How To Adjust Journal Entries - By william adkins updated february 04, 2019. For example, going back to the example above, say your customer called after getting the bill and asked for a 5% discount. Minister for justice helen mcentee. An adjusting journal entry is typically made just prior to issuing a company’s financial statements. Print out the unadjusted trial balance. Web there are three general types of entry adjustments, those being: Web how to make adjusting entries. Web legal luck runs out: For companies with manual accounting systems, accountants log adjusting entries using spreadsheets. Web to make an adjusting entry, you don’t literally go back and change a journal entry—there’s no eraser or delete key involved.

Adjusting Entries Example, Types, Why are Adjusting Entries Necessary?

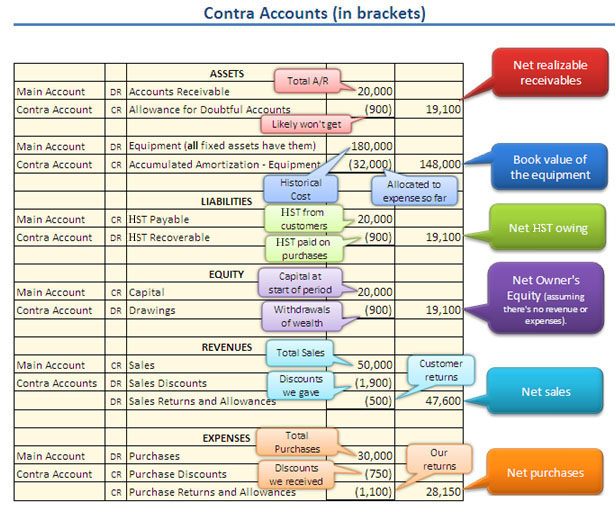

An adjusting journal entry is a financial record you can use to track unrecorded transactions. Web adjusting entries, also known as adjusting journal entries (aje),.

Adjusting Journal Entries Cheat Sheet 02/2022

Adjusting entries allow you to adjust income and expense totals to more accurately reflect your. At the end of every year or other accounting period,.

How to Adjust Journal Entries? YouTube

These adjustments are then made in journals and carried over to the account ledgers and accounting worksheet in the next accounting cycle step. Learn how.

Adjusting Entries Examples Accountancy Knowledge

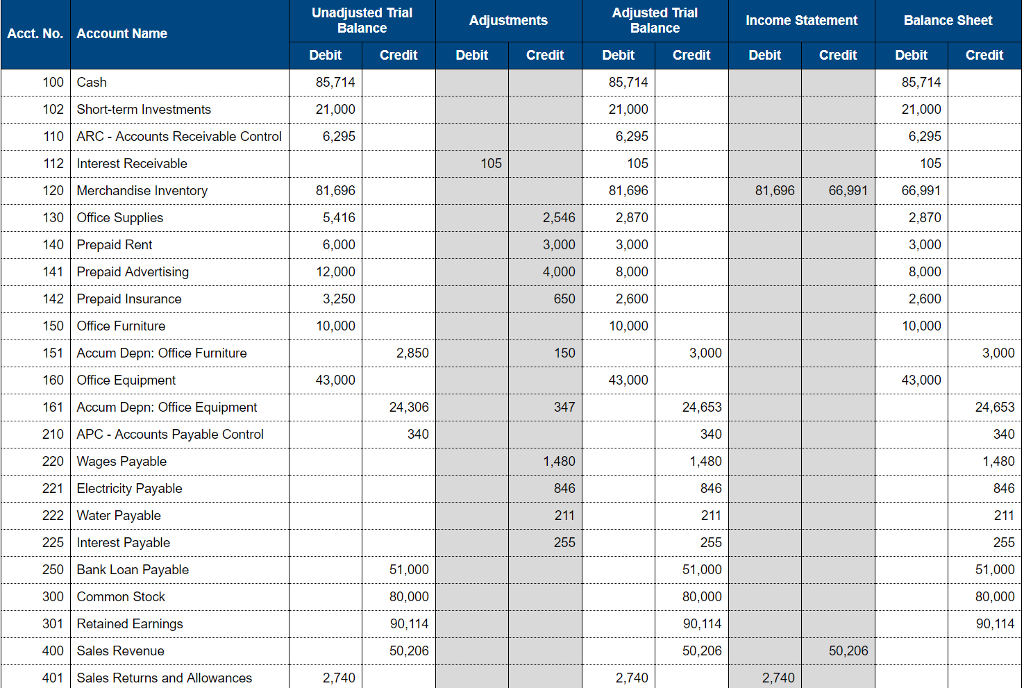

Look for anything that is missing. November 08, 2022 05:54 pm. First, the business transaction has to be identified. This is a systematic way to.

️Adjusting Journal Entries Worksheet Free Download Gmbar.co

Accountants frequently use adjusting journal entries to record unclassified transactions or fix minor errors. Web adjusting entries are step 5 in the accounting cycle and.

How to Adjust Journal Entry for Unpaid Salaries

An adjusting journal entry is typically made just prior to issuing a company’s financial statements. Determine what current balance should be. Obviously, if you don’t.

Types of Adjusting Entries with Examples Financial

Web 1 of 2 |. Minister for justice helen mcentee. November 08, 2022 05:54 pm. An adjusting journal entry is a type of journal entry.

Adjusting Journal Entries Examples

Using our vehicle example above, you must identify what transaction took place. What is the purpose of adjusting entry at the end of accounting period?.

Adjusting Journal Entries Defined Accounting Play

Adjusting entries allow you to adjust income and expense totals to more accurately reflect your. Web there are generally three steps to making a journal.

Web Every Journal Entry In The General Ledger Will Include The Date Of The Transaction, Amount, Affected Accounts With Account Number, And Description.

Accountants frequently use adjusting journal entries to record unclassified transactions or fix minor errors. Web here are the three main steps to record an adjusting journal entry: Web how to make adjusting entries. What is the purpose of adjusting entry at the end of accounting period?

Adjusting Entry For Supplies Expense Faqs.

For companies with manual accounting systems, accountants log adjusting entries using spreadsheets. An adjusting journal entry is a unique kind of journal entry that adjusts the overall balance of an account. Web an adjusting journal entry is an entry in a company's general ledger that occurs at the end of an accounting period to record any unrecognized income or expenses for the period. Here is the process we will follow:

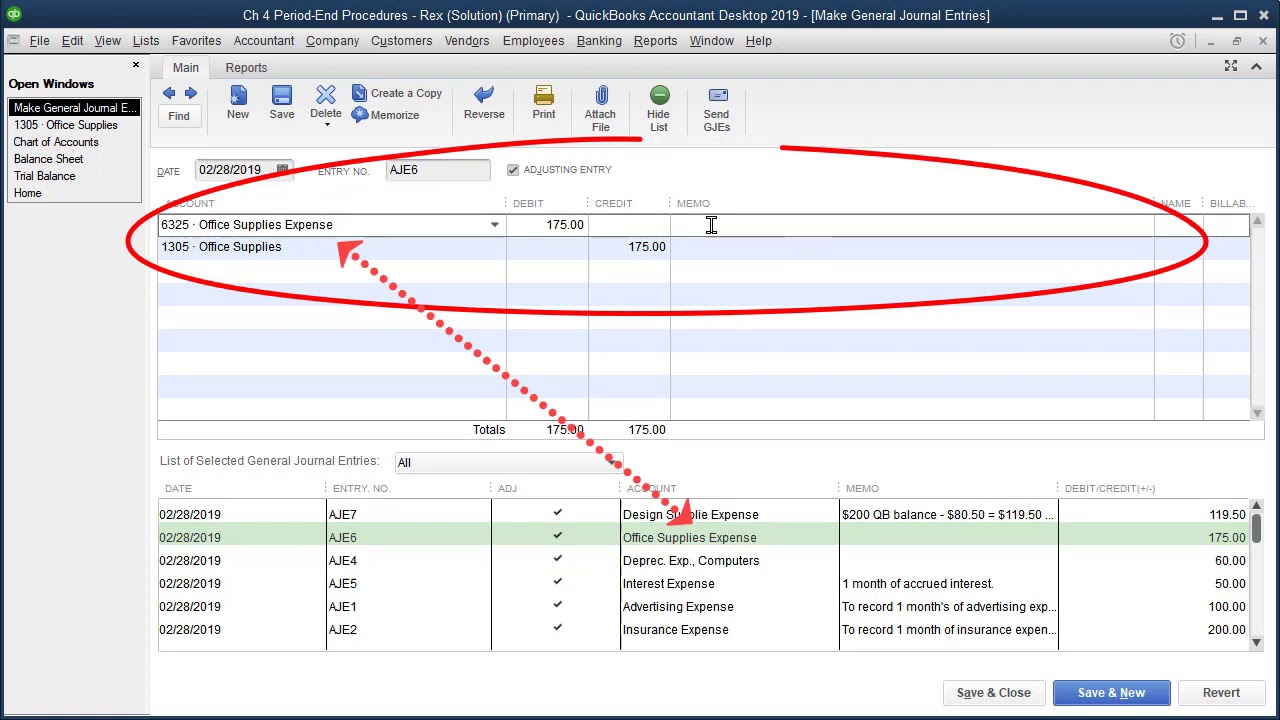

Make Adjusting Journal Entries In Quickbooks Online Accountant.

An adjusting journal entry is a financial record you can use to track unrecorded transactions. Solved • by quickbooks • 828 • updated january 29, 2024. When cost of supplies used is recorded as supplies expense. Minister for justice helen mcentee.

In The Future Months The Amounts Will Be Different.

Web how to make adjusting entries. Look for anything that is missing. Interest expense will be closed automatically at the end of each accounting year and will start the next accounting year with a $0 balance. First, the business transaction has to be identified.