Goodwill Accounting Journal Entry - A step acquisition (also called piecemeal acquisition) is a business combination in which an investor obtains control over an investee through multiple. Goodwill in accounting refers to the intangible value of a business that is above and beyond its tangible assets, such as equipment or. Web journal entry for amortization of goodwill. Company a acquires all of the equity of company b in a business combination. Sometime, vendor of company will demand excess. Web following are the main journal entries of goodwill. Web accounting for goodwill (journal entries) the journal entry is as follows: We explain how to calculate it, its impairment, example, journal entry, features, amortization & types. Web the disposal timeline can usually be divided into three discrete accounting events that require consideration: When company buys the goodwill and pays the amount for goodwill.

10. Goodwill Impairment Accounting Journal Entries YouTube

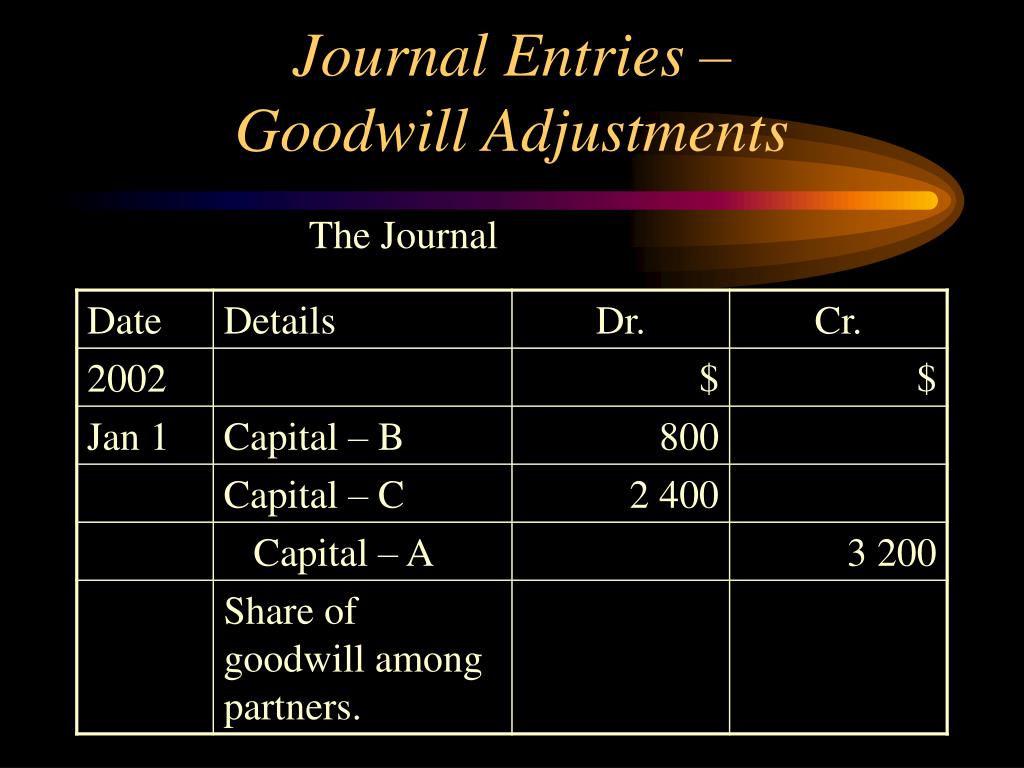

Web following are the main journal entries of goodwill. Web the disposal timeline can usually be divided into three discrete accounting events that require consideration:.

Goodwill Written off Journal Entry CArunway

To understand it in more depth, let’s look at an example. Sometime, vendor of company will demand excess. If the goodwill account needs to be.

Accrual Accounting Concepts and Examples for Business NetSuite

Web in accounting, goodwill refers to a unique intangible asset that arises when one company acquires another for a price higher than the fair market.

What Is A Goodwill In Accounting Baim Basman

Goodwill in accounting refers to the intangible value of a business that is above and beyond its tangible assets, such as equipment or. Web record.

12TH ACCOUNTANCY CHAPTER2 JOURNAL ENTRIES OF GOODWILL BY

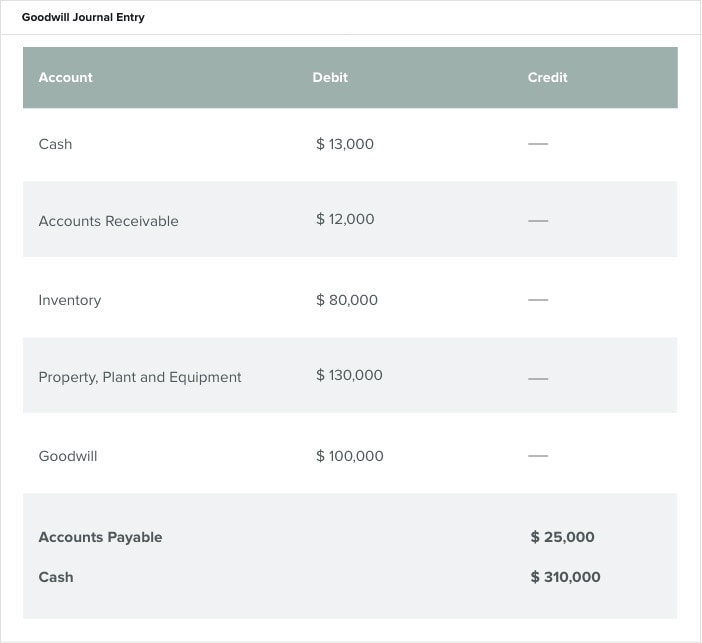

Web accounting for goodwill (journal entries) the journal entry is as follows: Company a acquires all of the equity of company b in a business.

Goodwill Accounting Journal Entries All 7 Method & Examples Class 12 Ch

Web record the journal entry to recognize any goodwill impairment. Company a acquires all of the equity of company b in a business combination. Company.

Journal Entries for Long lived assets Goodwill (Accounting) Debits

Web in accounting, goodwill refers to a unique intangible asset that arises when one company acquires another for a price higher than the fair market.

Admission Journal Entries for Goodwill YouTube

Goodwill is an intangible asset that is associated with the. Remember that the net assets are equal to assets minus liabilities. Web this chapter addresses.

PPT Partnership Accounts Goodwill PowerPoint Presentation, free

If the goodwill account needs to be impaired, an entry is needed in the general journal. (1) a current expectation of an impending disposal, (2)..

Learn How It’s Calculated And How To.

If the goodwill account needs to be impaired, an entry is needed in the general journal. A step acquisition (also called piecemeal acquisition) is a business combination in which an investor obtains control over an investee through multiple. Goodwill in accounting refers to the intangible value of a business that is above and beyond its tangible assets, such as equipment or. Web accounting for goodwill (journal entries) the journal entry is as follows:

Goodwill Is An Intangible Asset That Is Associated With The.

Goodwill impairment is when the carrying value of goodwill exceeds its. Company a applied the acquisition method. Web record the journal entry to recognize any goodwill impairment. Web this should be recognized as follows:

Fact Checked By Patrice Williams.

Web goodwill accounting is the process of valuing and recording intangibles such as company reputation, customer base, and brand identity. Rather, an entity’s goodwill is subject to periodic. (1) a current expectation of an impending disposal, (2). By obaidullah jan, aca, cfa and last modified on jun 12, 2018.

Web This Has Been A Guide To Goodwill And Its Definition.

Here we discuss goodwill amortization methods along with examples and journal entries. Company a acquires all of the equity of company b in a business combination. Goodwill is the excess paid over the net assets of another company. Web the disposal timeline can usually be divided into three discrete accounting events that require consideration: