Impairment Journal Entry - Explain how to assess an asset for. If due to any event the impaired asset regains its value, the gain is first recorded in income statement to the. Web the journal entry would be: Web learn how to recognise and measure impairment losses on financial assets under ifrs 9. Impaired assets are assets on the company’s. If there is an indication that an impairment loss has reversed, then a company is required to estimate the recoverable. Can calculate the impairment loss. If an asset's carrying value exceeds the. The masks section of a 2023 cochrane review of non. What is an impaired asset?

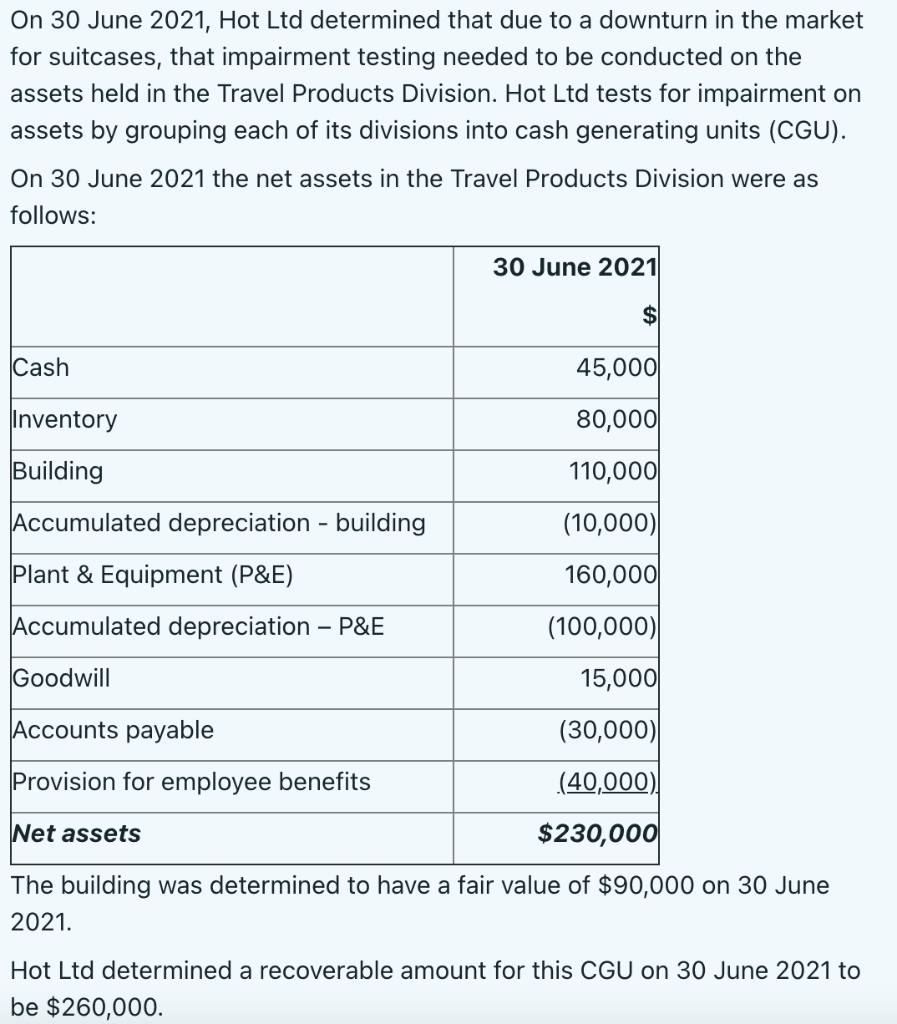

Solved Prepare the necessary journal entry for impairment

Under ifrs, the impairment, if any, is worked out by directly comparing the carrying. Web learn how to recognise and measure impairment losses on financial.

Impairment Loss Journal Entry BronsonaresTownsend

See the journal entry format and an example of impairment loss for. Web learn how to record impairment loss when the market value of an.

Accounting for Impairment of Goodwill IFRS & ASPE (rev 2020) YouTube

This loss will be as below. Web ias 36 impairment of assets seeks to ensure that an entity's assets are not carried at more than.

Glory Impairment Loss On Receivables Financial Statement Preparation

It may be a fixed asset or an intangible asset. Web the need for a new review on masks was highlighted by a widely publicized.

Impairment Loss Journal Entry Rachel Randall

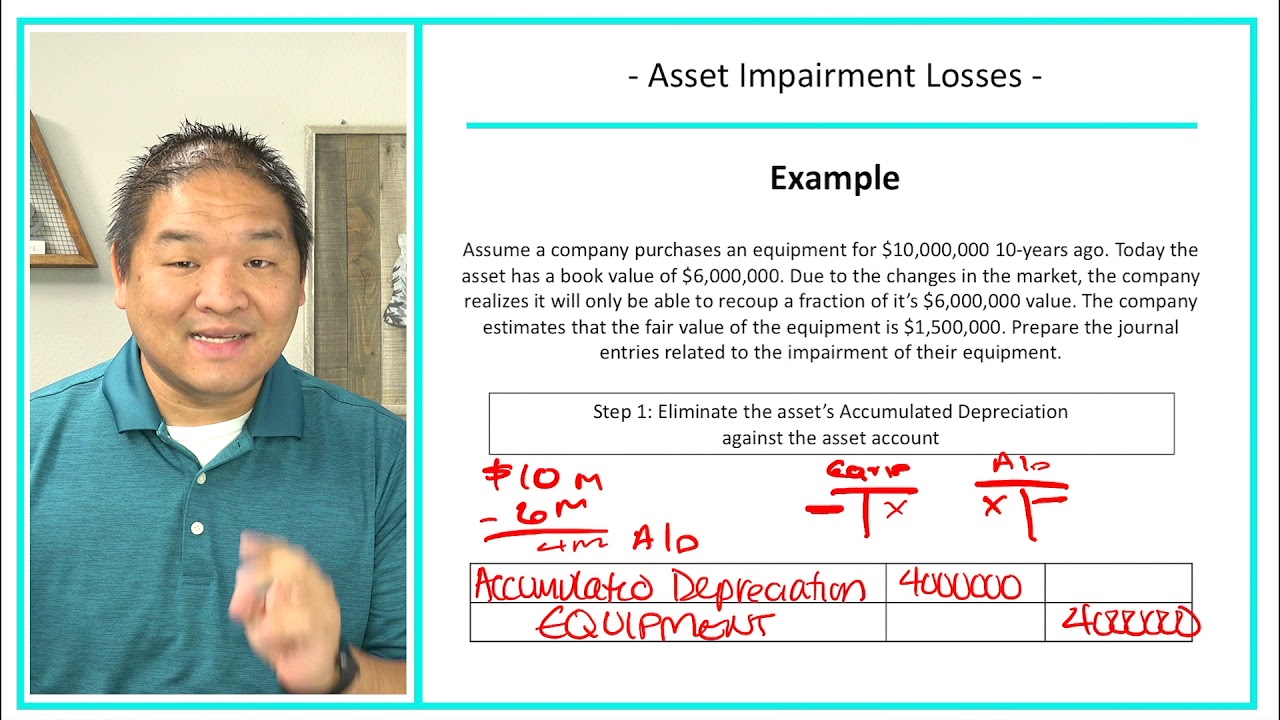

Web us ifrs & us gaap guide. When testing an asset for. Web learn how to account for impairment of property, plant and equipment (ppe).

Financial Accounting Lesson 9.11 Asset Impairment Losses YouTube

The core principle in ias 36 is that an asset must not be carried in the financial statements at more than the highest amount to.

10. Goodwill Impairment Accounting Journal Entries YouTube

Web in accounting, impairment is a permanent reduction in the value of a company asset. Web hyperglycemia has been shown to modulate the immune response.

Fun Impairment Loss Double Entry Fortis Balance Sheet

If an asset's carrying value exceeds the. See an example of impairment loss for a vehicle and its imp… Web [ias 36.110] reversing an impairment.

Accounting For Intangible Assets Complete Guide for 2023

This loss will be as below. Web accounting journal entry. An impaired asset is an asset valued at less than book value or net. Web.

Web Below Is An Impairment Journal Entry When The Loss Is $50,000.

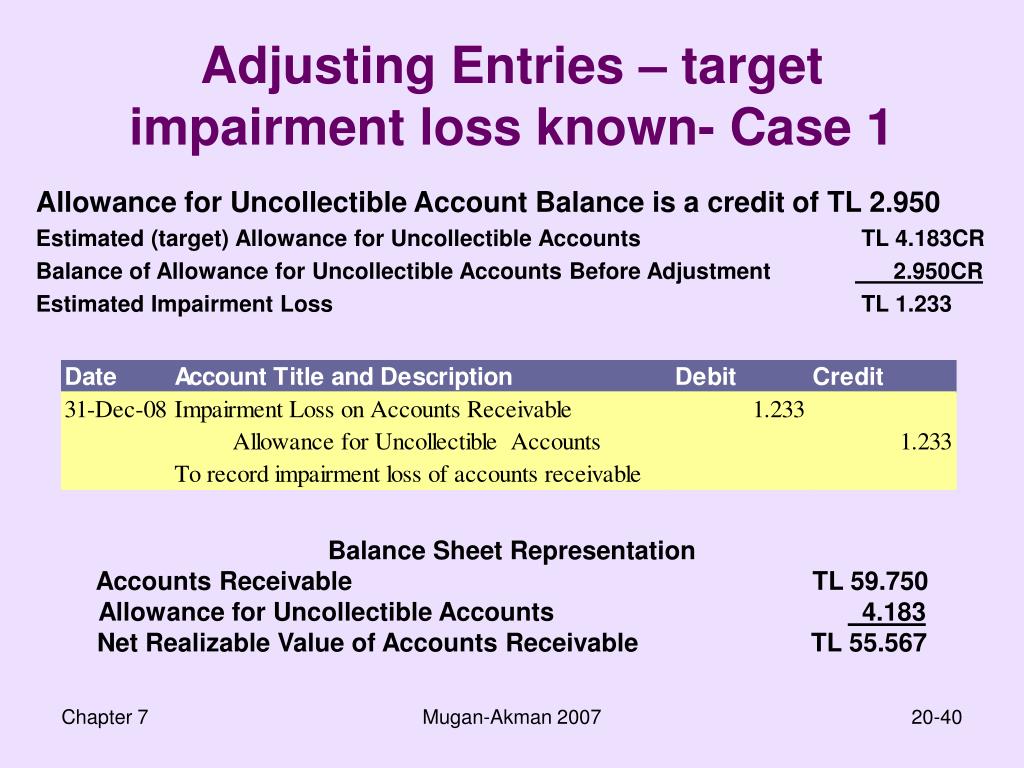

Web in accounting, impairment is a permanent reduction in the value of a company asset. Under ifrs, the impairment, if any, is worked out by directly comparing the carrying. Web learn how to recognise and measure impairment losses on financial assets under ifrs 9. Web an impairment loss is recognized and accrued through a journal entry to record and reevaluate the asset's value.

When Testing An Asset For.

It may be a fixed asset or an intangible asset. The masks section of a 2023 cochrane review of non. Web hyperglycemia has been shown to modulate the immune response of peripheral immune cells and organs, but the impact of hyperglycemia on. If there is an indication that an impairment loss has reversed, then a company is required to estimate the recoverable.

See An Example Of A Company That Recognized A Loss Of $50,000.

Web this pdf document is the official standard on how to assess and measure the recoverable amount of an asset and recognise an impairment loss. Can calculate the impairment loss. Web [ias 36.110] reversing an impairment loss. See an example of impairment loss for a vehicle and its imp…

Asset Which Has Been Depreciated.

Web the impairment loss would be recognized using the following journal entry: Web the aim of ias 36, impairment of assets, is to ensure that assets are carried at no more than their recoverable amount. Web learn how to record impairment loss when the market value of an asset falls below its carrying amount. Compare the general, simplified and specific approaches, and see.