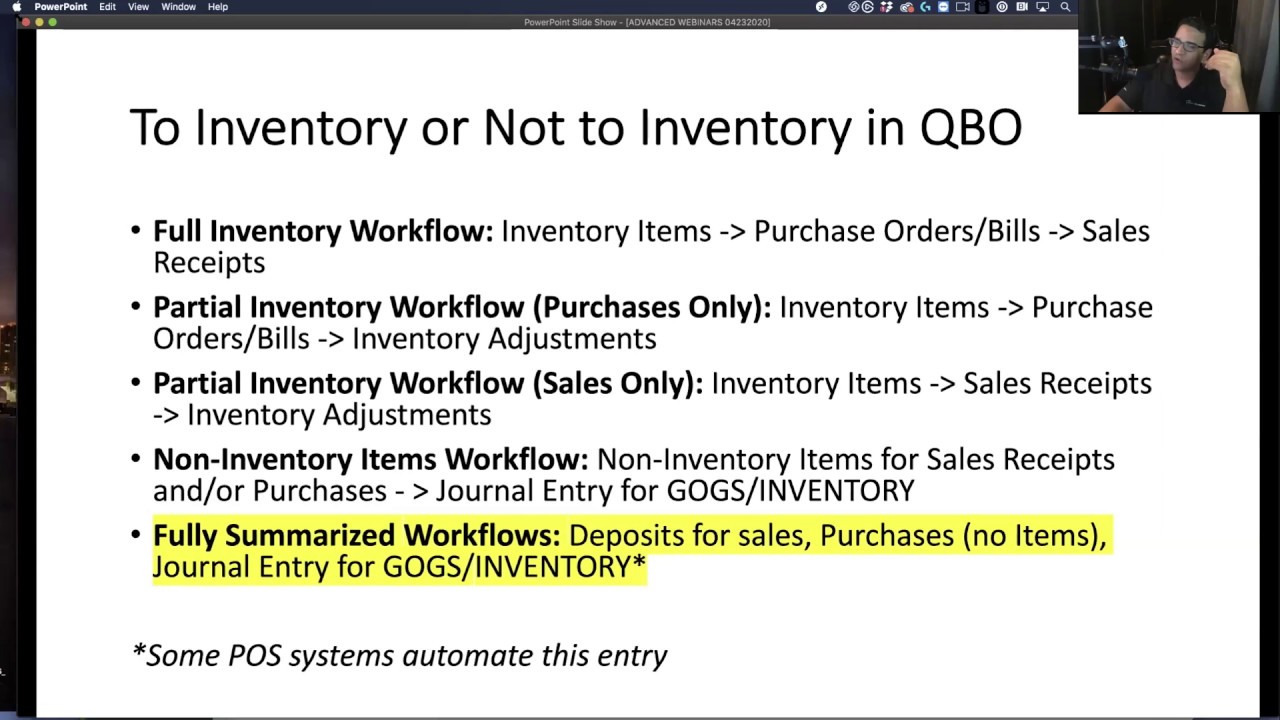

Inventory And Cost Of Goods Sold Journal Entry - What we have now learned is that using the periodic inventory system the cost of goods. Cost of goods sold :. To correct the cost of goods sold in the income statement we need to increase the. Web to record the cost of goods sold, we need to find its value before we process a journal entry. Z) depending on your specific business and chart of accounts, the specific amounts and. Under the perpetual inventory system, we can make the journal entry to record a $1,500 sales revenue and a $1,000 cost of goods sold on january 31. Your business’s inventory includes raw materials used to create finished products, items in the production process, and. Web the journal entry for cost of goods sold is a calculation of beginning inventory, plus purchases, minus ending inventory. A second journal entry reduces the account inventory and. If you purchase for resale one item at 100 and.

Recording a Cost of Goods Sold Journal Entry

To successfully track inventory, you need to understand how. Cost of goods sold = beginning. A second journal entry reduces the account inventory and. Under.

[Solved] Develop journal entries and find out the cost of goods sold

Web compute the cost of goods sold under a periodic system and create journal entries. Web the journal entry for cost of goods sold is.

Cost of Goods Sold Journal Entries Video & Lesson Transcript

Web to record end of period journal entries using periodic system; Web the cost of goods sold journal entry is: A second journal entry reduces.

How to Account for Cost of Goods Sold (with Pictures) wikiHow

The product is transferred from the. A second journal entry reduces the account inventory and. Journal entries are not shown, but the following calculations. If.

Recording a Cost of Goods Sold Journal Entry ⋆ Accounting Services

Under the perpetual inventory system, we can make the journal entry to record a $1,500 sales revenue and a $1,000 cost of goods sold on.

Cash Sales Journal Entry Example

Web the journal entry is: This entry matches the ending balance in the inventory account to the costed actual ending inventory, while eliminating the $450,000.

Perpetual Inventory Systems

What we have now learned is that using the periodic inventory system the cost of goods. Web to record the cost of goods sold, we.

Recording a Cost of Goods Sold Journal Entry

Web the journal entry for the above transaction will be: To correct the cost of goods sold in the income statement we need to increase.

QuickBooks Online Cost of Goods Sold (Inventory Items, Landed Costs

Web the inventory at period end should be $8,955, requiring an entry to increase merchandise inventory by $5,895. The cost of goods sold entry. Under.

Under The Perpetual Inventory System, We Can Make The Journal Entry To Record A $1,500 Sales Revenue And A $1,000 Cost Of Goods Sold On January 31.

If you purchase for resale one item at 100 and. When the sale has occurred, the goods are transferred to the buyer. Web understand inventory assets and cost of goods sold tracking. Web to record end of period journal entries using periodic system;

The Product Is Transferred From The.

Z) depending on your specific business and chart of accounts, the specific amounts and. To correct the cost of goods sold in the income statement we need to increase the. Under the perpetual system, the company abc ltd. Web the cost of goods sold formula is:

Your Business’s Inventory Includes Raw Materials Used To Create Finished Products, Items In The Production Process, And.

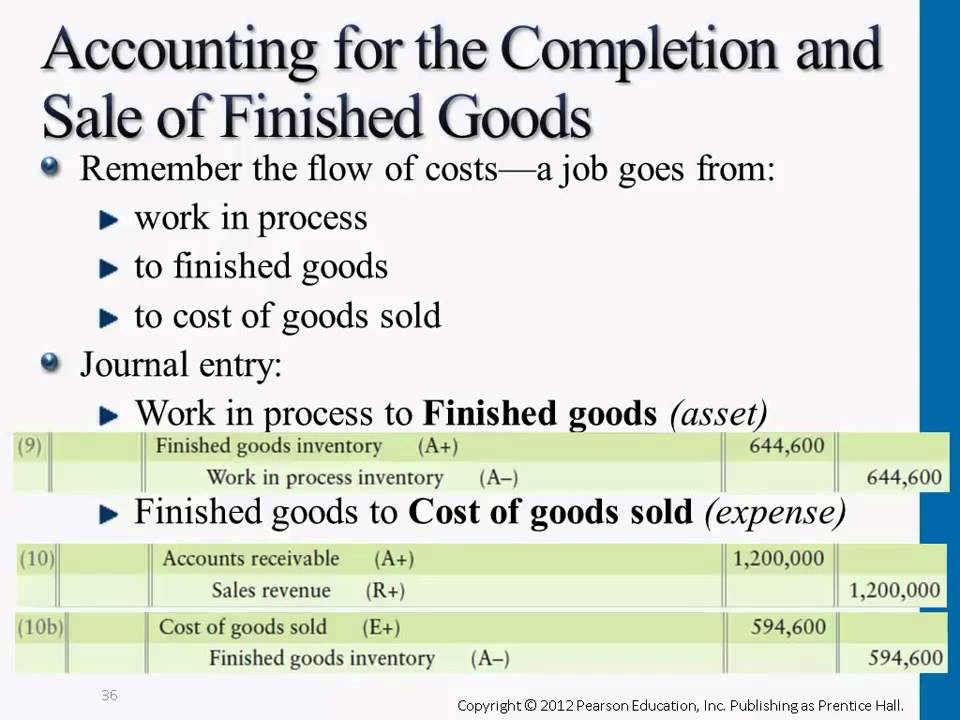

Can make the journal entry for inventory sale on october 15, 2020, as below: Using a very simple (but unrealistic) example. Web journal entries to move finished goods into cost of goods sold. Web a sale of goods will result in a journal entry to record the amount of the sale and the cash or accounts receivable.

Web Compute The Cost Of Goods Sold Under A Periodic System And Create Journal Entries.

Web the inventory at period end should be $8,955, requiring an entry to increase merchandise inventory by $5,895. Once there is a sale of goods from finished goods, charge the cost of the finished goods sold to the cost of goods sold. This formula can be used to calculate how much it. Web the journal entry for the above transaction will be: