Expense Journal - Web the best way to master journal entries is through practice. If you use accrual accounting, you’ll need to make adjusting entries to your journals. Web journal entries for expenses are records you keep in your general ledger or accounting software that track information about your business expenses, like the date they. They are associated with more. The wall street journal, istock retirees took more money out of their savings to keep up with rising prices, raising the risk of depleting their nest eggs. Prepaid expenses are those expenses which are paid in advance for a benefit yet to be received. Whenever an expense is made, whether it be paid in cash, on credit, or simply. Web journal entries are the first step in the accounting cycle and are used to record all business transactions and events in the accounting system. Web an accrued expense is an expense that has been incurred within an accounting period but not yet paid for. Web an accrued expense journal entry is passed on recording the expenses incurred over one accounting period by the company but not paid actually in that accounting period.

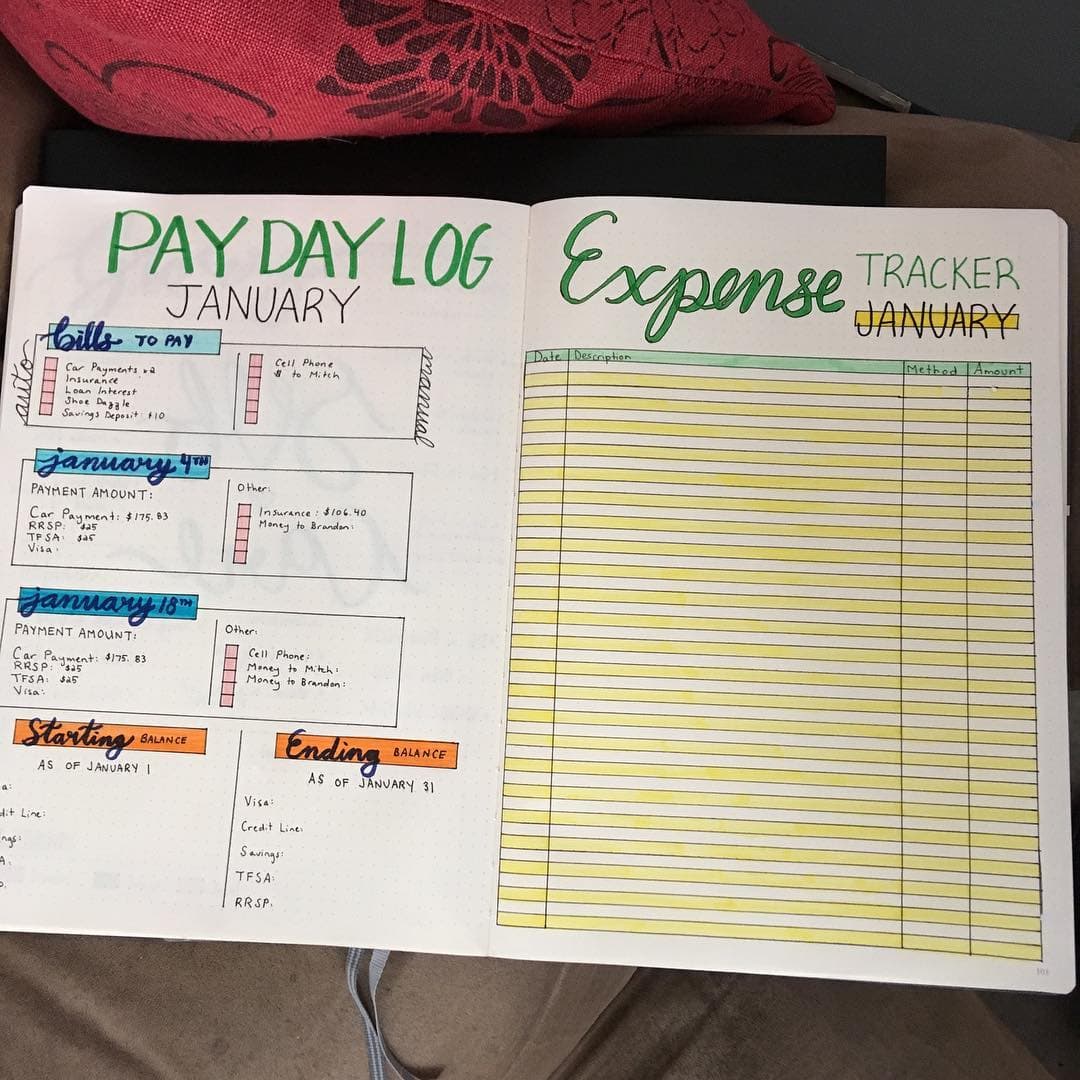

How to Create a Monthly Expense Tracker in a Bullet Journal in 2021

Journal entry for income received in advance. A journal is often referred to as the book of original entry because it is the place the.

Expense Journal Wonderful Expense Journal Book / Financial Ledger Book

The perks of such expenses are yet to. Web mastering the art of compensation expense journal entries: Presentation on the balance sheet. Journal entries are.

bujo expense tracker!! Bullet journal ideas pages, Bullet journal

A journal is the first place information is entered into the accounting system. Whenever an expense is made, whether it be paid in cash, on.

Examples of How to Record a Journal Entry for Expenses Hourly, Inc.

As business events occur throughout. Fundamental to the accounting in a business are journal entries. There are all kinds of accrued expenses your business might.

How to Create a Monthly Expense Tracker in a Bullet Journal Zebra Pen

Web the key to the journal entry or accounting treatment for reimbursable expenses incurred by employees is that since it is a legit business expenditure.

EXCEL of Cash Journal Expendiure.xls WPS Free Templates

Web journal entries are the first step in the accounting cycle and are used to record all business transactions and events in the accounting system..

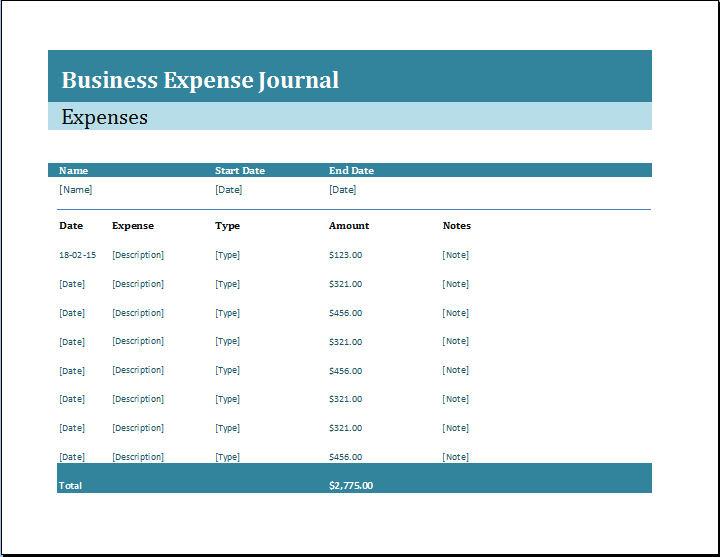

Business Expense Journal Template Word & Excel Templates

Web a quick reference for accrued and deferred income and expenditure journals, setting out commonly encountered situations dealing with accruals and deferrals. Web the following.

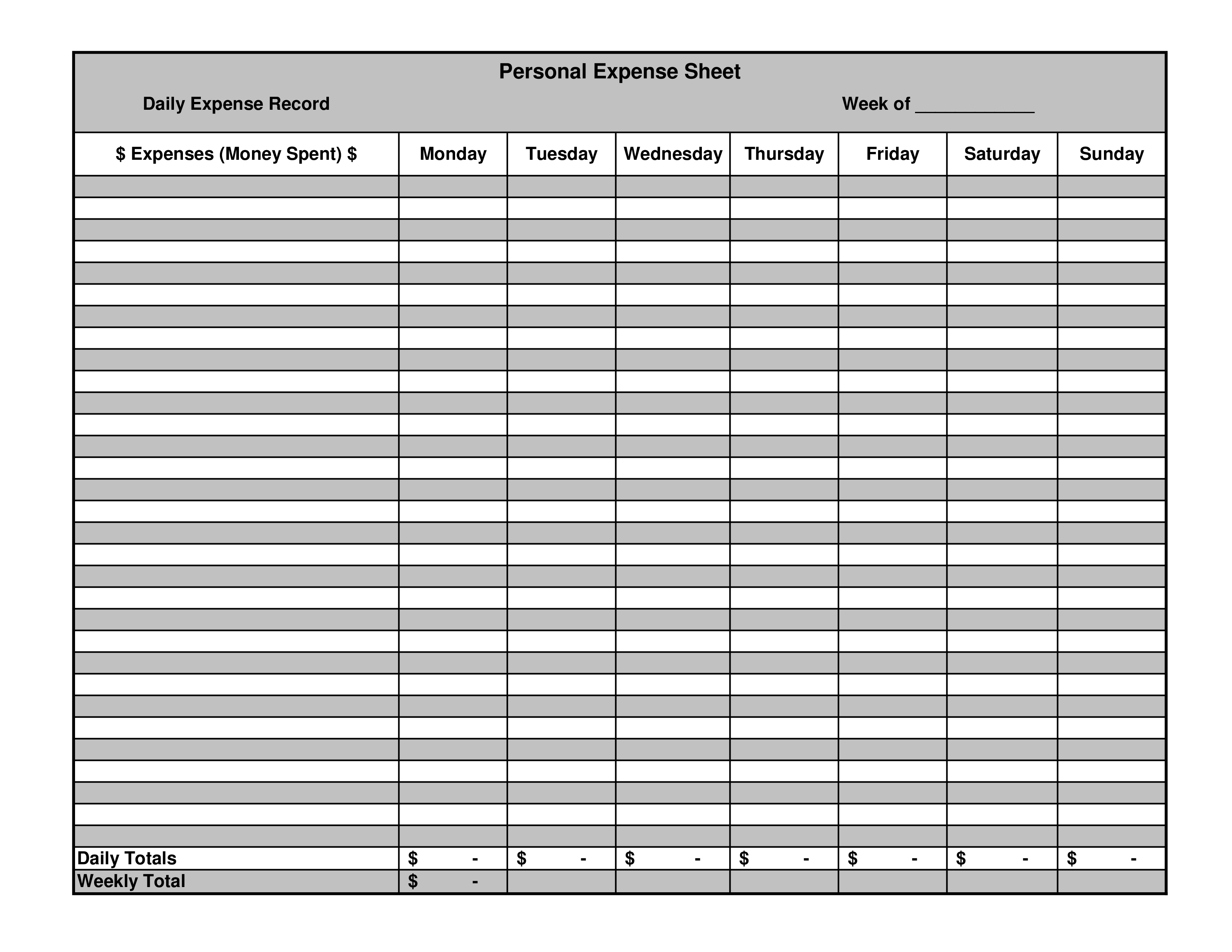

Personal Expense Templates at

Prepaid expenses are those expenses which are paid in advance for a benefit yet to be received. Web journal entries for expenses are records you.

Record all your daily expense so you know where money is spent. Compile

Just like with income, when we have an expense, we use the specific name of the expense, which in this case is salaries. Web the.

Web Accountants Use Special Forms Called Journals To Keep Track Of Their Business Transactions.

Web expense journal entries are the critical accounting entries that reflect the expenditures incurred by the entity. They are an obligation for the business. Web journal entries are the first step in the accounting cycle and are used to record all business transactions and events in the accounting system. Journal entry for prepaid expenses.

The Wall Street Journal, Istock Retirees Took More Money Out Of Their Savings To Keep Up With Rising Prices, Raising The Risk Of Depleting Their Nest Eggs.

Likewise, depreciation expense represents the cost that incurs during the. Depreciation is an allocation of the cost of tangible assets over its estimated useful life. A journal is the first place information is entered into the accounting system. Web the outstanding expenses journal entry involves two accounts:

The First Example Is A Complete.

They are associated with more. Web michael schumacher's ongoing treatment reported as staggering expense. Prepaid expenses are those expenses which are paid in advance for a benefit yet to be received. Web the key to the journal entry or accounting treatment for reimbursable expenses incurred by employees is that since it is a legit business expenditure at its core, the p&l impact is.

Here Are Numerous Examples That Illustrate Some Common Journal Entries.

Journal entry for accrued income. Web an accrued expense journal entry is passed on recording the expenses incurred over one accounting period by the company but not paid actually in that accounting period. Web accrued expense journal entry. Whenever an expense is made, whether it be paid in cash, on credit, or simply.