How To Journalize A Loan In Accounting - The journal entry for the amortization of intangible assets is as follows: Show journal entry for this loan taken from a bank. This is an official record within your accounting software. Personally i'd prefer to expense in one hit rather than prepay, as i doubt you'd get anything back if you repaid the loan tomorrow. Record the initial loan transaction. This applies to loans or other debt obligations. As can be seen the principal repayment is 157.05 which is the cash payment of 187.05 less the interest expense of 30.00. Debit of $1,500 to loans payable. By now, you should be able to predict what the journal entry for amortization will look like. Like most businesses, a bank would use what is called a “double entry” system of accounting for all.

Loan Journal Entry Examples for 15 Different Loan Transactions

The amortization expense account & the intangible asset account. Web the journal entry to recognize the receipt of the loan funds is as such: The.

Accounting Journal Template Spreadsheets contributed us the possible to

Web an accounting journal entry is the written record of a business transaction in a double entry accounting system. A loan journal entry can be.

Basic Accounting for Business Your Questions, Answered

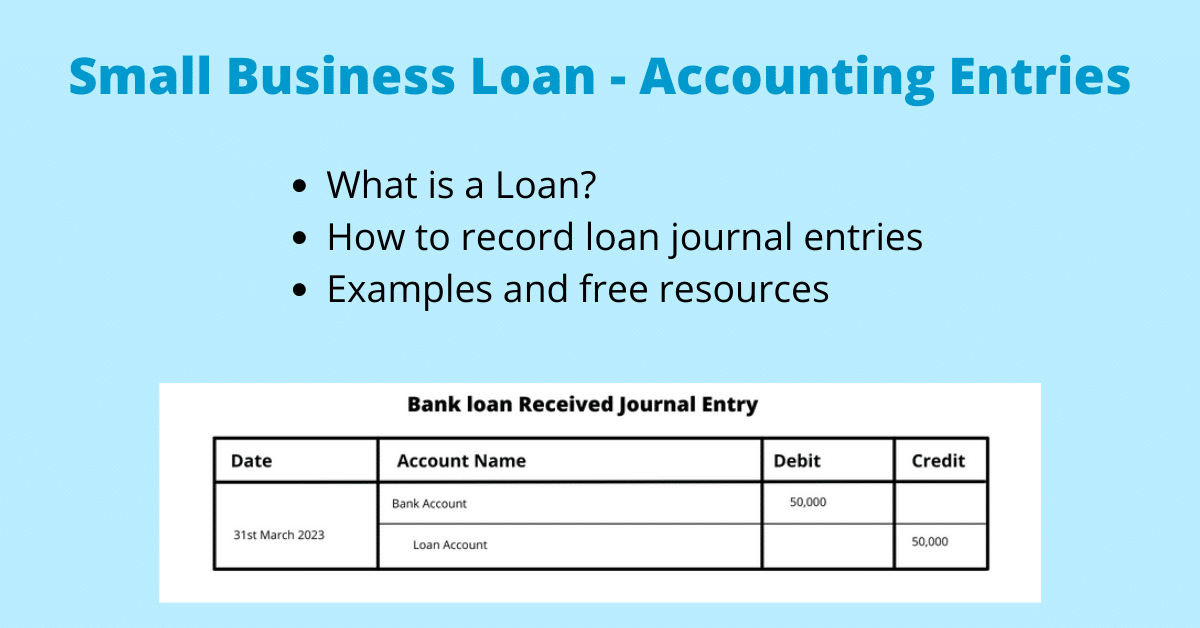

When recording your loan and loan repayment in your general ledger, your business will enter a debit to the cash account to record the receipt.

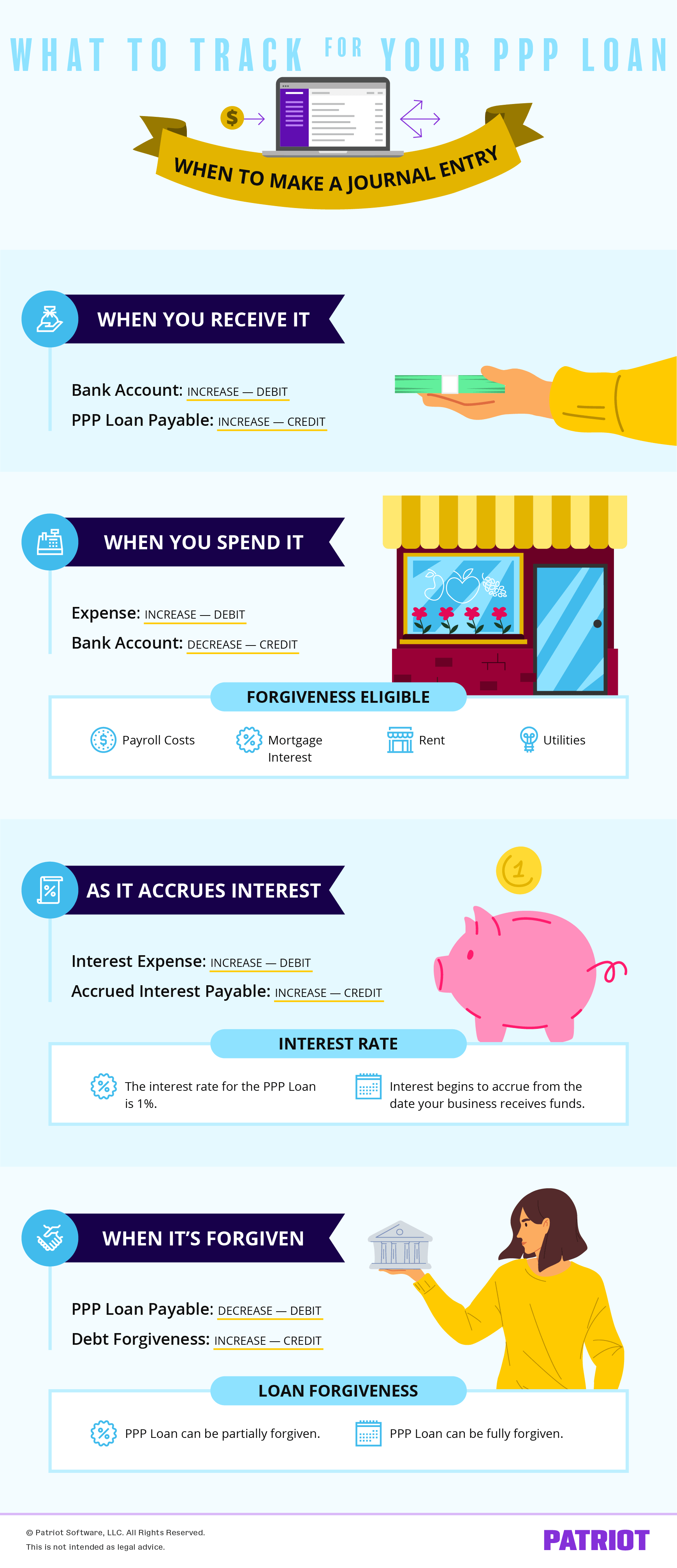

PPP Loan Accounting Creating Journal Entries & PPP Accounting Tips

Mortgages payments are typically calculated using an amortization calculator. The balance sheet is now correct. Credit of $2,000 to cash. Record amortization of intangible assets..

Journal Entries Accounting

Interest expense is calculated on the outstanding amount of the loan for that period. Every journal entry in the general ledger will include the date.

Loan Accounting Entries Business Accounting Basics

Where your software or bookkeeping system allows you to add a loan journal entry. Journal entry for a bank loan repaid in full Let’s look.

Accounting Journal Entries For Dummies

The journal entry would involve debiting the interest expense account for $200, debiting the loan liability account for $800, and crediting the cash account for.

Accounting Journal Entries For Dummies

Let’s look at an example. Personally i'd prefer to expense in one hit rather than prepay, as i doubt you'd get anything back if you.

Who Pays For The Loan Origination Course

Record the loan proceeds and loan liability. On december 31, 2022, the interest accrued on the loan must be recognized. Debit of $500 to interest.

The Notes Payable Account Could Have Been Substituted For Loan Payable.

The journal entry would involve debiting the interest expense account for $200, debiting the loan liability account for $800, and crediting the cash account for the total payment of $1,000. Web here are four steps to record loan and loan repayment in your accounts: Web in accounting, accrued interest is the amount of interest that has been incurred but not yet paid as of a specific date. Below is a compound journal entry for loan payment made including both principal and interest component;

(Being Intangible Asset Amortized) Two Accounts Are Involved In The Journal Entry For Amortization Of Intangible Assets:

It is recorded as a “loan receivable” in the creditor’s books. On december 31, 2022, the interest accrued on the loan must be recognized. Recording the initial loan is the first step of the payment process. Web the company’s accountant records the following journal entry to record the transaction:

Show Journal Entry For This Loan Taken From A Bank.

Web an accounting journal entry is the written record of a business transaction in a double entry accounting system. The journal entry for the amortization of intangible assets is as follows: Web loan received via direct credit from abc bank for 1,00,000 for new machinery. Common types of adjusting entries include accrued expenses, accrued revenues, provisions, and deferred revenues and expense and estimates.

Web A Loan Receivable Is The Amount Of Money Owed From A Debtor To A Creditor (Typically A Bank Or Credit Union).

By now, you should be able to predict what the journal entry for amortization will look like. Web journalizing entries for amortization. As can be seen the principal repayment is 157.05 which is the cash payment of 187.05 less the interest expense of 30.00. Journal entry for a bank loan repaid in full