Hedge Accounting Journal Entries - Web hedge accounting bc6.1 the objective of hedge accounting bc6.1 hedging instruments bc6.27 hedged items bc6.64 qualifying criteria for hedge accounting bc6.136 accounting for qualifying hedges bc6.178 hedges of a group of items bc6.304 hedging credit risk using credit derivatives bc6.346 effective date and. Web the accounting entries for fair value hedge are explained below −. It accrues semiannual interest in the debt at an affixed rate of 6.5%. Such entities could still designate the net position as a gross designation. Web ifrs 9.6.6.1(c) limits the designation of net positions in cash flow hedges to hedges of foreign exchange risk (discussed in section 3.6.3 above). However, in practice, entities often hedge other types of risk on a net cash flow basis. If the entity decides not to apply hedge accounting, then it still needs to recognize the change in fair value of the derivative in profit or loss (ifrs 9). Ldenfity key changes that may have the most impact on existing hedges. Web january 15, 2016, journal entries. So, users and preparers alike supported a fundamental reconsideration of the current hedge accounting requirements in ias 39.

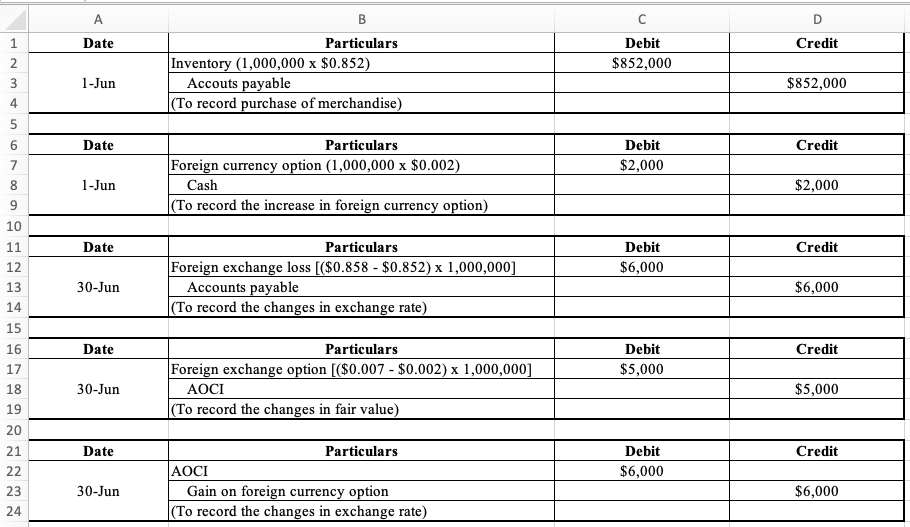

Answered On June 1, Cairns Corporation purchased… bartleby

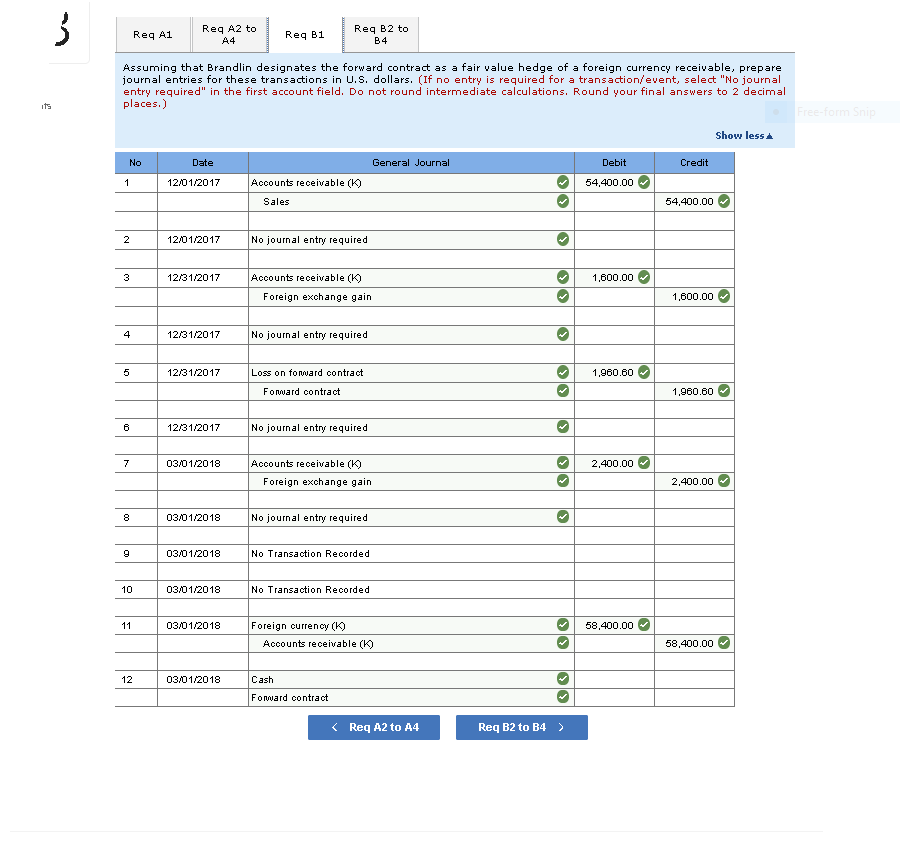

Web its application of the hedge accounting rules. Web a fair value hedge, as defined by ifrs 9.6.5.2 (a), mitigates the risk of exposure to.

Cash Flow Hedge Vs Fair Value Hedge JermaineewaPeters

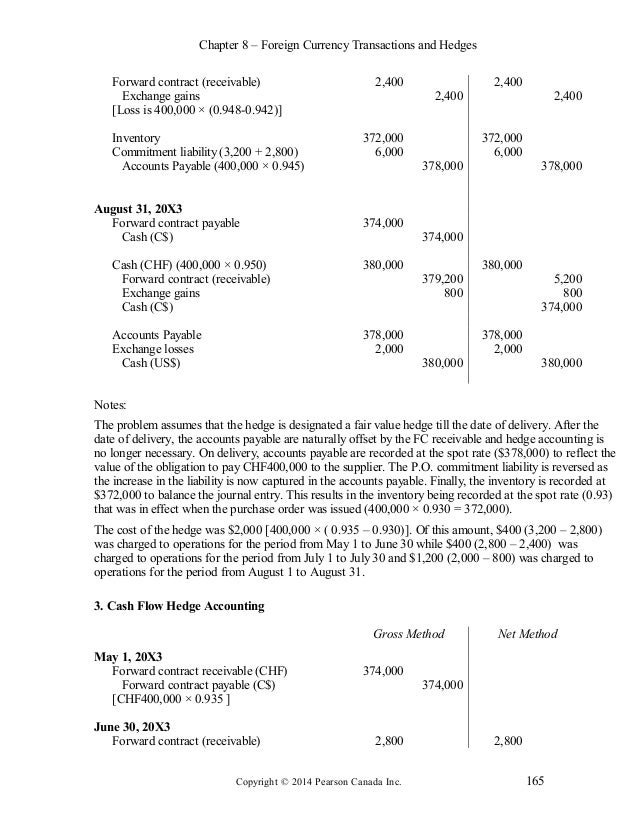

Journal entry at the end of 20x4 is as follows: In balance sheet, financial liabilities from hedging instruments. This october 2023 edition includes guidance on.

Hedge Accounting Journal Entries Ppt Powerpoint Presentation Layouts

Web the accounting entries for fair value hedge are explained below −. Web accounting for fair value hedge example. On may 1, 2017, an american.

Hedge accounting example journal entries by evanveetm Issuu

The spot rate on may 1, 2017, was €1=$1.0899. Web handbooks | october 2023. Assess potential new hedging strategies that align with your entity's risk.

How to Show Cash Flow Hedge in Financial Statements Accounting Education

Web the accounting method reflects the mechanics of the hedge, i.e. Web handbooks | october 2023. This practical guide focuses on the third phase of.

Journal Entries of Hedge Fund Accounting Methods

However, in practice, entities often hedge other types of risk on a net cash flow basis. This will result in a loss to the company..

Foreign Currency Hedge Accounting Journal Entries Wallstreet Forex

However, in practice, entities often hedge other types of risk on a net cash flow basis. In balance sheet, financial liabilities from hedging instruments. Web.

Fund Accounting/Accounting Journal entries for Mutual fund and Hedge

Journal entry at the end of 20x4 is as follows: In balance sheet, financial liabilities from hedging instruments. Web journal entries when no hedge accounting.

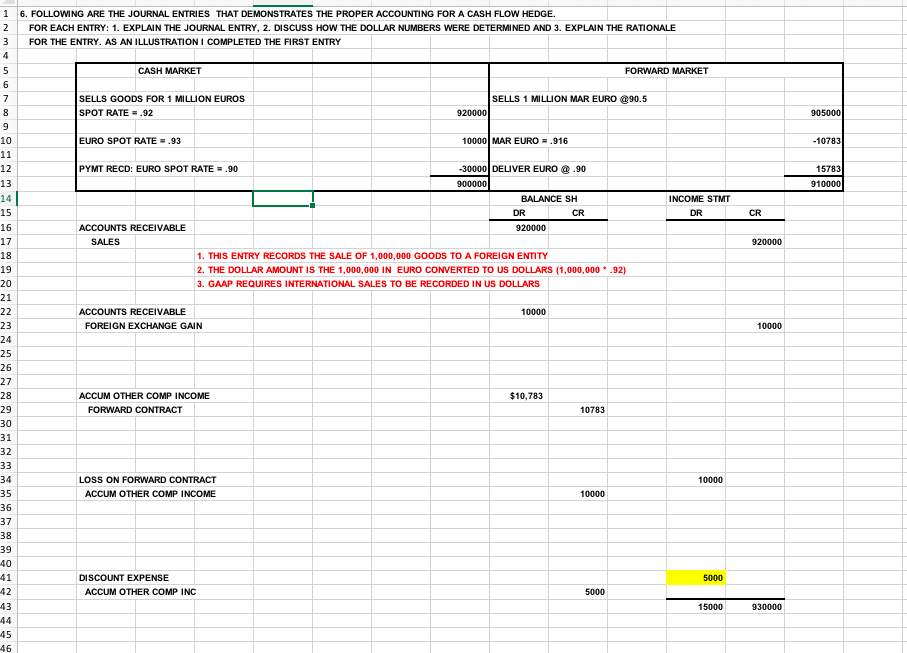

1 6. FOLLOWING ARE THE JOURNAL ENTRIES THAT

If there is any gain. Is a company engaged in commodities trading. At the end of the first quarter, since the actual kilometers for the.

To Offset This Loss, The Company Enters Into An Offsetting Position Through A Derivative Contract, Which Also.

This will result in a loss to the company. If there is any loss. This practical guide focuses on the third phase of ifrs 9, ‘financial instruments’, covering general hedge accounting. Web the accounting method reflects the mechanics of the hedge, i.e.

Ldenfity Key Changes That May Have The Most Impact On Existing Hedges.

However, in practice, entities often hedge other types of risk on a net cash flow basis. In profit and loss account, fair value loss on hedging instrument. Entity a makes the following journal entries for interest payable. Where an entity designates a derivative contract as a hedging instrument, it needs to, meet the qualifying criteria as set under:

Web The Accounting Entries For Fair Value Hedge Are Explained Below −.

At the end of the first quarter, since the actual kilometers for the quarter were 3,100, the cash flows exposure which required hedging increased to eur 3,100,000 (=3,100*1,000). Web a fair value hedge, as defined by ifrs 9.6.5.2 (a), mitigates the risk of exposure to changes in the fair value of a recognised asset or liability or an unrecognised firm commitment (or a component of such items). Using q&as and examples, we provide interpretive guidance on derivatives and hedging. The hedging instrument compensates the balance sheet and income statement effects of the hedged instrument.

Assess Potential New Hedging Strategies That Align With Your Entity's Risk Policy.

• better connect your internal risk management and external reporting. Such entities could still designate the net position as a gross designation. Management 1 1 a new approach 2 2w this could affect you ho 3 3 introduction 5 4 scope and alternatives to hedge accounting 7. Journal entry at the end of 20x4 is as follows: