Gasb 87 Lessor Journal Entries - Web the comprehensive example below will illustrate the accounting treatment of a lease from a lessor’s perspective under gasb 87. Five more articles to help you get ready for the gasb 87 effective date. The initial lease term is 36 months with two renewal options for 12 months. Web follow governmental accounting standards board statement 87 when making determinations regarding. New lease accounting standards, changes, and full examples. As a lessor reporting under gasb 87, the initial journal entry to record a lease on the commencement date or transition date for an existing lease establishes a lease receivable and a deferred inflow of resources. Web together, all the agreements will provide the entries that are needed for the gasb 87 lease journal entries in the initial year of implementation. A city leases a portion of their municipal building space to a local coffee shop (lessee). Web click the button below to download examples of lease transactions and events based on gasb statement 87, leases, as amended and expanded on by subsequent gasb pronouncements through june 30, 2020. Web for governments that are a lessee or lessor in accordance with gasb 87, there are journal entries that have to be made when the lease begins and throughout the lease term.

Lessee accounting for governments An indepth look Journal of

The initial lease term is 36 months with two renewal options for 12 months. Web understand how to account for a lease under gasb 87.

Gasb 87 Template

Lessee journal entries with example. 1.2k views 1 year ago gasb. $1,000 monthly payment due 1st of each month. Issued in 1990 and outlined how.

GASB 87 Lessee Lease Accounting Example EZLease

Learn how to calculate the lease liability for a finance lease for lessees under the lease accounting standards, gasb 87, with rachel, including. Web further,.

Lessee accounting for governments An indepth look Journal of

Lessee journal entries with example. Learn how to calculate lease liability and asset, understand net present value calculation all in excel. No services are provided.

GASB 87 Lessee Journal Entries YouTube

Web follow governmental accounting standards board statement 87 when making determinations regarding. Gfoa has prepared an example of the entries needed from. Web gasb 87.

Gasb 87 Excel Template

Web lessor accounting under gasb 87. Web for governments that are a lessee or lessor in accordance with gasb 87, there are journal entries that.

GASB 87 Lessor Journal Entries YouTube

No services are provided to the lessee with the lease. This statement increases the usefulness of governments’ financial statements by requiring recognition of certain lease.

Gasb 87 Excel Template

Web as a lessor reporting under gasb 87, the initial journal entry to record a lease on the commencement date or transition date for an.

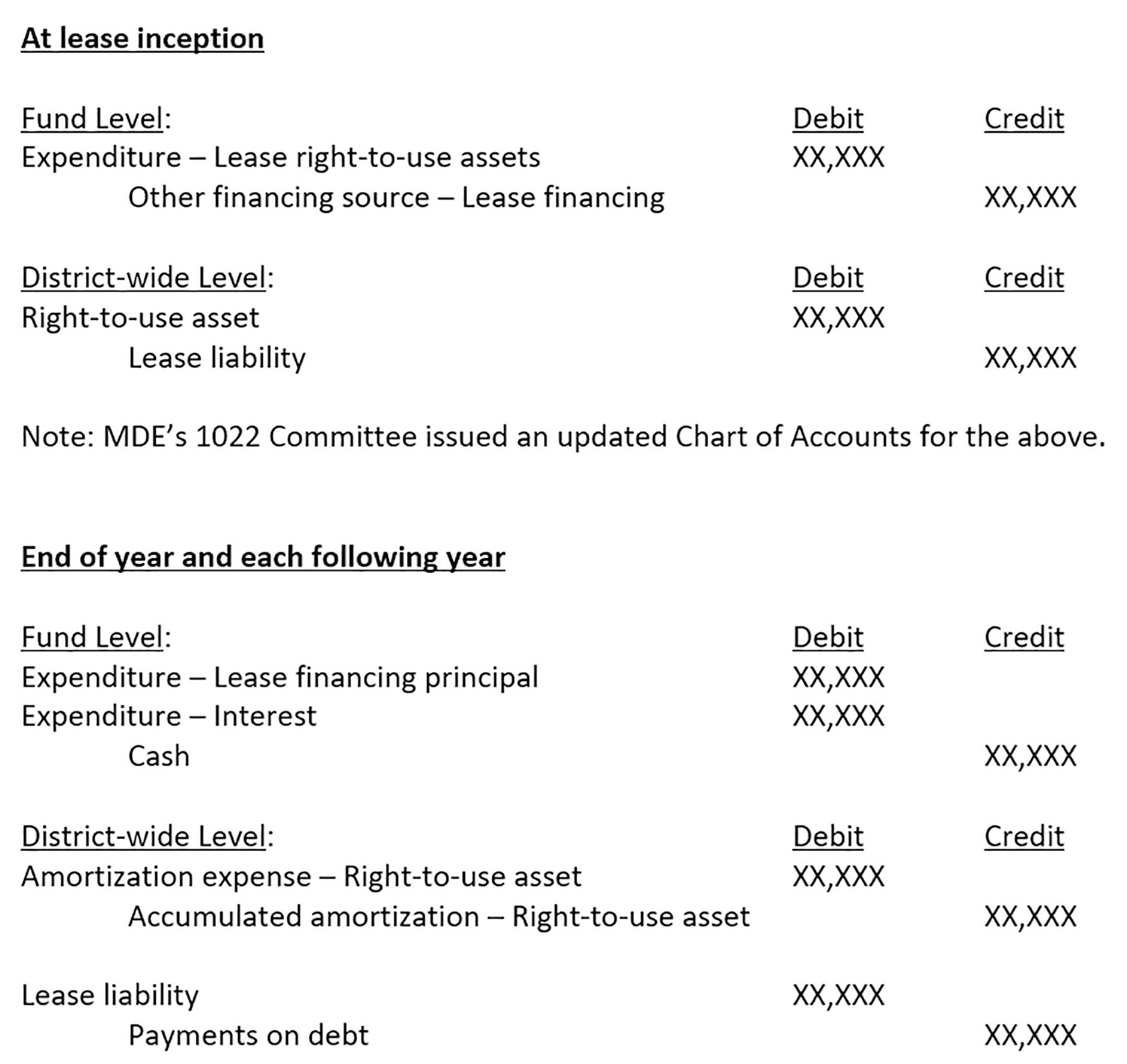

What School Districts Need to Prepare Now for GASB 87 Leases

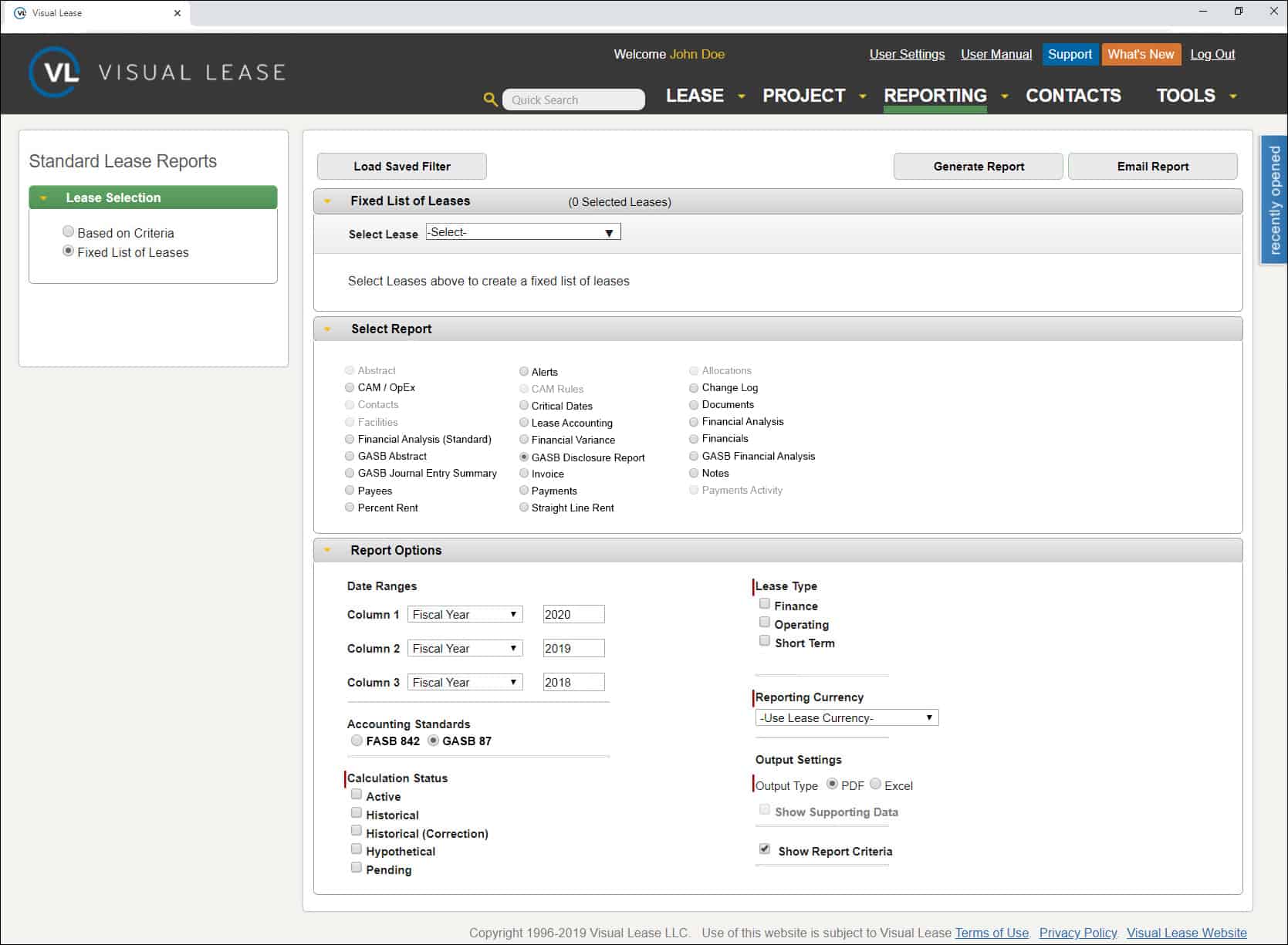

Web the gasb 87 lessor template is an excel workbook developed by the sco to provide departments with a tool that will help them generate.

• Lessorsmust Recognize Lease Receivables And Deferred Inflows Of Resources On Their Financial Statements.

Web together, all the agreements will provide the entries that are needed for the gasb 87 lease journal entries in the initial year of implementation. • lesseesmust recognize lease liabilities and intangible right of use (rou) lease assets on their statements. The lease receivable is measured at the present value of lease payments expected to be received during the lease term. Gfoa has prepared an example of the entries needed from.

Web Understand How To Account For A Lease Under Gasb 87 With This Detailed Article.

Web click the button below to download examples of lease transactions and events based on gasb statement 87, leases, as amended and expanded on by subsequent gasb pronouncements through june 30, 2020. The following example journal entries are for governmental funds only. Why were these changes implemented? Calculate the initial lease asset value.

No Services Are Provided To The Lessee With The Lease.

Lease accounting calculations you need to know. 1.2k views 1 year ago gasb. Web the gasb 87 lessor template is an excel workbook developed by the sco to provide departments with a tool that will help them generate the information for the journal entries and note disclosures required under gasb 87. Web gasb 87 is the new leasing standard, superseding a number of previous lease accounting standards being:

$1,000 Monthly Payment Due 1St Of Each Month.

Web as a lessor reporting under gasb 87, the initial journal entry to record a lease on the commencement date or transition date for an existing lease establishes a lease receivable and a deferred inflow of resources. Lessee journal entries with example. Learn how to calculate lease liability and asset, understand net present value calculation all in excel. Temporary building lease (lessor) lease starts 1/01/21 for 60 months;