Goods Sold Journal Entry - To record the cost of goods sold, we need to find its value before we process a journal entry. Web journal entry for sales and purchase of goods. Money comes into the business whenever there is a sale, and it must be recorded accordingly. Journal entry to move work in process costs into finished goods; Goods are those items in which a business deals. The cost of goods sold entry records. This is posted to the. Web journal entries to move direct materials, direct labor, and overhead into work in process; Web the purchase return process, also known as the returns outwards process, involves returning goods to a supplier for various reasons such as defects, wrong. Web how to record a journal entry for cost of goods sold.

Cost of Goods Sold Journal Entries Video & Lesson Transcript

The transaction, goods sold for cash, has an effect on both sides of the accounting equation. This entry matches the ending balance in the inventory.

Recording a Cost of Goods Sold Journal Entry

Next, let’s record the sale of. It shows how they paid and adjusts accounts such as cost of goods sold. Web journal entries to move.

[Solved] Develop journal entries and find out the cost of goods sold

Web journal entries to move direct materials, direct labor, and overhead into work in process; Web journal entry for sales and purchase of goods. When.

Journal Entry for Goods Sold on Credit YouTube

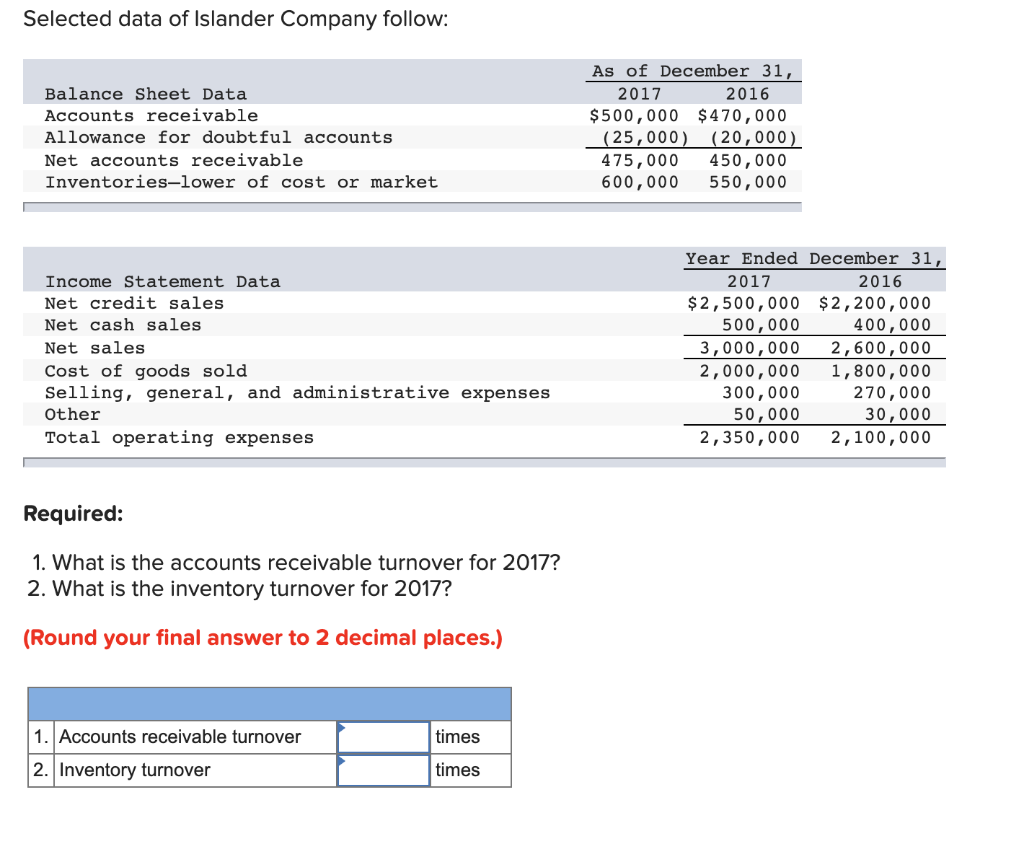

It shows how they paid and adjusts accounts such as cost of goods sold. Web 10.2 calculate the cost of goods sold and ending inventory.

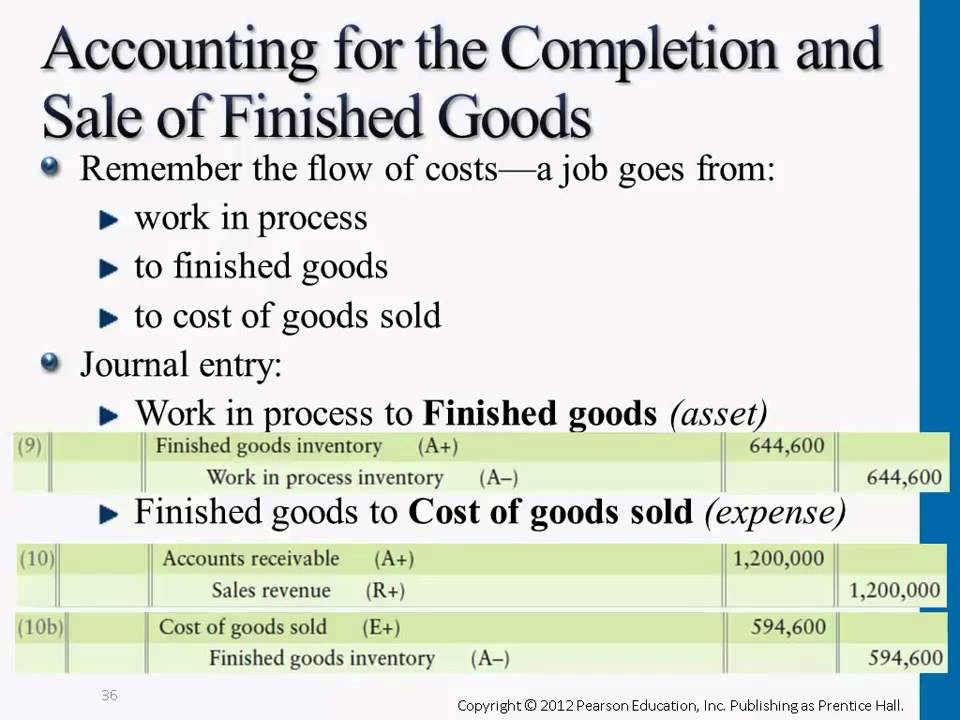

Completion of Sale & Finished Goods Journal Entries YouTube

Web the journal entry for cost of goods sold is a calculation of beginning inventory, plus purchases, minus ending inventory. Web cost of goods sold.

3 Purchase goods for Cash journal entry YouTube

Web introduction to cost of goods sold. In other words, goods are the. When the cost of goods sold is subtracted from sales, the remainder.

How to Account for Cost of Goods Sold (with Pictures) wikiHow

Web cost of goods sold is likely the largest expense reported on the income statement. Instead, as the sporting good store’s accountants, we’ll just use.

Recording a Cost of Goods Sold Journal Entry

Web we won’t write the journal entry for this transaction. Next, let’s record the sale of. With the information in the example, we can calculate.

Recording a Cost of Goods Sold Journal Entry ⋆ Accounting Services

Web the journal entry for cost of goods sold is a calculation of beginning inventory, plus purchases, minus ending inventory. As a business owner, you.

In Other Words, Goods Are The.

Web cost of goods sold with journal entry examples. Goods are those items in which a business deals. Web what is the journal entry to record the cost of goods sold at the end of the accounting period? Web journal entries to move direct materials, direct labor, and overhead into work in process;

Web Introduction To Cost Of Goods Sold.

Journal entry to move work in process costs into finished goods; In this post, we’ll discuss how to record a cost of goods sold journal entry in quickbooks online (qbo). When recording journal entries for the cost of goods sold, accountants work in tandem with manufacturing or operations to. The cost of goods sold sometimes abbreviated to cogs or referred to as cost of sales, is the costs associated with.

Web How To Record A Journal Entry For Cost Of Goods Sold.

This entry matches the ending balance in the inventory account to the costed actual ending inventory, while eliminating the $450,000 balance in the purchases account. Money comes into the business whenever there is a sale, and it must be recorded accordingly. Web the cost of goods sold journal entry is: Web accounting for costs of goods sold in financial statements:

Web The Journal Entry For Cost Of Goods Sold Is A Calculation Of Beginning Inventory, Plus Purchases, Minus Ending Inventory.

Web when recording the expense of merchandise purchased by a business, a journal entry is made to debit the cost of goods and credit the inventory account. This is posted to the. Web cost of goods sold is likely the largest expense reported on the income statement. Web we won’t write the journal entry for this transaction.