Gasb 87 Journal Entries - Use our free templates to better understand gasb 87 lease accounting. $1,000 monthly payment due 1st of each month. Navigate gasb 87 and 96 standards with accounting solutions. Issued in 2010, gasb 62 mirrors most of. 1.2k views 1 year ago gasb. With amanda, walkthrough calculating the lease receivable using the. Web gasb 87 is the new leasing standard, superseding a number of previous lease accounting standards being: Web the initial journal entry under gasb 87 will establish the asset and liability on the statement of financial position, as well as remove the cumulative deferred rent balance. Web click the button below to download examples of lease transactions and events based on gasb statement 87, leases, as amended and expanded on by subsequent gasb. Web learn how to calculate the lease liability and asset under gasb 87 with journal entries and examples.

Lessee accounting for governments An indepth look Journal of

Web learn how to calculate the lease liability and asset under gasb 87 with journal entries and examples. Web the initial journal entry under gasb.

What School Districts Need to Prepare Now for GASB 87 Leases

With amanda, walkthrough calculating the lease receivable using the. Web learn about the new standards and guidance for accounting and reporting leases by governments in.

Gasb 87 Template

Web gasb 87 is the new leasing standard, superseding a number of previous lease accounting standards being: 87, leases, or gasb 87, is a statement.

Gasb 87 Excel Template

1.2k views 1 year ago gasb. Web learn how to calculate the lease liability and asset under gasb 87 with journal entries and examples. Web.

GASB 87 Lessee Journal Entries YouTube

Web this article illustrates only the basics of lessee accounting under gasb 87, and additional analysis will be required for leases with variable payments, contracts.

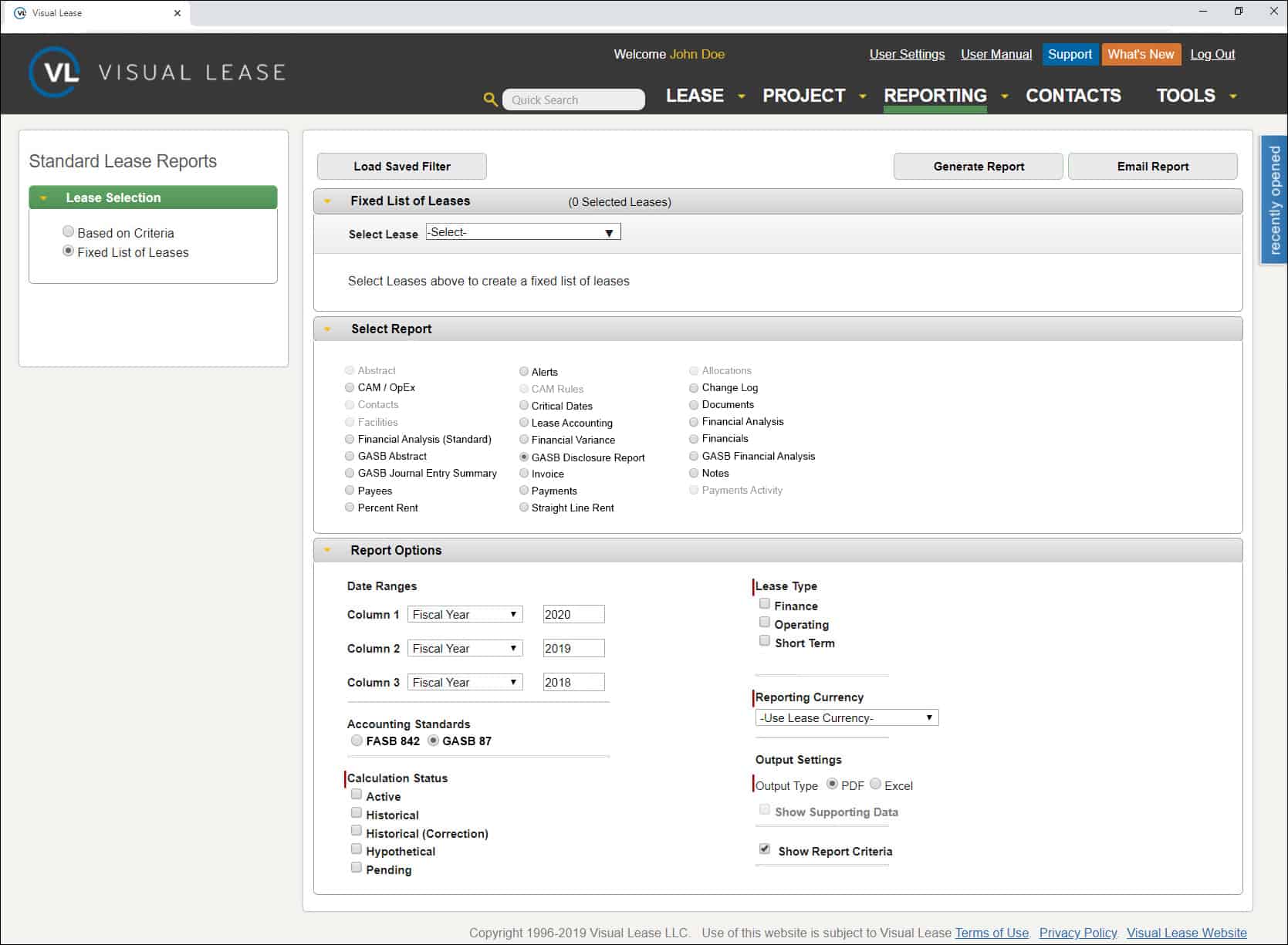

GASB 87 Compliant Lease Accounting Software Visual Lease

Web what we will cover. Web learn how to calculate the lease liability and asset under gasb 87 with journal entries and examples. 1.2k views.

GASB 87 Lessor Journal Entries YouTube

1.2k views 1 year ago gasb. Find out the changes, inputs, and steps involved in accounting for a lease. The implementation of gasb statements 87..

Webinar A Detailed Example of Applying the New GASB 87 Standard

Web find a gasb 87 lessee lease accounting example at ezlease. Web identifying the lease term under gasb 87; Lessor accounting under gasb 87. By.

GASB 87 Lease Accounting Software EZLease

Web learn about the new standards and guidance for accounting and reporting leases by governments in this official document. Web identifying the lease term under.

Learn How To Calculate The Lease Liability For A Finance Lease For Lessees Under The Lease Accounting Standards, Gasb 87, With.

Web gasb 87 is the new leasing standard, superseding a number of previous lease accounting standards being: Click here to see other lease. Assumptions for lease liability calculation; Issued in 2010, gasb 62 mirrors most of.

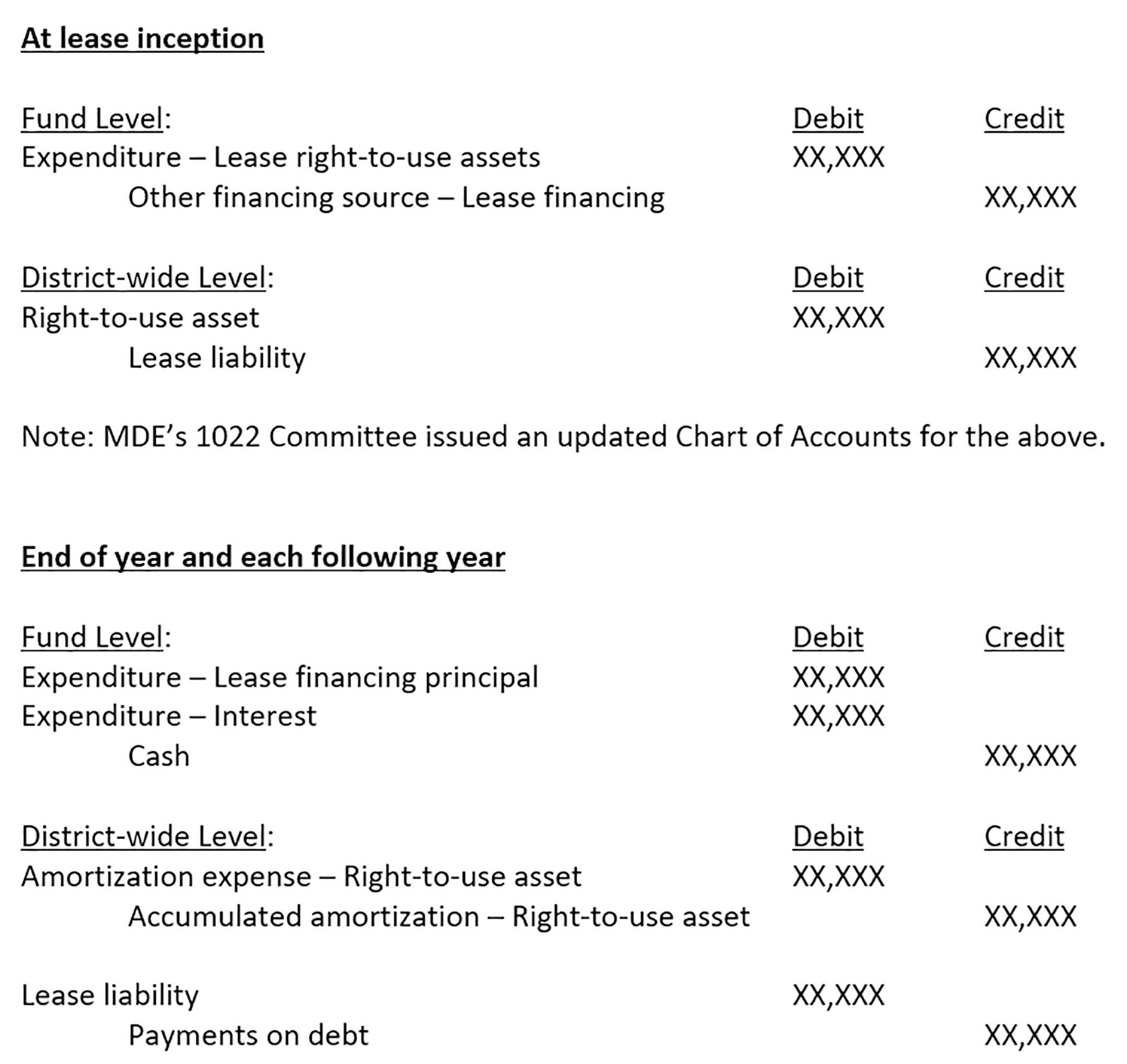

Journal Entries Will Differ Depending On Their Fund Type And Whether That Fund Requires Modified Accrual Accounting Entries.

Web what we will cover. With amanda, walkthrough calculating the lease receivable using the. Lease accounting examples like this one make it easy to understand the accounting. Discuss an overview of the single model for recording leases (capitalization) discuss lessor considerations.

Web Calculation Of Necessary Journal Entries.

Web follow governmental accounting standards board statement 87 when making determinations regarding. Navigate gasb 87 and 96 standards with accounting solutions. Required disclosures at the end of the lease term. Web this article illustrates only the basics of lessee accounting under gasb 87, and additional analysis will be required for leases with variable payments, contracts with multiple.

Gasb 96 Is Effective For Fiscal Years Beginning After June 15, 2022, And.

Web gasb 87 lessor accounting example with journal entries. 87, leases, or gasb 87, is a statement that outlines new requirements for lease accounting for governmental entities with significant. By finquery | feb 24, 2021. Web for governments that are a lessee or lessor in accordance with gasb 87, there are journal entries that have to be made when the lease begins and throughout the lease term.