How To Record Revenue Journal Entry - Revenue received in advance journal entry. Credit the sales revenue account to recognize the income earned. Web an unearned revenue journal entry involves recording a double entry in your accounts records when you receive payment, then another double entry when you supply the. Web the following deferred revenue journal entry outlines the most common journal entries in accounting. Web sales journal entries, sometimes referred to as revenue journal entries, are records of a cash or credit sale to a client. Web this journal entry is to record the collection of receivables as the company receives the cash payment from the customer for the service it provides in october 2020. Web they need to calculate revenue per month by divide total amount by the number of months. This journal entry needs to record three events, which are the recordation of a. Steps to record a sales revenue journal entry. On your company income statements, list it as earned revenue.

How to use Excel for accounting and bookkeeping QuickBooks

On january 1, 2024, taco king leased retail space from fogelman properties. This journal may be called a revenue, sales or. The company records revenue.

Unearned Revenue Journal Entry LizethkruwSmith

To record an expense, you enter the cost as a debit to the relevant expense account (such as utility expense or. Accrued revenue is a.

Accruals and Prepayments Journal Entries HeathldDunn

On 30 apr, as the work already completed they need to record revenue to make sure it meets the matching principle. Debit the accounts receivable.

9.1 Explain the Revenue Recognition Principle and How It Relates to

Credit the sales revenue account to recognize the income earned. Web date january 01, 2024 general journal debit credit a. Web accrued revenue journal entries.

Subscription Revenue Journal Entry

Accrued revenue is a current asset recorded for sales products shipped or services delivered that have not yet been billed to the customer or paid.

The Adjusting Process And Related Entries

Web sales credit journal entry refers to the journal entry recorded by the company in its sales journal when the company makes any sale of.

LO 3.5 Use Journal Entries to Record Transactions and Post to T

Debit the accounts receivable account to record the amount owed by the customer. These entries also reflect any changes to. On january 1, 2024, taco.

PPT Accounting for Rural Transits PowerPoint Presentation, free

In simple terms,, deferred revenue means the revenue. Web date january 01, 2024 general journal debit credit a. The company records revenue into the income..

What Is The Journal Entry For Payment Of Salaries Info Loans

The journal entries would be as. Revenue received in advance journal entry. Web the double entry bookkeeping journal entry to show the revenue received in.

Web Let’s Walk Through The Process Of Recording Revenue Recognition Journal Entries With The Following Journal Entries.

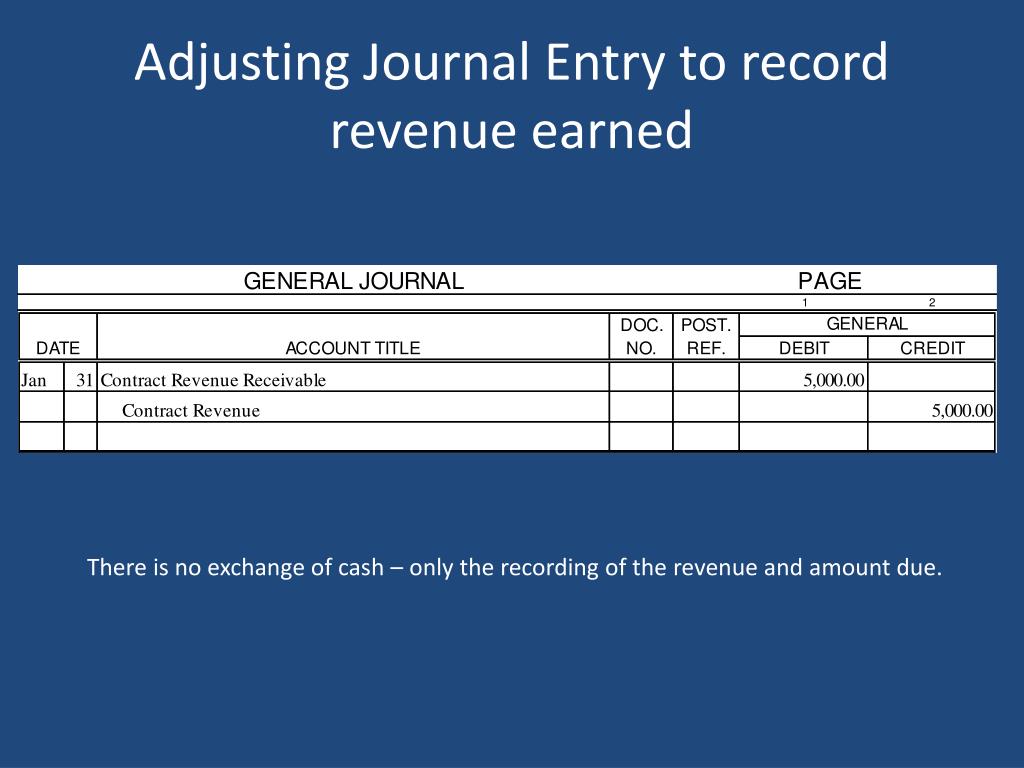

Credit the sales revenue account to recognize the income earned. Revenue recognition under asc 606. Web accrued revenue is recorded with an adjusting journal entry that recognizes items that would otherwise not appear in the financial statements at the end of the. These entries also reflect any changes to.

On Your Company Income Statements, List It As Earned Revenue.

Web accrued revenue journal entries are records put in for product deliveries that are done to customers, but the payment if which is scheduled at a later stage. Steps to record a sales revenue journal entry. Web an unearned revenue journal entry involves recording a double entry in your accounts records when you receive payment, then another double entry when you supply the. Web the following deferred revenue journal entry outlines the most common journal entries in accounting.

Web The Double Entry Bookkeeping Journal Entry To Show The Revenue Received In Advance Is As Follows:

Web a sales journal entry records the revenue generated by the sale of goods or services. On 30 apr, as the work already completed they need to record revenue to make sure it meets the matching principle. A journal entry must be made each time a business makes a sale. Web they need to calculate revenue per month by divide total amount by the number of months.

Web The Per Month Revenue Of The Company Is $1000.

Web posted on january 2, 2021 by online accounting guide. In simple terms,, deferred revenue means the revenue. Web how do you record a journal entry for an expense? Accrued revenue is a current asset recorded for sales products shipped or services delivered that have not yet been billed to the customer or paid yet.