Interest Earned Journal Entry - When a company borrows money, they must pay interest and record the interest payable or expense accurately to reflect. Web accrued interest meaning in accounting is an amount that has been accrued but not yet paid over a period due to debt undertaken or given. Understand the essentials of accrued interest, from calculations and journal entries to its impact on. Deposited a sum of $ 500,000 in the bank account on december 01,. Web the journal entry for recording interest received from the bank is provided below: Web this journal entry is to recognize $250 of interest expense that charges for the month of april as well as to recognize the $250 of interest liability that the company owes at the. Debit the receiver and credit all incomes and gains) example. I create and use an income account called interest income. Date the journal entry for the day interest was posted to the account. I'll share with you the complete actions in recording interest in quickbooks online.

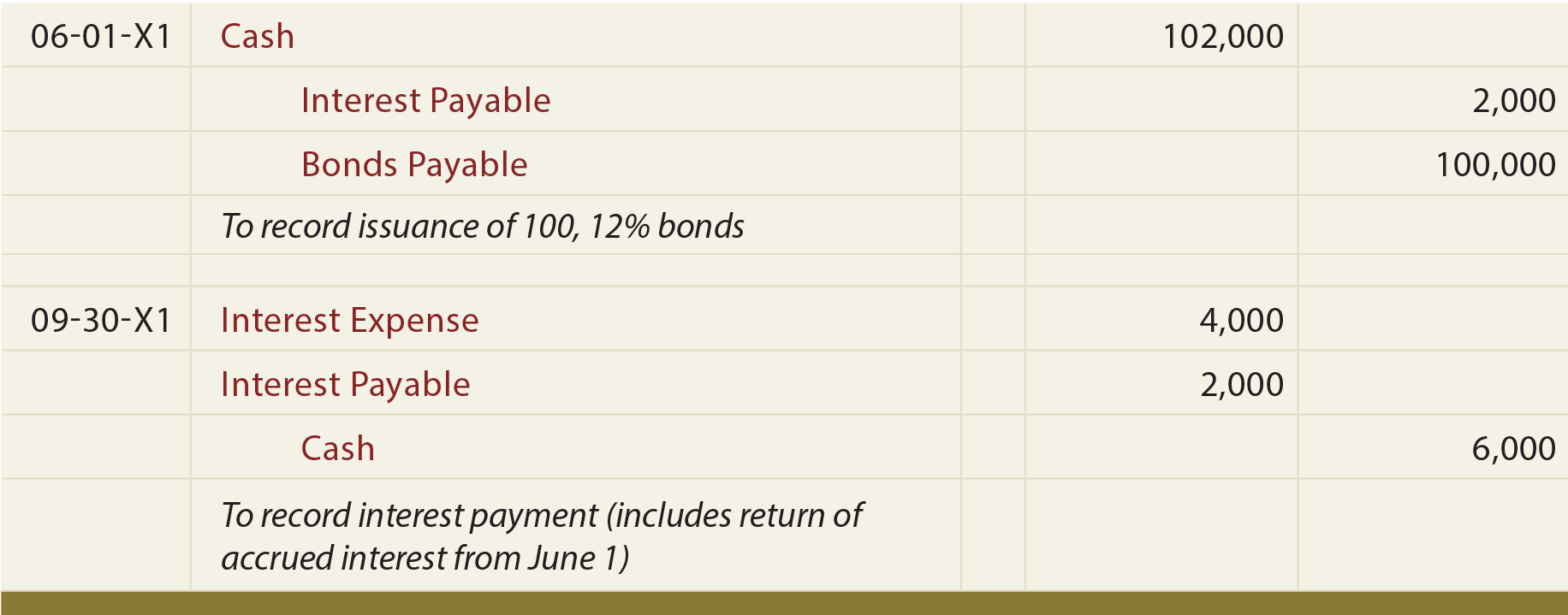

Bonds Issued Between Interest Dates, Bond Retirements, And Fair Value

The company can make the interest income journal entry by debiting the interest receivable account and crediting the interest income account. To the maker of.

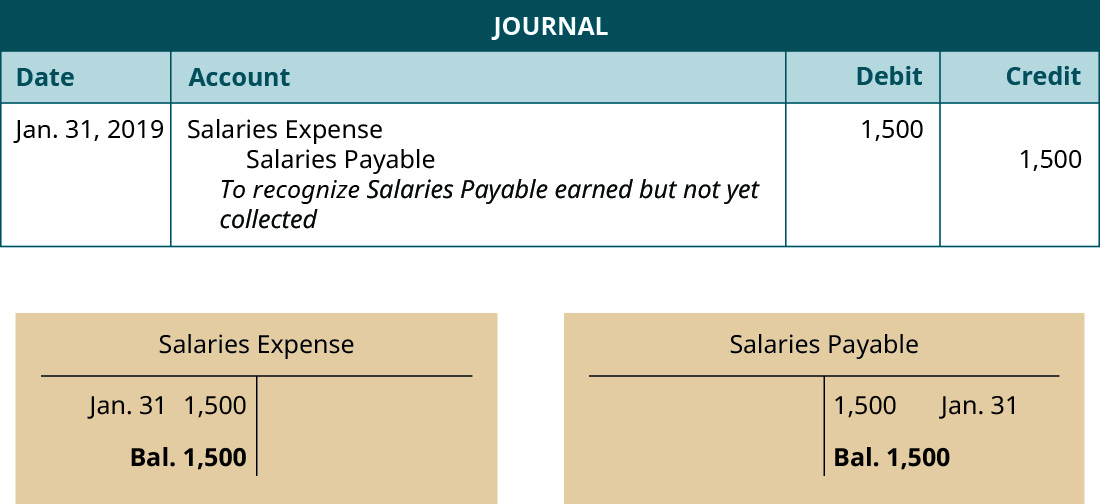

The Adjusting Process And Related Entries

Cash is debited for the receipt of the amount. Debit the receiver and credit all incomes and gains) example. Web this journal entry is to.

Trading and Profit and Loss Account Opening Journal Entries

I create and use an income account called interest income. Web below are the examples of interest receivable journal entries. Web when the business earns.

How to Adjust Journal Entry for Unpaid Salaries

Web this accrued interest income journal entry is made to recognize our right to receive the cash in the future on the balance sheet as.

Interest Earned Double Entry Bookkeeping

Web interest income journal entry is crediting the interest income under the income account in the income statement and debiting the interest receivable account in.

Unearned Interest Journal Entry

An asset account is debited to increase it. Debit the receiver and credit all incomes and gains) example. Web when the business earns and receives.

When a Job Is Completed the Journal Entry Involves a OlivehasHenderson

To the maker of the note, or borrower, interest. Web the adjusting journal entry would be: Web accrued interest meaning in accounting is an amount.

Accounting Journal Entries For Dummies

When a company borrows money, they must pay interest and record the interest payable or expense accurately to reflect. The amount will be collected after.

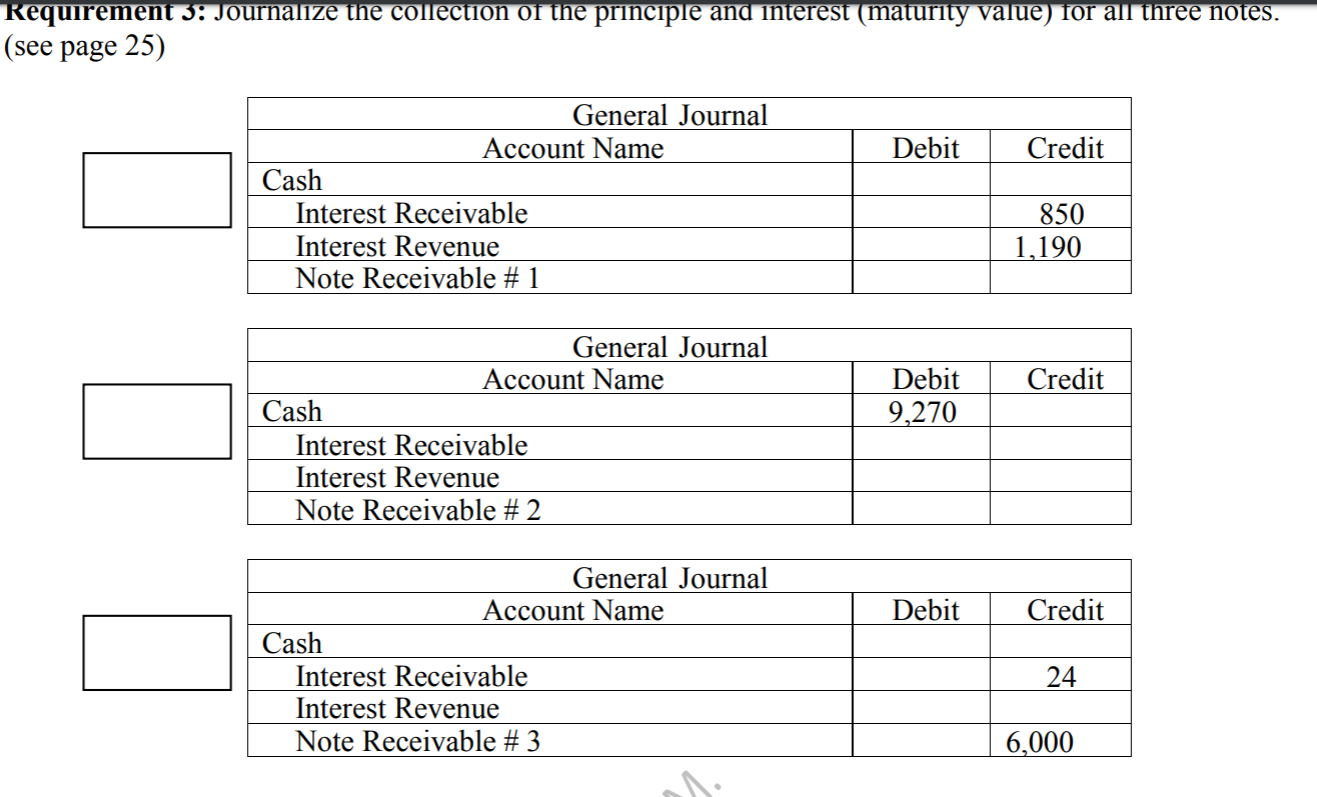

Outline page 28, the journal entry for the collection

If it is a bank account, the date. Web when the business earns and receives interest income, the journal entry is: When a company borrows.

Calculate And Record Accrued Interest.

Web when you accrue interest as a lender or borrower, you create a journal entry to reflect the interest amount that accrued during an accounting period. I'll share with you the complete actions in recording interest in quickbooks online. Interest receivable and interest income. Web this journal entry is to recognize $250 of interest expense that charges for the month of april as well as to recognize the $250 of interest liability that the company owes at the.

When A Company Borrows Money, They Must Pay Interest And Record The Interest Payable Or Expense Accurately To Reflect.

The amount will be collected after 1 year. Cash is debited for the receipt of the amount. Interest is the fee charged for use of money over a specific time period. Web how to record an interest expense journal entry.

Web Recording Interest Earned Requires A General Journal Entry.

This entry typically involves two accounts: Web the journal entry for recording interest received from the bank is provided below: Web interest income journal entry is crediting the interest income under the income account in the income statement and debiting the interest receivable account in the balance sheet. Accrued interest = interest rate x (time period/365) x loan amount.

To The Maker Of The Note, Or Borrower, Interest.

Web the journal entry for interest paid on loan is as follows; An asset account is debited to increase it. Deposited a sum of $ 500,000 in the bank account on december 01,. Understand the essentials of accrued interest, from calculations and journal entries to its impact on.