How To Prepare A Closing Journal Entry - Web what accounts do you open and close? Web closing journal entries are made at the end of an accounting period to prepare the accounting records for the next period. Accountants use this type of closing entry when clearing a company's accounts. Web how, when and why do you prepare closing entries? A closing entry is a journal entry made at the end of the accounting period. Closing entries transfer the balances from the temporary accounts to a permanent or real account at. In this example we will close paul’s guitar shop, inc.’s temporary accounts using the income summary account method from his financial statements in the previous example. The first entry closes revenue accounts to the income summary account. There are three general closing entries that must be. Remember the income statement is like a moving picture of a business, reporting revenues and expenses for a period of time (usually a year).

Closing Entries Accountancy Knowledge

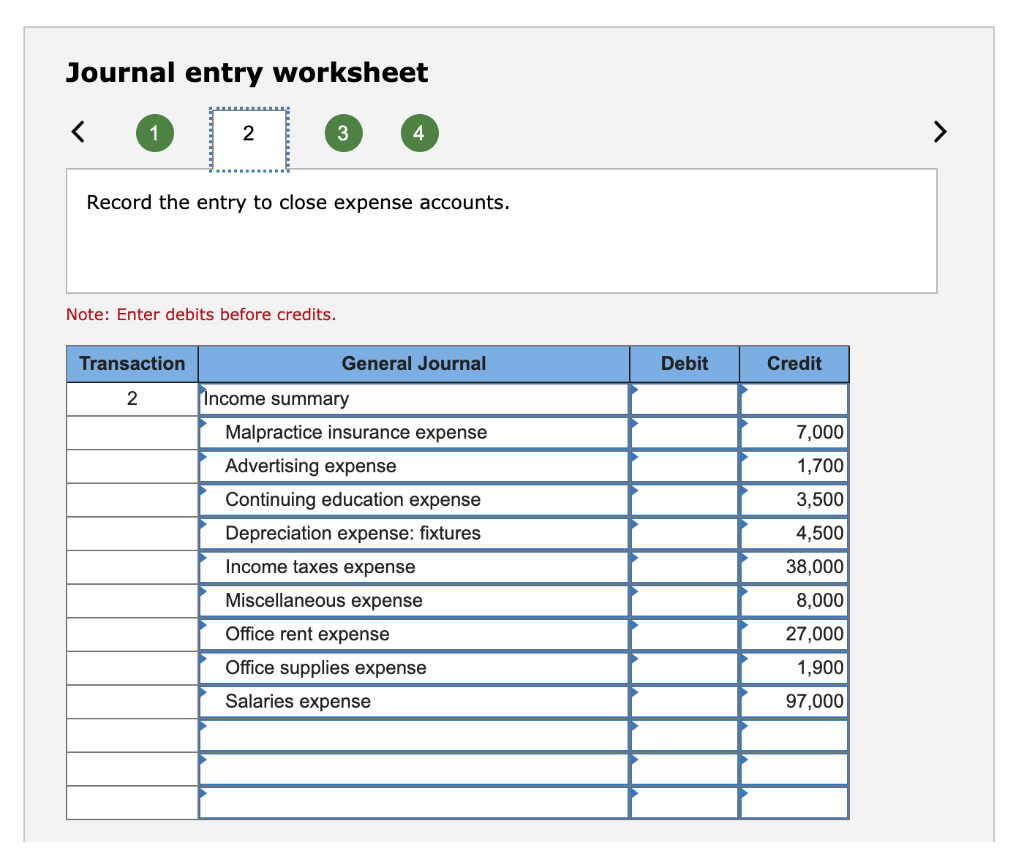

Web the four basic steps in the closing process are: Temporary accounts can be found in the accounting ledger, specifically the general ledger of accounts..

Solved a. Prepare the necessary closing entries on December

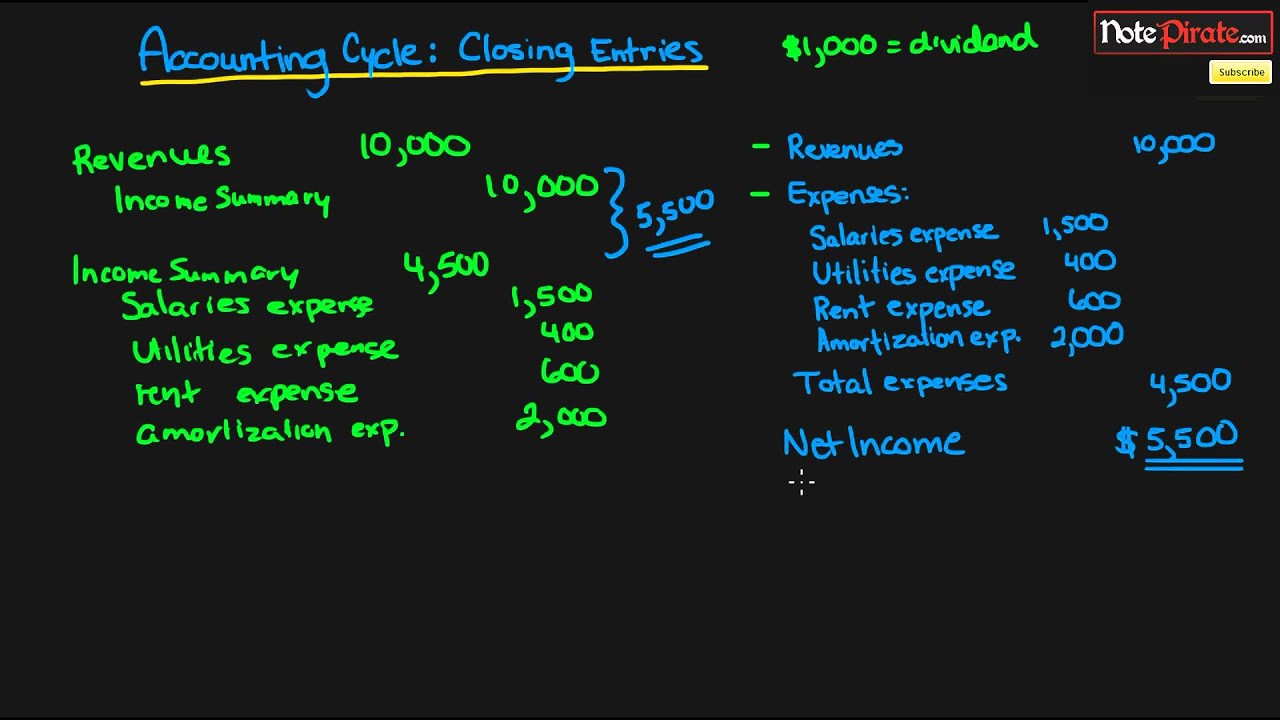

The first entry closes revenue accounts to the income summary account. By doing so, the company moves these. Accountants use this type of closing entry.

How to Prepare Closing Entries (Financial Accounting Tutorial 27

Closing entry for income summary. Temporary accounts can be found in the accounting ledger, specifically the general ledger of accounts. Closing the revenue accounts —transferring.

Closing Entries are journal entries made to close

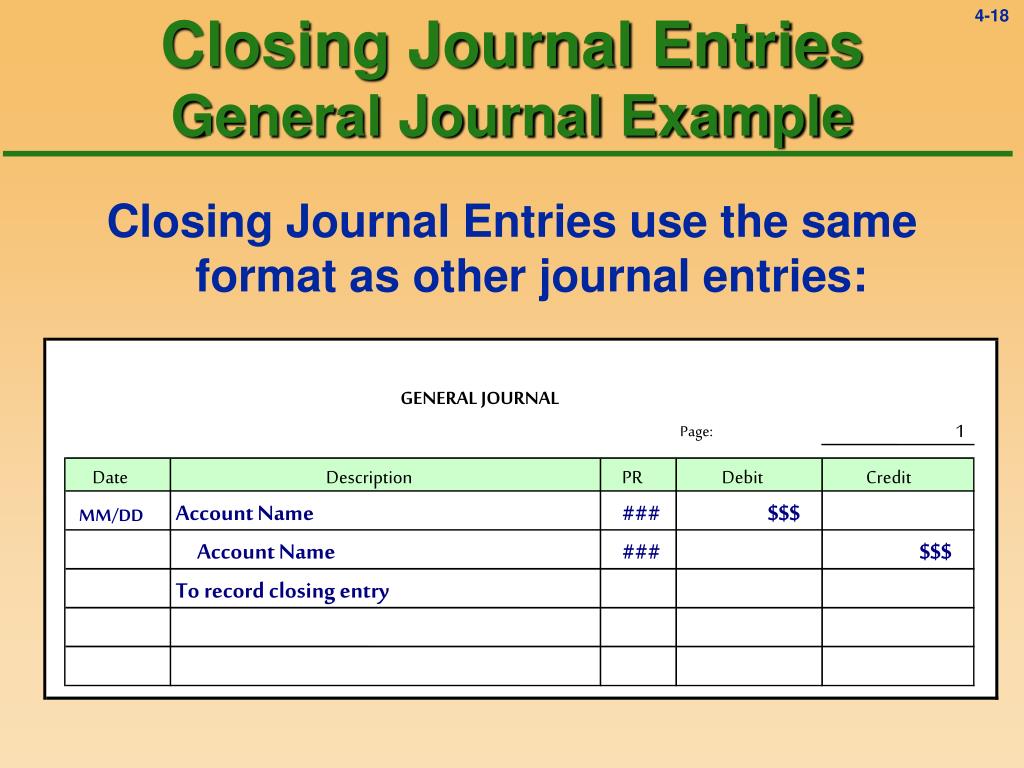

Web a closing entry is a journal entry that is made at the end of an accounting period to transfer balances from a temporary account.

Closing entries explanation, process and example Accounting for

Closing entries transfer the balances from the temporary accounts to a permanent or real account at. A closing entry is a journal entry made at.

Closing Entries Example, Preparing Closing Entries, Summary, Next Step

Web a revenue closing entry is a journal entry made at the end of an accounting period to transfer the balances of temporary accounts (like.

Closing Journal Entries

Web closing journal entries are used at the end of the accounting cycle to close the temporary accounts for the accounting period, and transfer the.

Journalizing Closing Entries / Closing Entries Types Example My

Web below is the journal entry that will assist in this process: There are three general closing entries that must be. Web how can you.

[Solved] Prepare the closing journal entries. Part IV Closing Journal

In this example we will close paul’s guitar shop, inc.’s temporary accounts using the income summary account method from his financial statements in the previous.

Four Entries Occur During The Closing Process.

A closing entry is a journal entry made at the end of the accounting period. Web in this article, we define a closing journal entry and temporary accounts, explore the meaning of an income summary and a permanent account, identify how to write a journal entry to close the books, examine rules to follow when doing so, and explore examples of journal entries for closing the books. Web closing journal entries are made at the end of an accounting period to prepare the accounting records for the next period. All generated revenue of a period is transferred to retained earnings so that it is stored there for business use whenever needed.

Web What Accounts Do You Open And Close?

Fortunately, there is an abbreviation that would help you to remember what to close, which will be shown further down. Remember the income statement is like a moving picture of a business, reporting revenues and expenses for a period of time (usually a year). 75% off the full crash course on udemy: It helps prepare the books for the next accounting period.

In This Example We Will Close Paul’s Guitar Shop, Inc.’s Temporary Accounts Using The Income Summary Account Method From His Financial Statements In The Previous Example.

Web closing entries is simple, as you must follow only a few steps. However, the hard part of closing entries is remembering and knowing which accounts to close and how you complete them. When closing the revenue account, you will take the revenue listed in the trial balance and debit it, to reduce it to zero. The first entry closes revenue accounts to the income summary account.

Closing Revenue To Income Summary.

The goal is to make the posted balance of the retained earnings account match what we reported on the statement of retained earnings and start the next period with a zero balance for all temporary accounts. Temporary accounts are the type of accounts that must be opened and closed during these reporting cycles. Companies use closing entries to reset the balances of temporary accounts − accounts that show balances over a single accounting period − to zero. Here’s what the article covers: