Interest Paid Journal Entry - Web interest paid for the borrowing journal entry. When companies raise debt, lenders expect to be compensated through periodic or scheduled interest payments along with. When the interest payable is being accrued but. Web the journal entry would involve debiting the interest expense account for $200, debiting the loan liability account for $800, and crediting the cash account for the. Web this journal entry is usually made at the period end adjusting entry to record the interest payable and expense when the interest payment on borrowings has not been made yet. Web the journal entry for interest paid depends on the type of transaction and the accounting method used by the company. Generally, when a company pays interest on a. *assuming that the money was due to be paid to abc bank ltd. Accountants realize that if a company has a balance in. This journal entry is made when the principal amount of bank overdraft with interest is actually paid to the bank by debiting interest payable.

Accounting Journal Entries For Dummies

To make a journal entry, you enter the details of a transaction into your company’s books. Web learn how to create common journal entries for.

When a Job Is Completed the Journal Entry Involves a OlivehasHenderson

Generally, when a company pays interest on a. When companies raise debt, lenders expect to be compensated through periodic or scheduled interest payments along with..

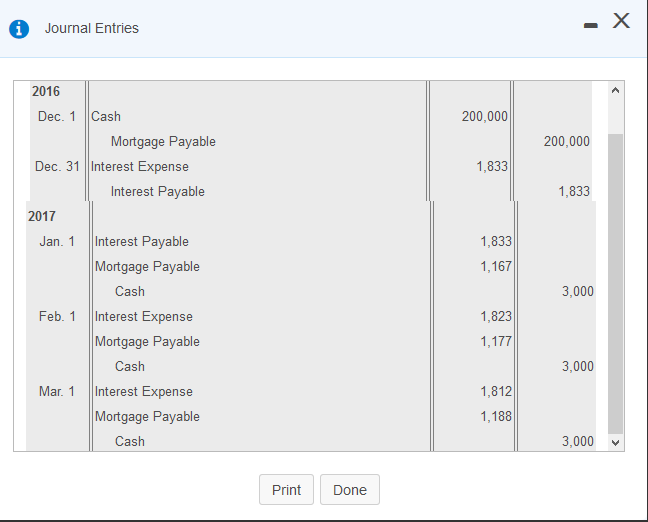

Solved Journal Entries 2016 Dec. 1 Cash 200,000 Mortgage

Subtract the total deductions from the gross pay to find the net pay—the amount that will actually be disbursed to the employee. Web when interest.

Journal Entry Examples

When companies raise debt, lenders expect to be compensated through periodic or scheduled interest payments along with. Web interest paid for the borrowing journal entry..

Accounting Journal Entries For Dummies

Web interest paid for the borrowing journal entry. Web here’s the journal entry the company passes for interest expense and interest payable on the balance.

Self Study Notes The Adjusting Process And Related Entries

Web the interest payable journal entry is used to record the interest expense associated with a loan or other borrowing agreement. Based on the loan.

Journal entries Meaning, Format, Steps, Different types, Application

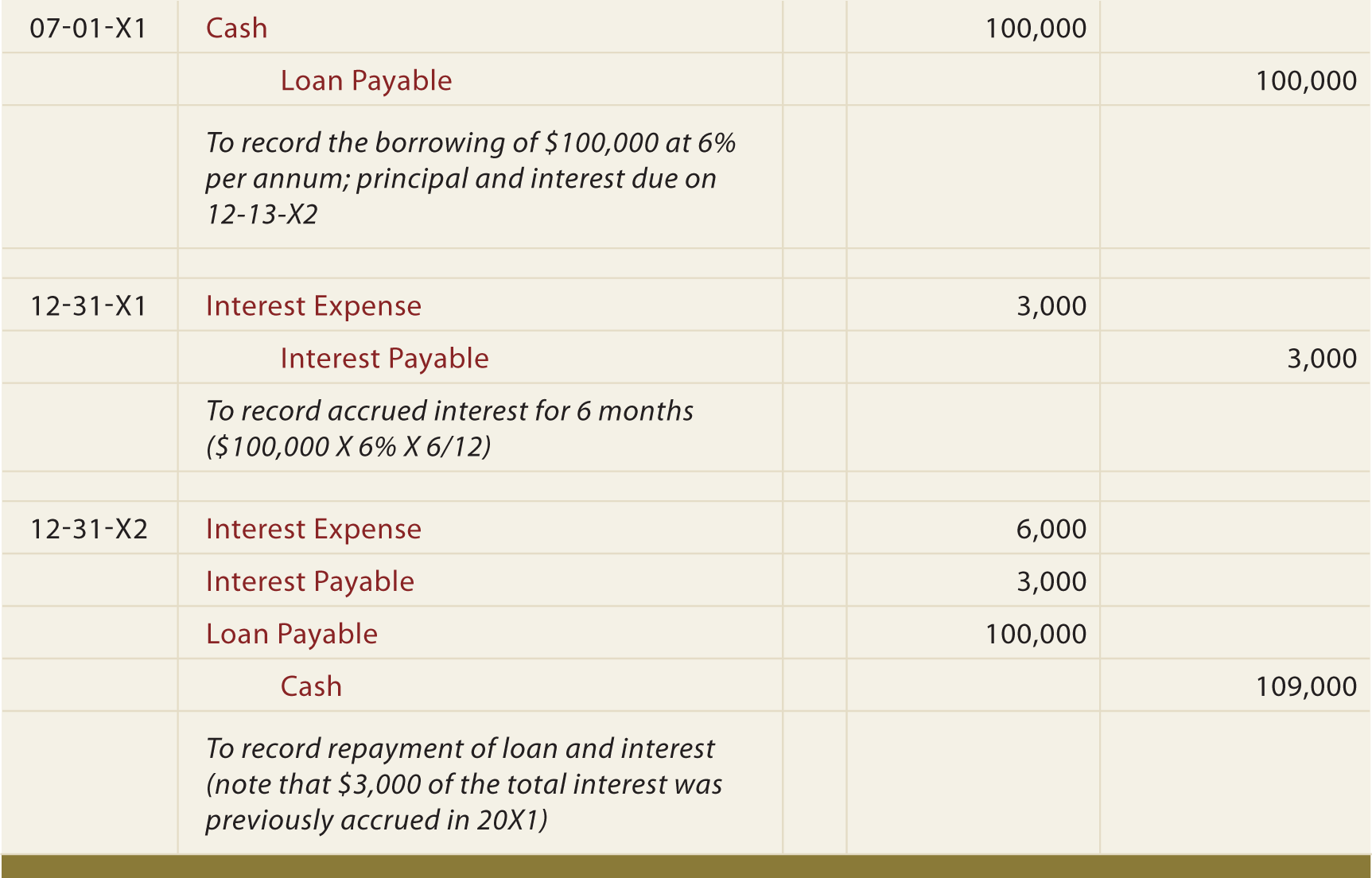

Web learn how to create common journal entries for accrued interest, including adjusting entries and delayed bond issues sold at par value. Web when interest.

What is Accrued Interest? Formula + Loan Calculator

Web what is “paid in kind (pik) interest”? Web a journal entry in accounting is how you record financial transactions. When companies raise debt, lenders.

What Is The Journal Entry For Receiving A Loan

*assuming that the money was due to be paid to abc bank ltd. Web a journal entry in accounting is how you record financial transactions..

Web On The Date Of Payment To The Bank:

Web the journal entry for the interest payable should include the amount of interest that is owed and the period in which it was incurred. The company is required to pay monthly interest expenses on the loan to the bank. Web please prepare journal entry for paid interest on loan. Web pass necessary journal entries for the issue of debentures and debenture interest for the year ended 31 st march 2018 assuming that interest is payable on 30 th september and.

Accountants Realize That If A Company Has A Balance In.

When the company makes the payment for the interest on borrowing money, it can make the journal entry by debiting the interest. We explain its formula and journal entry with net expense, example & differences with interest payable. When the interest payable is being accrued but. Web what is “paid in kind (pik) interest”?

Web This Journal Entry Is Usually Made At The Period End Adjusting Entry To Record The Interest Payable And Expense When The Interest Payment On Borrowings Has Not Been Made Yet.

This journal entry is made when the principal amount of bank overdraft with interest is actually paid to the bank by debiting interest payable. Web learn how to create common journal entries for accrued interest, including adjusting entries and delayed bond issues sold at par value. Web guide to what is interest expense. Web when interest payable liability is extinguished by paying cash or through a checking account, it is eliminated from books by debiting interest payable account and.

When Companies Raise Debt, Lenders Expect To Be Compensated Through Periodic Or Scheduled Interest Payments Along With.

Subtract the total deductions from the gross pay to find the net pay—the amount that will actually be disbursed to the employee. To make a journal entry, you enter the details of a transaction into your company’s books. Generally, when a company pays interest on a. The debit side of the journal entry should.