General Journal For Depreciation - Web this depreciation journal entry will be made every month until the balance in the accumulated depreciation account for that asset equals the purchase price or. Written by true tamplin, bsc, cepf®. Web the adjusting entry for accumulated depreciation in general journal format is: When recording a journal entry, you have two options, depending on your current accounting method. To deal with the asset disposal we first need to calculate its net book value. Web examples of transactions recorded in the general journal are asset sales, depreciation, interest income and interest expense, and stock sales and repurchases. From the view of accounting, accumulated depreciation is an important aspect as it is relevant for capitalized assets. Web depreciation expense is computed as: Web to calculate depreciation by month: The information recorded in the journal is used to.

Depreciation journal Entry Important 2021

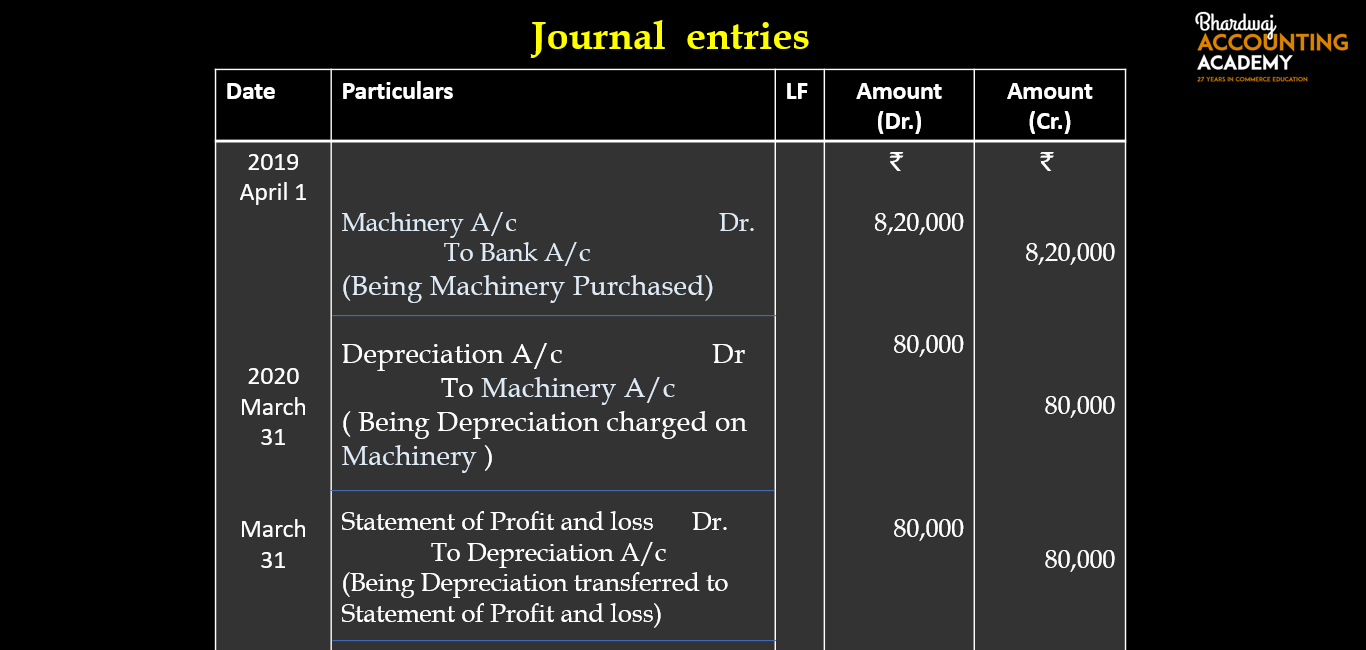

Web the journal entry for depreciation is: To deal with the asset disposal we first need to calculate its net book value. Web guide to.

General Journal in Accounting Double Entry Bookkeeping

$1,950 ÷ 12 = $162.50. Transfer between subsidiary ledger personal accounts. Web the adjusting entry for accumulated depreciation in general journal format is: The business.

Adjusting Entries Journalizing Depreciation Adjusting Entries

From the view of accounting, accumulated depreciation is an important aspect as it is relevant for capitalized assets. Web this depreciation journal entry will be.

DEPRECIATION ACCOUNTING Definition, Methods, Formula & All you should

$1,950 ÷ 12 = $162.50. Web guide to what is general journal. Web journal entry for depreciation. To deal with the asset disposal we first.

Depreciation and Disposal of Fixed Assets Finance Strategists

Web depreciation is a systematic process for allocating (spreading) the cost of an asset that is used in a business to the accounting periods in.

13.4 Journal entries for depreciation

Goods taken for personal use. Disposal of fixed assets is accounted for by removing cost of the asset and any related accumulated depreciation and accumulated..

What is the journal entry for depreciation? Leia aqui What is

Therefore, it is very important to understand that when a depreciation expense journal entry is recognized in the. When recording a journal entry, you have.

Journal Entry for Depreciation Example Quiz More..

Web depreciation expense is computed as: We explain it with example, accounting, format, differences with general ledger, uses & advantages. The information recorded in the.

Make a twocolumn General Journal. Depreciation Calculations

The information recorded in the journal is used to. Depreciation of fixed assets entries explained. Goods taken for personal use. We explain it with example,.

When Recording A Journal Entry, You Have Two Options, Depending On Your Current Accounting Method.

From the view of accounting, accumulated depreciation is an important aspect as it is relevant for capitalized assets. Web disposal of fixed assets. Written by true tamplin, bsc, cepf®. Web here are four easy steps that’ll teach you how to record a depreciation journal entry.

Therefore, It Is Very Important To Understand That When A Depreciation Expense Journal Entry Is Recognized In The.

Web the journal entry for depreciation is: Reviewed by subject matter experts. To deal with the asset disposal we first need to calculate its net book value. Credit to the balance sheet account accumulated depreciation;

Debit To The Income Statement Account Depreciation Expense;

We explain it with example, accounting, format, differences with general ledger, uses & advantages. Unlike journal entries for normal. Web to calculate depreciation by month: Web the depreciation expense is calculated at the end of an accounting period and is entered as a journal as follows:

Depreciation Of Fixed Assets Entries Explained.

Web depreciation expense is computed as: Web depreciation is a systematic process for allocating (spreading) the cost of an asset that is used in a business to the accounting periods in which the asset is used. Web the adjusting entry for accumulated depreciation in general journal format is: The business writes off the fixed assets or scraps them as having no value.