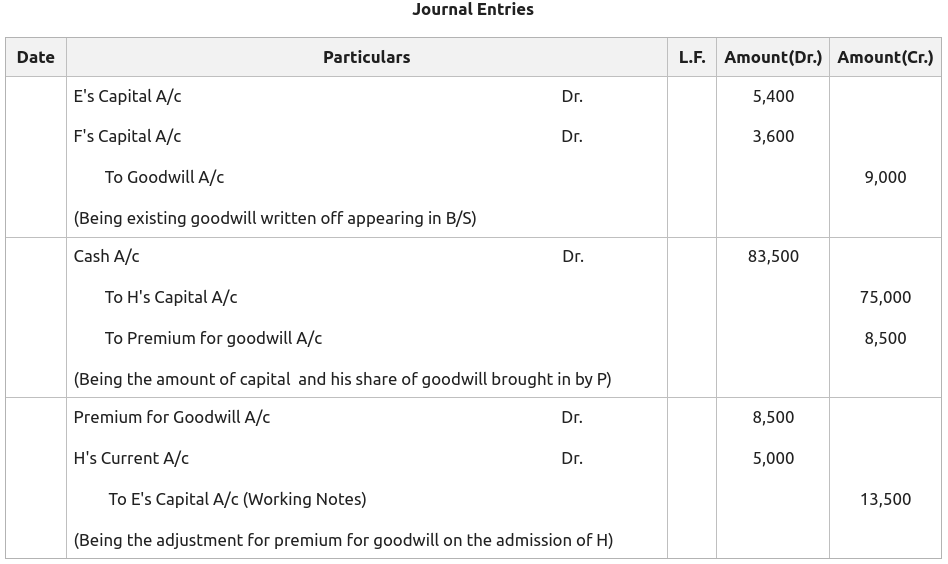

Goodwill Journal Entry - See an example of journal entry, calculation, and explanation with a table of assets and liabilities. Web as per the as 10, we shall record goodwill in the books only when some consideration in money or money’s worth has been paid for it. Learn how to record goodwill on acquisition, the difference between the purchase price and the fair value of net assets of the acquired company, as an intangible asset on the consolidated financial statements. (1) a current expectation of an impending disposal, (2). X, y, and z are partners in the firm sharing. Web the purchase price of a company is more than the calculated value due to its intangible assets is called goodwill. Web the journal entries of the impairment are as follow: It also says that in case of admission of. Note that a bargain purchase will. Web any amount paid over the net assets is considered to be goodwill.

Goodwill Written off Journal Entry CArunway

Let’s check what is goodwill in accounting, its. Web goodwill is an intangible asset created when a company pays a premium over the fair market.

PPT Partnership Accounts Goodwill PowerPoint Presentation, free

From an accounting standpoint, goodwill is internally generated and is not recorded as an asset unless it is purchased during the acquisition of another company..

Journal Entries for Long lived assets Goodwill (Accounting) Debits

See an example of journal entry, calculation, and explanation with a table of assets and liabilities. Web the journal entries of the impairment are as.

10. Goodwill Impairment Accounting Journal Entries YouTube

Web for example, if $30,000 of legal fees are incurred, the following journal entry would be made: Web goodwill amortization refers to the process in.

The Digital Insider Accounting Treatment of Goodwill in case of

Web goodwill is an adjusting entry on the balance sheet to help explain why the cash spent to acquire a company is greater than the.

Treatment of Goodwill journal entries YouTube

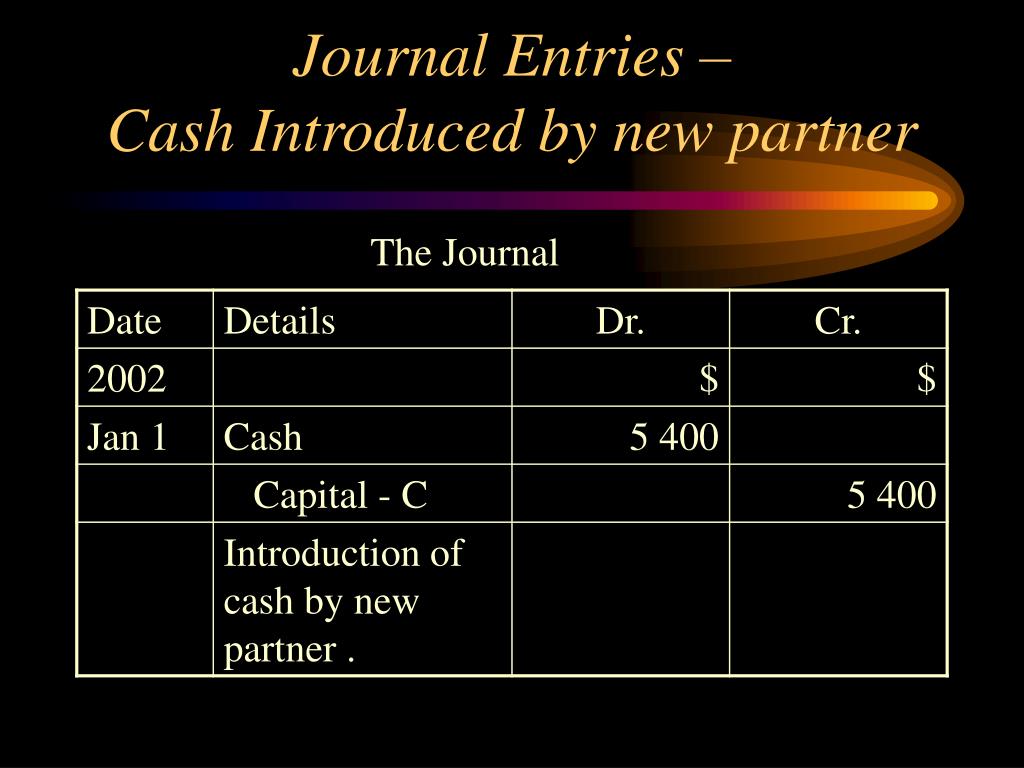

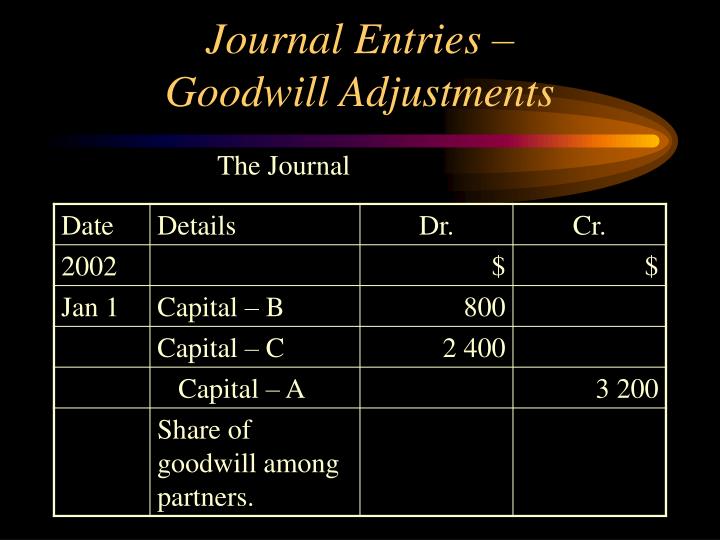

Web it is adjusted discretely through partner’s capital accounts by recording the following journal entry: See an example of journal entry, calculation, and explanation with.

PPT Partnership Accounts Goodwill PowerPoint Presentation ID356641

Web the disposal timeline can usually be divided into three discrete accounting events that require consideration: Web learn how to record goodwill impairment as a.

Comment comptabiliser les écarts d'acquisition ou goodwill

X, y, and z are partners in the firm sharing. Let’s check what is goodwill in accounting, its. Learn how to calculate goodwill, see. Learn.

Admission Journal Entries for Goodwill YouTube

Learn how to record goodwill on acquisition, the difference between the purchase price and the fair value of net assets of the acquired company, as.

Web Any Amount Paid Over The Net Assets Is Considered To Be Goodwill.

Inherent or internally generated goodwill is the value of the business in excess of the fair value of the net. Learn what it is and how to calculate it in five steps. X, y, and z are partners in the firm sharing. Web goodwill amortization refers to the process in which the cost of the goodwill of the company is expensed over a specific period, i.e., there is a reduction in the value.

See An Example Of Journal Entry For.

Web learn how to record goodwill impairment as a loss on the income statement and a reduction of goodwill on the balance sheet. It also says that in case of admission of. Web the purchase price of a company is more than the calculated value due to its intangible assets is called goodwill. Generally, the acquirer in a business combination is willing to pay more for a business than the sum of the fair values of the.

Learn How To Record Goodwill On Acquisition, The Difference Between The Purchase Price And The Fair Value Of Net Assets Of The Acquired Company, As An Intangible Asset On The Consolidated Financial Statements.

Web it is adjusted discretely through partner’s capital accounts by recording the following journal entry: Web as per the as 10, we shall record goodwill in the books only when some consideration in money or money’s worth has been paid for it. Let’s check what is goodwill in accounting, its. See an example of journal entry, calculation, and explanation with a table of assets and liabilities.

Note That A Bargain Purchase Will.

Web goodwill accounting is the difference between the purchase price of a business and its book value. Web the disposal timeline can usually be divided into three discrete accounting events that require consideration: Learn how to calculate goodwill, see. Web goodwill is an intangible asset created when a company pays a premium over the fair market value of the target company's net assets.