How To Journal Depreciation - Web how to book a fixed asset depreciation journal entry. Web the journal entry to record depreciation is fairly standard. Accordingly the net book value formula calculates the nbv of the fixed assets as follows. Web there are various methods used to calculate depreciation, but they generally fall into two categories. The married with children alum got candid about her mental health on the latest episode of her podcast. Retiring an asset no longer in use. Web depreciation is the gradual decrease in the value of a company’s assets. Web the journal entry is used to record depreciation expenses for a particular accounting period and can be recorded manually into a ledger or in your accounting software application. The business writes off the fixed assets or scraps them as having no value. Consequently the depreciation charge will be the same for each accounting period.

Depreciation and Disposal of Fixed Assets Finance Strategists

Depreciation is associated with buildings, equipment, vehicles, and other physical assets which will last for more than a year but will not last forever. Links.

Accounting Entries for Depreciation, Accounting Lecture Sabaq.pk

Web journal entries for the straight line depreciation. Web christina applegate is opening up about living with depression after her ms diagnosis. One is where.

Journal Entry for Depreciation Example Quiz More..

What is an example of accumulated depreciation? Web journal entries document the declining value of assets and the removal or sale of assets. It can.

8 ways to calculate depreciation in Excel Journal of Accountancy

Accumulated depreciation journal entry (debit or credit) accumulated depreciation formula. The married with children alum got candid about her mental health on the latest episode.

DEPRECIATION ACCOUNTING Definition, Methods, Formula & All you should

Web how to book a fixed asset depreciation journal entry. For example, manufacturing equipment is a fixed asset class. Web an accumulated depreciation journal entry.

Depreciation Explanation Accountingcoach with Bookkeeping Reports

Proper asset management through bookkeeping entries impacts overall financial health. Estimated value of the fixed asset at the end of its useful life. Web the.

Adjusting Entries Journalizing Depreciation Adjusting Entries

We'll work through a straight l. It is done to adjust the book values of the different capital assets of the company and add the.

Depreciation journal Entry Important 2021

Depreciation is associated with buildings, equipment, vehicles, and other physical assets which will last for more than a year but will not last forever. Fixed.

Depreciation entry Depreciation Journal entry How to Depreciation

Fixed assets are purchases your company makes that add value to the business and that help your company make money. Web depreciation is a systematic.

Depreciation Lets You Spread The Cost Of Assets Out Over The Time They’re Being Used, And Affects Both Your Business’s Financial Health And Tax Reporting.

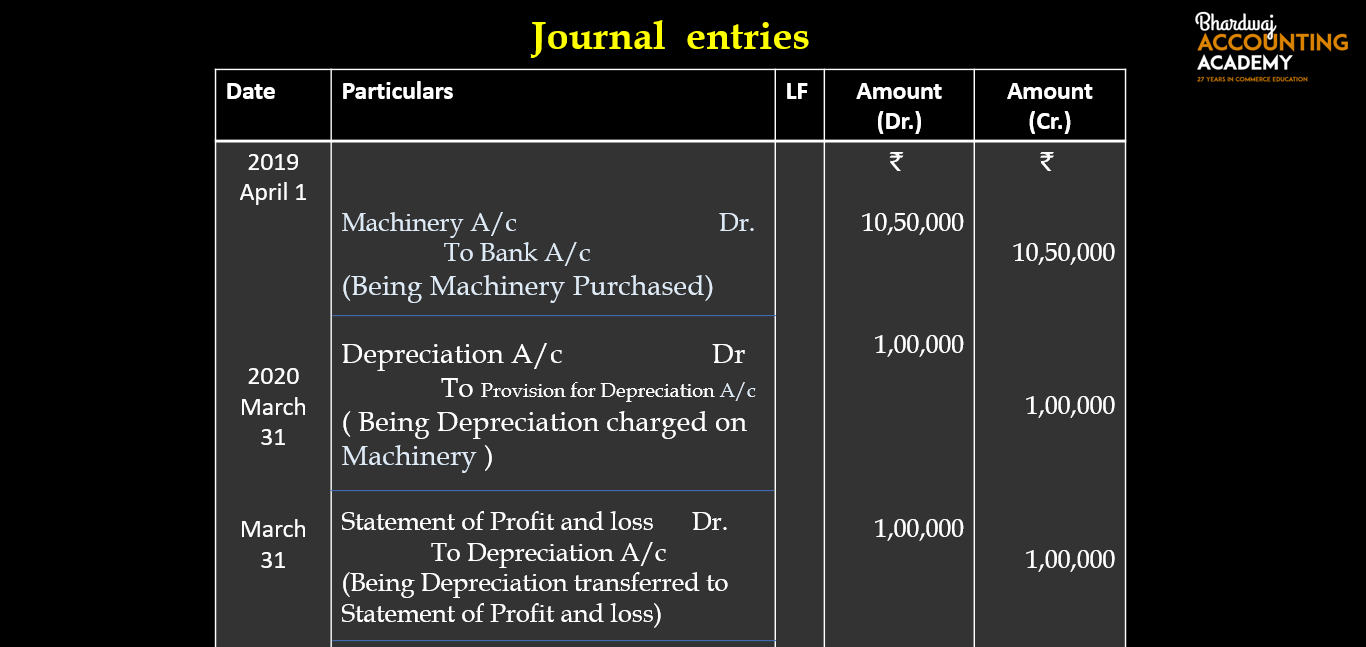

Web journal entries document the declining value of assets and the removal or sale of assets. Web table of contents. Accordingly the net book value formula calculates the nbv of the fixed assets as follows. Web there are two methods that can be used to record the journal entry for depreciation.

Depreciation Is A Measure Of How Much Of An Asset's Value Has Been Depleted Over The Depreciation Schedule Or Period.

Web the journal entry is used to record depreciation expenses for a particular accounting period and can be recorded manually into a ledger or in your accounting software application. Residual value or scrap value: Debit to depreciation expense, which flows through to the income statement. The straight line method depreciates the asset at a constant rate over its useful life.

Web The Journal Entry To Record Depreciation Is Fairly Standard.

Estimated value of the fixed asset at the end of its useful life. One is where the depreciation account is debited and accumulated depreciation account is credited. Web depreciation is a systematic process for allocating (spreading) the cost of an asset that is used in a business to the accounting periods in which the asset is used. Web journal / african journal of politics and administrative studies / vol.

Basics Of Bookkeeping For Asset Management.

Purchase price and all incidental cost of the asset. The best examples are computers, office furniture and. Web depreciation is the gradual decrease in the value of a company’s assets. To deal with the asset disposal we first need to calculate its net book value (nbv) in the accounting records.