Financing Lease Journal Entries - Web learn how to calculate and record the lease liability and right of use asset for an operating lease under the new lease accounting standard asc 842. Beginning with a finance lease, the initial journal entry at transition will resemble this: Web learn how to account for leases under asc 842, the new lease accounting standard issued by the fasb. Web learn how to record a finance lease and journal entries for leased assets under the new lease accounting standards. Web lease accounting has often been criticized for being too reliant on bright lines and subjective judgments, as lessees were not required to disclose assets and liabilities. Determine the lease term under asc 840; The new lease accounting standard, asc 842, has introduced. Web understanding asc 842 journal entries for lease accounting. Web learn how to account for a finance lease under asc 842, the new lease accounting standard. The lessee should record a lease liability on.

Finance Lease Journal Entries businesser

Web finance lease journal entries. Web lease accounting has often been criticized for being too reliant on bright lines and subjective judgments, as lessees were.

Finance Lease Entries Financeviewer

Web operating lease accounting example and journal entries. Web learn how to record finance leases in the double entry system with examples and explanations. See.

Finance Lease Journal Entries businesser

Determine the lease term under asc 840; Initial recognition of the rou asset. The article covers the key. Web journal entries are foundational to recording.

How to Calculate the Journal Entries for an Operating Lease under ASC 842

Details on the example lease agreement; Creating your journal entries will require lease liability, rou assets,. Web learn how to calculate and record the lease.

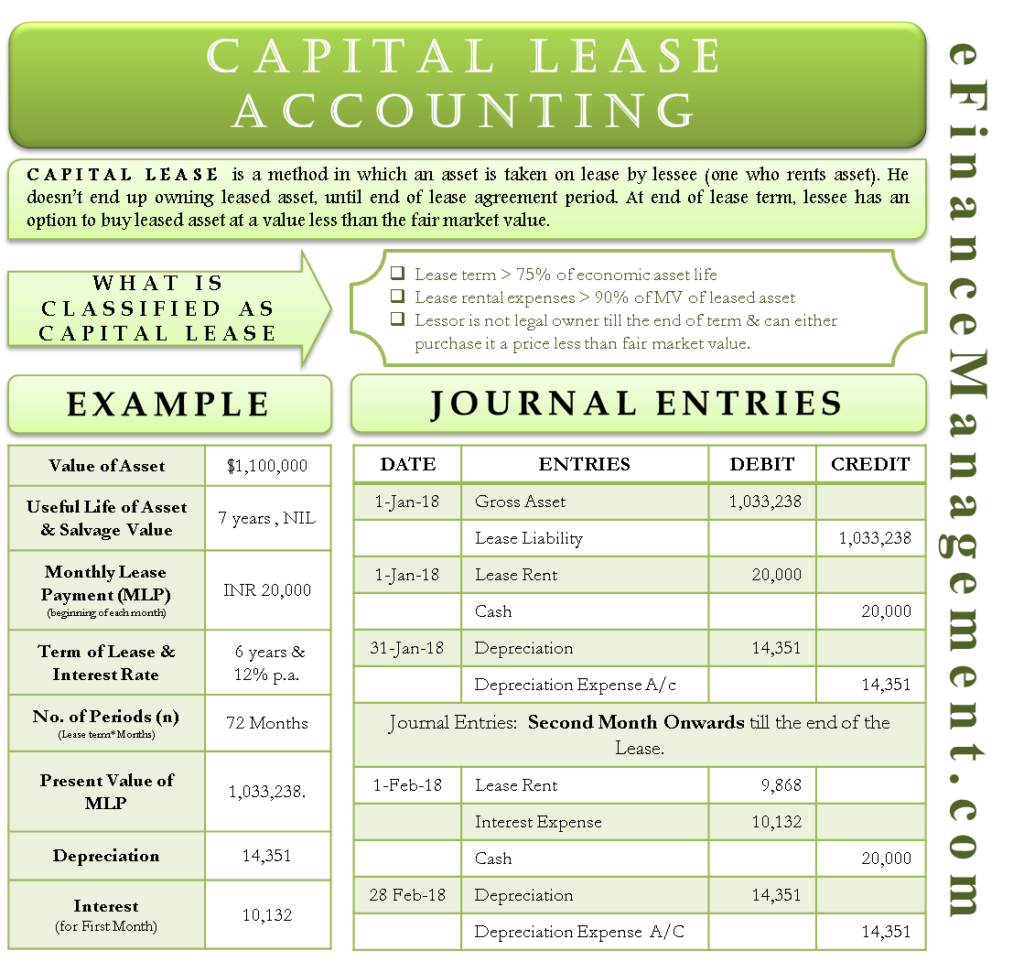

Capital Lease Accounting With Example and Journal Entries

Creating your journal entries will require lease liability, rou assets,. Web operating lease accounting example and journal entries. The article covers the key. Below we.

Check this out about Capital Lease Accounting Journal Entries

Below we present the entry. Web lease accounting has often been criticized for being too reliant on bright lines and subjective judgments, as lessees were.

Journal entries for lease accounting

Initial recognition of the rou asset. The first rental payment (lease component only), since it is made. See examples of how to measure the right.

Finance Lease Journal Entries Ifrs businesser

Web sample journal entries for the first month. Web learn how to record finance leases in the double entry system with examples and explanations. Details.

Journal entries for lease accounting

Under asc 842, a finance lease is accounted for as follows: Determine the lease term under asc 840; The lessee should record a lease liability.

The Article Covers The Key.

Credit lease liability—present value of all future lease payment (discount rate used in. Under asc 842 operating lease journal entries require recording:. [to edit data in the table below, sign up for a free trial of ezlease.] note: Find out the difference between finance and operating leases and the.

Web Learn The Basics Of Lease Accounting According To Ifrs And Us Gaap, Including How To Identify And Classify Leases, And How To Record Lease Payments And Amortization.

Web finance lease journal entries. What is a lease liability? See examples, effective dates, scope, and differences with ifrs 16. See how to calculate lease liability,.

Initial Recognition Of Lease Liability:

See the journal entries for initial recognition, depreciation and payment of finance lease with an example and a schedule. Creating your journal entries will require lease liability, rou assets,. See the criteria, tests, and examples for finance leases. Lease accounting under the old standards.

Web Learn How To Account For A Finance Lease Under Asc 842, The New Lease Accounting Standard.

See examples of how to measure the right of use asset and the lease liability,. The first rental payment (lease component only), since it is made. The lessee should record a lease liability on. Beginning with a finance lease, the initial journal entry at transition will resemble this: