Interest Income Journal Entry - The most typical journal entries used to record interest receivable are: Web interest income journal entry: Web under the accrual concept of accounting, income is recognized when earned regardless of when collected. Web there are two ways of recording the interest, either in the reconciliation page or creating a new interest account. If it is a bank account, the date. Web what is the journal entry for interest receivable? On feb 1, 2021, when the. Web calculate and record accrued interest. Web an accounting journal entry is the written record of a business transaction in a double entry accounting system. An asset account is debited to increase it.

What is Accrued Interest? Formula + Loan Calculator

The interest receivable will be present as current assets on the balance sheet. Web an accounting journal entry is the written record of a business.

Accrued Interest Journal Entry Ppt Powerpoint Presentation

To the maker of the note, or borrower, interest is an expense; Once the interest income is accrued (becomes receivable), the journal. A journal keeps.

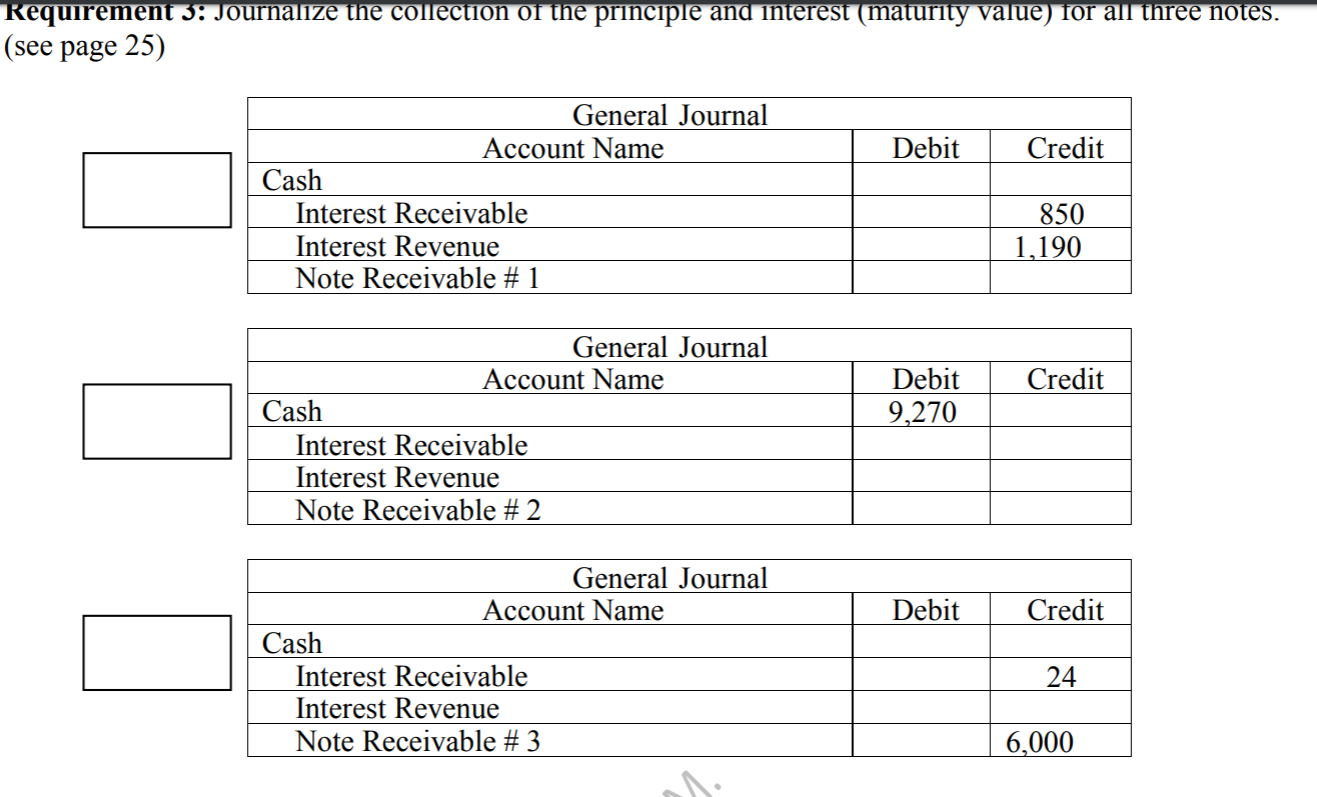

Outline page 28, the journal entry for the collection

To make a journal entry, you enter the details of a transaction into your. Web recording interest earned requires a general journal entry. Every entry.

Journal entries Meaning, Format, Steps, Different types, Application

A credit to the interest income account. An asset account is debited to increase it. If it is a bank account, the date. Once the.

Interest Earned Double Entry Bookkeeping

Web recording interest earned requires a general journal entry. The most typical journal entries used to record interest receivable are: Web interest income journal entry:.

When a Job Is Completed the Journal Entry Involves a OlivehasHenderson

Learn how to account for interest income by making journal entries at the end of the period and when receiving the interest. A debit to.

How to Record Interest Receivable Journal Entry? (Example, Definition

The most typical journal entries used to record interest receivable are: A journal keeps a historical account of all. Web what is a journal entry?.

Bond Premium and Interest Journal Entry YouTube

If it is a bank account, the date. Web calculate and record accrued interest. Web an accounting journal entry is the written record of a.

Unearned Interest Journal Entry

Cash is debited for the receipt of the amount. Web a journal is often referred to as the book of original entry because it is.

Once The Interest Income Is Accrued (Becomes Receivable), The Journal.

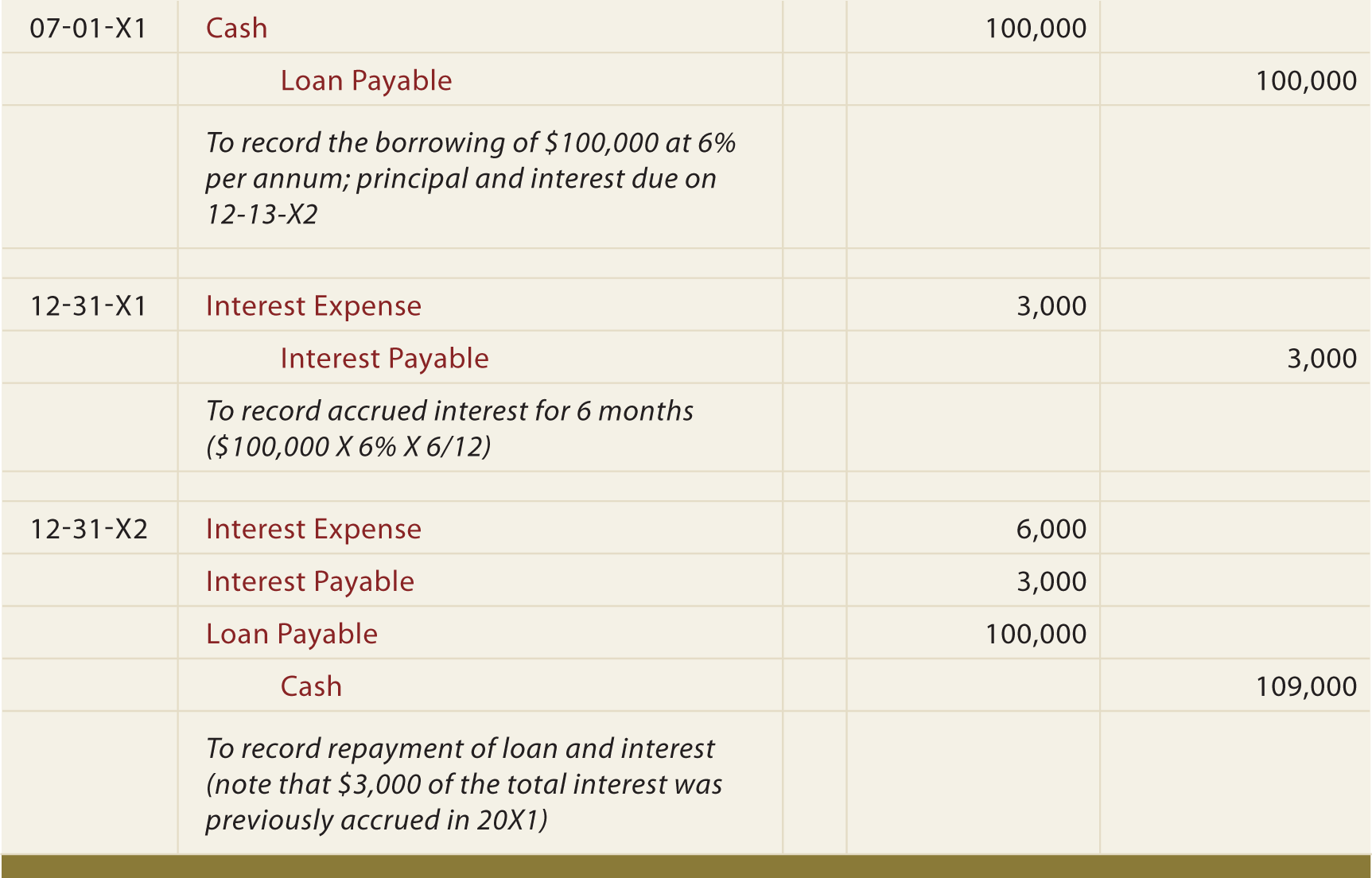

Web the entry consists of interest income or interest expense on the income statement, and a receivable or payable account on the balance sheet. Since the payment of accrued. Learn how to account for interest income by making journal entries at the end of the period and when receiving the interest. Every entry contains an equal debit and credit along with the.

To The Maker Of The Note, Or Borrower, Interest Is An Expense;

Web an accounting journal entry is the written record of a business transaction in a double entry accounting system. An asset account is debited to increase it. Web interest revenue is the earnings that an entity receives from any investments it makes, or on debt it owns. Web the journal entry is debiting interest receivable and credit interest income.

Interest Is The Fee Charged For Use Of Money Over A Specific Time Period.

A journal keeps a historical account of all. Web a journal is often referred to as the book of original entry because it is the place the information originally enters into the system. Web calculate and record accrued interest. Web interest income journal entry:

Web Investment Income Refers To The Amount Earned On Investments In Common Stock, Bonds Or Other Financial Instruments Of Outside Companies In The Forms Of.

See the sample screenshot for the reconciliation. A debit to the interest receivable account. If the company has already earned the right to demand payment and no. Cash is debited for the receipt of the amount.