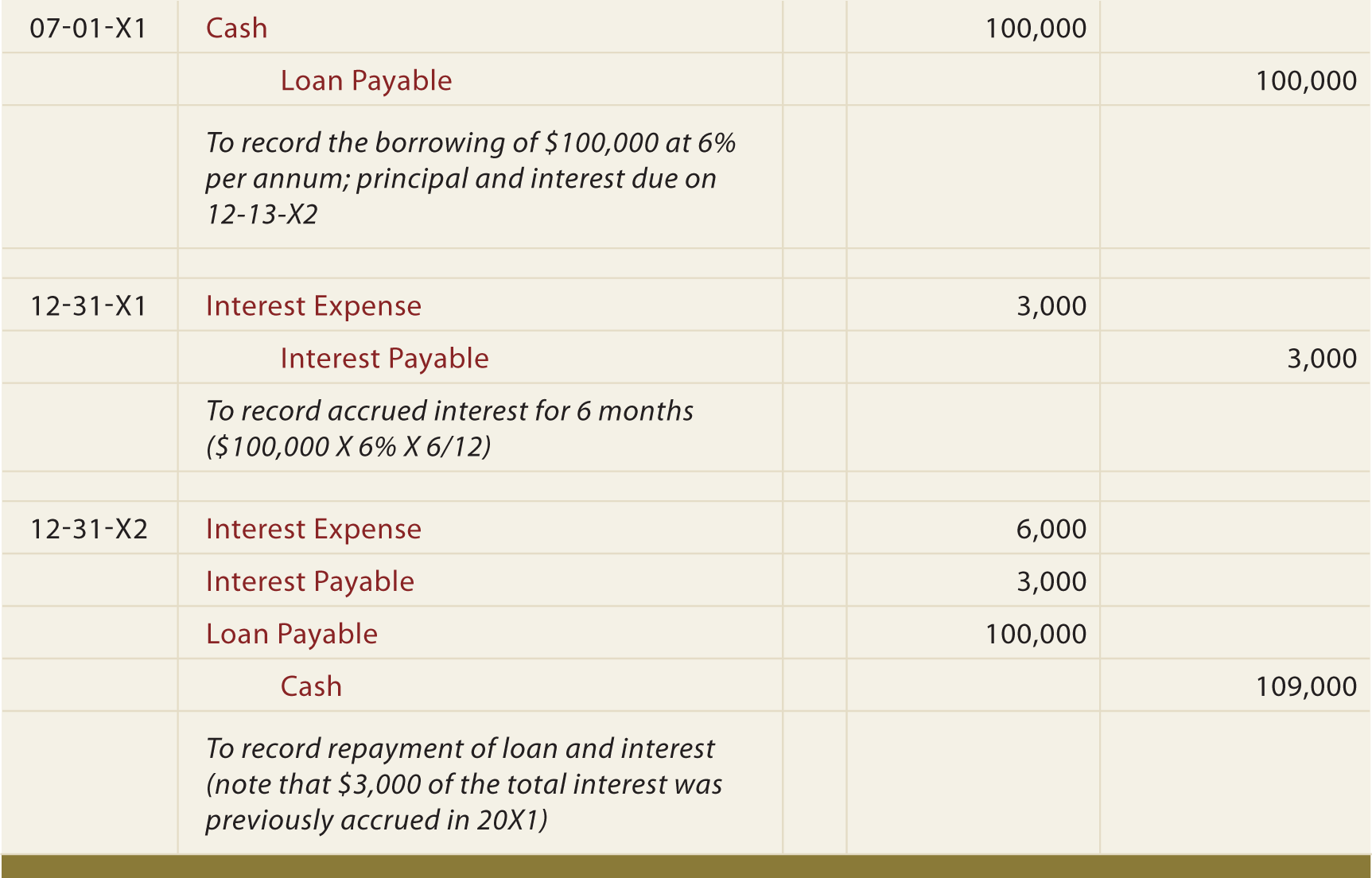

Interest Expense Accrued Journal Entry - Web the adjusting entry for accrued interest consists of an interest income and a receivable account from the lender’s side, or an interest expense and a payable account from the. Checked for updates, april 2022. Web this journal entry captures the amount of interest accrued over the duration of the accounting period. Web interest expense is the cost that the company has to pay if they borrow funds for the purpose of growth, expansion, and meet the operational cost of the. Web the journal entry for the accrued interest includes a debit to the interest expense account and a credit to the interest payable account. The accrued expenses may include interest expense,. Web learn how to create common journal entries for accrued interest, including adjusting entries and delayed bond issues sold at par value. Web this journal entry is to eliminate the $250 interest liability that the company has recorded in the april 30 adjusting entry as well as to record the interest expense that has. Web at the end of the month, borrower needs to record interest portion which not yet been paid to the creditors. When a company borrows money, they must pay interest and record the interest payable or expense accurately to reflect.

Accrued revenue how to record it in 2023 QuickBooks

Web example of accrued expense journal entry. It will increase the interest receivable amount $ 2,000 and interest income for the. Web how to record.

Great Paying Interest Expense And Receiving Revenue Are Examples Of The

A company, xyz ltd, has paid interest on the outstanding term loan of $1,000,000 for march 2018 on 5th april 2018. Web the journal entry.

Self Study Notes The Adjusting Process And Related Entries

Web accrued interest is posted as an adjustment journal entry at the end of an accounting period and reversed on the first day of the.

What is Accrued Interest? Formula + Loan Calculator

Web accrued interest is posted as an adjustment journal entry at the end of an accounting period and reversed on the first day of the.

Accruals and Prepayments Journal Entries HeathldDunn

Web the adjusting entry for accrued interest consists of an interest income and a receivable account from the lender’s side, or an interest expense and.

Accrued Expense Meaning, Accounting Treatment And More

Web this journal entry is to eliminate the $250 interest liability that the company has recorded in the april 30 adjusting entry as well as.

Accrued Expenses Journal Entry How to Record Accrued Expenses With

Web the adjusting entry for accrued interest consists of an interest income and a receivable account from the lender’s side, or an interest expense and.

What is Accrued Interest? Formula + Loan Calculator

It will represent as interest expense on income statement and interest. It is a liability because the company has incurred a. Web the adjusting entry.

Journal Entry Examples Accounting Bamantara Darya

Web the journal entry is debiting accrued interest receivable $ 2,000 and interest income $ 2,000. Checked for updates, april 2022. Web accrued interest is.

Web Accrued Interest Is Booked At The End Of An Accounting Period As An Adjusting Journal Entry, Which Reverses The First Day Of The Following Period.

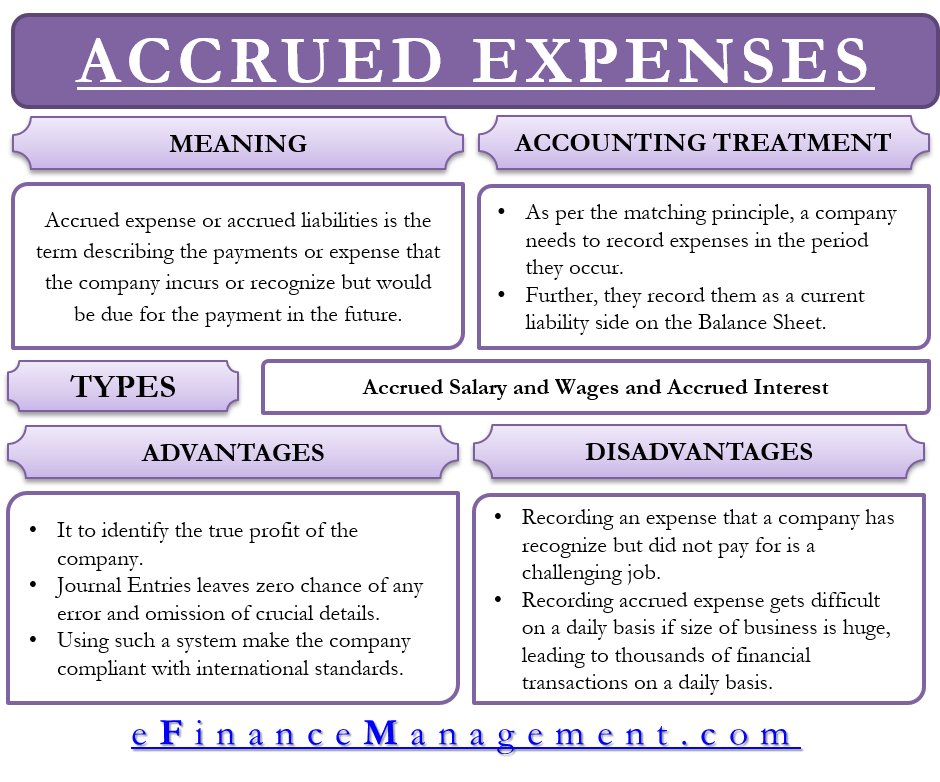

Calculations, entries, and financial impacts. Web adjusting entry for accrued expense. The accrued expenses may include interest expense,. Web at the end of the month, borrower needs to record interest portion which not yet been paid to the creditors.

Web How To Record An Interest Expense Journal Entry.

Web the journal entry for the accrued interest includes a debit to the interest expense account and a credit to the interest payable account. Accrued expense is the expense that has already incurred during the period but has not been paid for yet. It is a liability because the company has incurred a. Web with the above information, here is the formula to calculate accrued interest:

It Will Represent As Interest Expense On Income Statement And Interest.

Understand the essentials of accrued interest, from calculations and journal entries to its impact on. Checked for updates, april 2022. Web accrued interest is posted as an adjustment journal entry at the end of an accounting period and reversed on the first day of the next period. Web the journal entry is debiting accrued interest receivable $ 2,000 and interest income $ 2,000.

A Company, Xyz Ltd, Has Paid Interest On The Outstanding Term Loan Of $1,000,000 For March 2018 On 5Th April 2018.

Web this journal entry captures the amount of interest accrued over the duration of the accounting period. Accrued interest = interest rate x (time period/365) x loan amount. Web the journal entry for accrued interest expense is as follow: Web learn how to create common journal entries for accrued interest, including adjusting entries and delayed bond issues sold at par value.