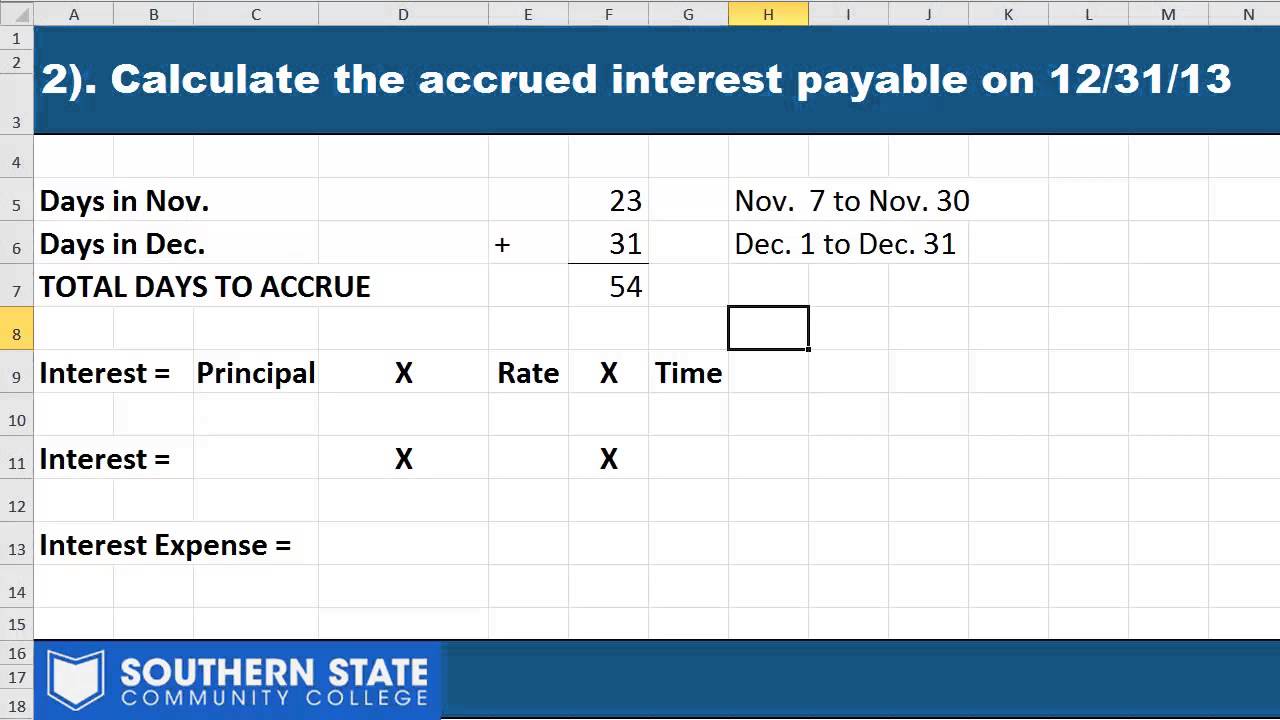

Interest Payable Journal Entry - Web both interest payable and cash decrease for the total interest amount accumulated during 2017. As you can see the interest. Web the adjusting journal entry for interest payable is: Since the payment of accrued. Web interest payable is the interest expense that has been incurred (has already occurred) but has not been paid as of the date of the balance sheet. This amount can be a crucial part of a. Web the income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year); Web here are the journal entries of interest payable at the end of the month, when the company decides to make the payable, then the entries are as follows: Web when interest payable liability is extinguished by paying cash or through a checking account, it is eliminated from books by debiting interest payable account and. When the interest payable is being accrued but.

What is Accrued Interest? Formula + Loan Calculator

Web here’s the journal entry the company passes for interest expense and interest payable on the balance sheet. Web the journal entry will increase the.

Journal Entries and Trial Balance in Accounting Video & Lesson

Web the entry consists of interest income or interest expense on the income statement, and a receivable or payable account on the balance sheet. How.

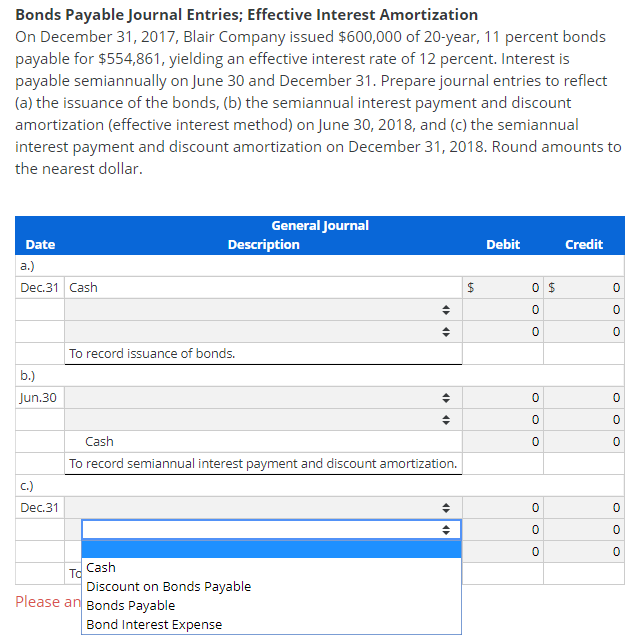

Solved Bonds Payable Journal Entries; Effective Interest

When the interest payable is being accrued but. Web interest expense journal entry (debit, credit) interest payable account from the perspective of the company, the.

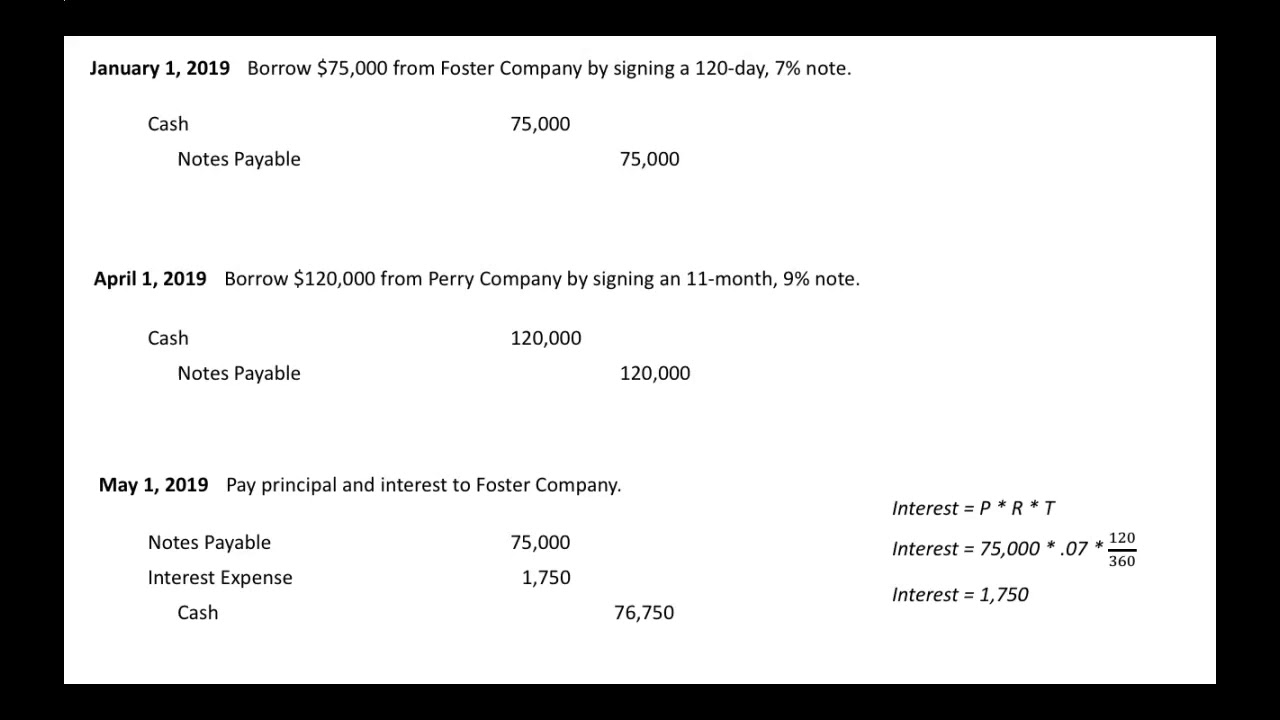

Notes Payable

Web here’s the journal entry the company passes for interest expense and interest payable on the balance sheet. Web this journal entry of accrued interest.

Bonds Payable Lecture 2 Journal Entries YouTube

This transaction will reverse the interest payable to zero and record interest expense from. Web here are the journal entries of interest payable at the.

Notes Payable (Journal Entries) YouTube

As you can see the interest. Web interest payable is the amount of interest on its debt that a company owes to its lenders as.

Mortgage Note Payable (Journal Entries) YouTube

Web the adjusting journal entry for interest payable is: The interest can be compounded,. Web here’s the journal entry the company passes for interest expense.

Notes Payable Journal Entries YouTube

Web interest payable is the interest expense that has been incurred (has already occurred) but has not been paid as of the date of the.

Mortgage Payable Journal Entry

Web the journal entry for the interest payable should include the amount of interest that is owed and the period in which it was incurred..

Web This Journal Entry Is Usually Made At The Period End Adjusting Entry To Record The Interest Payable And Expense When The Interest Payment On Borrowings Has Not Been Made Yet.

Web the income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year); Since the payment of accrued. This amount can be a crucial part of a. Web how you create an accrued interest journal entry depends on whether you’re the borrower or lender.

Web The Entry Consists Of Interest Income Or Interest Expense On The Income Statement, And A Receivable Or Payable Account On The Balance Sheet.

Web interest payable is the amount of interest on its debt that a company owes to its lenders as of the balance sheet date. Web the following is the journal entry for the payment made to the creditor: This transaction will reverse the interest payable to zero and record interest expense from. Web both interest payable and cash decrease for the total interest amount accumulated during 2017.

Web The Journal Entry Will Increase The Interest Expense On Income Statement.

Web the journal entry for the interest payable should include the amount of interest that is owed and the period in which it was incurred. As the company has not yet made a payment, it will create interest payable on balance sheet. Web this journal entry of accrued interest on note payable will increase total expenses on the income statement and total liabilities on the balance sheet by the same amount of $500. The debit side of the journal entry should.

Web The Adjusting Journal Entry For Interest Payable Is:

Web interest payable is the interest expense that has been incurred (has already occurred) but has not been paid as of the date of the balance sheet. Web when interest payable liability is extinguished by paying cash or through a checking account, it is eliminated from books by debiting interest payable account and. Web when the company makes the payment on the interest of notes payable, it can make journal entry by debiting the interest payable account and crediting the cash account. Web interest expense journal entry (debit, credit) interest payable account from the perspective of the company, the interest expense due on the notes payable is.