Interest Expense Journal Entry - Web this journal entry of the $2,500 accrued interest is necessary at the end of our accounting period of 2021. How to calculate interest expense. If this journal entry is not made, both total expenses and total liabilities in the 2020 financial statements will be understated by $8,000. For the above transaction, the following journal entry would be recorded (annual); Learn how to record interest expense and interest payable in the accounting journal with examples. Web the adjusting journal entry for interest payable is: It is unusual that the amount shown for each of these accounts is the same. ( both, balance sheet and profit and loss statement items) Before diving into some business examples on how to make journal entries for interest expenses, let’s first go over some accounting basics you’ll need to know. This journal entry captures the amount of interest accrued over the duration of the accounting period.

Journal entries Meaning, Format, Steps, Different types, Application

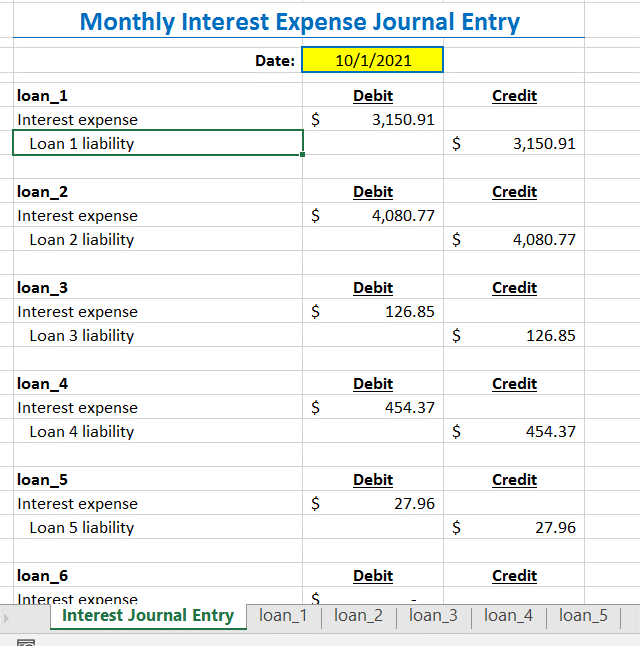

Web most companies record the amount of interest expense on a monthly basis and note the accruing interest when interest expense should be recognized. The.

What is Accrued Interest? Formula + Loan Calculator

Web interest expense = ($ 50,000 x 12%)/12 months = $ 5,000 per month. The journal entry is debiting interest expense $ 5,000 and crediting.

Great Paying Interest Expense And Receiving Revenue Are Examples Of The

What is an example of. To record an accrued interest expense, the following journal entry should be recorded: Web most companies record the amount of.

Loan Interest Expense Made Easy Anthony W. Imbimbo CPA

It is unusual that the amount shown for each of these accounts is the same. Represents the amount of interest currently owed to lenders. The.

Journal Entries and Trial Balance in Accounting Video & Lesson

Web most companies record the amount of interest expense on a monthly basis and note the accruing interest when interest expense should be recognized. To.

Basic Journal entry rule of EXPENSES [STEP BY STEP Guide] YouTube

Interest is deducted from earnings before interest and taxes (ebit) to arrive at earnings before tax (ebt). Since the payment of accrued interest is generally.

Interest Expense Definition, Example, and Calculation

Web this journal entry of the $2,500 accrued interest is necessary at the end of our accounting period of 2021. Since the payment of accrued.

Accounting Journal Entries For Dummies

The controller issues financial statements each quarter, and wants to know the amount of the interest expense for the past three months. It is unusual.

LongTerm Notes

Interest payable is the amount of interest owed to lenders by a corporation as of the balance sheet date. What is an example of. For.

Interest Payable Is The Amount Of Interest Owed To Lenders By A Corporation As Of The Balance Sheet Date.

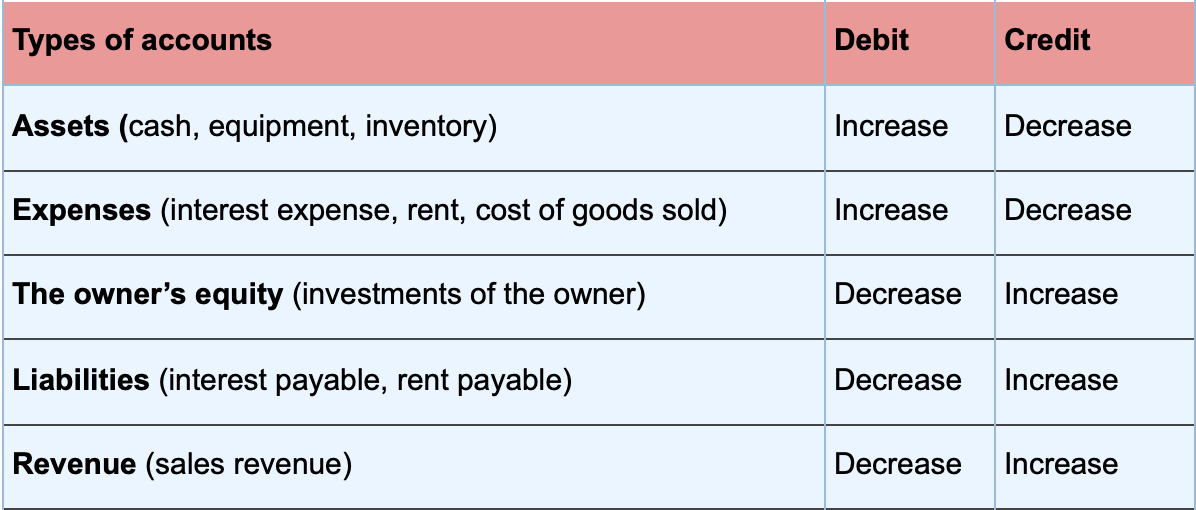

Web interest expense = ($ 50,000 x 12%)/12 months = $ 5,000 per month. Web most companies record the amount of interest expense on a monthly basis and note the accruing interest when interest expense should be recognized. (balance sheet items) revenue expenditure (profit and loss statement items) provisions (both, balance sheet and profit and loss statement items) deferred revenue expenditures. Web accruing interest expense requires a journal entry to debit interest expense and credit accrued interest liabilities.

(Being Interest Paid To Hsbc Bank On Loan) Percentage Of Interest P.a.

Web expense journal entry forms a significant part of: For example, a company has borrowed $85,000 at a 6.5% interest rate. If this journal entry is not made, both total expenses and total liabilities in the 2020 financial statements will be understated by $8,000. Learn how to record interest expense and interest payable in the accounting journal with examples.

What Is An Example Of.

Web the adjusting journal entry for interest payable is: ( both, balance sheet and profit and loss statement items) Interest is deducted from earnings before interest and taxes (ebit) to arrive at earnings before tax (ebt). Calculating simple interest expense is a function of multiplying the stated annual interest rate, principal amount, and time.

Principal X Interest Rate X Time Period = Interest Expense.

To record an accrued interest expense, the following journal entry should be recorded: If this journal entry is not made, our total expenses on the income statement as well as total liabilities on the balance sheet will be understated by $2,500 for the 2021 financial statements. Web what is a journal entry? Represents the amount of interest currently owed to lenders.

![Basic Journal entry rule of EXPENSES [STEP BY STEP Guide] YouTube](https://i.ytimg.com/vi/lQnM_JjzfaQ/maxresdefault.jpg)