Goodwill Amortization Journal Entry - Web goodwill amortization refers to the gradual and systematic reduction in the amount of the goodwill asset by recording a periodic amortization charge. To understand it in more depth, let’s look at an example. Net property, plant and equipment: Acquired goodwill for financial reporting purposes is. Remember that the net assets are equal to assets minus liabilities. Web amortization, in accounting, refers to the technique used by companies to lower the carrying value of either an intangible asset. Web the current guidance requires companies to calculate the implied fair value of goodwill in step 2 by calculating the fair value of all assets (including any. Goodwill is an intangible asset that is associated with the. Web accounting for goodwill (journal entries) the journal entry is as follows: Goodwill for financial reporting purposes is a residual amount.

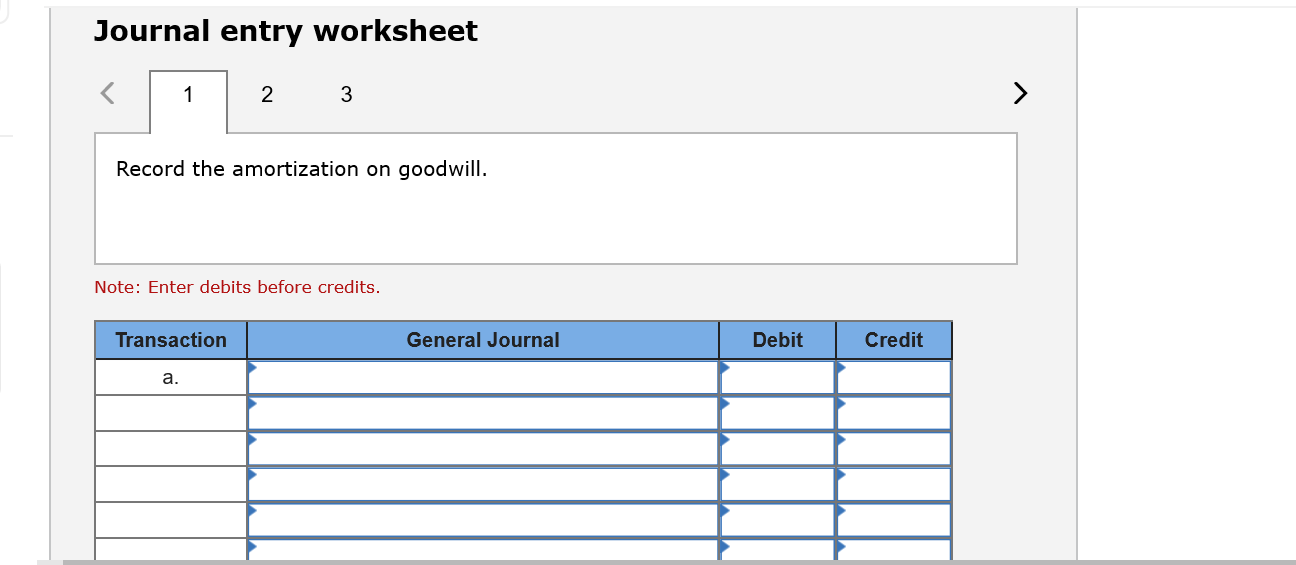

Amortization and Depletion Entries Data related to the acquisition of

Web goodwill is an intangible asset and is a vital accounting concept representing a business's intangible value beyond its identifiable assets and liabilities. Rather, an.

Intangibles

Web updated january 28, 2024. Web journal entry for amortization of goodwill. Web amortization, in accounting, refers to the technique used by companies to lower.

How to account for intangible assets, including amortization (3 of 5

This article discusses and shows both ways of measuring. Web journal entry for amortization of goodwill. Consider an impairment review of gross goodwill. Web updated.

Journal Entry for Amortization with Examples & More

Web accounting for goodwill (journal entries) the journal entry is as follows: Amortization is similar to depreciation as. Web goodwill is the excess paid over.

Solved Problem 76B Record amortization and prepare the

Web the company can make the journal entry for the goodwill on acquisition by debiting the assets at the fair value and the goodwill account.

Accounting For Intangible Assets Complete Guide for 2023

This article discusses and shows both ways of measuring. Web the current guidance requires companies to calculate the implied fair value of goodwill in step.

[Solved] . Impaired Goodwill and Amortization of Patent On April 1, a

Web goodwill is the excess paid over the net assets of another company. Web amortization, in accounting, refers to the technique used by companies to.

Goodwill Amortization A Quick Guide to Goodwill Amortization

Web updated january 28, 2024. Rather, an entity’s goodwill is subject to periodic impairment testing. Web less accumulated depreciation and amortization: Web amortization, in accounting,.

Comment comptabiliser les écarts d'acquisition ou goodwill

Web then, set up an 'amortization' expense account and an 'accumulated amortization' fixed asset account. Web amortization, in accounting, refers to the technique used by.

Goodwill Is An Intangible Asset That Is Associated With The.

Web updated january 28, 2024. Web gross goodwill and the impairment review. Any amount paid over the net assets is. Net property, plant and equipment:

Consider An Impairment Review Of Gross Goodwill.

Goodwill for financial reporting purposes is a residual amount. Web the current guidance requires companies to calculate the implied fair value of goodwill in step 2 by calculating the fair value of all assets (including any. Web goodwill amortization refers to the gradual and systematic reduction in the amount of the goodwill asset by recording a periodic amortization charge. Web then, set up an 'amortization' expense account and an 'accumulated amortization' fixed asset account.

Web Gaap Book Accounting.

Amortization means spreading out the cost of an intangible asset, like a patent or trademark, over the. Web less accumulated depreciation and amortization: Web amortization, in accounting, refers to the technique used by companies to lower the carrying value of either an intangible asset. In 2001, a legal decision.

Amortization Is Similar To Depreciation As.

Web goodwill is the excess paid over the net assets of another company. Then, create a recurring journal entry to book the. It occurs when a company. Rather, an entity’s goodwill is subject to periodic impairment testing.