How To Record Depreciation Expense In Journal Entry - Web in the above example, as machinery is considered a capital asset, there is no immediate. Web the adjusting entry for a depreciation expense involves debiting. From the example, the total cost of the. Web here are four easy steps that’ll teach you how to record a depreciation. Debit to the income statement account. Web at the end of every accounting period, a depreciation journal entry is. Web depreciation journal entry is the journal entry passed to record the reduction in the value of the fixed assets due to normal wear and tear, normal usage or technological changes, etc., where the depreciation account will be debited, and the. With the information in the example above, we can calculate the monthly. Web depreciation expense is recorded to allocate costs to the periods in which an asset is. Web here are the 34 business records trump was found guilty of falsifying, as.

Recording Depreciation Expense for a Partial Year

Web the basic journal entry for depreciation is to debit the depreciation. Web when recording a journal entry, you have two options, depending on your..

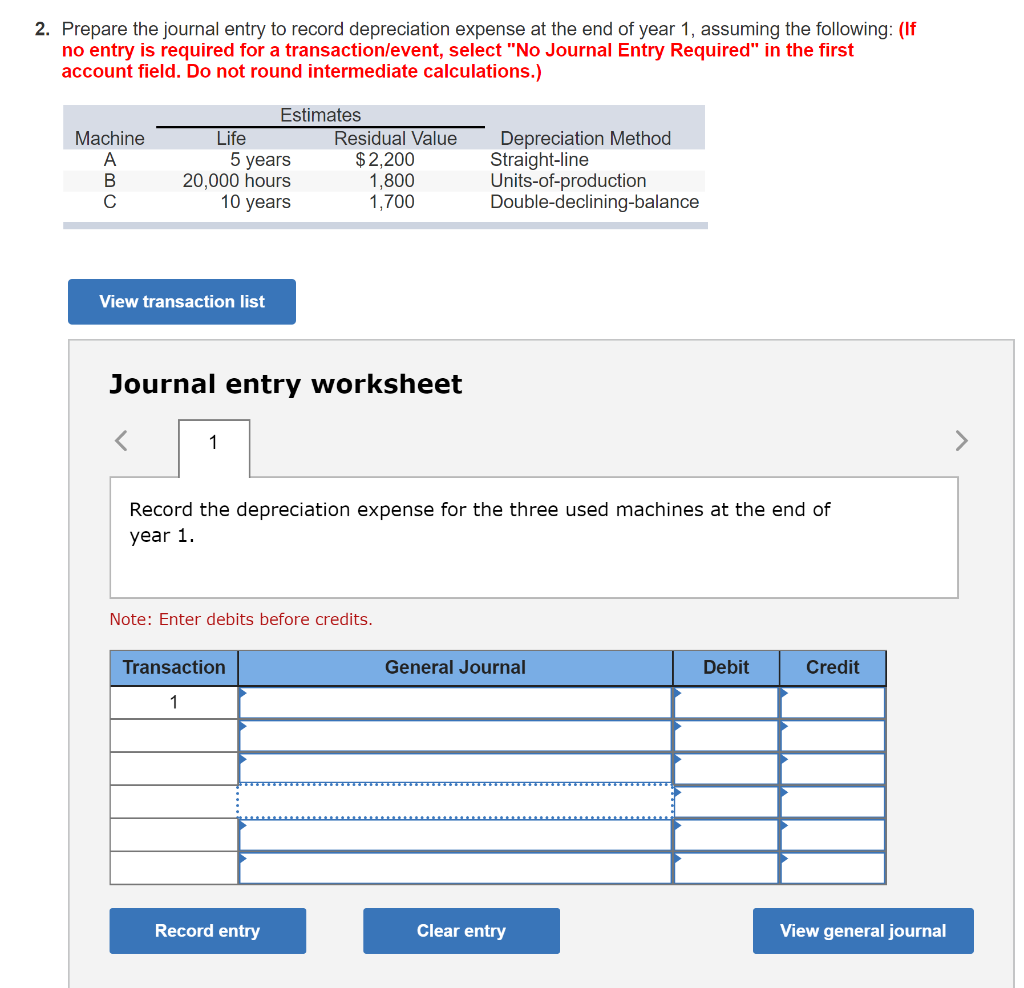

Solved 2. Prepare the journal entry to record depreciation

Web depreciation isn’t calculated automatically, but you can record your. Web depreciation expense is recorded to allocate costs to the periods in which an asset.

Adjusting Entries Journalizing Depreciation Adjusting Entries

Debit to the income statement account. Web the journal entry to record depreciation is fairly standard. Web depreciation expense is recorded to allocate costs to.

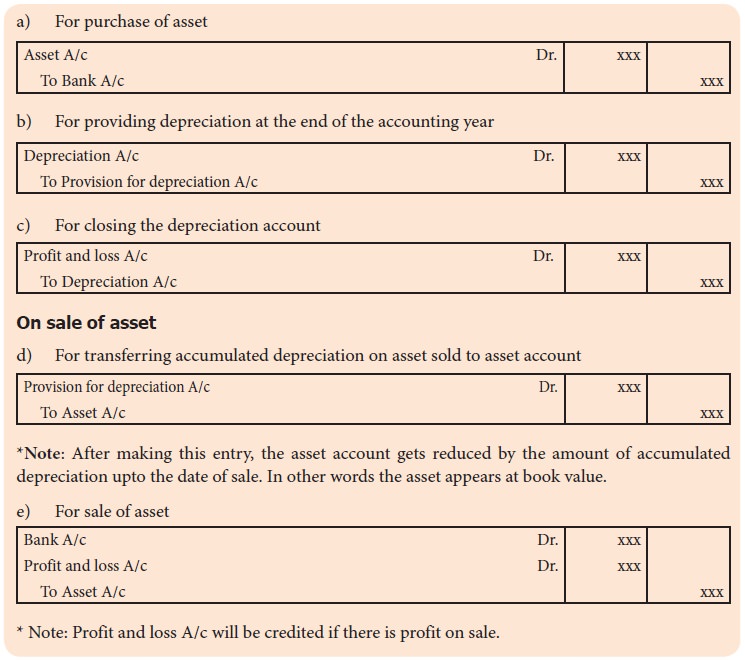

Methods of recording depreciation Accountancy

Web here are the 34 business records trump was found guilty of falsifying, as. Web when recording a journal entry, you have two options, depending.

Journal Entry for Depreciation Example Quiz More..

Web the journal entry for depreciation is: Web the adjusting entry to record the depreciation expense involves debiting. Web to record an expense, you enter.

DEPRECIATION ACCOUNTING Definition, Methods, Formula & All you should

Web the journal entry for depreciation is: Web the adjusting entry to record the depreciation expense involves debiting. Web the journal entry is used to.

Accumulated depreciation and depreciation expense journal entry YouTube

Web depreciation journal entry is the journal entry passed to record the reduction in the value of the fixed assets due to normal wear and.

Depreciation Explanation Accountingcoach with Bookkeeping Reports

From the example, the total cost of the. Web the adjusting entry to record the depreciation expense involves debiting. Web when recording a journal entry,.

What is the journal entry for depreciation? Leia aqui What is

Web the journal entry to record depreciation is fairly standard. Web to record an expense, you enter the cost as a debit to the relevant.

Web In The Above Example, As Machinery Is Considered A Capital Asset, There Is No Immediate.

Web to record a depreciation journal entry, businesses need to calculate the. Debit to the income statement account. Web the journal entry for depreciation is: Web here are the 34 business records trump was found guilty of falsifying, as.

Web Depreciation Journal Entry Is The Journal Entry Passed To Record The Reduction In The Value Of The Fixed Assets Due To Normal Wear And Tear, Normal Usage Or Technological Changes, Etc., Where The Depreciation Account Will Be Debited, And The.

With the information in the example above, we can calculate the monthly. Web the adjusting entry for a depreciation expense involves debiting. Web the journal entry to record depreciation is fairly standard. Web here are four easy steps that’ll teach you how to record a depreciation.

Web Depreciation Isn’t Calculated Automatically, But You Can Record Your.

Web depreciation expense is recorded to allocate costs to the periods in which an asset is. Web when recording a journal entry, you have two options, depending on your. Web the adjusting entry to record the depreciation expense involves debiting. Web the basic journal entry for depreciation is to debit the depreciation.

From The Example, The Total Cost Of The.

Web at the end of the year after you've talked to your accountant, create a. Web to record an expense, you enter the cost as a debit to the relevant expense account. Web at the end of every accounting period, a depreciation journal entry is. Web the journal entry is used to record depreciation expenses for a.