Gift Card Journal Entry - Web the sale of a gift certificate should be recorded with a debit to cash and a credit to a liability account such as gift certificates outstanding. During the holiday, company sold the gift cards for $ 200,000 to. Web there are several points to consider when accounting for promotions and gift card sales: Web learn how to record the sale, redemption and expiration of gift cards in accounting. Web the journal entry is debiting gift card liability and credit sale revenue. When a gift card’s value is not redeemed by the consumer, retailers (and their. Definition of gift cards in accounting. Company abc is the retail store. Learn how to note gift card sales and redemption in your client's books. Web basic and advanced gift card revenue recogniton, journal entries and examples.

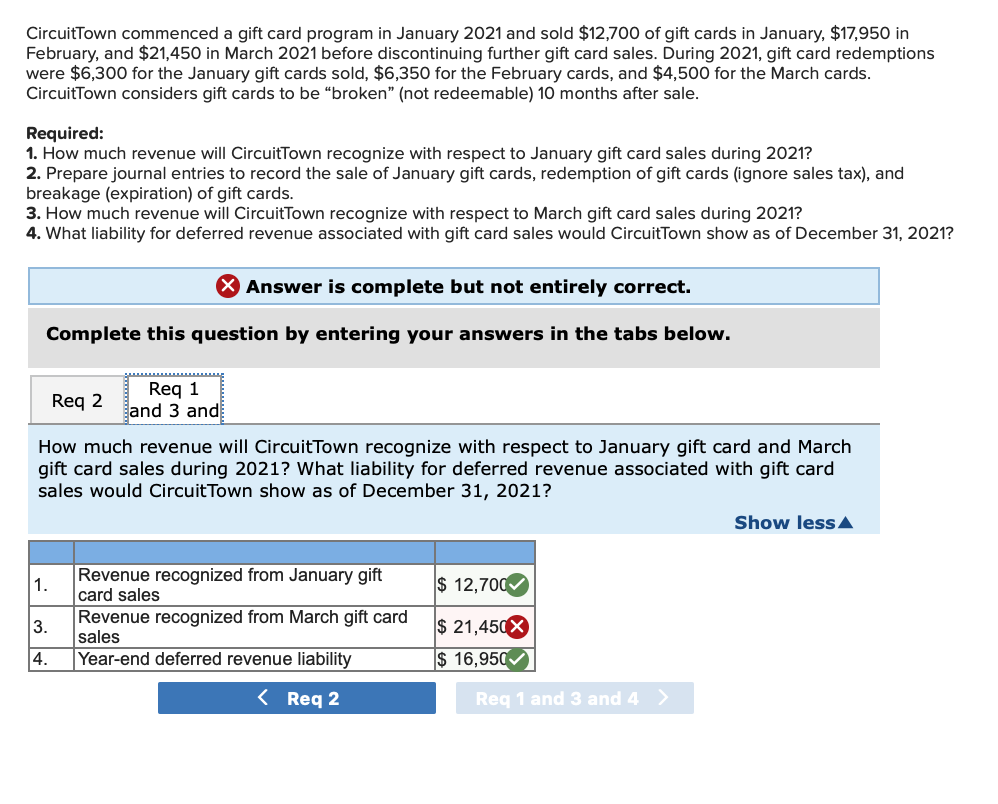

Solved Exercise 139 (Algo) Gift Cards (LO133] CircuitTown

Upon customer prepayment, a contract liability is recognised, not revenue. Below is an example of a journal. Company abc is the retail store. Web when.

Accounting For Gift Cards Double Entry Bookkeeping

During the holiday, company sold the gift cards for $ 200,000 to. Web when you sell gift cards, it increases (credits) the liability account and.

3 Purchase goods for Cash journal entry YouTube

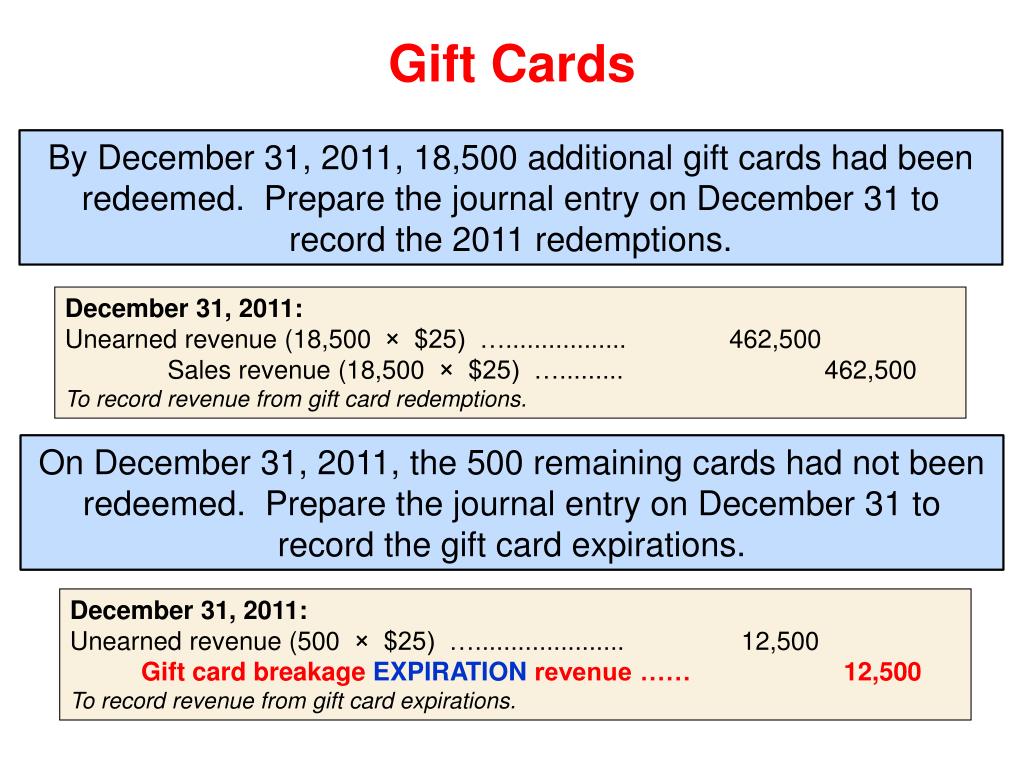

(1) when to recognize revenue and (2) what to do if some portion of the gift card is never redeemed (breakage). Web journal entry for.

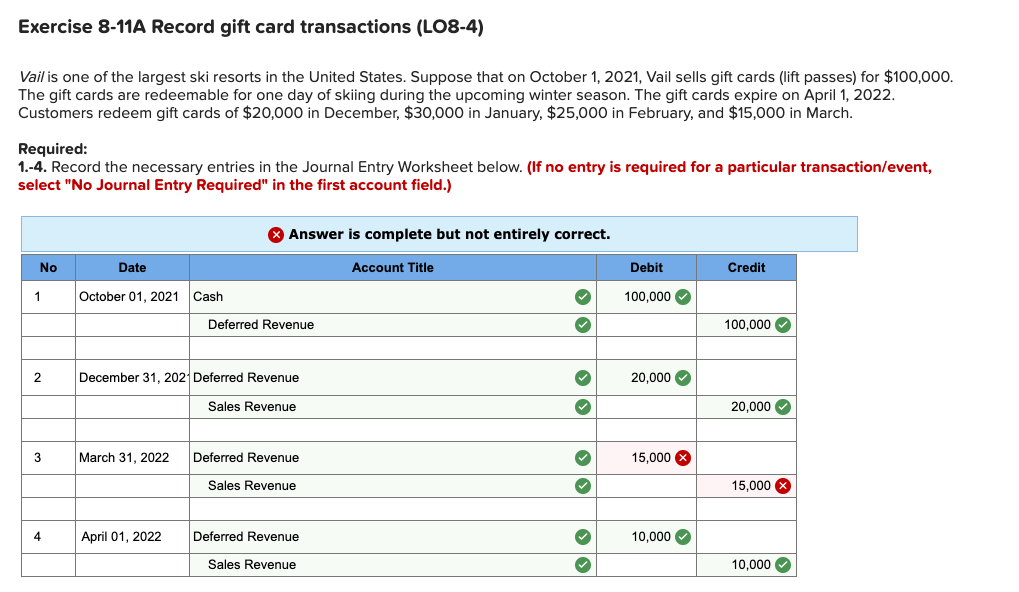

Solved Exercise 811A Record gift card transactions (LO84)

Web journal entries for issuing and redeeming store credit or a gift card. Web journal entry for gift cards. Upon customer prepayment, a contract liability.

gift card breakage revenue example YouTube

See the journal entries, examples and accounting policy for gift cards. Web basic and advanced gift card revenue recogniton, journal entries and examples. Web unresolved.

Solved CircuitTown commenced a gift card program in January

February 08, 2021 08:46 am. We offer gift cards that have an expiration date. Web there are two steps to the gift cards process: See.

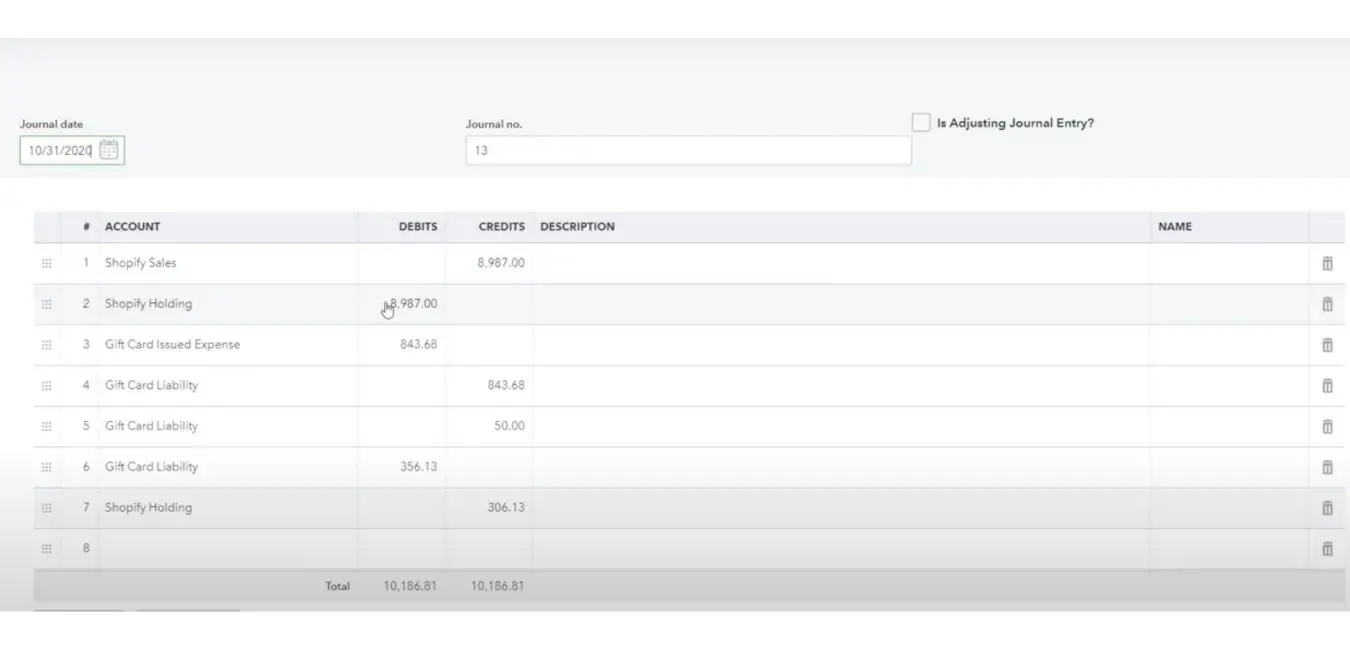

How To Record Your Shopify Store Gift Card Sales & Redemptions In

Web journal entry for gift cards. Revenue is recognised when the promise is. Web the essential accounting for gift cards is for the issuer to.

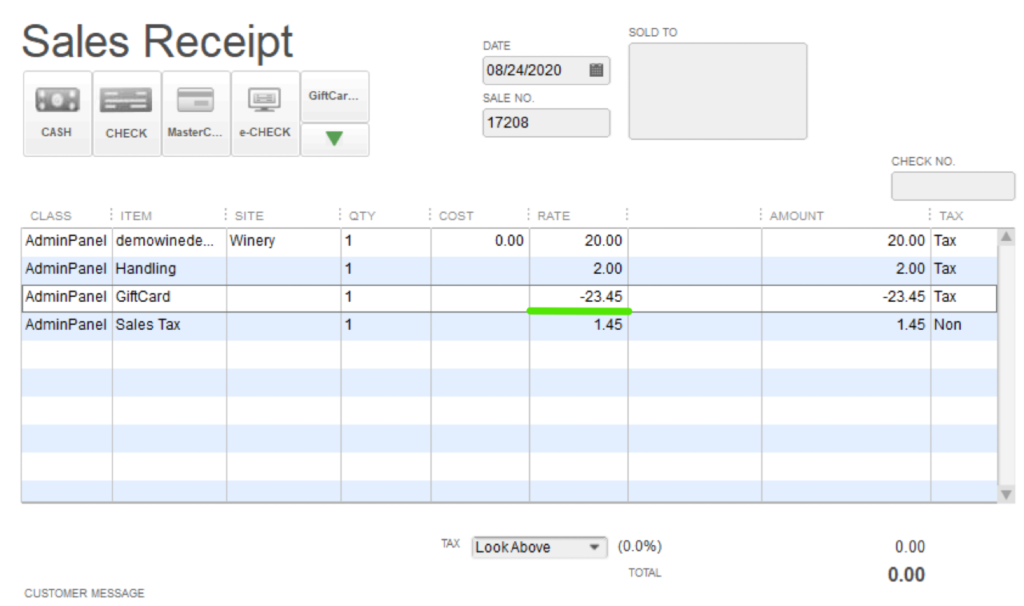

How Do Gift Card Transactions Work? WGITS

Web accounting for gift cards presents two issues: Definition of gift cards in accounting. Web learn how to record the sale, redemption and expiration of.

PPT Chapter 13 PowerPoint Presentation, free download ID3024969

Web unresolved reporting issues stemming from the reporting treatment of gift card sales and “breakage” (gift cards that consumers fail to redeem) potentially involve several..

Note That Revenue Is Not Recorded.

Web the journal entry is debiting gift card liability and credit sale revenue. Definition of gift cards in accounting. Web gift cards are sold to the customers (usually in return for cash), and the business must establish the liability for its obligation to supply the customers with goods in the future. Learn how to note gift card sales and redemption in your client's books.

When A Gift Card’s Value Is Not Redeemed By The Consumer, Retailers (And Their.

Upon customer prepayment, a contract liability is recognised, not revenue. Web accounting for gift cards presents two issues: Web journal entries for issuing and redeeming store credit or a gift card. Web the journal entry for the gift card transaction will show the company has received cash from the customer and, in turn, has a liability to the customer.

Web There Are Two Steps To The Gift Cards Process:

Below is an example of a journal. Web there are several points to consider when accounting for promotions and gift card sales: Initial recording of gift card sales. No goods or services were rendered upon the.

We Offer Gift Cards That Have An Expiration Date.

Web journal entry for gift cards. During the holiday, company sold the gift cards for $ 200,000 to. Web the key points that impact accounting for gift cards are: Web the essential accounting for gift cards is for the issuer to initially record them as a liability, and then as sales after the card holders use the related funds.

![Solved Exercise 139 (Algo) Gift Cards (LO133] CircuitTown](https://media.cheggcdn.com/media/aff/aff5bad8-dca3-484d-a0de-9b22e029607c/phpYJQRRt)

![Solved Exercise 139 (Algo) Gift Cards (LO133] CircuitTown](https://media.cheggcdn.com/media/c85/c851179e-bea4-4855-86d1-e47510ccc6d2/phpHnnD2s)