How To Record Outstanding Checks Journal Entry - When doing a bank reconciliation, the reconciling items are categorized as to book reconciling items and. Write off the check by decreasing (crediting) your outstanding checks account and increasing (debiting) your main cash account. Web a quick reference for bank reconciliation journal entries, setting out the most commonly encountered situations when dealing with bank reconciliations. The journal entry for writing off an outstanding check would look like this: When there are old outstanding checks on a bank reconciliation, they should be eliminated. Web how to record accounts payable journal entry. Enter the checks with the original date and amount, total them and add that amount to the opening balance. The entry simply reverses back the original entry by increasing back the cash balance and accounts payable. Web in both scenarios, the check is removed from the outstanding checks list associated with the bank reconciliation. Web if a check was voided in the current month but was written in the previous month and appeared on the previous month’s list of outstanding checks, you should write a journal entry to do the following:

Solved a. Outstanding checks of 12,800. b. Bank service

Create an adjusting journal entry where you debit your bank account for the amount of the voided check and credit the expense account that was.

Journal Entry Examples

This may eliminate the accounting entries and the need to report and remit the outstanding check amounts to your state government years later. Learn how.

Solved Bank Reconciliation? Journal Entries Prepare The

The journal entry for writing off an outstanding check would look like this: To do that, you'll need to create an account and item to.

Journal Entry Outstanding Balance

In a bank reconciliation the outstanding checks are a deduction from the bank balance (or balance per the bank statement). Web updated june 24, 2022..

PA53 Identifying Outstanding Checks and Deposits in Transit and

Web in both scenarios, the check is removed from the outstanding checks list associated with the bank reconciliation. Web the journal entry for an outstanding.

Payroll Journal Entry Example Explanation My Accounting Course

Web how to record accounts payable journal entry. Then on the next reconciliation you perform, you can clear the old uncleared checks and the journal.

PA53 Identifying Outstanding Checks and Deposits in Transit and

Learn how to account for them and create a outstanding expenses entry! Though prone to causing issues, outstanding checks can be easily kept track of.

Accounting Journal Entries For Dummies

Web the best practice is to communicate with the payees of your outstanding checks before the checks have been outstanding for a second month. To.

Bank Reconciliation

Web the first is to create a journal entry with the appropriate vendor's details and apply it to the existing credit/debit afterward. Web if a.

Example Of An Outstanding Check In The Bank Reconciliation.

Credit the account (s) that was debited when the check was originally recorded. Web create a list of outstanding checks or get a list from the bank. Web in both scenarios, the check is removed from the outstanding checks list associated with the bank reconciliation. Write off the check by decreasing (crediting) your outstanding checks account and increasing (debiting) your main cash account.

Web How To Record Accounts Payable Journal Entry.

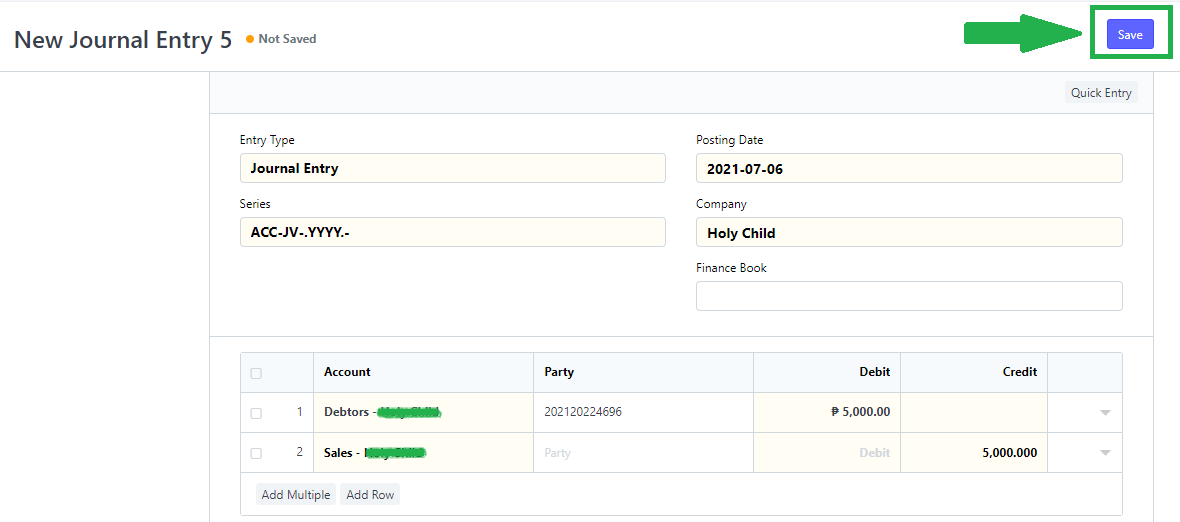

Void checks that no longer are redeemable. To do that, you'll need to create an account and item to be used when offsetting the vendor's bill/check. Web select journal entry. Web the journal entry for outstanding expenses involves two accounts:

Web How To Account For Outstanding Checks In A Journal Entry?

This may eliminate the accounting entries and the need to report and remit the outstanding check amounts to your state government years later. December 19, 2019 05:16 am. Web i think the correct way to enter the outstanding checks is to enter a beginning cash balance that equals your outstanding checks on 12/31, use a journal entry, dr cash and cr suspense account (set this account up as an expense account). Web they need to make a journal entry to write off the outstanding check by debiting cash at bank and credit accounts payable.

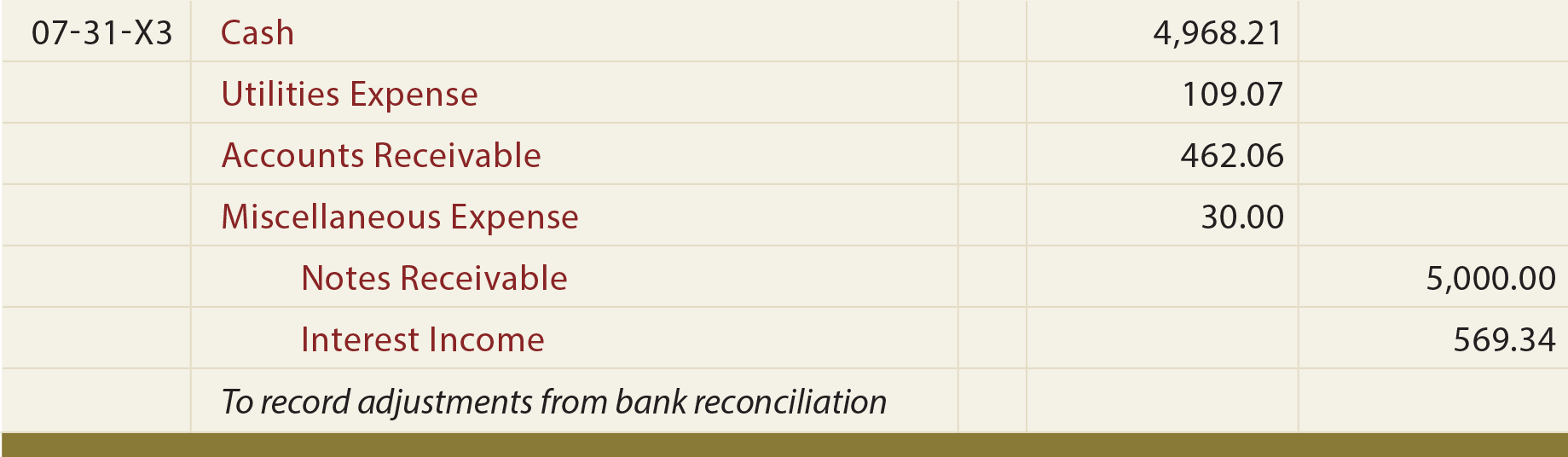

I Usually Record One Large Journal Entry But You Can Also Record A Separate Entry For Each Item In The Reconciliation.

Web a quick reference for bank reconciliation journal entries, setting out the most commonly encountered situations when dealing with bank reconciliations. Web if a check was voided in the current month but was written in the previous month and appeared on the previous month’s list of outstanding checks, you should write a journal entry to do the following: Enter the information in the field to create journal entry. When there are old outstanding checks on a bank reconciliation, they should be eliminated.