How To Record Depreciation In Journal Entry - Accelerated depreciation methods, on the other hand, allocate a larger portion of the cost of the asset in the early years of its useful life and a smaller portion in later years. By debiting the depreciation expense and crediting accumulated depreciation, the book value of the asset decreases on the balance sheet. Depreciation refers to the method of accounting which allocates a tangible asset's cost over its useful life or life expectancy. Web definition of journal entry for depreciation the journal entry for depreciation is: These entries align financial statements with actual economic activity, ensuring accurate and transparent reporting.there are six types of adjusting entries. Web to record depreciation, a journal entry is made at the end of each accounting period, debiting the depreciation expense account and crediting the accumulated depreciation account. Your accountant knows the best methods. Web the journal entry is used to record depreciation expenses for a particular accounting period and can be recorded manually into a ledger or in your accounting software application. Estimated value of the fixed asset at the end of its useful life. Journal entry for year 2.

Journal Entry for Depreciation Example Quiz More..

Credit the fixed asset account for the original cost of the asset. Web the journal entry to record depreciation is fairly standard. Depreciation is the.

Journal Entry For Depreciation

These entries align financial statements with actual economic activity, ensuring accurate and transparent reporting.there are six types of adjusting entries. Web instead, you need to.

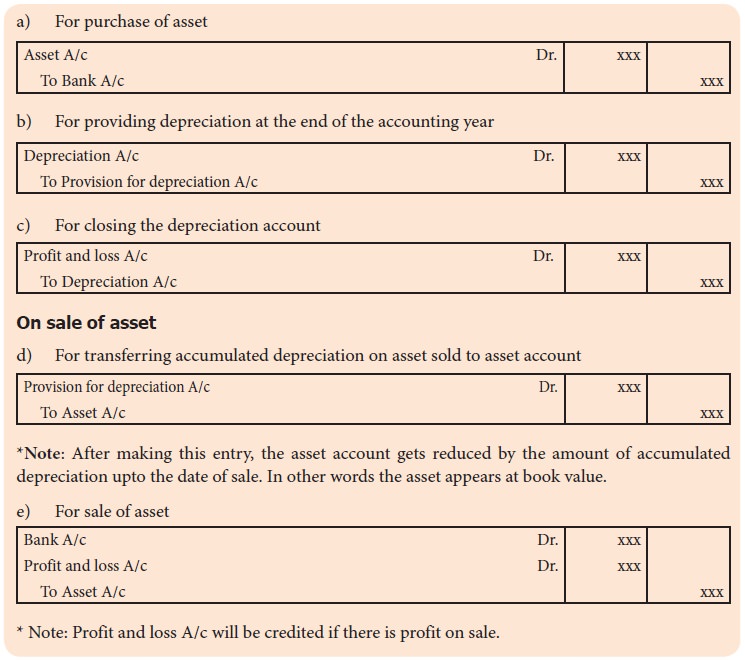

Methods of recording depreciation Accountancy

To calculate depreciation expense, you need to know four things: Web to record depreciation, a journal entry is made at the end of each accounting.

Recording Depreciation Expense for a Partial Year

By debiting the depreciation expense and crediting accumulated depreciation, the book value of the asset decreases on the balance sheet. These entries align financial statements.

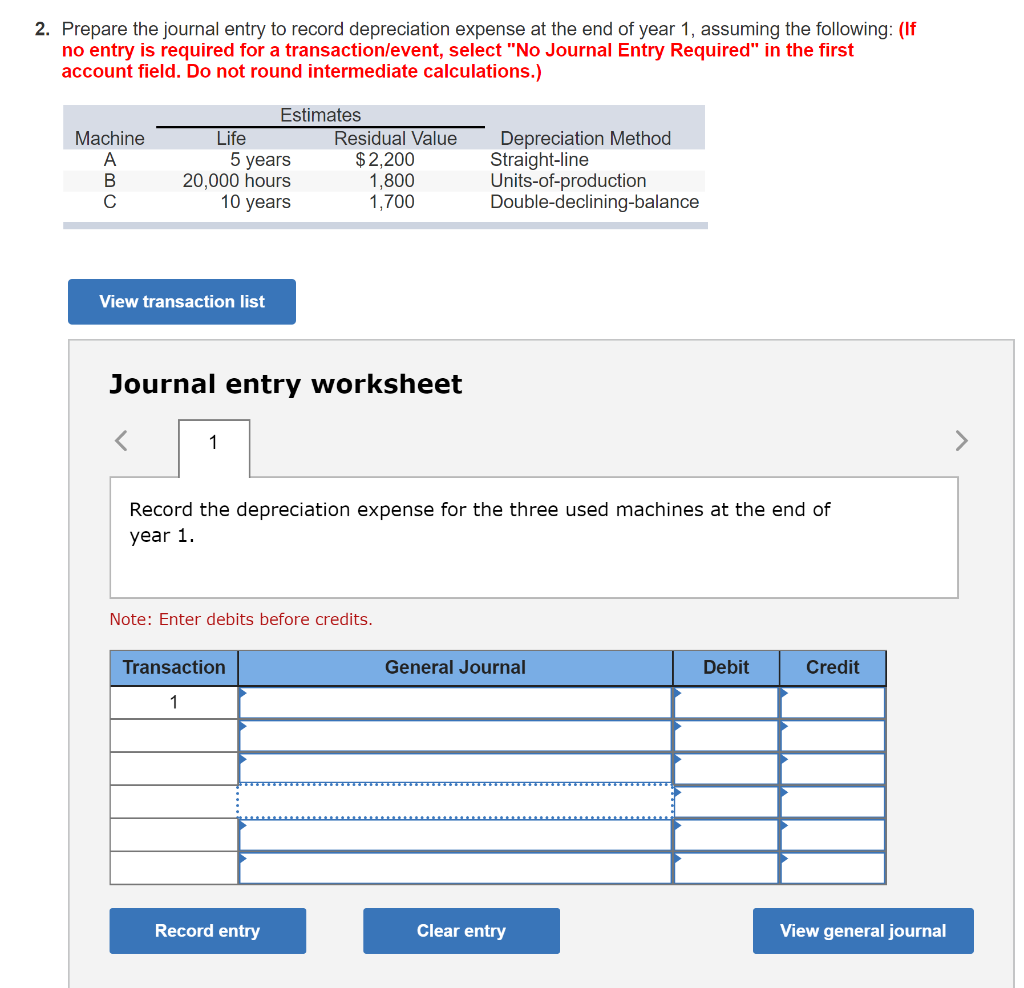

Solved 2. Prepare the journal entry to record depreciation

Web when recording a journal entry, you have two options, depending on your current accounting method. Accrue dividends payable if a corporation. Journal entry for.

Journal Entry for Depreciation Example Quiz More..

Web here are four easy steps that’ll teach you how to record a depreciation journal entry. Residual value or scrap value: Web it is recorded.

What is the journal entry for depreciation? Leia aqui What is

Account for the sale of fixed assets. For example, manufacturing equipment is a fixed asset. Calculating asset depreciation is difficult. Web recording journal entry of.

Adjusting Entries Journalizing Depreciation Adjusting Entries

Residual value or scrap value: In year 1, the journal entry is as follow: Depreciation refers to the method of accounting which allocates a tangible.

Depreciation Explanation Accountingcoach with Bookkeeping Reports

Depreciation in periods after revaluation is based on the revalued amount. Web the basic journal entry for depreciation is to debit the depreciation expense account.

Calculating Asset Depreciation Is Difficult.

Your accountant knows the best methods. Residual value or scrap value: Depreciation in periods after revaluation is based on the revalued amount. Web recording journal entry of accumulated depreciation.

Once Depreciation Has Been Calculated, You’ll Need To Record The Expense As A Journal Entry.

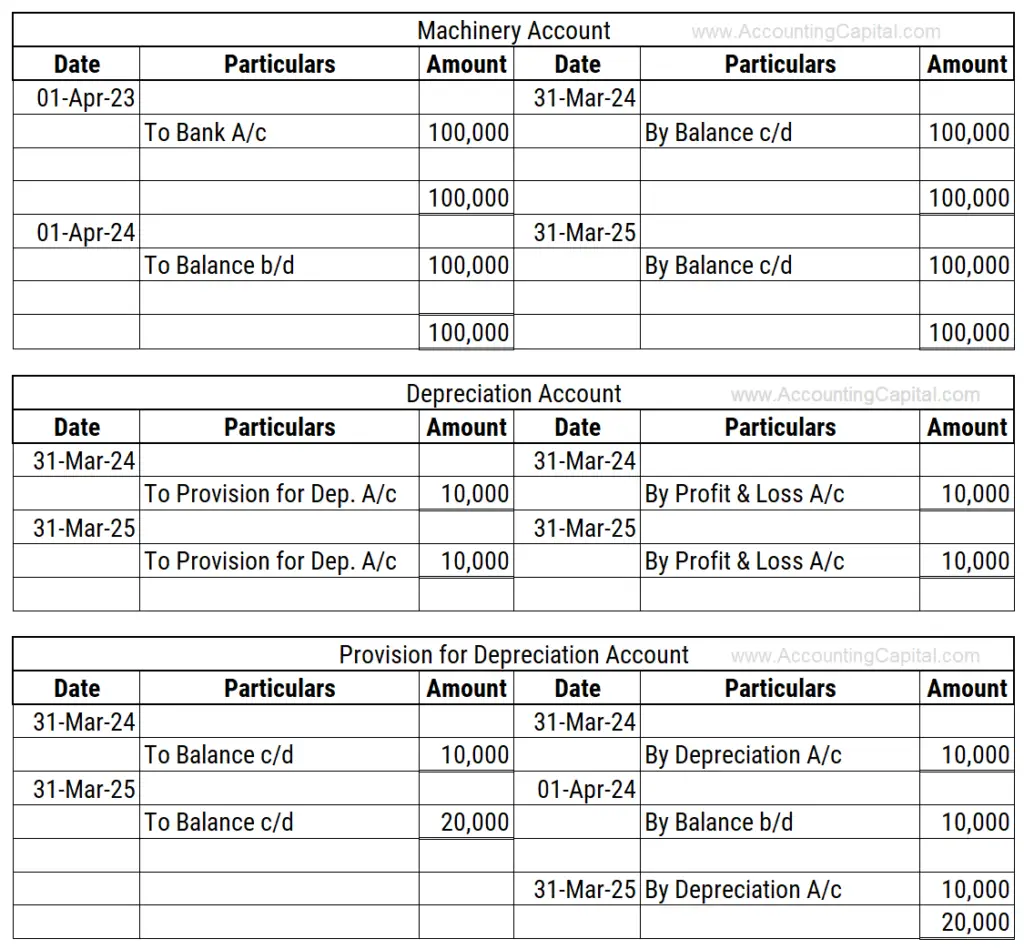

One is where the depreciation account is debited and accumulated depreciation account is credited. Web journal entries for the straight line depreciation. The depreciation journal entry records the passage of time and the use of an asset. Web a depreciation journal entry is used at the end of each period to record the fixed asset or plant asset depreciation in the accounting system.

Web Record Depreciation Expense.

Web definition of journal entry for depreciation the journal entry for depreciation is: Web to reflect the decrease in the value of an asset, businesses use depreciation to record journal entries accurately. Accrue dividends payable if a corporation. These entries align financial statements with actual economic activity, ensuring accurate and transparent reporting.there are six types of adjusting entries.

Web The Journal Entry Is Used To Record Depreciation Expenses For A Particular Accounting Period And Can Be Recorded Manually Into A Ledger Or In Your Accounting Software Application.

Web it is recorded through the following journal entry: By debiting the depreciation expense and crediting accumulated depreciation, the book value of the asset decreases on the balance sheet. Depreciation for 2011 shall be the new carrying amount divided by the remaining useful life or $190,000/17 which equals $11,176. Web the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the income statement) and credit the accumulated depreciation account (which appears in the balance sheet as a contra account that reduces the amount of fixed assets).