Freight Charges Journal Entry - The expense is paid by the person who. Freight expenses refer to the fees a carrier charges for transporting cargo from a source site to a destination point. When a company hires a 3 rd party transportation. Under the matching principle, all. Web deposit all applicable duties, taxes, charges, and fees in a timely manner. Web fob accounting deals with the treatment of freight charges and how they are recorded in the accounting system. Web a ship at the port of los angeles in march. What is freight paid in accounting? We can make the journal entry for delivery of goods when we deliver the goods to the customer by. Cost of delivery goods out or freight out.

Solved Brief Exercise 611 Record freight charges for

Web freight general journal entry. The expense is paid by the person who. In this case, the journal entry for fob. Web fob accounting deals.

Perpetual Inventory System Journal Entry

Web what is the journal entry for paid freight? The expense is paid by the person who. 10k views 2 years ago journal entry class.

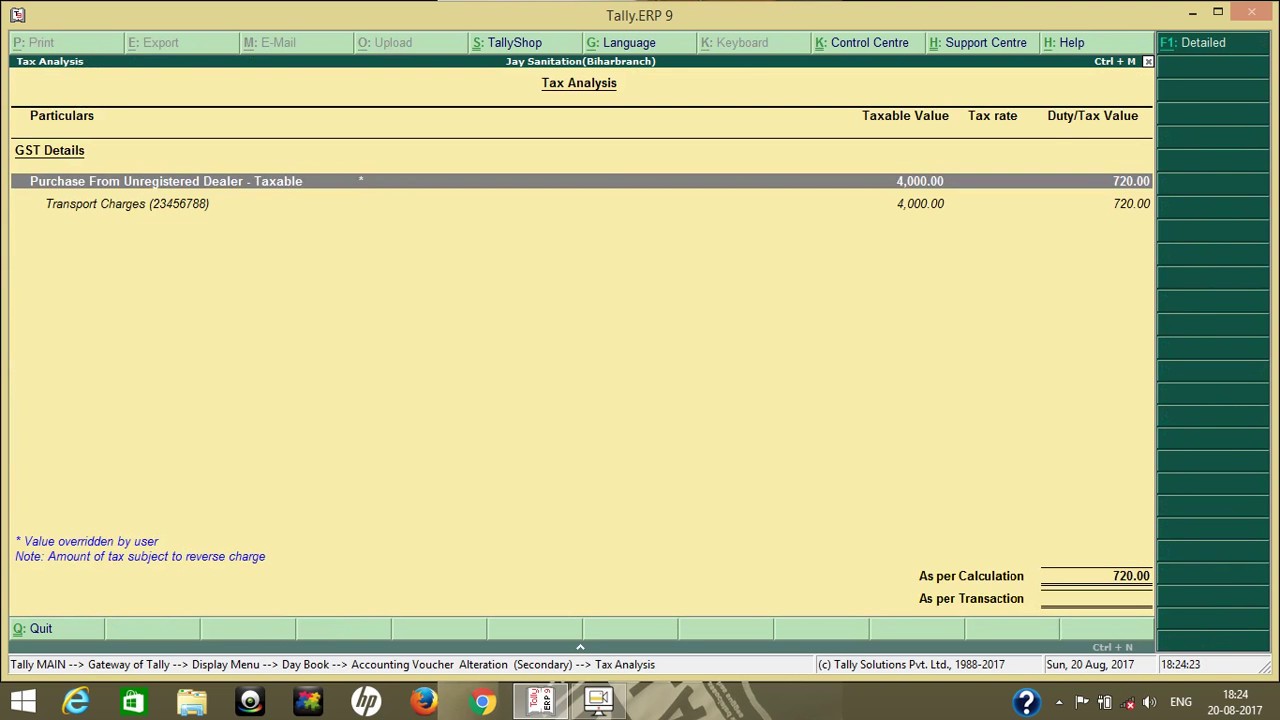

freight charges entry in tally YouTube

How do you record a freight journal? Your ask joey ™ answer. Freight expenses refer to the fees a carrier charges for transporting cargo from.

How to charge Freight, Transportation, Packing or any other Expenses in

Web freight general journal entry. Delivery expense increases (debit) and cash decreases (credit) for the shipping cost amount of $100. Web your ask joey ™.

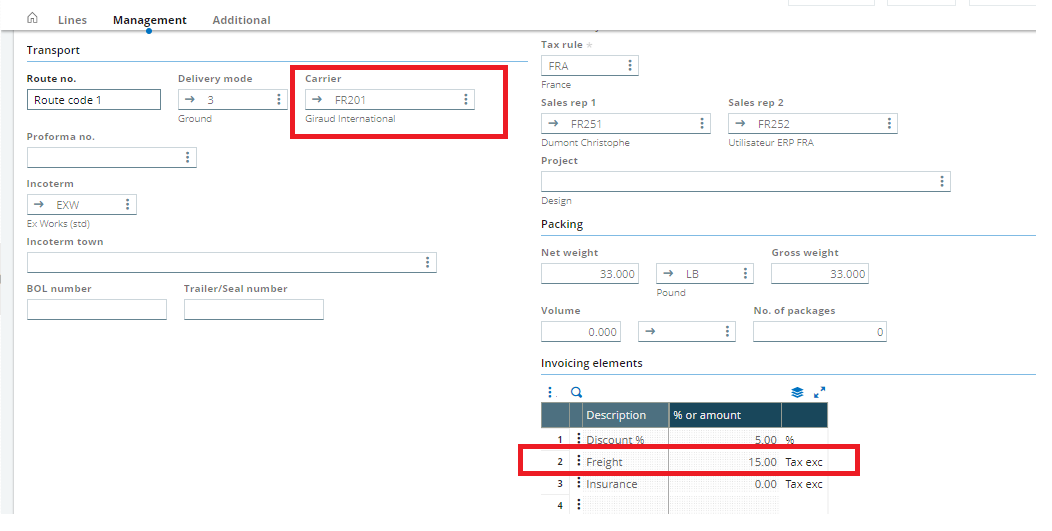

How to calculate freight charges automatically Sage X3 Tips, Tricks

Web the basic method is to charge freight out to expense as soon as you incur the cost. Web what is the journal entry for.

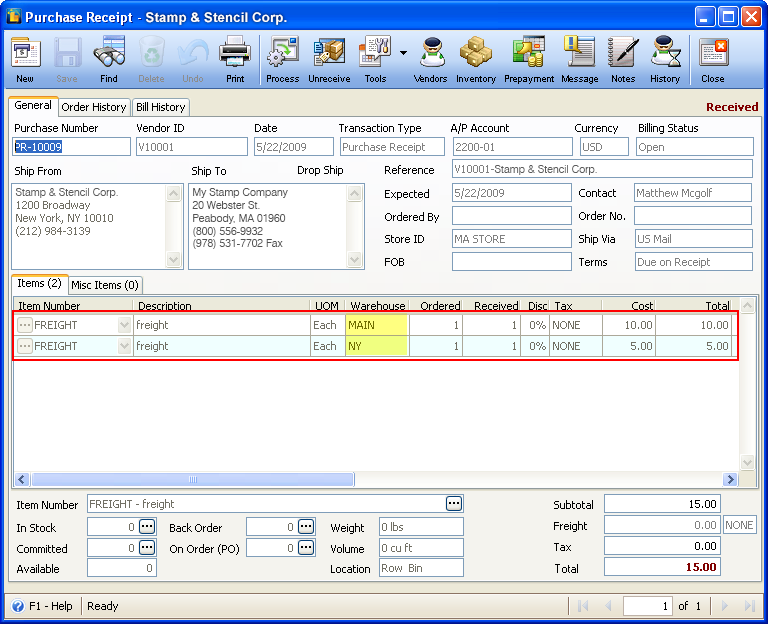

Freight Charges By Warehouse

Web what is the journal entry for paid freight? What is freight in and freight out in. Web your ask joey ™ answer. We can.

PPT Merchandising Operations and the Accounting Cycle PowerPoint

In this case, the journal entry for fob. What is freight in and freight out in. We can make the journal entry for delivery of.

Journal Entries for Normal Charge and Reverse Charge Service Tax Acc

Your ask joey ™ answer. Is the buyer or the seller paying freight charges? Pay amounts due on any entry under the bond at the.

TRANSPORT EXPENSES transportation charges entry in tally for gst from

Purchase considerations for merchandising businesses. Freight expenses refer to the fees a carrier charges for transporting cargo from a source site to a destination point..

Delivery Expense Increases (Debit) And Cash Decreases (Credit) For The Shipping Cost Amount Of $100.

Under the matching principle, all. Your ask joey ™ answer. In this case, the journal entry for fob. Is the buyer or the seller paying freight charges?

Shipping Point, The Purchaser Is Responsible For.

Web deposit all applicable duties, taxes, charges, and fees in a timely manner. Web what is the journal entry for paid freight? Pay amounts due on any entry under the bond at the time goods are released from cbp custody. An income statement contains many aspects of financial information, including specific costs that are sometimes hard to.

Cost Of Delivery Goods Out Or Freight Out.

A possible issue here is the timing of the recognition. Ship diversions from the red sea helped push up container freight rates by roughly 30% in. Web the journal entry for freight charges is an important accounting record that must be handled with care and accuracy. If goods are sold f.o.b.

Factors Such As Fob Shipping Point And Fob.

Web return outwards, also known as purchases returns or purchases allowances, refers to goods that a business returns to its suppliers or vendors. Web a ship at the port of los angeles in march. The expense is paid by the person who. In accounting, fob destination means the seller is responsible for the goods until they arrive at the customer’s destination.