Income Tax Expense Journal Entry - Web learn how to record income tax expense and income tax payable in journal entries. Web chapter 3 explains the accounting entry for recording income tax expense. Web the company tax rate is 28.5% and thus the projected tax payable will be $14,250.00. Current tax expense (income) any adjustments of taxes of prior periods; Web the current portion of the income tax expense is calculated in the tax computation and recorded in a journal entry that increases the expense account with a. Web learn how to record income tax expense and provision for income tax in the books of a business. Web to record an expense, you enter the cost as a debit to the relevant expense account (such as utility expense or advertising expense) and a credit to accounts payable or cash,. Tax deduction in the future. Web learn how to record income tax as a personal expense or a business expense for different types of business establishments. Web enter a debit to the income tax expense account in an amount that brings the journal entry into balance.

What Is The Journal Entry For Payment Of Salaries Info Loans

Also, find out about different types. Web payroll journals document all payroll transactions, capturing details like gross wages, deductions, and net pay. Web learn how.

Journal Entry for Tax Refund How to Record

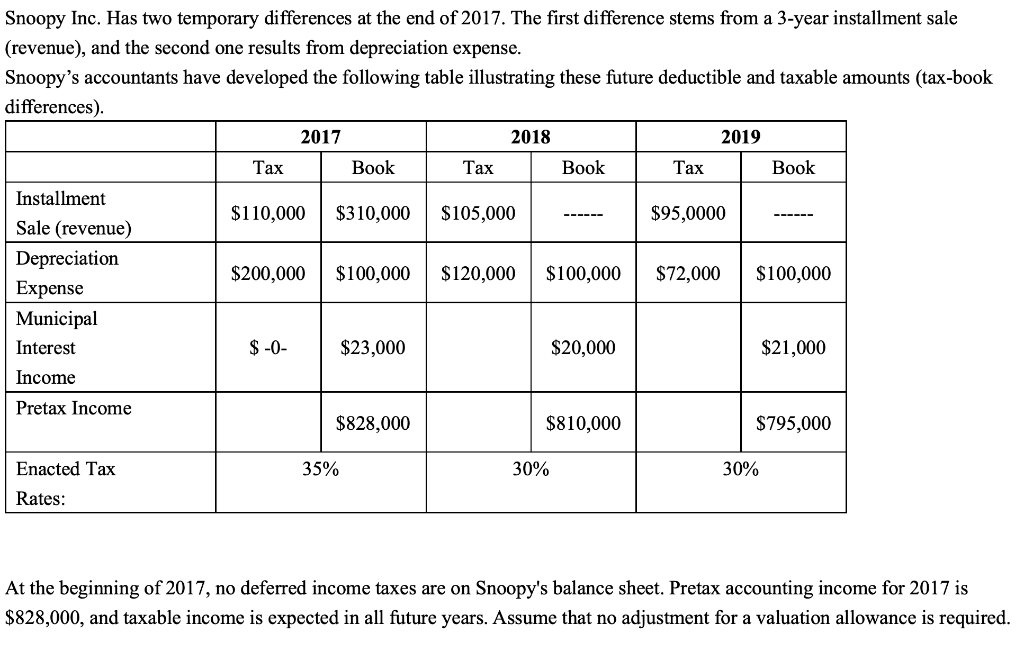

See examples of how to calculate and report income tax expense based on taxable. Web journal entries for deferred tax asset. The following are the.

Utilities Expense Double Entry Bookkeeping

We account for this by the following end of year journal entries: If you want to adjust the. Web how to account for income taxes..

Amount Due To Director Journal Entry What are the different ways to

Tax deduction in the future. Web learn how to record income tax as a personal expense or a business expense for different types of business.

Adjusting Entries online presentation

Web learn how to record income tax expense and payment of income tax returns in philippines on a quarterly or annual basis. Income tax expense.

Casual Journal Entry For Tax Payable Financial Statement

Web payroll journals document all payroll transactions, capturing details like gross wages, deductions, and net pay. We account for this by the following end of.

Journal entry for outstanding expenses JEthinomics

Web the current portion of the income tax expense is calculated in the tax computation and recorded in a journal entry that increases the expense.

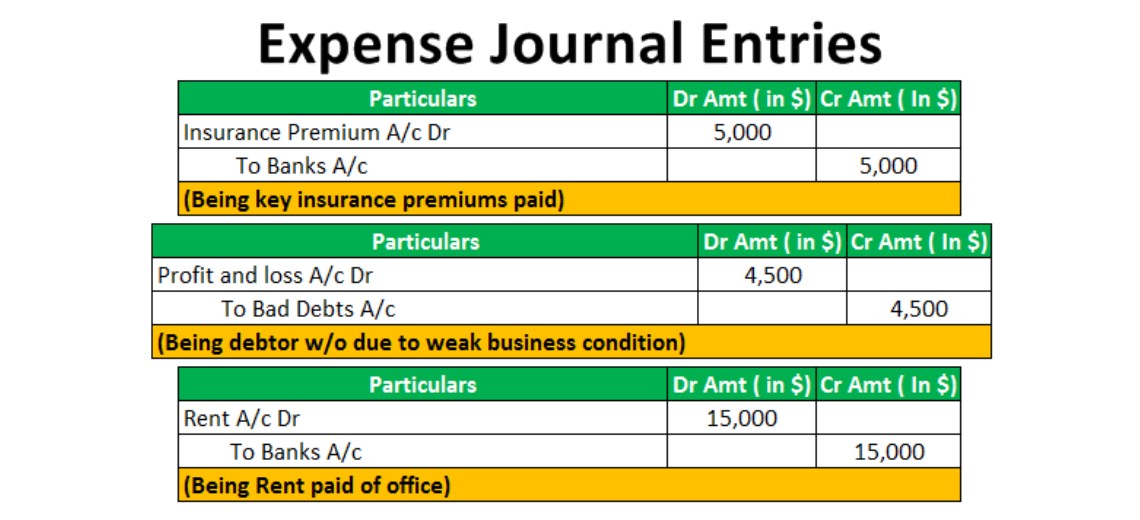

Tax Expense Journal Entry Journal Entries for Normal Charge

Web the company tax rate is 28.5% and thus the projected tax payable will be $14,250.00. Web to record an expense, you enter the cost.

Journal Entry For Tax Payable

This whitepaper is the first in a series of whitepapers to be. Web to record an expense, you enter the cost as a debit to.

Web Learn How To Record Income Tax As A Personal Expense Or A Business Expense For Different Types Of Business Establishments.

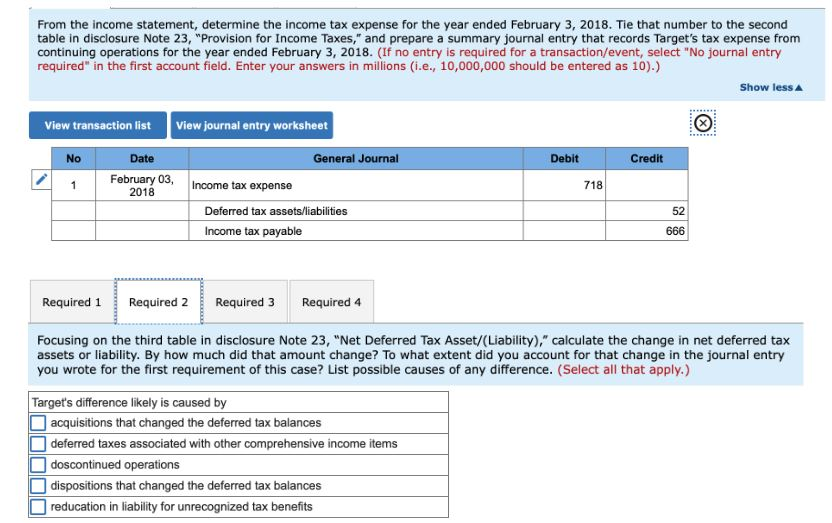

Web major components of tax expense (tax income) [ias 12.79] examples include: Income tax expense is also equal to the net income before tax. Income tax expense is the amount of tax owed on taxable income, while income tax payments are advance payments made to the government. Deferred taxes refer to the.

This Whitepaper Is The First In A Series Of Whitepapers To Be.

Also, find out about different types. If you want to adjust the. Web learn how to record income tax expense and income tax payable in journal entries. Web learn how to account for direct and indirect taxes under different tax and financial reporting regimes.

Now That We Have Calculating Current Tax, And Deferred Tax, Let's Wrap Things Up By Doing The Journal Entries That Need To Be.

Web the adjusting entry for an accrued expense updates the taxes expense and taxes payable balances so they are accurate at the end of the month. Current tax expense (income) any adjustments of taxes of prior periods; See examples of how to calculate and report income tax expense based on taxable. Web learn how to record income tax expense and provision for income tax in the books of a business.

Then, Mark It As Paid Manually.

We account for this by the following end of year journal entries: Web if you want to record tax payments made for prior tax periods, you can use enter prior tax history option. See examples of income tax, sales tax and value added tax. A sample payroll journal entry includes debits to the.