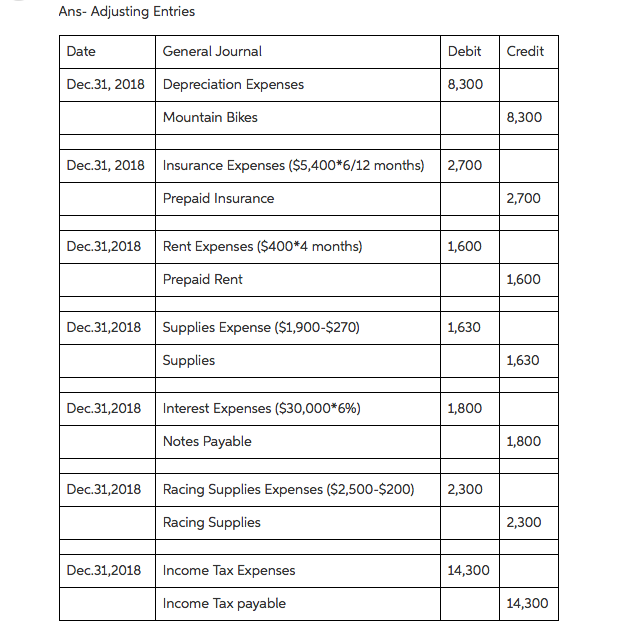

Insurance Expense Journal Entry - Web the following entries show the initial payment for the policy and the subsequent adjusting entry for one month of insurance usage. The journal entry also helps to ensure that the company is properly tracking its expenses. Web (1) journal entries to account for the above transaction on april 1, 20x5 and june 30, 20x5. Web the adjusting entry for prepaid expense depends upon the journal entry made when it was initially recorded. Web the payroll tax expense journal entry tracks employer contributions to payroll taxes, such as social security, medicare, and unemployment insurance. The payment made by the company is listed as an expense for the accounting period. The expenditure account is debited here, and the accrued liabilities account is credited. Web written by cfi team. When payroll is processed, this entry recognizes the employer’s liability, debiting the payroll tax expense account and crediting the relevant payroll tax liability accounts. Web the adjusting entry ensures that the amount of insurance expired appears as a business expense on the income statement, not as an asset on the balance sheet.

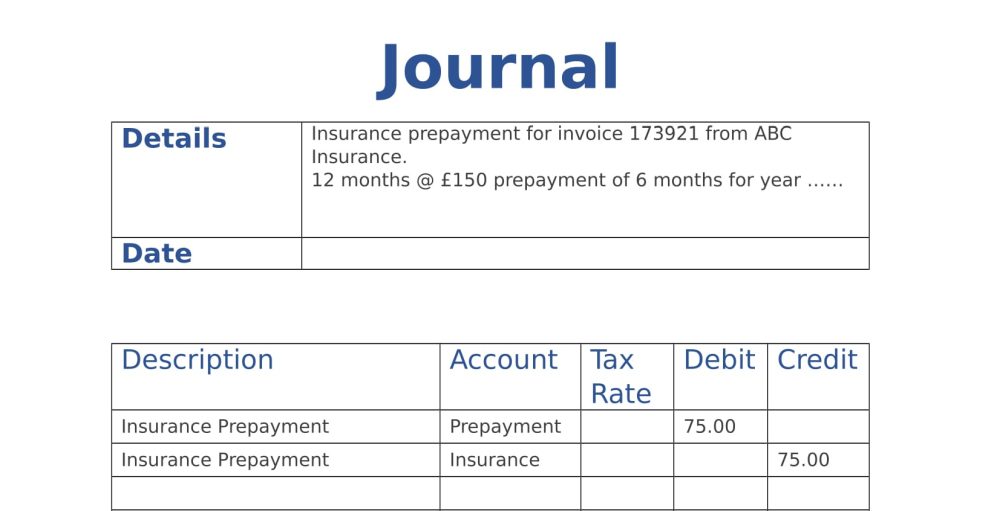

Journal Entry Problems and Solutions Format Examples

When companies initially pay for the total. Likewise, the company can make insurance expense journal entry by debiting insurance expense account and crediting prepaid insurance.

Journal Entry for Prepaid Insurance Online Accounting

Likewise, the company can make insurance expense journal entry by debiting insurance expense account and crediting prepaid insurance account. The insurance expense needs to be.

Journal Entry For Prepaid Expenses

Web please prepare a journal entry for unexpired insurance. The payment made by the company is listed as an expense for the accounting period. This.

Insurance Expense Adjusting Entry Prepaid Insurance Business

(2) balance in prepaid insurance account on june 30, 20x5. Web the first journal entry is to recognize the loss. The insurance expense needs to.

Insurance Expired During the Year Adjusting Entry

Web in this journal entry, the total expenses on the income statement will increase as a result of insurance expiration. Likewise, the company can make.

Accrued Expenses Journal Entry How to Record Accrued Expenses With

On the other hand, the balance of prepaid insurance on the balance sheet will decrease by the same amount. To record the prepayment as a.

The Adjusting Process And Related Entries

Web on december 31, the company writes an adjusting entry to record the insurance expense that was used up (expired) and to reduce the amount.

Adjusting Journal Entries Jojonomic Officeless Operating System, No

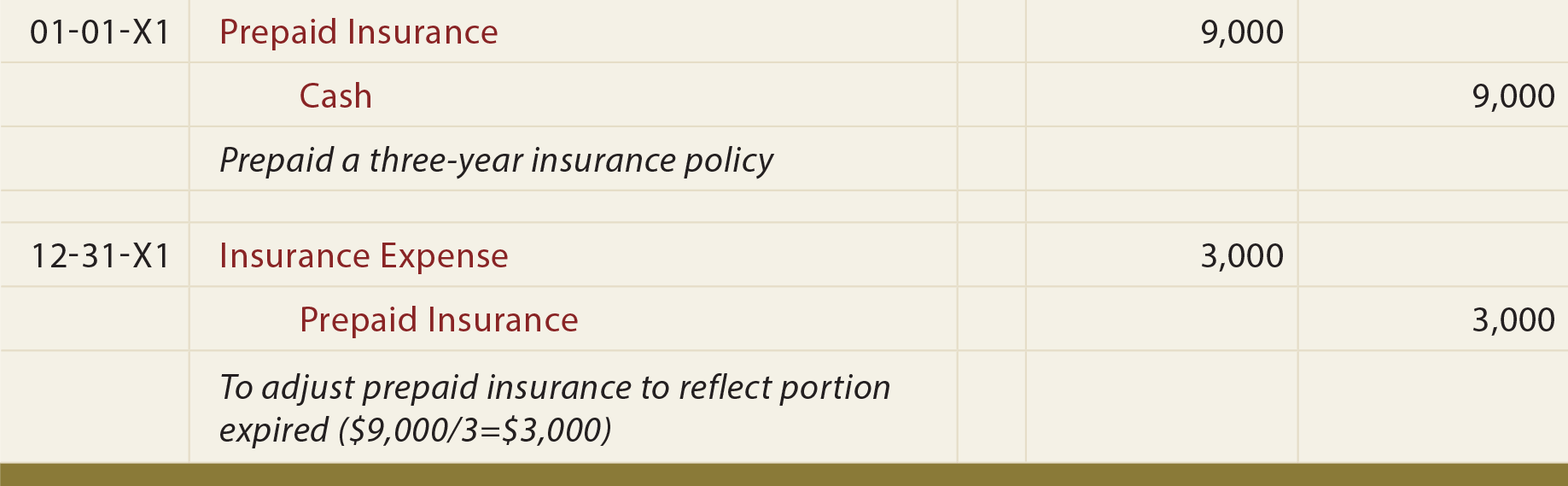

In the first entry, cash decreases (credit) and prepaid insurance increases (debit) for $4,500. Web on june 1st, 2020, you will make the following journal.

Insurance Journal Entry for Different Types of Insurance

Under the asset method, a prepaid expense account (an asset) is recorded when the amount is paid. Web journal entries for expenses are records you.

Accruals Are Expenses And Revenues That Gradually Accumulate Throughout An Accounting Period.

In the second entry, prepaid insurance decreases (credit) and insurance expense increases (debit) for one month’s. Insurance expense is the amount that a company pays to get an insurance contract and any additional premium payments. Web journal entries for expenses are records you keep in your general ledger or accounting software that track information about your business expenses, like the date they were incurred and how much they cost. Web the adjusting entry for prepaid expense depends upon the journal entry made when it was initially recorded.

Web The Following Journal Entry Accommodates A Prepaid Expense:

At the end of june, your bookkeeper will need to make an adjusting journal entry to reflect that now you only have 11 months of prepaid insurance. Web the journal entry for insurance expenses is an important part of the accounting process. (balance sheet items) revenue expenditure (profit and loss statement items) provisions (both, balance sheet and profit and loss statement items) deferred revenue expenditures. There are two ways of recording prepayments:

To Record The Prepayment As A Current Asset:

Business expenses can include a range of things, like rent, payroll, and inventory. When companies initially pay for the total. When payroll is processed, this entry recognizes the employer’s liability, debiting the payroll tax expense account and crediting the relevant payroll tax liability accounts. In the first entry, cash decreases (credit) and prepaid insurance increases (debit) for $4,500.

An Insurance Expense Occurs After A Small Business Signs Up With An Insurance Provider To Receive Protection Cover.

Web in this journal entry, the total expenses on the income statement will increase as a result of insurance expiration. Web please prepare a journal entry for unexpired insurance. On the other hand, the balance of prepaid insurance on the balance sheet will decrease by the same amount. Web monthly insurance expense = $ 120,000 / 12 months = $ 10,000 per month.