Finance Lease Asc 842 Journal Entries - Web thank you for your review! Suppose you have a 5 year lease beginning 7/1/23 through 6/30/28. An entity needs to determine whether a contract is within the scope of asc 842 and understand the scope exceptions. We’ll tackle accounting for operating leases under asc 842 much like the standard. Interest and amortization expense are recognized for finance leases. Us ifrs & us gaap guide. Determine the lease term under asc 840. Web what is the journal entry for operating lease? For a comprehensive discussion of the lease accounting guidance in. Then it can proceed with examining other.

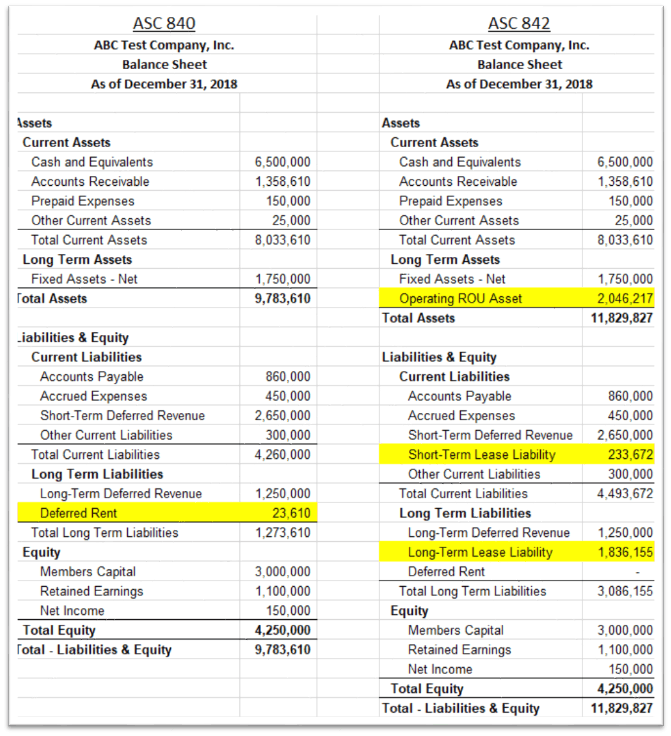

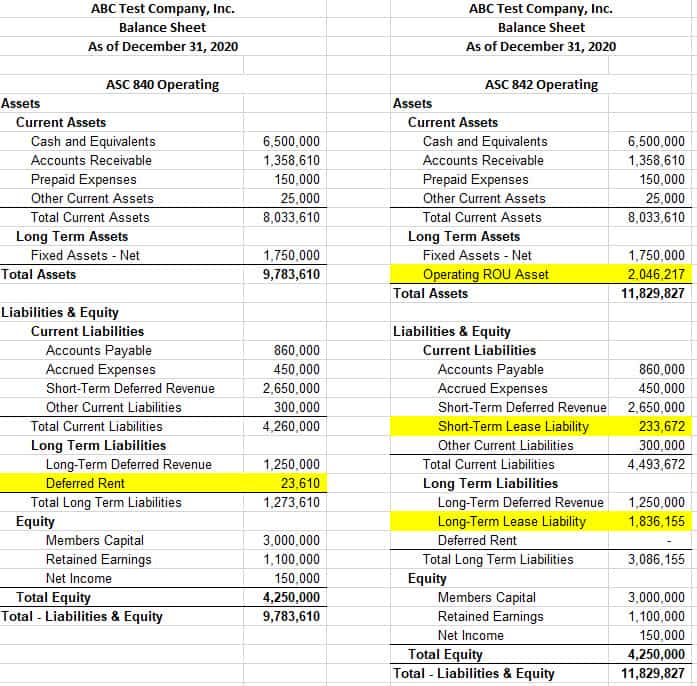

ASC 842 Summary of Balance Sheet Changes for 2020

Onboard new leases & amendments. Web the board issued proposed accounting standards update, leases (topic 842): The issuance of the standards are the. Web we’ll.

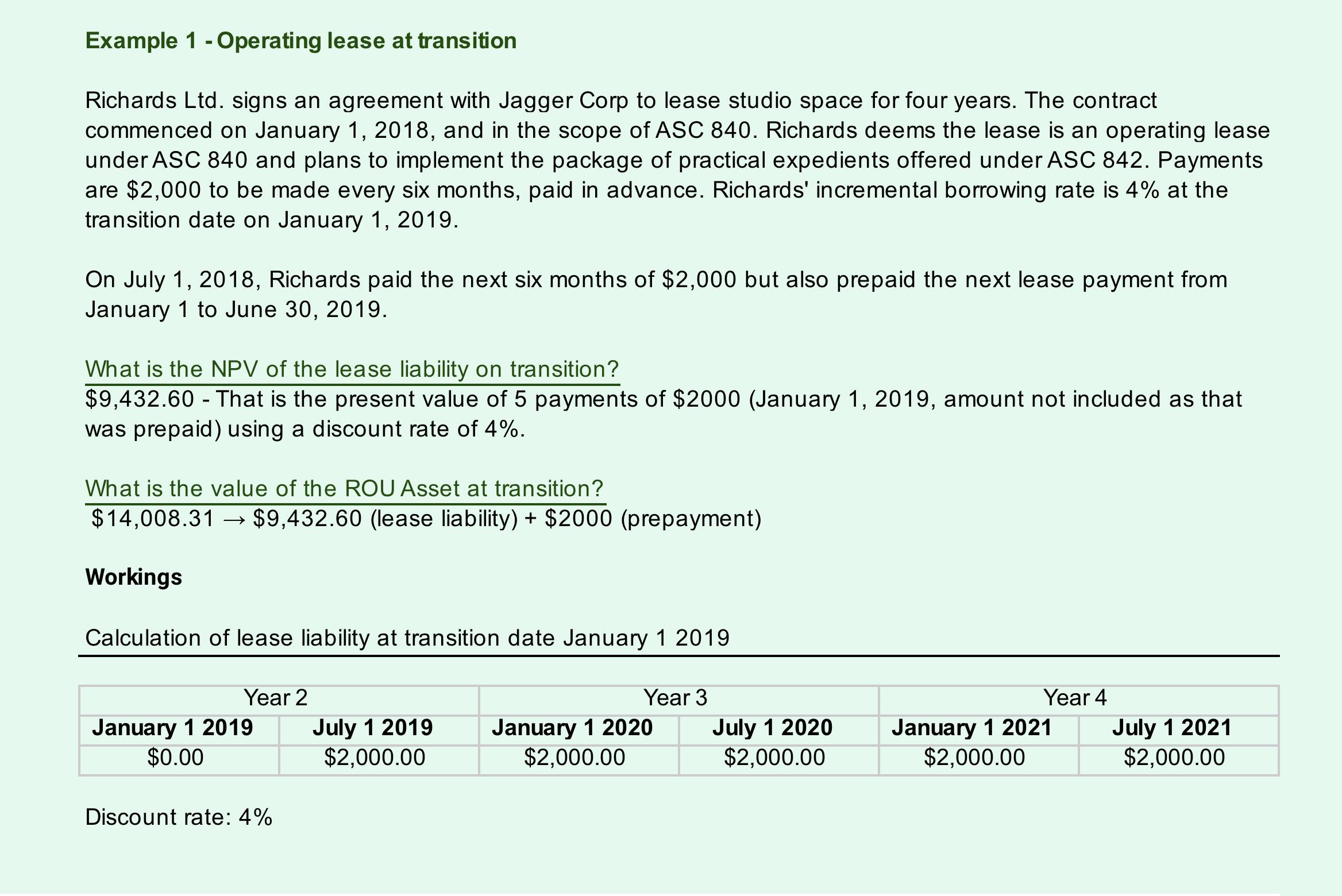

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

For a comprehensive discussion of the lease accounting guidance in. The new lease accounting standard, asc 842, has introduced significant changes to how companies record.

Asc 842 Lease Accounting Template

Web lessee accounting asc 842 requires a lessee to classify a lease as either a finance or operating lease. Web the board issued proposed accounting.

Leases 101 New Accounting Standard Asc 842 Part 2 Finacco

Web lease accounting has often been criticized for being too reliant on bright lines and subjective judgments, as lessees were not required to disclose assets.

Asc 842 Operating Lease Excel Template

Web lessee accounting asc 842 requires a lessee to classify a lease as either a finance or operating lease. Web the board issued proposed accounting.

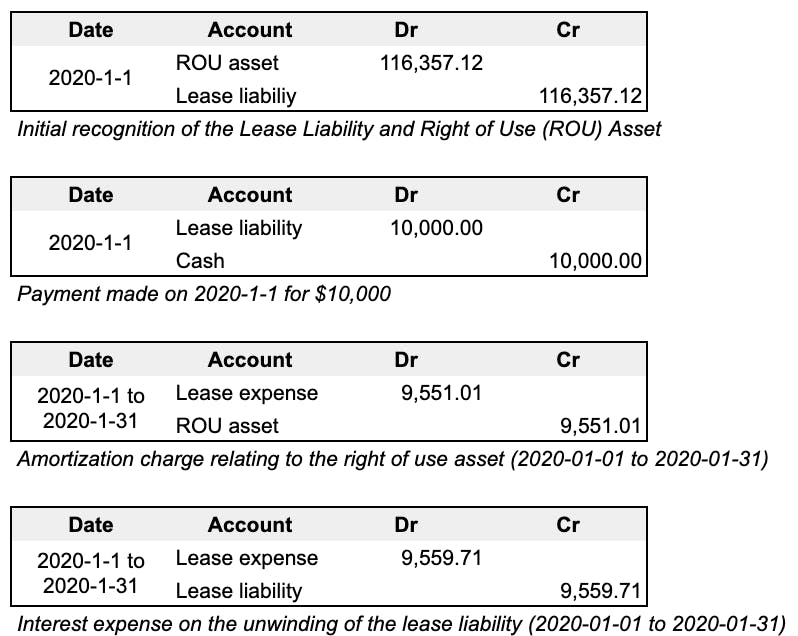

Lease Liabilities in Journal Entries & Calculating ROU Visual Lease

Web how to choose lease accounting software. The new lease accounting standard, asc 842, has introduced significant changes to how companies record and report leases..

How to Calculate the Journal Entries for an Operating Lease under ASC 842

Interact with accounting team members to ensure. Web how to calculate the journal entries for an operating lease under asc 842. Details on the example.

First Class Asc 842 Balance Sheet Presentation How Should A Look

For a comprehensive discussion of the lease accounting guidance in. Web the board issued proposed accounting standards update, leases (topic 842): Web the monthly journal.

Finance Lease Journal Entries businesser

Onboard new leases & amendments. Web how to choose lease accounting software. Web lessee accounting asc 842 requires a lessee to classify a lease as.

Determine The Lease Term Under Asc 840.

Web this article serves just that purpose. Web lease accounting has often been criticized for being too reliant on bright lines and subjective judgments, as lessees were not required to disclose assets and. Us ifrs & us gaap guide. The issuance of the standards are the.

Web Asc 842 Offers Practical Expedients That Can Be Elected By Certain Entities Or In Certain Arrangements.

Web here’s an example to show what asc 842 journal entries would look like for finance leases. Total lease payments of $1,146,388 + $10,000 initial direct costs divided by 10 years. Web how to choose lease accounting software. An entity needs to determine whether a contract is within the scope of asc 842 and understand the scope exceptions.

Web As Documented Above, The Present Value Of The Minimum Lease Payments Is $15,293, So The Initial Journal Entry To Record The Finance Lease At Lease.

Web operating lease accounting example and journal entries. As you work through your unique software selection process, keep the following points in mind: Web thank you for your review! The new lease accounting standard, asc 842, has introduced significant changes to how companies record and report leases.

Then It Can Proceed With Examining Other.

Interest and amortization expense are recognized for finance leases. Suppose you have a 5 year lease beginning 7/1/23 through 6/30/28. Web how to calculate the journal entries for an operating lease under asc 842. Web what is the journal entry for operating lease?